Assessing The Potential Of Bitcoin Mining In Energy Monetization

If trade is considered the lifeblood of an economy, then surely energy would mark the essence of life itself. Without energy, then trade has no foundation to stand upon. And yet, some seem intent on diminishing the capacity for the world to generate this very essence of an economy and of the world. Thankfully, it seems that some are waking up and facing the music.

Woe Is We, Thx ESG

During the week of August 7th ratings agency S&P Global announced that it would no longer be using ESG scores to determine credit quality of public companies. A spokesperson for S&P Global also (quoted by Bloomberg) stated that their move to ‘not rely on ESG scores in credit ratings’ will not affect the company’s philosophies towards ESG goals, or how the organization assesses a firm’s creditworthiness.

This comes at an interesting time. After years of consistent aggravated PR campaigns against specifically oil and gas. With publicly stated concerted efforts to attempt to hamper O&G production and processing operations reality, it seems, is starting to finally set in. Time will tell what this pivot ultimately leads to with regards to the heightened polarity around ESG and the fixation on emissions and their implied impact on climate change.

There is one thing that I cannot help but get off my chest…

How boorishly cliche; to not be capable of seeing how irrational a tact may be, ignoring data and logic, until failure and mark-ed difficulty are staring us in the face. If there is a silver-lining here, I suppose it would be that this serves as evidence that we are still clutching on to our humanity. This capability of making silly mistakes that yield outlandish consequences proves that (at least so far) we haven’t completely turned into cyborgs yet. So… go us.

Now we not only need to undo all of the damage to public understanding that has been inflicted upon oil & gas, but we also need to explain how important hydrocarbons are to the production of renewables, and why a shortage in black gold is bad for everybody and has significant impacts on all forms of energy generation. Which it seems we are approaching more rapidly than we want to admit.

Choppy Waters for Oil

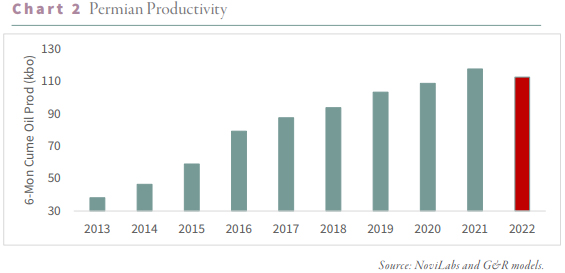

What really drives this point home is the report produced by Goehring & Rozencwajg (referred to as “G&R” going forward) on May 31st, 20233. Conventional non-OPEC oil production has markedly declined, while nonconventional non-OPEC (that basically means US Shale) production has stalled out, globally. The problem is that, according to G&R, the Permian Basin accounted for 75% of all nonconventional supply growth since 2016, globally – of the 7.4mm b/d the Permian supplied 5.4.

“Well, Mike, that’s just for non-OPEC production. You’re making it sound like it’s all doom and gloom, there’s still the OPEC producers.”

Yes you are correct. However, G&R are of the opinion that OPEC production has turned negative, an opinion that I have now heard from multiple different sources and also share (take that with a big helping of salt). This gives two reasons to be concerned about the previously stated production numbers:

1. If the majority of global supply growth was due to expansion in the Permian, and that has now passed, that suggests that supply and demand will continue to invert, and begin to pick up steam. Because, as G&R elaborate on, oil demand was forecasted to diminish after 2019 and instead has smacked back with a vengeance. And this isn’t just a “return to normal” situation, that demand is continuing to expand4. Meaning: energy prices should explode in such a scenario, making for the costs of quite literally everything more egregious. Ergo: the return of inflation and nauseating discussion volume over how real those measures are. Prepare yourselves.

2. If the supply growth stall is only on the non-OPEC side of the equation, that places America in a not-so-great tough spot. Our oil production has contributed to our prowess, and if we were to no longer be capable of continuing to expand access to our supply of oil, that removes a tool from our shed. And if you know anything about politik (and trade) you want every advantage at your disposal when things come to the negotiating table. NOW, lucky for the US is that (from my elementary understanding) we still have basins that we can lean on between California, Alaska, Louisiana, etc. However, these are much much smaller than Texas, and all together suggest by my back-of-the-napkin math ~20-25 billion barrels of potential production.

