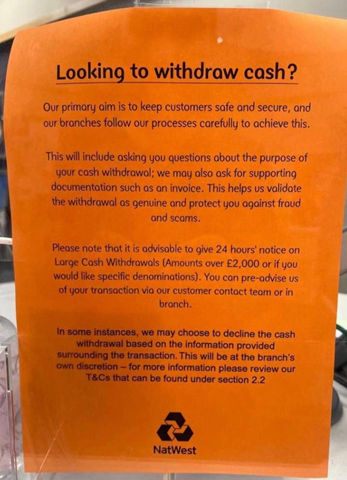

A reader sent me this graphic which is circulating on social media. Whenever I see an unattributed image like this going around I want to verify it, lest it be photoshopped, a deep-fake or some derivation of “urban legend”.

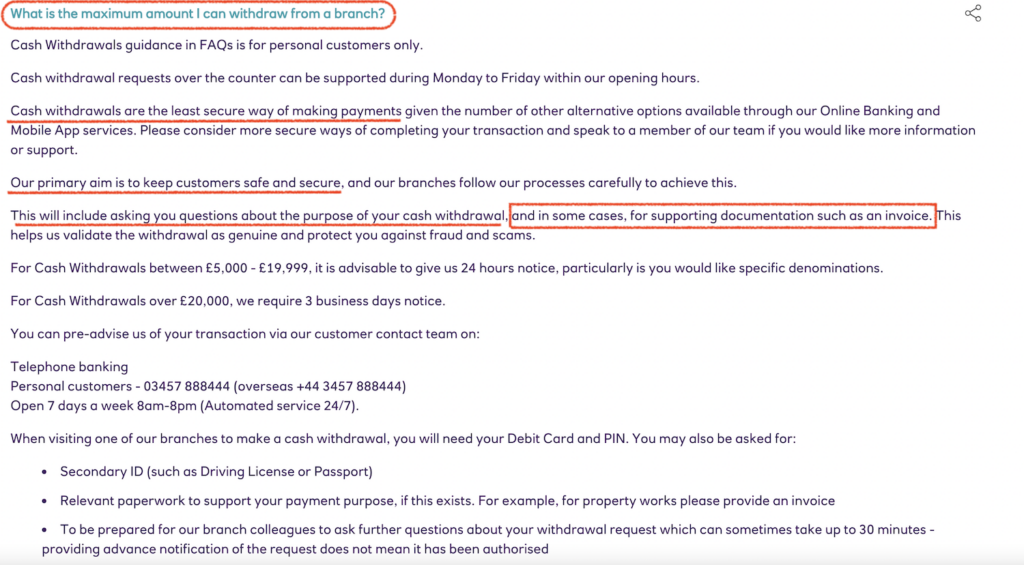

Sure enough, if you go to NatWest bank’s website, right here – you see this cash withdrawal policy spelled out for all to see:

This isn’t actually new

Here in Canada, for at least a few years – predating COVID, the big four banks have been routinely asking you why you are taking cash out whenever you withdraw anything over a couple thousand dollars. However, you can tell them pretty well anything (“because I want it”, “none of your business” or even “to blow it all on booze and hookers”, will all work). I haven’t heard of a case where a withdrawal has been denied based on the reason supplied, yet.

But now that we’re starting to see it formalized in policy language of banks, we can all see where this is going.

The war on cash has been in full swing for a long time, India banned large denominations bills in 2016 and will now start eliminating them from the monetary base. France has been signalling a prohibition on cash payments over 1,000 € since 2013 and finally, quietly, it seems, made it part of the framework this year.

It portends a wider initiative across the entire Eurozone (who is also trying to lump in crypto payments under the restrictions).

Here Come the CBDCs

This is all to lay the groundwork for the march into Central Bank Digital Currencies (CBDCs) which will seek to accomplish three objectives of Late Stage Globalism:

- Eliminate privacy – making all transactions trackable, traceable and taxable in realtime.

- Introduce controls on how, when and why you are spending your own money. Think China-style social credit, which in its Westernized form will almost certainly involve personal carbon footprint quotas.

And most importantly (otherwise we wouldn’t be calling it “Late Stage Gobalism”): - Extend the runway of fiat currencies – which are about to hit the wall as a long-wave debt super-cycle reaches its crescendo.

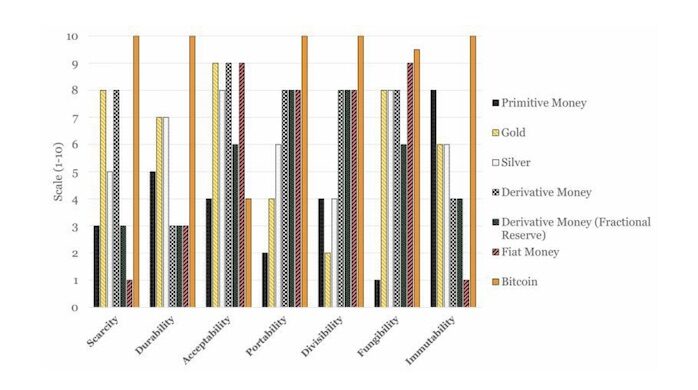

The antidote to all this, is of course, Bitcoin. The only digital asset that is scarce, truly decentralized, has frictionless portability, and is backstopped in physical reality (the “7th property”) in away gold isn’t. It embodies all other properties of sound money:

There are still many who scoff at the idea of “magic internet money” becoming viable at all, let alone the main bulwark against the coming CBDCs. We know cash is doomed, we know any state or central bank issued digital substitutes will simply be linear, digital extensions of fiat: backed by nothing, based on debt, but with added layers of technocratic surveillance and control.

