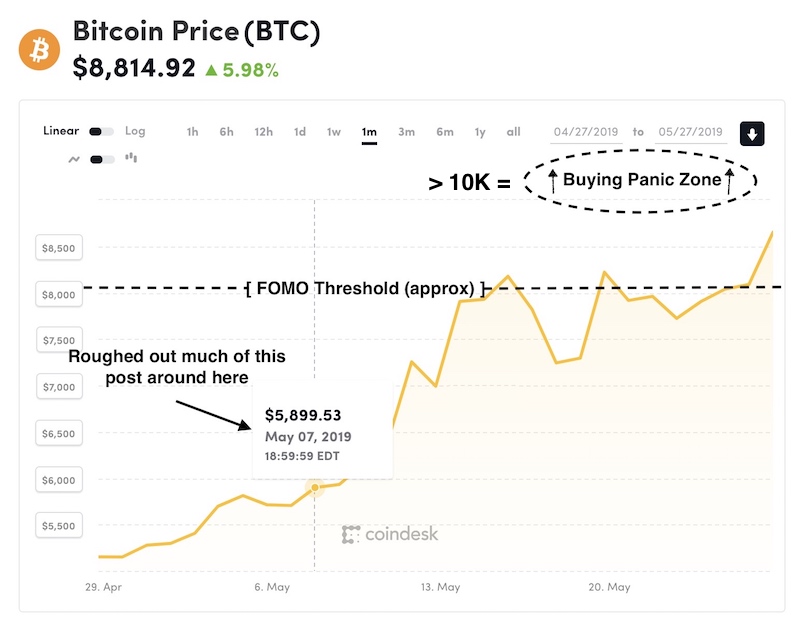

I meant to write this back around May 7th or so, after I listened to “What Bitcoin Did #104” with Tuur Demester and then read his “Bitcoin in Heavy Accumulation” paper. The title of my post was supposed to be “Is Bitcoin finally putting in a bottom?” Real life got in the way of my writing, for a few weeks and then Bitcoin went and did this

I saw a thread in a crypto group on Facebook polling the members, “What is the catalyst behind the Bitcoin price surge” and I personally think it was the release of that Tuur Demester paper. Until then, there were too many head fakes and too much volatility but he made a cogent case that overall, the whales were back in accumulation mode.

Bitcoin’s inelasticity of units

One of the more interesting takeaways from the “What Bitcoin Did” podcast interview was his observation that, with a max 21 million Bitcoin that will ever exist, and an estimated 3 million Bitcoin lost forever through various forms of misadventure, that leaves 17 million BTC now with a global population of millionaires somewhere around 20 million. That means that there is not enough Bitcoin in existence for each millionaire in the world to possess one full BTC.

This leads to the dynamic Kurt Detlev S. Schlichter predicted in his Paper Money Collapse when he throughly debunked the objection that money can never return to a hard-backed currency because of there being a shortage of a fixed unit currency like gold to fulfill all of an economy’s transaction volume.

Said differently, one of the arguments against an inelastic currency, such as Bitcoin – is that there isn’t enough of the monetary unit to go around to accommodate an expanding economy.

According to Schlichter:

“A monetary system with a money commodity of essentially fixed supply will experience secular deflation. A growing economy, with an entirely inflexible money supply will exhibit a tendency for prices to decline on trend, and for money’s purchasing [power] to steadily increase. But the key question now, is why should this be a problem? We have already seen that historically secular deflation was rather minor and that it certainly never appeared to present any economic difficulties. No correlation between deflation or recession or stagnation is evident under commodity money systems. [T]here are no reasons on conceptual grounds to consider deflation to be a problem”

The ostensible reason why central bankers and policy makers target inflation is to expand the number of currency units to service the economy. But that’s disingenuous, and the real reason inflation is targeted is because it enables various governments to borrow more than they should, and then pretend to pay it off in currency units with diminished purchasing power. Inflation is theft, yet very few people understand this (not the least of which is “Politics of Bitcoin” author David Golumbia, who insists that inflation increases purchasing power).

What actually happens in terms of an inelastic currency, is that prices go down over time. We would also expect to see the currency unit itself sub-divide into smaller denominations, something which Bitcoin and crypto-currencies are uniquely suited toward.

