Does the Fed have the will to lash itself to the mast?

In Greek mythology, on the island of Anthemoessa, lived dreaded creatures called Sirens, half woman, half bird, they would sing songs so enchanting that passing sailors would invariably change course toward them and wreck themselves upon the rocky shores. Odysseus and his crew set sail from Circe and knew they had to pass the island, and they knew what fate awaited them should they succumb to the Sirens’ call. Odysseus gave his crew beeswax to stuff in their ears, however he, intent on being the only man on the Seven Seas to hear the fabled song and survive, lashed himself to the mast. Having ordered his men not to release him or heed any orders he might give until well past the danger, he went stark raving mad as they sailed past the island. No matter how much he begged his crew, they held fast and kept to the plan…

I remember when Nortel’s stock crashed back in 2000, it actually peaked out in July, a few months after the dotCom crash hit that march. At the time I didn’t really know anything about economics or financial markets. Zilch. People like me were walking around thinking literally “The QQQ’s would always go up” and that the March sell-off was a “buy-the-dip” type event. In late 1999 I took a $500 cash advance on my Mastercard and opened an E-trade account. By March 2000 it was worth $3500 and I thought Warren Buffet was a pussy.

Then it all came unglued. I wasn’t invested in Nortel, but the fact that it was still going up after the March dotCom crash had me thinking it was all a temporary glitch in the matrix. When Nortel started to crash a few months later, I remember feeling bewildered and confused because the reported catalyst behind the first sell-off was that their guidance was for slower growth.

It made no sense to me, if they’re still growing, albeit a little slower, then what’s the problem? Little did I know….

Little did I know that the global economy, since the Greenspan era of the late 90’s was in the process of being entirely financialized. It wasn’t actually a Ponzi, in the classical definition of the term (later investors being paid out by funds from earlier ones), because the ever increasing valuations were being generated by ever increasing amounts of stimulus and debt.

To fix the dotCom crash, the Fed doubled down, and inflated a housing bubble.

“To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that.. Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.”

— Paul Krugman, “Dubya’s Double Dip?” NY Times, Aug 2, 2002

Same deal there. ‘Housing prices only go up’ was the mantra. Most of us know what happened next.

The pattern to observe here is two-fold:

1. the amount of time the central bankers endured market corrections and recessions to play out before stepping in with stimulus, and

2. the starting points from whence stimulus and bubble transference began

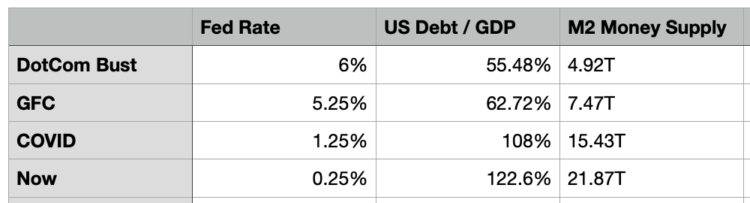

The amount of time got shorter, and the effective interest rates heading into the crisis were lower, while the overall debt bubble and money supplies were larger. Much larger:

Each one of these episodes was one of global, coordinated, can-kicking. Each of them exacerbated wealth inequality, reduced competition and further ensconced central bank policy wonks as unelected technocrats over the economy.

Now that the taper is here and purportedly being accelerated at the same time rate hikes are being dutifully jawboned beginning next year there is seemingly near-unanimous consensus that the markets are putting in a secular top of epic proportions.

Apparently central bankers are now going to try to normalize their way out of not only the COVID monetary interventions, but by extension, all that which came before. The Fed in particular is supposed to be reducing its balance sheet and hiking interest rates.

