That’s why only Central Banks can create digital currencies

The Fed recently put out a white paper, Data Privacy for Digital Asset Systems, which contends that the expectation of privacy in digital currencies (read: CBDCs) stems from misunderstanding how digital systems work.

“Concepts such as the desire for ‘cash-like anonymity’ are based on false underlying assumptions.”, is the crux of it (quick, somebody tell the Monero team, and everybody else already deploying anonymizing protocols and applications for digital assets).

The subtext is that there can be some privacy and confidentiality safeguards built into CBDCs, but at the end of the day those would still be subject to being overridden or dispensed with. The paper doesn’t come out and say that, but it does make oblique references:

“confidentiality implies that collected and stored data is protected from view in some manner, such as obfuscation or access restriction, and available only to authorized actors.”

Which of course makes you wonder who exactly will be authorized and what will their capabilities be? It truly is the trillion dollar question.

WEF: “Hold my beer”

If we keep this paper in mind while we consider the World Economic Forum’s recent article on digital currencies, privacy and freedom, which put a finer point on it, while paying lip service to the desire for privacy in those characteristic WEF-speak euphemisms:

“A digital cash replacement should not enable criminality, but there should be some freedom to transact with complete privacy.”

“Some freedom” implies that any freedom will be subject to approval, because either you have complete freedom, or you don’t.

“Some freedom” coming from the WEF especially, sounds a lot like their “Life in 2030” vision, which is mostly known for point #1: “You’ll own nothing and be happy”.

Point #4 is “You’ll eat much less meat. An occasional treat, not a staple. For the environment, and for your health”.

In other words, according to the WEF, digital currencies will afford some privacy and some freedom. Just like how in 2030 you’ll be able to eat some meat. (As long as you behave.)

Throughout the piece the impetus toward digital currencies is ascribed to consumer preferences for convenience – that nation states and NGOs (including the WEF) are relentlessly pushing us there, along with digital IDs and health passports, is never mentioned.

Through their preference for the convenience of electronic payments, we will inadvertently lose the historic freedom that only cash provides: to spend our money on what we want, with whom we choose.

It’s always amusing to watch the Davos-darlings pretend to grapple with thorny ethical issues:

As governments and central banks consider introducing retail central bank digital currencies (CBDC), they must therefore answer the following: Once the last cash payment is made, does this mean our historic right to make payments that are not observable or censorable by the state will end on the same day? Is that what we want?

The answer, of course, is a resounding “yes” if we’re to remember some of the more breathless pronouncements from their conclaves:

Alibaba Group president J. Michael Evans boasts at the World Economic Forum about the development of an “individual carbon footprint tracker” to monitor what you buy, what you eat, and where/how you travel. pic.twitter.com/sisSrUngDI

— Andrew Lawton (@AndrewLawton) May 24, 2022

“We are developing, through technology, an ability for consumers to measure their own carbon footprint. What does that mean? That’s where are they travelling, how are they traveling? What are they eating? What are they consuming on the platform? So, individual – carbon – footprint – tracker. Stay tuned, we don’t have it operational yet, but it’s something we’re working on”.

The WEF article tackles the conundrum:

any system that allows people to make payments that cannot be traced or blocked is bound to attract criminals as well as facilitate personal liberty… A digital currency system should not mimic the “wild west”, but there should be some freedom to transact with complete privacy.

This is the only physical book you need when medical help is not on the way.

This is the only physical book you need when medical help is not on the way.

The Home Doctor: Practical Medicine for Every Household

featuring

32 Home Treatments That Can Save Your Life one Day

And while the article acknowledges that,

“if a CBDC doesn’t have some element of this capability, my prediction is it will fail in some major developed economies.”,

the entire framing is that Central Banks are the only game in town, and they need to get it right:

If the private sector could deliver a truly cash-like product itself, then we wouldn’t need this debate, but even a limited degree of cash-like behaviour would be incompatible with electronic payments laws. The reality is that only a central bank could deliver this type of product, thanks to the precedent set by their monopoly on the issuance of cash.

This paragraph would be the so-called “money-shot”. There is no mention of Bitcoin, or that crypto-currencies and stablecoins are already becoming ceded territory within the regulatory frameworks of nation states. There is no acknowledgement that many holders of wealth and capital will simply end-run CBDCs for the very reasons they articulate.

One of the WEF’s core tenets is that nation states are losing their position as the sole arbiters of power in this Fourth Industrial Revolution. That means they will have to coexist within a rubric of “Stakeholder Capitalism”, but what the WEF sending mixed messages:

On the one hand, governments are losing their primacy (and thus, monopoly on money issuance and supra-national initiatives like digital id’s and health passports), while on the other, only they have the authority to bless ascendent monetary systems. Which is it?

And how could you possibly publish an article like this without observing the elephant in the room: Bitcoin (and crypto-currencies, including stablecoins) have already entered the monetary landscape and have changed it in irreversible ways.

As expected when it comes to the World Economic Forum, it’s a display of truly breathtaking hubris and nescience.

My forthcoming ebook The CBDC Survival Guide will give you the tools and the knowledge to navigate coming era of Monetary Apartheid. Bombthrower subscribers will get free when it drops, sign up today.

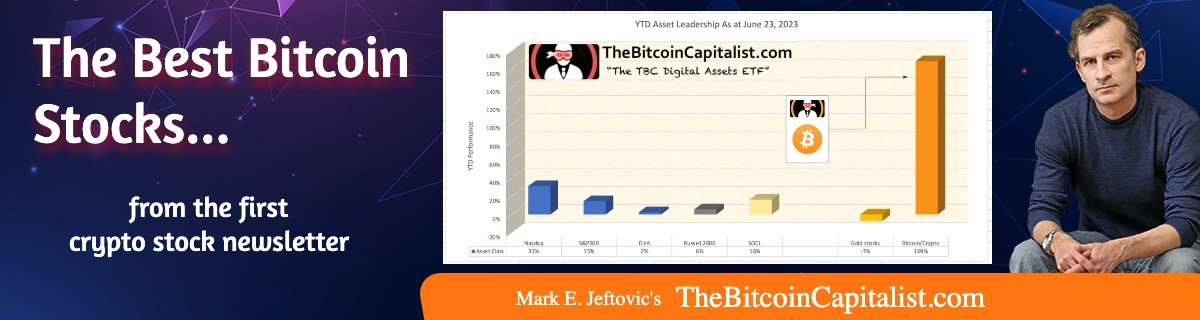

Today’s post was an excerpt from the CBDC coverage section of the latest The Bitcoin Capitalist. TBC provides actionable intelligence on the macro forces shaping Late Stage Globalism and a tactical toolkit for preserving and growing your wealth as it plays out. Try it today here.

It's also of Biblical proportion.

See this:

https://revelation13.substack.com/p/revelation-13-happening-now

Thoughts on Revelations 2:17?

Was it Nigeria that torched the banks that initiated CBDC ??

They didn’t torch the banks (as far as I know), but it hasn’t gone well, and they recently removed the head of the central bank and arrested him on corruption charges.