But I’ll break even as soon as gold cracks $178,820.86/oz

Peter Schiff hates Bitcoin and constantly admonishes HODLers that if they had any brains they would sell their BTC and use it to buy gold. If you look at his timeline on Twitter/X, there are innumerable tweets advising one to do this, but this one is a good example for today’s lesson because of the way he frames it as “a mistake” to hold BTC over the yellow metal:

It’s not about bashing Bitcoin. It’s about saving people from making the mistake of buying it instead of gold. It’s also about trying to help people who already own it to sell and buy gold instead before Bitcoin crashes for good.

— Peter Schiff (@PeterSchiff) April 9, 2024

James Joyce once said, “Mistakes are the portal to discovery”, and you won’t believe the “discovery” I made the other night as I was sifting through my records collecting documentation on some of my gold holdings of which I’ve been cashing out at these highs to buy an investment property (shout out to the Rock Star Real Estate crew for all their help).

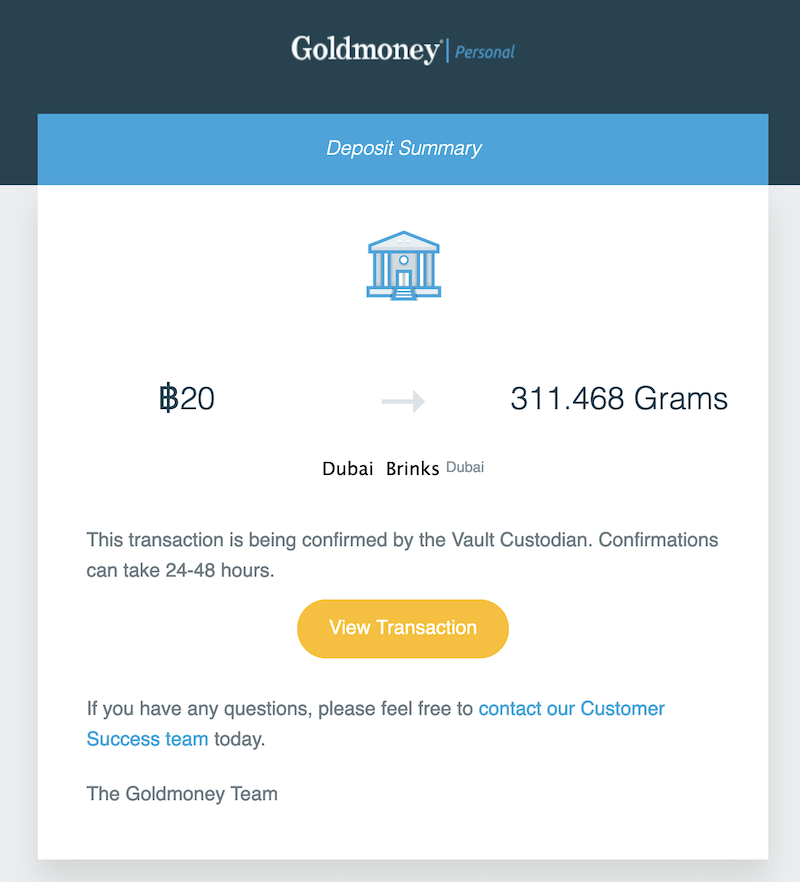

Among the emails from Goldmoney, who used to facilitate Bitcoin into gold exchanges, was a deposit receipt from 2016…

The date was October 14, 2016, and yes, I traded 20 BTC of magic internet money for 311 pebbles of shiny yellow rock.

Let’s take a look at how I fared following what I now call “the Peter Schiff Playbook”:

Oof.

Could have bought that property, and the house on either side of it, in cash.

Live and learn. Obviously, in 2016 it was earlier days. I had done work on Bitcoin, but not as much as I have by now (it wasn’t until the next year, in 2017, but before the parabolic spike in Bitcoin, when I was in England for the ENS WG meeting, that I had my “crypto really is here to stay” epiphany. Until then it still seemed nebulous and unclear what the trajectory would be).

Will this asymmetry continue into the future?

