Maybe adding CBDCs to the BSR is an example of 4-D chess?

This may come as a shock to those suffering from what I call “Type 2 TDS” (Trump Divinity Syndrome) but the president’s declaration to add sh*tcoins to the national strategic reserve contradict his own declarations against Central Bank Digital Currencies (CBDCs)

The inciting incident: Trump comes out against CBDCs

Trump has been vocal about his opposition to CBDCs from the same moment he declared himself to be pro-Bitcoin and announcing his intention to create a US Bitcoin Strategic Reserve.

Once in office his Jan 23rd Executive Order for “Strengthening American Leadership in Digital Financial Technology” specifically, section 5 called for

“taking measures to protect Americans from the risks of Central Bank Digital Currencies (CBDCs), which threaten the stability of the financial system, individual privacy, and the sovereignty of the United States, including by prohibiting the establishment, issuance, circulation, and use of a CBDC within the jurisdiction of the United States.”

We all know by now that via his recent post on TruthSocial, Trump declared that altcoins like Ethereum, Ripple (and ADA) would be added to the national strategic reserve.

Who wants to tell him?

Plot Twist: XRP is a CBDC! (and so is ETH)

In December 2020, the Gary Gensler’s SEC filed a lawsuit against Ripple, alleging that XRP was an unregistered security and that the company conducted an illegal securities offering by selling XRP tokens. Gensler is gone now, those days are over, and the SEC has dropped many of its suits against cryptos – although it has not yet explicitly dropped the one against Ripple (Anthony Scaramucci recently hinted they would).

In spite of or perhaps because of these regulatory headwinds, Ripple pivoted toward positioning itself as critical infrastructure for CBDCs.

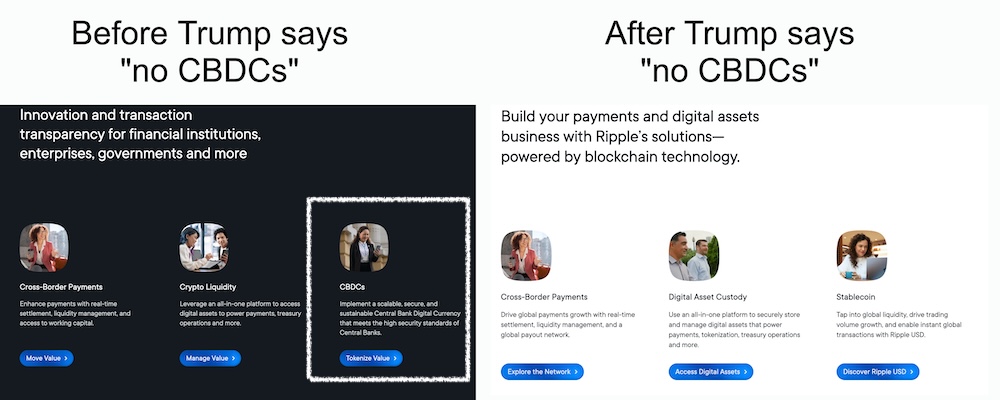

For years ripple declared CBDCs to be part of the value prop right on their home page, ….but then quietly dropped the reference sometime shortly after Donald Trump spoke in Nashville at Bitcoin 2024… suddenly it was about “stablecoins” and “cross border payments” – CBDCs shall no longer be spoken of on Ripple.com…

Ripple was also behind the now aborted #ChangeTheCode initiative, in partnership with Greenpeace, which was a smear campaign that attacked Bitcoin for its Proof-of-Work algorithm.

They also are heavy donors and lobbyists – kicking in over $60 million over the past year or so (and mostly to Democrat and left-wing entities – I wonder if TheDonald knew that before he added them to the SSR).

