By Kane KcGukin via The Mesh Point

When it came to finance, they were the smartest guys in the room. Two Nobel laureates, one-half of the “Black Scholes” options pricing equation, and leverage.

When the carnage of LTCM stopped it was understood that it was not a case of genius men wielding math models but rather an abuse of leverage. They were levered 30-1.

LTCM made big bets on pricing discrepancies. Arbitraging stocks, bonds, currencies, and derivatives with the expectation that prices would eventually converge.

Until… They were wrong.

When the unexpected happens markets suddenly find the smartest guys in the room are mere mortals, not God’s. Declining market opportunities expose that these capitalists have no special powers. Only special agreements allow them to ignore conventional risk-taking rules.

Their addiction to risky bets is the driver behind extreme levels of leverage.

With the collapse of LTCM, it looked like a single hedge fund was going down the tubes and about to pull the entire global financial system along with it.

Is the Same Scenario Playing Out Today?

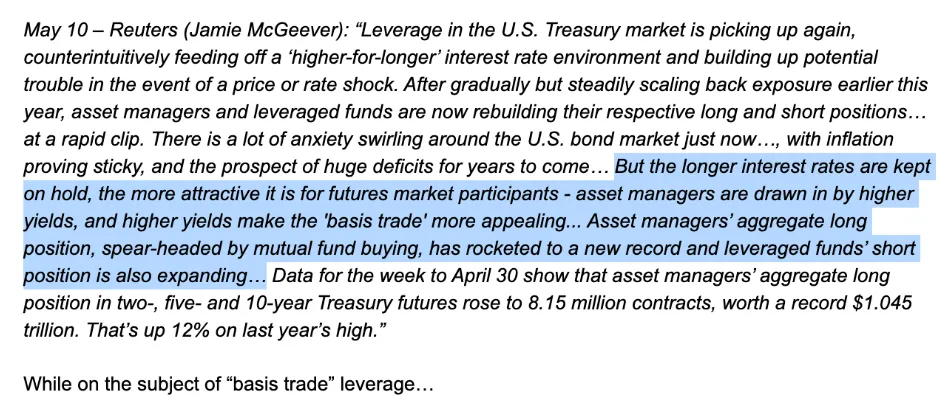

Are we seeing the same infatuations with leverage and discrepancies in a much more important space – the US Treasury market?