Should the ascent of crypto currencies continue, we should expect see the subdivisions of bitcoin being used in everyday parlance and transactions reference smaller subdivisions of BTC, from bitcents (0.01 BTC, or cBTC) to millibits (0.001 BTC or mBTC), then microbits (0.000001) or eventually even satoshis themselves (“sat”, 0.00000001 BTC).

What makes a secular cycle in crypto?

“Systems like Ethereum (and Bitcoin and NXT, and Bitshares, etc) are a fundamentally new class of cryptoeconomic organisms — decentralized, jurisdictionless entities that exist entirely in cyberspace, maintained by a combination of cryptography, economics and social consensus”

— Vitalik Buterin

One thing Demester said in passing was that we are in still in an intact singular secular bull market in Bitcoin, which started in 2008. When I wrote “Welcome to Bitcoin’s Trough of Disillusionment” I posited that the secular bull market ended in 2017, making for a 9-year secular run. My best guess was that we were then entering a secular bear market in crypto and that would need to be measured in years, not months.

I get hung up on this because as I’ve previously wondered, if crypto-currencies are indeed a new form of asset class, and I posited in “This Time is Different: What Bitcoin Actually Is” that they are, then I would expect them to behave like other asset classes, and switch leadership between secular bull cycles.

That’s not a law by any means. But in general, whatever lead the market up in the previous bull (think Nifty 50, .COMs, housing and now the FAANGs), leadership shifts to different sectors on subsequent bull cycles within the asset class. Each bull market has a defining narrative unto itself (mostly variations on a “this time it’s different”). When the narrative changes, the sectors that lead the bull are the ones that correspond to that new mythology. The next equities bull may be biotech, or nanotech.

But crypto is so new, what are “the sectors”? Was the last spike defined by the ICO craze, and the next one, if and when it occurs, will be defined by something else? Whatever it will be may not even exist yet. With crypto we repeatedly find ourselves in uncharted territory. To paraphrase William Gibson,

Crypto-currencies were like a deranged experiment in social Darwinism, designed by a bored researcher who kept one thumb permanently on the fast-forward button.