This leaves behind implications for everything as I stated with regards to the prices. But not just in the prices of goods like your food or the gasoline at the pump. This also has impacts on the expansion of all energy sources, both renewable and oil & gas. Solar panels and wind turbines require significant hydrocarbon inputs, let alone their batteries. The same goes for the production of transmission infrastructure – what brings the electricity to our homes and businesses. This further complicates the conversation around energy sourcing diversification as wind & solar have a problem with economics: they produce their greatest amounts of power outside of the peak demand window. This demand typically floods in between 2pm-8pm when families and individuals are returning home at the end of the day and powering on central air systems, TVs, computers, charging devices, video gaming systems, and various appliances.

Nuclear does not get away from this conversation either without taking some licks. Reactors require significant upfront investment, not just in capital but also in land and water. While reactors may not require nearly the amount of space as their solar and wind counterparts, they are still preferred to be built near water sources. As the power production does not come from the radiation from the fuel rods themselves, but by using that radiation to heat water and produce steam, which spins turbine blades, and those turbines generate the electricity. Oh and that water assists with heat dissipation. So yeah, you’re gonna want a lake or river nearby for that reactor… and building a manmade body of water is a feat that most would prefer to avoid.

Enter Bitcoin Mining, Stage Left.

Nuclear Mining

This is where the big orange “B” comes in with force. First, we will touch on the nuclear discussion as we were literally just there. Nuclear reactors can be limited in project viability as their prime locations can be quite the distance from communities and cities. Meaning that said operations would require significant transmission infrastructure investment to “tie in” to the grid and supply power. Which also means that it could be some time, and many hundreds of millions of $’s invested before the project is capable of earning a return, if the goldilocks environment is not available.

Bitcoin miners are uniquely positioned for this precise predicament. While a young reactor project is waiting for transmission infrastructure to be completed and connected, reactors could partner with bitcoin miners to “move in” and bunk-up on their operation by providing virtually immediate demand. Better yet, is that nuclear generation is consistent. Bitcoin mining’s energy demand is consistent. When operations are properly managed, and equipment is maintained, there is very little downtime required from either side of this equation.

What this provides is an avenue for rapid monetization of future nuclear projects. Things get even better when the grid gets tied-in to our generator; bitcoin miners can either be selected as persistent partners providing consistent demand and serving as a load balancer (like Riot and Marathon have been performing in Texas), or they can be asked to move on. Miners are effectively energy demand mercenaries.

CleanSpark (CLSK) serves as a great example of the success that is possible to an already established nuclear project that incorporates bitcoin mining as a service augmentation. Recently the CLSK team held their earnings call boasting great returns on the production of the bitcoin asset and their fully funded expansion project that will result in a 77% expansion in hashrate bringing the total forecasted hashrate to 16 EH/s5.

For those that are not versed in bitcoin mining terminology “hashrate” refers to the number of attempts that a bitcoin mining machine spits out in an attempt to discover the necessary solution to the current block of transactions. The vast majority of bitcoin miners utilize mining pools, a service that allows any number of mining organizations or individuals to dedicate their resources (hashrate) to work in a coordinated effort to discover that next fabled block. Because these services aggregate so much hashrate, and the likelihood of receiving a bitcoin subsidy is so much greater than working purely as individuals, these pools function by divvying up bitcoin returns according to the % of work done by each participant6. Providing a likelihood for a relatively consistent stream of income for the miners plugged in to said pools.

Now, another interesting aspect of CleanSpark’s latest earnings call was their numbers reported on their all-in power costs, coming in at a mere $0.041 kWh, which was an 11% reduction in their power costs from the prior quarter. CLSK attributes this cost reduction to their “active power management strategy.” Now, I do not know what that strategy could be in technical terms, but I am going to guess that it is a strategy that is effectively load balancing for the cities in which they operate; it only makes sense. That strategy would effectively reduce their cost of energy by not consuming during peak demand hours, also allowing for power prices to be reduced for the community during such timeframes.