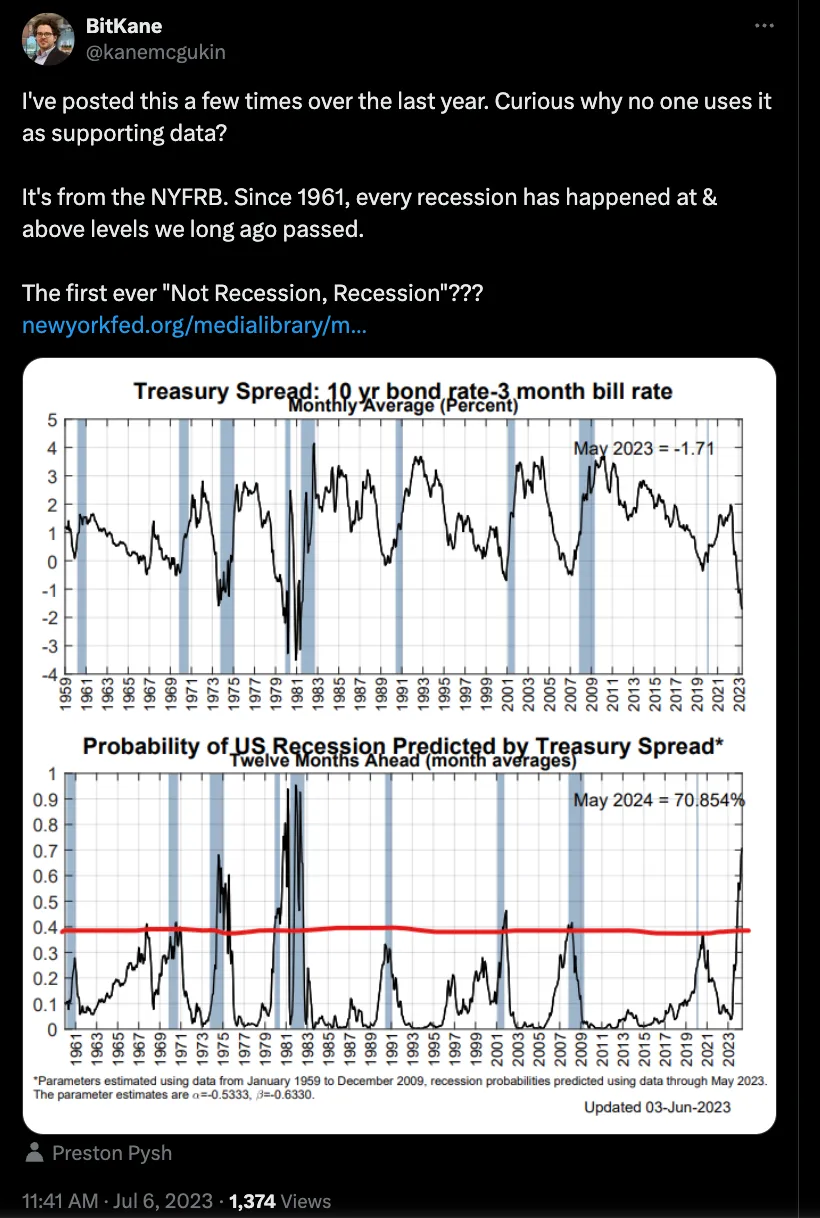

Is leverage and arbitrage the reason why the yield curve has remained inverted for one of the longest periods in history?

Or, is it possibly why we’ve avoided a recession for several years while almost every traditional signal has pointed to one?

Even the FEDs on data is being ignored.

Don’t get me wrong, this is not a recession post. It’s a post about the amount of leverage building up in a crowded but “safe” trade.

The problem with over-abuse of the leverage in the UST “basis trade” has been clear for years. However, it wasn’t until around 2015-2018 that we began to see it break with some level of frequency. The appearance of the trade working has more to do with growing FED programs like QE, QT, and BTFP, more so than the genius of prodigy traders.

At this point, credit facilities and backstops are more than expected. They are required. But, what if something “suddenly” changes? …

I have no level of “expertise” here though it is a clear and visible problem based on an abnormally large number of wild swings in Fixed Income markets over the past couple of years.