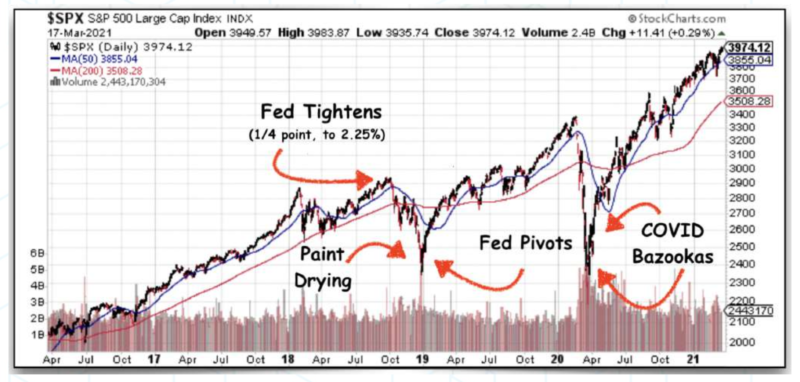

This will certainly affect the markets, and the big question is whether that unfolds as a gradual letting the air out, like Yellen’s famous “it’ll be like watching paint dry” euphemism, or more like a disorderly implosion. A crash, which from these levels would be one of near Biblical proportions.

The last time the Fed tried this, it didn’t go well, and the Fed had to pivot and reverse course on a 1/4 point raise within weeks. And that was before COVID and all the stimulus from that.

In https://bombthrower.com/wp-content/uploads/2019/03/shutterstock_1030471843-e1551983495127-1.jpg Moss’ recent podcast his guest was Wall St For Main St CEO Jason Burak who pointed out that when the GFC hit, it took the Fed about 6 months to come in with massive interventions. When COVID hit, the intervention was enacted within weeks.

Now the Fed is talking serious about unwinding this mess. This time they supposedly mean it (even though in the latest meeting they hinted that they’ll stop meaning it if the markets get too rekt).

The question now, the only question really, is does the Powell and the rest of the Fed Board have the intestinal fortitude and iron will to ride out the economic carnage tapering and then tightening would unleash?

Is Jerome Powell was this era’s Paul Volcker?

One has to at least consider the possibility that The Fed will dig in, bite the bullet and try to normalize rates regardless of the carnage – think Paul Volcker, late 70’s. From his autobiography ‘Keeping At It’ released not long before his passing, he recounts (in a chapter section titled “Lashed to the Mast”) on being questioned, even much later in life if his interest rate hikes were designed “to deliberately produce a recession”.

“Deliberately designed? No.

Designed with a clear understanding that sooner or later the accelerating inflation process would culminate in a recession? Certainly, I myself was convinced that the longer the process continued, the greater the risk of a deep recession.

It is an interesting fact that that the Fed staff had concluded the economy was at the edge of recession even before the Saturday package was announced.

I suppose if some Delphic oracle had whispered in my ear that our policy would result in interest rates of 20 percent or more, I might have packed my bags and headed home [Volcker’s wife Barbara cried when his reappointment was confirmed. – markjr]

But that option wasn’t open. We had a message to deliver, a message to the public and to ourselves.

A relationship between money and the price level is one of the oldest propositions in economics, going back to the Scottish philosopher David Hume in the 1750s. Milton Friedman and his acolytes had some success in impressing on the public mind an (overly) simple proposition ‘Inflation is always and everywhere a monetary phenomenon’.

[the rate hikes] enforced upon the Federal Reserve an internal discipline that had been lacking: we could not back away from our newfound emphasis on restraining the growth in the money supply without risking a loss of credibility that, once lost, would be hard to restore. To overdramatize it a bit, we were doomed to follow through. We were ‘lashed to the mast’ in pursuit of price stability”.’

Bear in mind what is feeding the market instability now is simply that the Fed wants to decelerate the rate of bond purchases. What will happen when the spigot gets turned off completely? How about when they come in with rate hikes?

Looking at the pattern of past financial crises, the interest rates before, the debt levels and money supply, we see a clear trajectory of a monetary system running out of runway. Given the shrinking intervals between the onset of crisis to massive central bank intervention, I don’t know how long a massive financial cataclysm would be endured before the Fed reverses position again and comes in the levitate markets again.

The big question, in fact the only question, is would that actually work this time? Because eventually it won’t, and this next time may be the last time for this global financial system.

Here’s Jason Burak from the aforementioned https://bombthrower.com/wp-content/uploads/2019/03/shutterstock_1030471843-e1551983495127-1.jpg Moss interview on why the Fed can’t let asset prices go down:

Burak: The government loves asset price inflation and that’s why the policy’s like this. So we can have deflation but it will not last at this point. I’d be shocked if it lasts for more than 3 or 4 months because that’s how ridiculous the system is. The system is a currency and credit Ponzi scheme with government and corporate debt.

