“Nobody got fired for buying IBM”

…but you might get fired for not buying Bitcoin

Every Bitcoin cycle has a theme and a core driver, and sometimes we’re so close to it, we can’t really figure out what it is (or was) until it’s in the rear-view mirror.

In 2013, I always said it was the Cyprus Bail-Ins and the realization that the banking system was heading in a direction where the expression, “safe as money in the bank”, wasn’t quite true anymore. The core driver was the rise of centralized exchanges – even though one of them, Mt. Gox, blew itself up in a meltdown event which is still unwinding to this day.

The 2017 cycle was about the explosion of the cryptocurrency space as an asset class unto itself: Ethereum stormed onto the scene and with the ERC-20 token specification, igniting a mania of “tokenize all the things”. The ICO boom drove the momentum – and the advent of stablecoins like Tether provided the lubricant to get capital into the digital asset space.

For the 2020 cycle, it was the arrival of the first maverick billionaires – Paul Tudor Jones, Stan Druckenmiller, Elon Musk, Michael Saylor – at the time when their entrance was mistakenly taken to mean, “the institutions are coming” into Bitcoin as an asset class.

Not even close. But what did happen was that a lot of hedge funds and high rollers who were ahead of the curve and out to capture alpha started piling into what was then called “The GBTC arb trade” – long story, explained in detail here but essentially meant that trading desks could book fat profits before they were actually realized, at the cost of locking up their capital for six months.

When it finally came apart (the cycle ended), the GBTC premium morphed into a discount to NAV – and when things went really bad (LUNA, 3AC, Celsius … FTX) GBTC’s own parent entity, DCG, went bankrupt and GBTC became an island of trapped capital, over $30 billion worth.

Now we’re in a new Bitcoin cycle:

We have a new theme and a new catalyst. GBTC comes into the picture here again, because it is both the reason why the Bitcoin price was somewhat muted once the catalyst hit, and also part of the new catalyst.

Remember what we’ve been saying for a year, maybe more: in the next cycle, the institutions will show up, and because of the huge asymmetry in Bitcoin, they will find it compelling enough to allocate a small percentage to it.

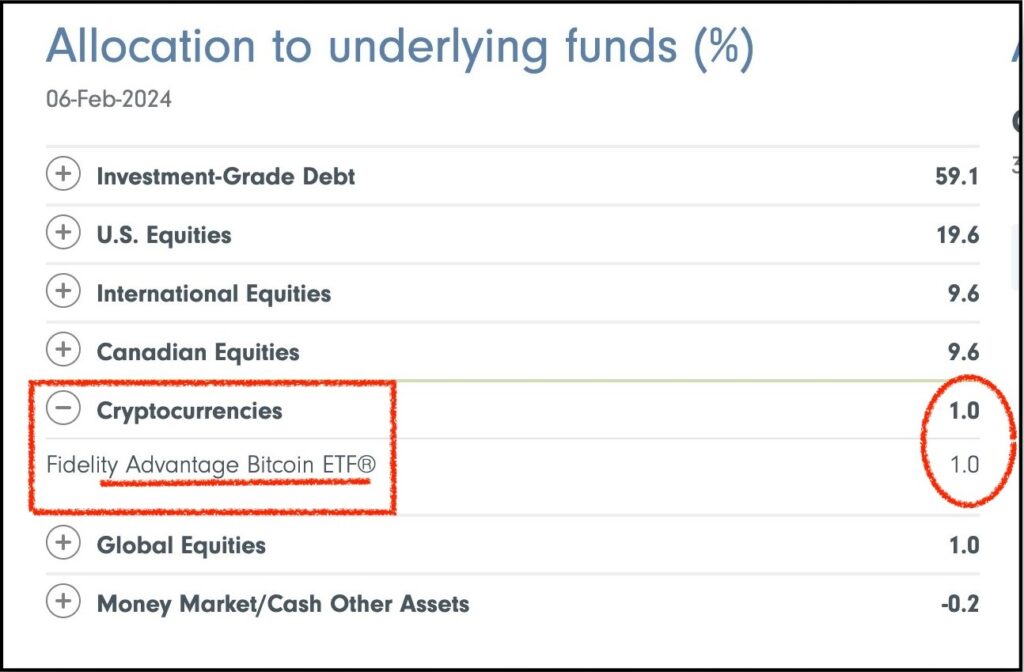

I predicted a new investment mantra for institutional fund managers, “The 1% Allocation”.