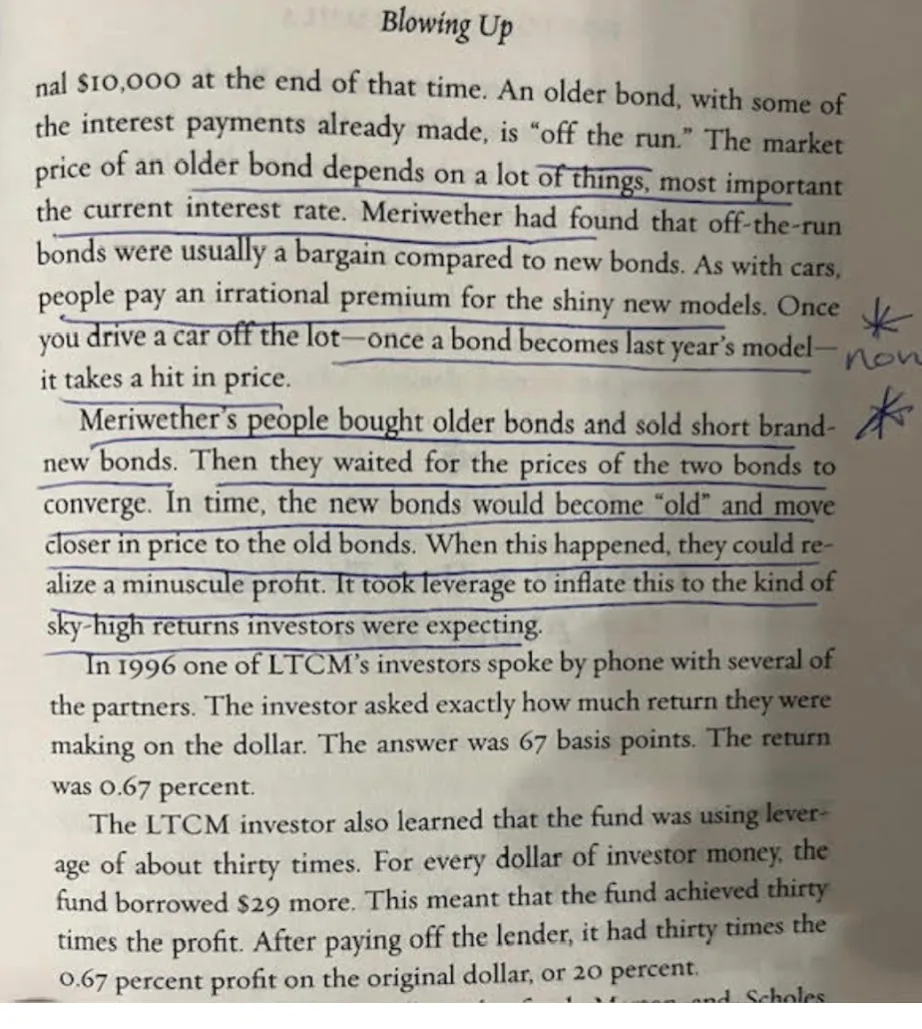

Reading a passage from Fortune’s Formula hints at the real issue. We are seeing an infatuation with taking on irrational risk. Assuming it’s risk-free and ignoring the immense amount of leverage required to make it all work.

Should we be okay with the pervasiveness of the “basis trade” because it is under watch by the “smartest guys in the room”?

Guys who appear smart but add a lot of complexity, arbitrage, and leverage to make minuscule profits look enticing. They are the ones working to keep things “stable”.

Is this “basis trade” or “arb” not the same as the ones we’ve seen blow up time and again? Is it back in the Treasury market?

Trades like this can go on for a while. It sounds good, and then the music stops. Once an “unexpected” event causes an entity to close a trade too early or causes a fail to deliver. That’s when a tidal wave of dominos ripples through the financial system and economy. Just ask Silicon Valley Bank.

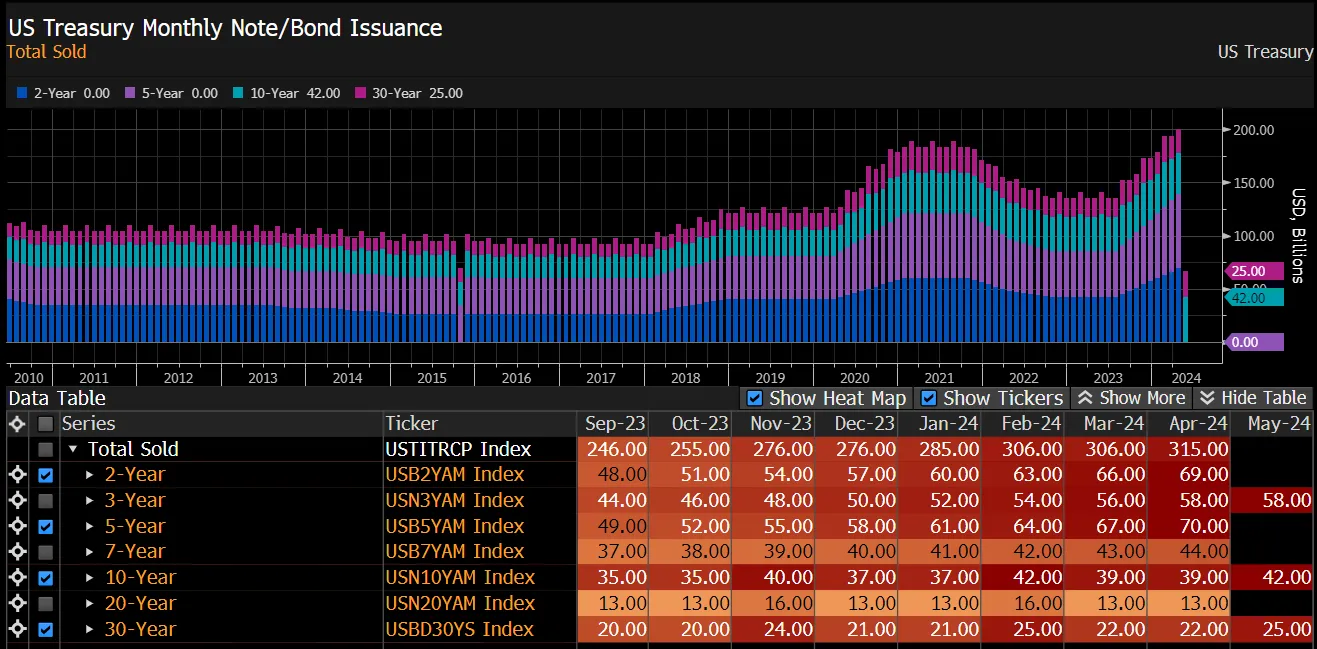

Leverage + Excessive Treasury Issuance = Manipulated profits.