CleanSpark even went so far as to further improve the quality of life for the community they have partnered with in Georgia. Matt Schultz, Vice Chairman at CleanSpark, shared that Washington, Georgia’s budget increased from $16 million to $30 million based solely on CleanSpark’s business activities7.

Wind & Solar Mining

There is little that actually needs to be said here. These energy sources are capable of benefiting from incorporating bitcoin mining in a very similar manner to nuclear. The difference being that, rather than responding strictly to demand, these renewables need to be capable of earning revenue outside of the peak power demand window. When your window of peak production is not matching up with the peak demand, additional strategies need to be sourced for revenue in order to cover the delta. Bitcoin mining covers that delta, and can go offline in response to any demands by the grid. Allowing the wind & solar operations to continue earning a solid revenue well outside of their locality’s peak demand window.

Conclusion

Look, I get it. Bitcoin has been an awfully cringe topic for almost everyone for the entirety of its existence. The community largely doesn’t help with that marketing and PR either. I get it. But we have to face the facts here, the world is changing and we are heading into a series of difficulties and complications that are going to require an upgrade to the incentivization of energy. I believe that mining bitcoin accomplishes that in ways that will change America, and the world, for the better. As I briefly described, mining the great orange asset provides a monetization strategy for all forms of energy generation, including oil and gas (which I have already touched on here). I very truly do not care if you call yourself a “bitcoiner.” I’ve never cared for tribalism or dogmas. But what I do care about is societal advancement and pushing towards a future of cheap and abundant energy.

It’s a world that I was promised as a child. And the world deserves its actualization. It may not be a “perfect” solution in your eyes, but I’ll be damned if it isn’t a better solution than everything else that is on offer currently.

Generate more energy, improve the condition of the world. Make some money while you’re at it.

Subscribe to the Bombthrower mailing list to get these posts as they come out (plus The CBDC Survival Guide when it’s ready), and follow Mike Hobart via his Substack and Twitter.

All right, this is so far out from the left field that I'm having a lot of trouble wrapping my head around this one. What you propose is using mini-nuclear reactors (that provide ridiculously expensive energy) to mine bitcoin (arguably the most impractical form of money ever invented that got any traction) in order to incentivize nuclear power, which has been unfairly demonized.

In other words, you are saying that nuclear power has been so demonized (because of the cough-cough connection with nuclear war) that the only way it's ever going to go forward is if you pair it with the biggest kludge ever.

I guess it would be better than going to an all-out nuclear war over the biggest reserves of uranium in the world, that according to Russia most definitely aren't in that country, but a casual glance at the map would suggest they might be economical with the truth.

On the other hand, how do you know there wouldn't be nuclear war over the biggest reserves of uranium in the world anyway? I mean, apart from saying that it would be an entirely irrational thing to do, but we've seen so many irrational things already, how do you know that this particular one isn't coming? Is anybody somehow still managing to keep track of the relative irrationality of stuff? Because I lost track of a lot of it after the literal zombie apocalypse topped by "let's defend democracy by trying to kill democracy, that has been dead for decades anyway".

Or are you trying to say that if we have nuclear war, at least let's attempt to get some nuclear power at the end of it, as opposed to, just turn everything to radioactive waste for no reason whatsoever?

Like I said, with this level of madness I get pretty lost. But I'd rather leave wind and solar out of bitcoin. On the grounds it gives me nightmares of a future where starving children worship a windmill attached to a bitcoin mining server with pretty lights – and the energy doesn't get used for anything else, and neither does the money.

A bitcoin is not a stored unit of energy. Completely opposite.

Crypto mining is more efficient at managing money transactions because everything is decentralized all of the work is spread out over thousands of small computers. A bank has people that live far away, that have to drive automobiles to get to work in giant buildings performing all of the work in HVAC controlled environments.