Let the data points commence: Fidelity, with $12.6 trillion AUM and one of the spot ETF providers (the only one who built out their own custodian to handle it) has added an allocation of “crypto” to their flagship, “All-In-One Conservative ETF” – self professed as, “A one-ticket solution diversified across regions, market caps and investment styles/factors, with the attractions of professional management.”

The one percent allocation goes back years – in fact the first time I saw it was in a Central Bank of Barbados working paper from a pair of economists there, recommending that country’s central bank hold 1% of it’s foreign reserves in Bitcoin – that was in 2015.

By 2022, even the Basel Committee on Banking Supervision was setting guidelines on “crypto” allocations for Tier 1 reserve assets:

“Group 2 exposure limit: A bank’s total exposure to Group 2 cryptoassets must not exceed 2% of the bank’s Tier 1 capital and should generally be lower than 1%”

(That BIS paper didn’t differentiate between Bitcoin and “crypto”, although it should…)

And this recent Motley Fool article, which is mostly about Cathy Woods’ upping her allocation in ARK Funds to 19% cites the 1% allocation as rather matter-of-fact conventional wisdom now:

“Until this year, the consensus view had been that Bitcoin should account for only a tiny portion of your overall portfolio. As a general rule of thumb, 1% was the norm, and any percentage over 5% was considered ultra-aggressive.”

The new 1% Rule: Buy Bitcoin

We all know the old adage, “Nobody got fired for buying IBM”, which was a mantra back in the “Nifty Fifty” days (which was before my time, but there have always been later iterations: substitute IBM for Microsoft, Google, Apple, etc.)

Here’s what I think happens now: while today nobody may get fired for buying, say, The Magnificent Seven, tomorrow you may very well get fired for not plunking 1% into Bitcoin. Yes, really.

What will a 1% allocation across the institutional wealth spectrum do to the value of Bitcoin? My mental model going back to The Crypto Capitalist Manifesto has always been to look at the total size of the bond market, compared to Bitcoin and precious metals.

Basically, this: pic.twitter.com/FhwvjUxYOq

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) February 11, 2024

From there I posit what would happen if just 1% of that “return-free risk” (bonds), walks on over to Bitcoin. Considering Bitcoin only recently recaptured the $1 trillion market cap, and there’s anywhere between $150T and $300T in global bonds (depending on what you include), a mere 1% exiting fiat-backed bonds and stacking sats would more than double Bitcoin’s market cap, at a minimum.

We’re just over a month into this new era of Bitcoin being available as an institutional allocation strategy and early indications are already there that capital allocators are even choosing Bitcoin over gold – which was something that admittedly, surprised me:

Can someone do a wellness check on @PeterSchiff? pic.twitter.com/mUc2xGwK2j

— Jameson Lopp (@lopp) February 14, 2024

I thought those who had already allocated to gold would stay there, and add Bitcoin, but it is now looking like institutional fund managers who had allocated to gold as an anti-fiat hedge have lost patience with gold’s repeated breakdowns from all-time-highs.

Gold did print a new all-time high in December, but as I’ve observed, since the prior high in 2020, a new ATH in gold may mean a multi-year pullback rather than an impending higher high.

Bitcoin, by contrast, looks poised to put up a new string of them, for the next couple years at least.

So I now humbly present you with “The Theme” of this cycle:

The Theme is: The Institutions are Coming.

The core driver is: The Bitcoin Spot ETFs.

The mantra will be: Allocate 1% to Bitcoin.

This is an excerpt from The Bitcoin Capitalist – Mid-Month Portfolio Review, we’re halting access soon: learn more here ».

My forthcoming ebook The CBDC Survival Guide will give you the tools and the knowledge to navigate coming era of Monetary Apartheid. Bombthrower subscribers will get free when it drops (and The Crypto Capitalist Manifesto while you wait), sign up today. Follow me on Nostr, or Twitter.

Why do you feel that gold and oil won’t explode upwards now?

So far gold just hasn’t, even tho it should.

Given that the gold stocks did not confirm the last ATH – I feel like it could be another couple years before gold notches up another one.

The ETF outflows also seem to indicate a lack of interest in despite all the reasons to be in it.