Pulling back the wool, makes it look like a pool of pricing discrepancies has likely allowed the yield curve to stay inverted for an abnormally long period.

Is There a Repeat of the LTCM Trade but This Time in US Treasuries?

Two of the largest players in the market – Citadel and Jane Street facilitate much of the discrepancies in hedge fund trades across the curve. Together they control an abnormally large portion of many of our markets as noted in Credit Bubble Bulletin.

How does the UST “basis trade” look like LTCM?

Currently, the FED is issuing a massive amount of short-dated paper. The market shorts it, buys the long end, for an extremely small gain. A gain that only appears profitable because of an irrational amount of leverage. All to make a “normal” annualized profit. Leverage that has been speculated to be in the 300%+ range!!

When The Unexpected Leads to Too Big to Fail

In reality, when something “unexpected” happens, these levered trades create pockets of destabilization, or systemic risk in our theorized “safest asset”.

“Moral hazard is today a greater issue than ever. The likes of Citadel and Jane Street have become too big to fail – and they operate as such. And to see them (and their use of leverage) expand so aggressively corroborates the “Terminal Phase” excess and speculative “melt-up” theses.” ~ Credit Bubble Bulletin, May 10th, 2024

One can only connect the dots for the growth of this trade. As people have been replaced by computers and “reduction in force” the players doing this basis trade have moved beyond just hedge funds and shadow banks. So, many small funds with billions of dollars seem to be placing the same low return, levered trade in the “safest security”.

Why? To offer bigger returns. But do they all understand the game they are playing?

Are they just another set of geniuses in the room supported by highly competitive and profit-first entities that will provide a line of credit to settle the trade without regard for where the underlying security lies?

Much like the GameStop saga… where “professionals” play a gamma squeeze game with little understanding of the signal provided by the Greeks underneath. Trades can get out of hand quickly. Causing entities to fold or requiring outside capital infusions. Creating a scenario where the rules must be changed to stop bleeding across the system of preferred players.

Many of these smaller funds and banks (SIVB types) don’t have the expertise, but are just copycatting a “trade that works.”… until… it doesn’t. Until the “unexpected”.

As we all know, every crowded trade stops working at the most critical juncture. When the last buyer buys, or the last seller sells. Just ask Sam Bankman-Fried (Jane Street Alum) and FTX.

Is the general fund market now shorting the short-end with (extreme) leverage? Is this pushing short-term yields much higher as the Treasury tries to combat by issuing more in the 2-5yr space where the buying is lower due to our geopolitical and financial backdrop?

Have we created an inversion that can’t un-invert because a large swath of the market is drunk off < 30bips that’s levered several hundred percent?

Will new FICC trading rules cause these trades to come apart at the seams?

Is the “unexpected”, a change in clearing rules that will centralize FICC trading which comes into play at the end of 2025 and into 2026?

Will rules that centralize clearing force many levered trades to be unwound?

Will it expose weak hands as players are forced to shift to meet new regulations?

Are we watching another case of the “sophisticated crowd” causing an irrational market bubble?

So far, all major bubbles have been created by the “smartest guys in the room”, not the dumbest. Not “Joe Six Pack”.

Those smart guys are the ones who repeatedly ignore the known risk to appease their internal desire for gambling and have historically been the ones causing problems for the entire global financial system.

In 2018/19, we saw the same issue causing Repo spikes and failures.

We saw the ramifications this past July/Oct when Bill Ackman was publicly, and in my opinion openly “talking his book” to enter and create exit liquidity for his trade.

In crypto, this is called a “rug pull” or “exit scam”.

Additionally, the August timeframe has become known as the period in which roughly all the players in this trade make adjustments. (see Jeff Snider’s work). Per Jeff, in this timeframe and in the Eurodollar curve, you see abnormal market moves in a historically low-volatility security.

These points and those below paint the picture of how big and out of hand the UST basis trade might be.

Are these moves just more deckchair shuffling among struggling players?

A couple of quick searches:

Amounts of leverage typically used in this market:

Get on the Bombthrower mailing list here and receive a free copy of The Crypto Capitalist Manifesto and The CBDC Survival Guide when it drops. Subscribe to Kane McGukin’s Substack here.

There is a difference between "Title" and "Tidal".

The author would be well served to figure out the difference. Hiring a competent editor would also help.

You are correct. Great catch. This reminds me of another great quote from the book.

“Reviewers who are best placed to understand an author's work are the least likely to draw attention to its achievements, but are prolific sources of minor criticism, especially the identification of typos.”

Appreciate the help!

Well said…