By Kane McGukin at The Mesh Point

Money is unique. Its properties are what give it value in comparison to other choices. Money is generally hard to replicate and lasts for long periods, thus making it a great value store.

Currency on the other hand is none of these things.

Currency’s value is its seamless ability to transact quickly. Making it an instrument that declines in value. Spend it now for excitement, or feel the pains of disappointment in the future.

Currency, like age, brings about great decline. Ever so rapidly as the years go by. Slowly degrading at first, and then exponentially in the latter stages.

Unlike money, currency does not store value, but rather, erodes it. However, currency does provide financial engineers the illusion of providing value and stability. It provides the ability to wave a magic wand and act with sleight of hand.

In a world filled with broken money. With currency abound. With the world’s population up in arms over not having enough money that stores value; it’s surprising to see how quickly we are willing to shift from a solution like Bitcoin. To then go and charge after trying to create another mechanically broken currency on top of a store of value asset. The process taking place brings back memories of how dollars were built on the back of gold.

I guess that’s human nature and the story that’s repeatedly told on the timeline of money.

Innovation for innovation’s sake???

Money is Faith and Faith is Money

1/9

The world🌍 operates off a basic set of Laws and Principles. You may have heard these more commonly described as “first principles”.

Here’s a short thread on why The Law of Money is always the same.

— BitKane (@kanemcgukin) March 27, 2024

Few laws dictate how we operate and those laws apply regardless of what century we live in. Those laws are bound by faith.

The predictability of these laws is what gives us faith. The predictability of true money, rather than the chaos of currency, is what gives us faith in storing value.

The interesting thing is money and wealth are no different, rooted in the same laws of faith. Thus, there are few monies… few things we can all agree to give faith to and store value in over time.

Fire for the caveman > art, gold & jewelry > real estate and coins in the middle ages > energy > and now digital assets like Bitcoin.

True stores of value are immutable.

They are assets that transend time. So, if we take this approach and realize that few things create our stores of value, then what are the seven ventures (ECC 11:2-6) we have to choose from?

Why Market Cap Matters

Market cap has always been a misnomer for me. It doesn’t matter at the individual level. It doesn’t tell you anything. It is just shares outstanding x price. What I mean by this is the market cap of a stock is not a signal. It only tells you the size of one company relative to another.

However, it’s different when you talk about asset classes, industries, or big pools of assets. Why?

Because there are relatively few places we can store value. So, if you view the size of one asset class relative to another you can begin to derive value from it. You begin to see what the 8,100,000,000 people of the world find valuable.

You begin to understand where people place their faith. You can see what people deem as money → what we consider value stores. In other words, you can see the seven ventures that we prefer to invest in. Storing value means that you decide at some point to trade some of that value for something you desire more. It doesn’t mean that you hold it forever.

We all hold a mix of assets that store value and we choose to liquidate those at varying degrees depending upon which best solves our moment of need. Naturally, some are more liquid than others and some have larger tradeoffs than others.

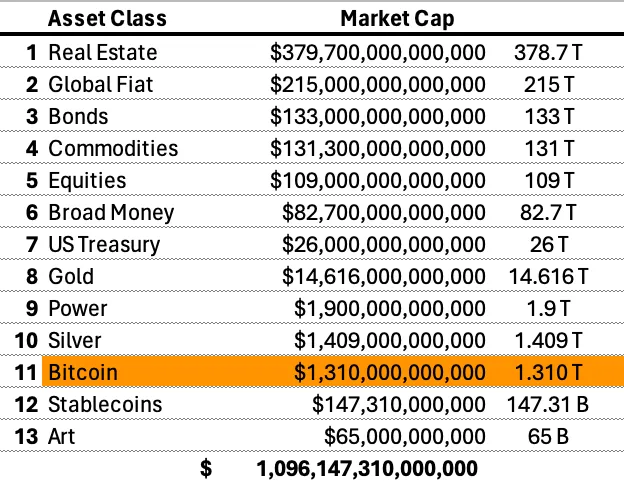

Here’s a quick rundown of current asset classes that dominate our markets. I’ve pulled these from the internet so they may not be 100% accurate, but they’re close enough to get the job done. Note that Global Fiat and Broad Money likely have a lot of overlap as these two markets are not easily agreed upon or transparent enough to compute.