How tf did Ripple get included into the strategic reserve? 👀

Wait. nm. pic.twitter.com/3D4OMLZpUA

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) March 2, 2025

Ethereum insiders have volunteered it as the blockchain base layer for CBDCs: in 2020, one of the project co-founders (Consensys CEO Joseph Lubin) undertook a pilgrimage to Davos to present a white paper to the World Economic Forum outlining exactly how Ethereum could serve as a CBDC:

“As the World Economic Forum meets in Davos for the 50th time, it does so against the backdrop of a sea change in the mechanics of money

Below we provide both an overview of CBDC and a concrete example of how a CBDC might be implemented on the Ethereum blockchain. We believe that Ethereum is the best-suited blockchain network for the kind of maximally secure, global-scale, interoperable settlement platforms that CBDCs require. But we are well aware that there are many other possibilities”

Consensys remains an active participant in numerous global CBDC initiatives (unlike Ripple, they don’t seem to have scrubbed their website of any references to the new four-letter c-word).

Some country level test beds (like Brazil’s Digital Real, whose pilot project already contained code to freeze bank accounts) have already launched, running on permissioned Ethereum as has Ripple, running pilots for Bhutan and Palau.

Synthesis: The case for rolling out CBDCs anyway

Who controls the money, controls the world. We live in an emerging hellscape of Haves and Have Nots because the middle class is being demolished. The chief delivery mechanism for this has been The Cantillon Effect – the ability to leech wealth from the wider population through the issuance of currency to insiders with proximity to the money printer.

Bitcoin stood against that – creating a new digital sound-monetary system outside the inner temple and by the time institutions and oligarchs realized it was something to be taken seriously, it was already unstoppable — they had to shift gears to getting onside with the tectonic shift, but there was still no way to retain control of society through directing the issuance of currency.

Centralized cryptos like Ethereum and Ripple promise that ability. Monetary policy can be modified and changed, pre-mines and token issuances abound, entire blockchains rolled back if something goes wrong and a “do-over” is needed – there is no sound money component around ETH, XRP, SOL or ADA.

Fiat currencies, otherwise fated to debase themselves to zero, can add a few decades onto the runway through morphing into stablecoins, fusing with tokenized assets and becoming de-facto CBDCs – whether they’re called that or not.

CBDCs (or quasi-coins) will become the rails for monetary policy, promulgating the imperatives of fiat debasement:

- Providing the rails for UBI

- Functional implementation for MMT

- Sustaining money velocity via “expiry dates” on money

- “Excess savings” disincentivized through negative interest rates.

Every CBDC initiative will either launch as, or morph into, a Chinese-style social credit system.

In the left-wing social democracies like Europe, Canada, Australia et al, these social credit systems will be centered around a purported “Climate Emergency” and the need for carbon footprint tracking and quotas.

This is important to understand:#CBDCs will not be “money”: in the sense we understand it. They will be social credit scores, capped by your personal carbon footprint quota👇 pic.twitter.com/e6ibVwXM65

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) October 4, 2024

The US is, at least for now – disavowing the ESG narrative, while still setting the table for social credit systems by some other name than CBDCs. It will still amount to the same thing.

What would a Trump-era pivot into CBDCs look like?

We’ve just seen how a BSR (“Bitcoin Strategic Reserve”) – as declared in Nashville in July 2024, started looking like it would be more of a CSR (Crypto Strategic Reserve) once the EO on fintech dropped and now with the latest announcement it’s officially going to be a SSR as in Sh*tcoin Strategic Reserve.

Adding Ripple alone made it that, but it also will hold Ethereum (leaving Solana and ADA for another conversation)

There are a couple of ways the Trump administration could implement CBDCs, without saying “CBDC”:

- Issued by the Treasury: If CBDC base layers like XRP and ETH are held in a national strategic reserve, the Treasury could issue Layer-2 tokens on them and they wouldn’t be issued by the “Central Bank” part of “CBDC” (in this case, the Fed). It would be called something else, like, maybe “FreedomCoins” that have the exact same capabilities as CBDCs.