If you’ve ever read The Crypto Capitalist Manifesto (which you can get here, free), my base case for Bitcoin is that:

- Ever increasing amounts of capital are on a one-way trip into Bitcoin – it has no intention of coming back out into the legacy fiat system

- The capital flows of the future are from fiat based assets – primarily bonds into hard assets like Bitcoin (and yes, gold – they’re both going much higher).

- At a $2 trillion market cap (compared to gold’s $15T or so) Bitcoin is still very early in the migration, even if a fraction of a fraction of a bond exodus heads into Bitcoin, it will result in a mind-boggling repricing higher, in fiat terms.

On this last point, I would argue that Bitcoin is earlier in this migration than gold is. And we see indications of this below, when I look at the dynamics of how each fares when used as loan collateral.

All of this got factored in when it came time to pull the trigger on cashing out some of our savings for a rental property, making it a no-brainer deciding whether to sell some of the gold at the highs versus some of the Bitcoin – also near the highs.

Bitcoin also provides superior collateral to gold, hands down.

There was also the option to borrow against either asset – and this may surprise you:

It is a more viable deal to borrow against your Bitcoin than it is to borrow against your gold.

People like Schiff keep telling you about gold’s 5,000 year history, etc. Yeah ok.

Turns out, you can borrow against your Bitcoin at a LTV of 50% at a place like Ledn (even higher in some places, like Coinbase) and carry it at about 14% annually. That’s expensive capital for sure, but with Bitcoin’s CAGR somewhere north of 25% annually, it’s practically an arb play.

Gold backed loans are usurious by comparison. 50% LTV as well, and 3% to 5% per month to carry it. Fucking. Crazy.

Especially when you compare gold’s CAGR which is single digits. 8% the last 10 years.

Said differently, Bitcoin’s CAGR is at least double what it costs to carry a loan against it, while gold’s is less than half.

We decided to unload some gold and in doing so was when I found that deposit receipt for my all-time worst.trade.evar.

Oh, now I also have to spend a few hours at my storage locker this weekend digging through bankers boxes looking for the receipts from some of my earliest gold purchases – otherwise a huge chunk of my down payment funds will get excluded from consideration. Can’t document it (on the bright side, I did find my Schmidt M1882 Swiss Officer’s revolver while I was scouring the house, …was wondering where that one went).

My banker literally told me, “If you end up selling some Bitcoin it’s no problem” – because it’s easier to prove to the bank the provenance of the Bitcoin over the prior 90 days than it is my gold.

At the end of the day, I can’t beat myself up too badly for making an expensive mistake in my past. It wasn’t the first, it won’t be the last. I still think gold has a place in one’s portfolio (somewhat, but the hassles around it have taken some of the glitter off) and I’m still invested in it to a lesser degree, but trying to frame the never-ending “gold-vs-Bitcoin” debate as an either/or scenario – the way Peter Schiff routinely does – is disingenuous and intellectually dishonest.

I’m sure he would tell me I was ahead of the curve, and that someday I’ll pull ahead on that gold trade (in other words… “HODL!”).

So I did the math on that, too:

When gold hits $178,820.86/oz I’ll be even-Steven on that 2016 trade.

Like it never happened.

I may have taken a bath on my bad trade from 2016, but at least my Bitcoin Capitalist portfolio has had multiple 1,000%+ grand slams this cycle, not to mention our latest addition which did over 120% in under a month (January) and a sleeper hit that ran over 3,000% from 0.12 last August to over $4.00 today. TBC readers were on board for these moves and more. Try it today »

Follow me on Twitter/X here, or get a copy of The Crypto Capitalist Manifesto free here.

Nostr: npub1elwpzsul8d9k4tgxqdjuzxp0wa94ysr4zu9xeudrcxe2h3sazqkq5mehan

a question: do you think it is possible that the "shiny stone" could one day be worth zero? do you think it is possible that Bitcoin could one day be worth zero? – honestly – bluntly – without infinite argumentations say: which of the 2 is more feasible that one day it will be worth zero? – by the way – I own BTC but I don't swear by it –

In a scenario where Bitcoin is a zero, a tin of dog food will be worth more than it or gold.

XAUT or PAXG!

When I feel like BTC is peaking and I want to take some profits but don't want to pull all the way out to fiat (USDC/USDT/USD)

Because gold is a slow mover compared to BTC, even though they might move up together when BTC is crashing it creates a strong negative correlation.

PAXG/BTC