What’s important here? These are the primary places people all over the world store value. There are roughly 13 asset classes. Maybe you can add another 1 or 2, but this paints the picture as to why asset classes matter.

Additionally, if we consider cryptocurrency in general, as opposed to just Bitcoin, the market cap is over $2T. However, most of crypto is vaporware or currency-based. Remember the value of currency is it’s cost of production which trends toward $0. So, in terms of “money”, I put more weight on actual stores of value here.

As discussed, currency does not store value, though it does allow quick, easy, and seamless value transfer.

Given this, we should mentally remove “global fiat” and “broad money”. These are included because of the sheer size and to show where bitcoin/crypto could realistically get to as we re-write the financial system because our monetary plumbing is out of date. The construction taking place will ensure that our financial pipes work better for the people of the 21st Century → the digital nomad!

If I’m making prognostications, my base case over the next 10-30 years is that Stablecoins become more dominant than treasuries while offering better currency characteristics than “Global Fiat and Broad Money”. Crypto will also play in the currency space much like credit cards do now, and Bitcoin will continue to play the role of gold in the digital arena. Though it offers optionality and programmability. Because of this, Bitcoin likely eats into real estate as well and bitcoin mining into the “power” arena.

These are reasons why market cap of the asset classes are much more important than market cap of a single stock. Because they give us a trajectory for Bitcoin’s value as it eats into portions of these assets (stores of value).

1/3

The importance of this image conveys the importance of #Bitcoin to the energy grid.

It’s basically a history of hydropower w/ solar, wind & gas connections. All the big player names and how they integrated over time. pic.twitter.com/iHC7mX3py3