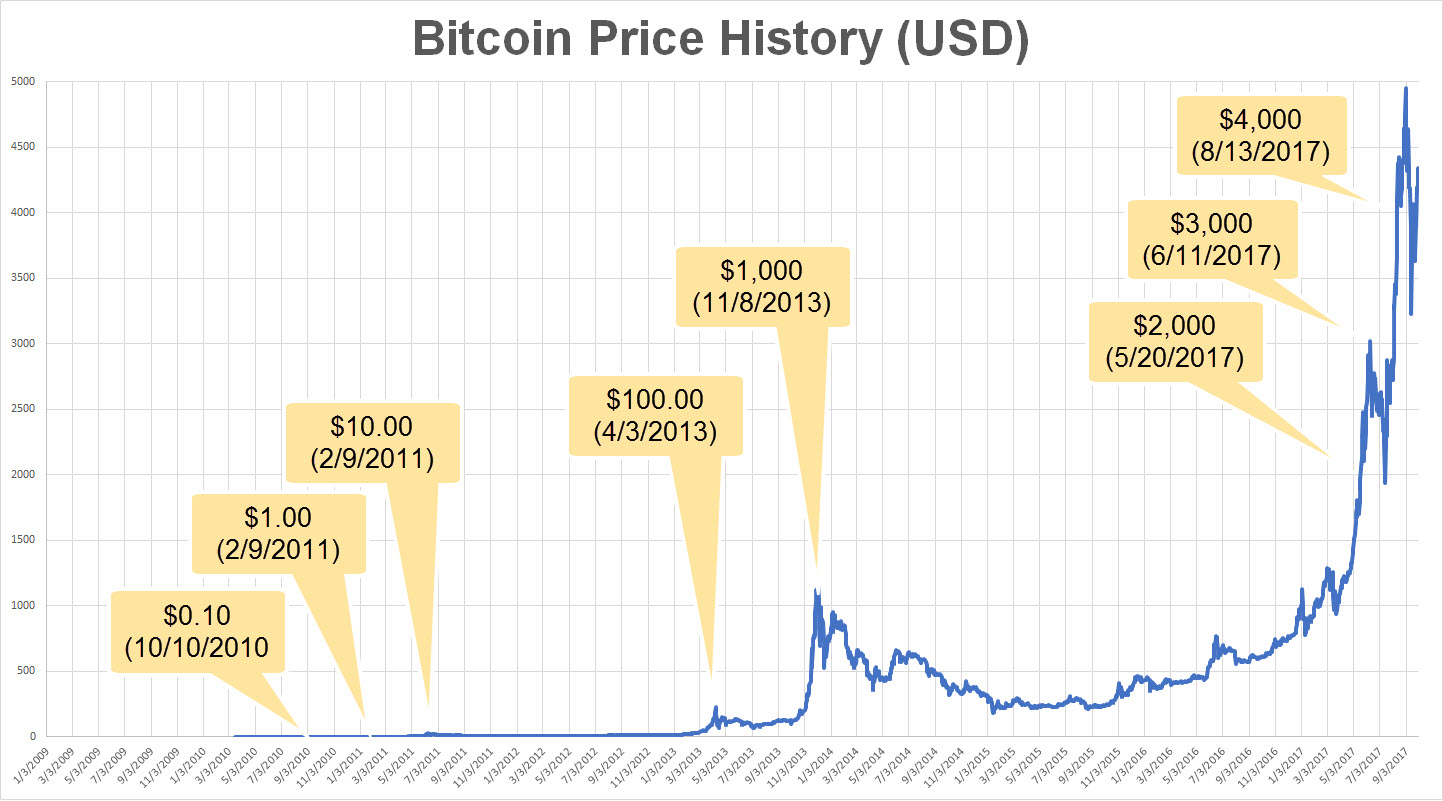

Events move faster in this space, and it’s still early going. Maybe each successive all-time high in the price of Bitcoin in USD terms was a secular cycle unto itself?

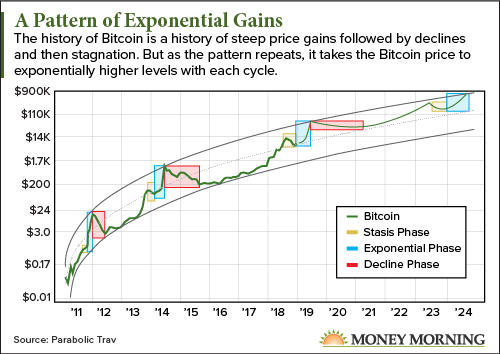

It is tempting, to look at this recurring pattern of Bitcoin price spikes and extrapolate into the future and envision yet another one that will dwarf the 2017 high in manner congruent with previous bull cycles. Where that would put it is almost impossible to guess, the following chart from the same article as the one above extrapolates the trend of “exponentially higher all-time-highs”:

But extrapolation of the past is one of the primary fallacies of investing. And, I think Demester said as much as well, that eventually Bitcoin volatility will settle out and into more normal ranges and away from these periodically expanding super-spikes. I actually think it would be better for the space and open the door to wider penetration among the general economy if that happens.

As interesting as you might find all of the forgoing, none of it is useful. Does it mean you should back up the truck and buy Bitcoin before the next super-spike? Or has it gone up too much, too soon and now it’s a screaming short?

Bitcoin stocks are not confirming this move

The Bitcoin equities, if we can actually point at any stocks and call them that, maybe OSTK, NVDA, possibly RIOT, don’t seem to be confirming the move. When that happens in precious metals it usually means the rally is a head fake or destined to stall out.

Any other “Bitcoin equities” have been ground all the way down into penny stock dust. MGTI and DPW Holdings are beyond trainwrecks. HIVE was the only penny stock I found whose chart doesn’t look absolutely terrible, but the fundamentals are a disaster.

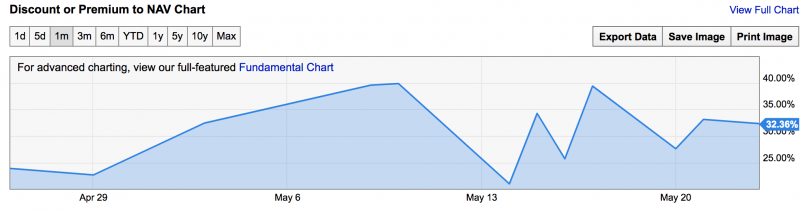

GBTC is moving in tandem with Bitcoin, which makes sense, yet the premium is currently around 33%, not the completely insane 70% or 80% that it commanded during the blow off top of 2017, further the premium to NAV has actually dropped a few points since this BTC move really took off:

Overall, the bitcoin stocks space is too new and too damaged to be able to tell us anything useful, other than making note that at least here, there is a conspicuous absence of exuberance.