Moss: So you’re basically saying if we see a dip in the markets, it would be very short lived which would then be met with an enormous amount of central bank manipulation to push the markets back up to new all-time-highs.

Burak: So if the Fed does not want to do that to help the U.S. treasury with capital gains taxes then what the Fed’s gonna have to do is they’re gonna gave to cover all those lost capitals gains taxes that the treasury was bringing in. The Fed would have to [monetize]… The Fed’s trapped, they don’t want to admit this, the Fed’s trapped and the balance sheet is not going to go down significantly, really ever again. Unless the US government drastically cut spending or the US loses World Reserve currency status in the near future”.

That’s why they won’t stay the course and they must inflate another bubble after this one pops. Who knows, maybe the next Fed induced bubble will be in cryptos themselves (I can hear Peter Schiff’s head exploding from here). Here’s Burak again, building on the theme that government tax revenues increasingly come from capital gains and for that reason, asset bubbles are a necessity:

Burak: “The Fed would have to cover the losses. All these capital gains taxes… Have you been to the Blockchain Summit here in DC? You should come if they have an in person one at Georgetown and listen to people from the US treasury. Listen to people from the Federal Reserve, listen to people from the Securities and Exchange Commission and the CFTC speak at the event…. they’ve been in Bitcoin for years. They love Bitcoin, they buy Bitcoin for family members, but they want to tax the crap out of it too and regulate it”

Moss: Which is fine, they can tax it, just pump it to the moon.

In other words, “We’re in an Everything Bubble That’s Too Big to Fail”. No matter what happens, the Fed must inflate serial bubbles for as long as possible because the alternative isn’t a brutal bear market of unknown length and indescribable pain, the alternative to another bubble is the end of the prevailing monetary system itself.

Today’s post contained excerpts from The Crypto Capitalist Letter, which covers macro tensions between the globalists and sovereign-individuals, along with a tactical focus on publicly traded crypto stocks. Get the overall investment / macro thesis free when you subscribe to the Bombthrower mailing list, or try the premium service for a month with our fully refundable trial offer.

I think with the economy in CCP occupied China on the brink of collapse (their real estate market is collapsing as we speak) anything their allies in DC accomplish will have to be done with Beijing's cooperation. My pet theory (unencumbered with any pesky data I'll admit) is that CCP is heavily invested in Crypto and is now forced to sell off en masse to try to prevent the inevitable, and I attribute recent dips in Bitcoin pricing to this.

Based on the history of communism as we know it, it seems to last at best about 70 years. That's the time it takes for a generation to grow up with every living generation before theirs saying "I grew up in this system, they've always made these promises, they've never come true". From my youthful interest in the nice sounding utopian theories like Marxism, I now have abiding suspicion of any "free lunch" economic theories, and special contempt for communism and socialism ("communism lite"). Not the people mind you, the theories. Our own special economic problems can be largely traced to our own socialists. I believe FDR was the first socialist president, and find claims he doubled the length of the Great Depression with his policies to be a very credible thought.

Bitcoin seems (from what I've read of the code and theory so far) to be well designed to weather tampering by those with poor impulse control. So long as we can keep a central "authority" from gaining real control over it, they may stretch and bounce it, but individuals can keep some control.

I recommend you overlay your existing knowledge onto the picture that Catherin Austin Fitts paints.

From her perspective, the Fed, along with all central bankers, are trying to transition us out of a monetary system altogether and into CBDC's…which is merely a socio-digital credit system. A 1000-yr third Reich of, ironically, Kabbalistic bankers. (I'll let you figure out why that is ironic)

Unfortunately, and after much consideration, I've come to the conclusion that this is the case…

And I suppose they will pump BTC and alt coins as their last "bubble" before the whole thing collapses and we move into the ultimate Hegelian Dialectic narrative where the "problem-starters" conveniently bring a solution to the table just after we react to the problem that they created to begin with.

Fitts is pretty consistently wrong about crypto. She seems to lump it in with CBDCs and they are polar opposites.

Thankyou for continuing to speak into the crypto space.