- Digital ID initiatives like REAL ID are accelerated under the rationale of eliminating illegal immigration and fentanyl mules.

The “REAL ID” initiative in the US has been underway since the aftermath of the 9/11 attacks.

During the Biden Administration, Wyoming Senator Cindy Lummis (of Bitcoin Strategic Reserve Bill fame) co-sponsored S.884: Improving Digital Identity Act which became HR 9783: Improving Digital Identity Act of 2024.

Here’s where the picture we’ve been developing on the eventual hybridization of cryptos (as distinct from Bitcoin), CBDCs and eventually, social credit, starts to fill in.

The corporate lobbyists for S.884 are interesting, including an early Ethereum investor (Jeffery Berns) and Mastercard, who already has a climate-controlled credit card that cuts off your spending when your CO2 footprint hits your personal limit (purely voluntary of course).

Ignore what they say, watch what they do

Readers here know that I consider the battle between Bitcoin versus CBDCs to be one for the very soul of humanity. Bitcoin being the anti-CBDC in all respects, and I thought Trump – with his aligning with Bitcoin and against CBDCs understood that, at least on an intuitive level.

Now I’m not so sure, given that he’s now in favour of adding at least two CBDC layer-1 blockchains to a national strategic reserve.

After the pushback came from that announcement – from even among crypto coin holders, the new Commerce Secretary Howard Lutnick has attempted some damage control by walking back elements of it:

“The President definitely thinks that there’s a Bitcoin strategic reserve. Now, there will be the question of, how do we handle the other cryptocurrencies? And I think the model is going to be announced on Friday when we do that.

A Bitcoin strategic reserve is something the President’s interested in. He spoke about it all during the campaign trail, and I think you’re going to see it executed on Friday.

So Bitcoin is one thing, and then the other currencies, the other crypto tokens, I think, will be treated differently—positively, but differently.”

Perhaps behind the scenes somebody has pointed out the contradiction between eschewing CBDCs out of one side of his mouth while talking up CBDC base layers out of the other.

Maybe XRP will be dropped from the Sh*tcoin Strategic Reserve, and be replaced with DOGEcoin (I’m not even kidding), or even TRUMP and MELANIA tokens (now I am, I hope).

We expect to know more on Friday, when the inaugural Crypto Summit happens in Washington, DC and Trump is expected to make a clarifying announcement.

This post contained some excerpts from my forthcoming CBDC Survival Guide which you can get free, once it drops – as well as parts of the latest Bitcoin Capitalist Letter, which you can try out here.

Join the Bombthrower mailing list today, follow me on Twitter/X here.

Exactly what I've been saying since the BTC event last year. He's creating a defacto CBDC with existing tokens.

His position is 180 degress in contradiction to what crypto was supposed to be about.

In the end…. since the BTC event (and even a bit earlier) I've been watching the Fink and Trump market manipulations of the crypto sphere. There's a pattern.

There might be a short-term play here, but they're going to tank the sector on a certain timeline. That's my opinion, your mileage may vary.

I suspected something amiss with Trump's patronizing even flippant remarks at the Nashville conference last year (paraphrase: "Yau all have fun with your Bitcoin now") Then the Trump meme coin and Melania's.

Now this!

I feel as if Trump is not really atuned to crypto in general, but is being influenced by subordinates (Eric, Ludnik, Garlinghouse and others) that have an agenda that is not in the best interests of Bitcoin and the promise it brings, but rather their own selfish and personal (power) interests. The Trump Meme coing points specifically to that thought.

I don't think a Bitoin Strategic Reserve is essential for Bitcoin success in the end, but properly constructed it wouldn't hurt.

It could be one or both of lying and incompetence.

Type 2 TDS.. 😀

lol

I was suspended from CMCap for writing about $XRP nocive nature and connections to the CEx's

Pffiu i couldnt care less as they all seem duped and brainwashed

Great article as usual!

You are awesome!