Bitcoin on the other hand, is enjoying a lot of optimism right now and it’s not uncommon to see lofty price targets being bandied around in social media again.

That said, I am tentatively in agreement that winter is over for Bitcoin, and that we are at least entering a basing phase ahead of a new bull cycle. Remember what I warned when I wrote Welcome to Bitcoin’s Trough of Disillusionment:

I have personally and notoriously been “too early” calling bottoms of gold bears since 2003. Possibly profitable advice would be: wait until I call for a bottom in Bitcoin and then wait another year.

It’s impossible for anybody to tell you how to the future will pan out, but I can tell you what we’re doing, how I’ve played it until now, and the approach that has worked for me in the past and never let me down:

Don’t buy Bitcoin. Earn it.

The best way I’ve found to invest in something like Bitcoin was an approach we took going back to the digital gold currency days of yore, when e-gold was a thing, and we became the first and only ICANN accredited registrar who would accept it as a payment method. Instead of converting those sales to fiat, the transaction volume was comparatively small enough that it wasn’t material to our cashflow. We could accumulate it, and over time, it added up to a few pounds of bullion, which we were diligently converting to physical via the secondary market.

In 2013 we ran the same play again, becoming effectively the first ICANN registrar to accept Bitcoin (and then Ethereum, and lately we dropped Bitcoin Cash and added Litecoin). From 2013 through to the super-spike in 2017, we for the most part accumulated it.

After the bubble peaked out, we kept accepting Bitcoin, but switched gears to converting half of it into gold, again, this time using Goldmoney / Bitgold. We don’t look at things as Bitcoin vs gold. We look at global financial repression and economic rigging as a situation that one defends against with Bitcoin and gold. They are natural compliments and not at all orthogonal to each other.

We’ve since shifted our weighting and are back in 100% accumulation mode for crypto-currencies. On this stretch of the crypto-currency journey I am talking to more business owners who want to do the same thing: offer Bitcoin as payment option to their customers.

If you own a business and want to add Bitcoin as a payment method so that you can essentially dollar cost average your way into a decent position, it may be a fortuitous time to start. Every bit of Bitcoin you earn now has that inexorable deflationary wind at its back that will hold and gain value in fiat money terms over time. Given global debasement of worldwide fiat currencies, perhaps spectacularly so.

As an example, during the blow off top in December 2017 I remember logging into a wallet I had setup for a tipjar on an old blog that had received a single tip, something like $2 or $5 (maybe even less), and was astounded to realize it had become worth $1500 or so. Think of that every time you accept a $5 or $20 or $150 payment from your business in Bitcoin, and if you’re doing that, as we were for years between 2013 and 2017, several times a day, you start to get that snowball effect.

If you don’t have the technical time or inclination to dig into this and set it all up, fear not, easyDNS is launching a fully managed easyCoin Payment Gateway, which runs under your own domain and collects Bitcoin into your own wallet. You can sign up here for an invite.

It is said that “bad money drives out the good”. That is, people hoard the better currency and spend into circulation the worse currency. If you widen the concept of currency to anything tradable (i.e. include goods and services), you can expect people to want to exchange goods that they don’t need (because they have manufactured them for sale, say) for good currency. Conversely they will be inhibited from buying goods with good currency unless they really need those goods at the time.

The Keynesian argument for inflation, promulgated by governments and their banker lackeys, is that without it, people don’t spend enough to keep everyone working. But perhaps the inflation policy is why we are awash in mass produced bric-a-brac.

We are in a world of material abundance where most of life’s material necessities can be made for everyone with just a few humans working to do it. That ought to lead to severe price deflation – something that is inhibited by the expectation of “stable” or “inflating” prices. How do we change the psychology so as to avoid a Keynesian depression in the short term?