— BitKane (@kanemcgukin) April 2, 2024

Future Value and Market Cap

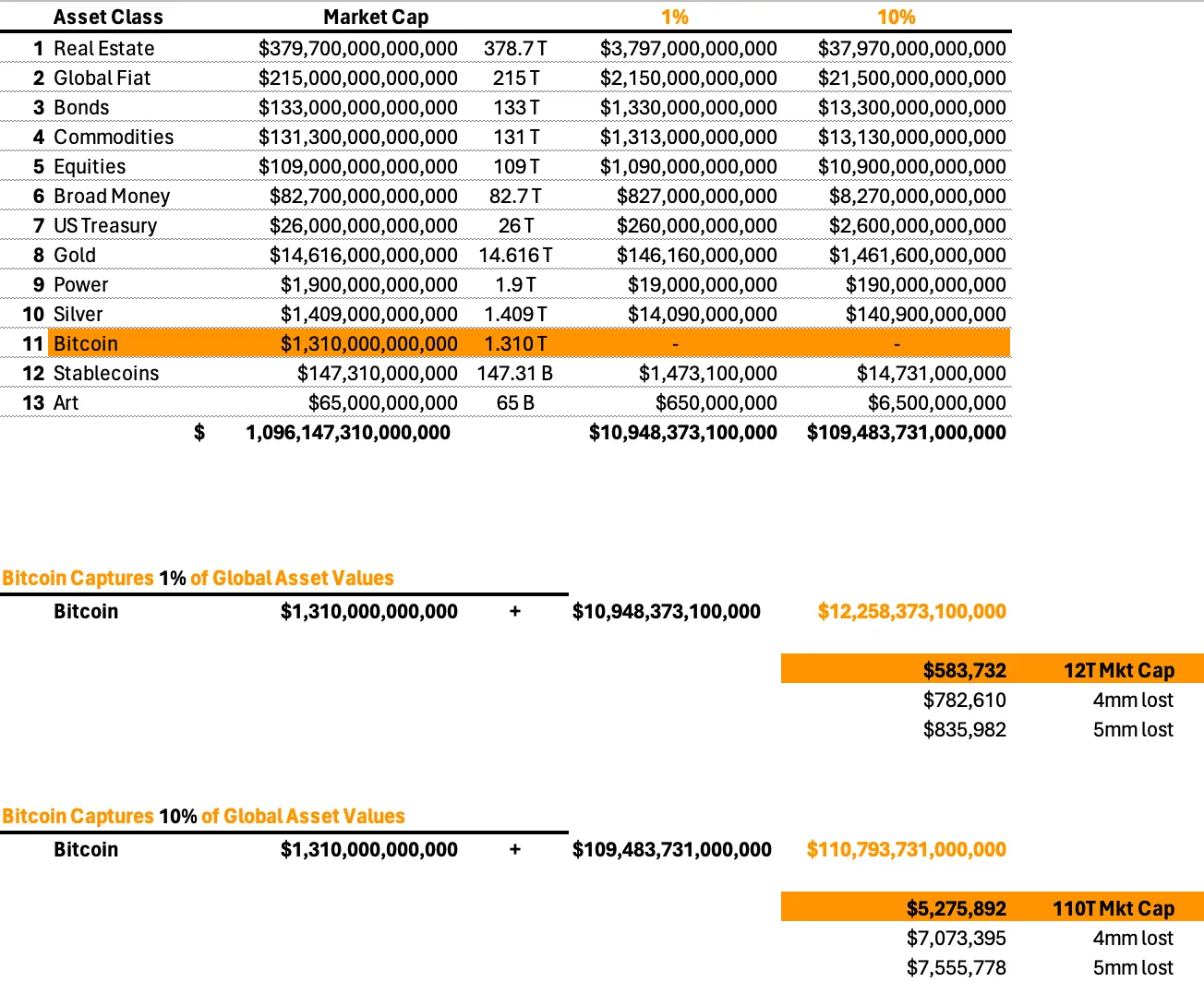

I’m not a big fan of if we just get 1% of total addressable market (TAM) projections, but this is the easiest way to project out Bitcoin’s value as it consumes some of the other primary asset classes we store value in. This also allows us to avoid some of the FOMO. Taking down asset classes takes time, it doesn’t happen by next Wednesday.

Realistically, in my opinion, Bitcoin likely eats into equities, bonds, gold, and potentially smaller portions of treasuries, commodities and broad money. Maybe some real estate too. In fairness, you can’t eat your Bitcoin. You can’t sleep in your Bitcoin and you can’t wear it. So, some of the most basic asset classes, those of living utility, will likely always carry more value.

When you start to look at Bitcoin in terms of Market Cap you can easily come up with future price projections by taking Market Cap / 21,000,000. And, if you’d like to get more aggressive then you can divide by 14 – 15,000,000, as roughly 4 to 5 million have been lost. The remaining 1,000,000 will be distributed over the next 116 years or so.

When looking at Bitcoin this way, you can see that its value per coin can easily range from several hundred thousand to several million per coin. But, and it’s a big but, we have to determine how much of the total pie Bitcoin will consume. And that will take time. That is why the 4-year cycles of Bitcoin are so important. They keep us interested and in-check.

Get on the Bombthrower mailing list here and receive a free copy of The Crypto Capitalist Manifesto and The CBDC Survival Guide when it drops.

Subscribe to Kane McGukin’s Substack here.

Obviously an intelligent person, where does he get the idea that Bitcoin "stores value"? At best, it can only hedge against fiat, and at worst, it's a pump-n-dump funded by guys who print fake USDT 10x faster than the Fed, when adjusted by marketcap.

Satoshi never mentioned storing value, he designed a Peer to Peer Electronic Currency.