With the mother of all economic recessions dead ahead (if not here already), and the fiat banking system more or less insolvent, the value proposition for CBDCs (a.k.a subservience-tokens) will be Universal Basic Income, with all encompassing strings attached.

Anybody relying on the State for their economic subsistence will have their lives gamified via their smartphones, their carbon footprints metered, their energy usage subject to approval. Such will be the life of a CBDC-serf.

![]()

When those days come, the bank won’t have to ask you why you want some of your own money and how you are going to spend it.

You’re the one who will have to ask them …for permission.

My next ebook is The CBDC Survival Guide and I’m sending it free to Bombthrower subscribers when it’s done (early June). In the meantime, subscribe now and get The Crypto Capitalist Manifesto while you wait. Follow me on Nostr, or Twitter.

You haven't heard of a withdrawal request being denied? You have now! I live in England and requested most of my own money from that very bank, NatWest. This was a year or so ago, before their FAQs as shown in your article. I was so surprised and blindsided when they asked for a reason, I gave the first answer which came to mind which was " I've decided to keep my money in cash at home, I'm not satisfied with the safety of the banks right now. " This was essentially the true reason, even back then I could see cbdc units coming and I wanted an escape fund. I was refused. I asked to speak to the Manager. Refused. I asked what right they felt they had to refuse me access to my own funds. They said they were happy to pay an invoice on my behalf or transfer my funds to another bank, so technically they weren't refusing my request, just " following internal policy" on cash withdrawals!

Of course I did transfer my funds, never set foot in that bank again. The new bank had no problem giving me cash. The young cashier asked why I wanted the cash and I gave her the same answer. She was interested, asked for more info on cbdc's, and said she would think about keeping her cash on hand as well lol

Mark

full censorship of your Apple IPhone is ALREADY HERE. My safari browser and DuckDuck Go will not even do a direct search anymore for me, and if I put in some video, tons of worthless Chinese videos come up, but nothing to do with my search. My phone is limited now to only 3 pages of search results, that's it!

Tell me how great bitcoin is after the evil people conduct a cyber attack and the internet goes bye-bye…

Bitcoin is decentralized so even if the net is out, the blockchain will continue unperturbed until it is back up. If you’re positing a total global internet outage – including satellites (where the blockchain also resides now), then the problems will not be confined to Bitcoin, and even your gold is not going to be much help to you.

Gold doesn’t need blockchain, Internet or electricity. Gold will always be acceptable currency. It always has. Proof: human history.

Nobody is disputing that.

What will give you problems is moving or traveling with any meaningful amount of it during a crisis.

With Bitcoin you can just memorize 12 words and get out of dodge.

I understand the theory behind crypto currencies, however, I prefer hard, real Sound money (precious metals coins, bars, medals, commemorative, and also other newer forms of specie such as gold notes and goldbacks! We are definitely headed for CBDCs, and probably a "Global CBDC!!" Crypto currencies are backed by absolutely nothing! They, like our fiat paper Dollar, are based on nothing but faith in and pure speculation!! Thanks, but no thanks to faith in pure speculation!!

The thing you’re missing is that Bitcoin (as distinct from all other cryptos) is a hard money. It’s backed by energy from the Proof-of-Work mining algorithm and it’s an inelastic, deflationary currency with a hard cap of 21 million units.

Your article on NatWest is very misleading. If you read the flyer carefully, it is from a UK bank, not a US Bank. I love Swiss America but you need to get your story straight. You said you verified it but obviously you did not.

TRUST AND VERIFY

Well, “Stan the Man”…

At what point did I say that NatWest was a US bank? I know it’s a UK bank.

Does it matter if it’s a US or a UK bank when what’s happening is a global phenomenon?

The only misleading thing is your own ethnocentrism, assuming that anything you are reading on the internet has to be about America. I’m not even an American myself, which you would have known if you had any reading comprehension ability.

I don't know much about Bitcoin or whether or not it's in some way backed by the governments of the world, or completely an independent way of buying and selling. One thing I do know is if it's in the way of the single global currency that is going to be implemented through most likely, Quantum Dot tattoo, it will be done away with through government legislation, all crypto will be ancient history. A social credit system created by a world government will be the only way to continue to buy and sell. The one world government will make it virtually impossible to stay out of the system and survive.

You’re one of those people who believe the governments of the world are all powerful entities and we live at their whims and mercy. The reality is the nation state as we understand it today is on the verge of unravelling. There will be no “one world government”, and no single currency aside from hyper-Bitcoinization – the currency of enemies.

However, if you truly believe you are powerless and destined to live enslaved as a social credit serf, then that is exactly how you are going to end up.

The alternative is, as I have been writing for some time: put your energy into the life you want, not the life you don’t want – become a Sovereign Individual, and take total responsibility for your life and your destiny.

The choice is yours.

I call you on the One World Government. We have that now with Central Banks. Play ball, or get squashed. Do you not think these Bankers are calling the shots? They control almost everything.