One of the surest things in life is that change is imminent

Amy Webb’s book, The Signals Are Talking, has sat on my nightstand for at least 4 or 5 years. I couldn’t figure out why. Now I know.

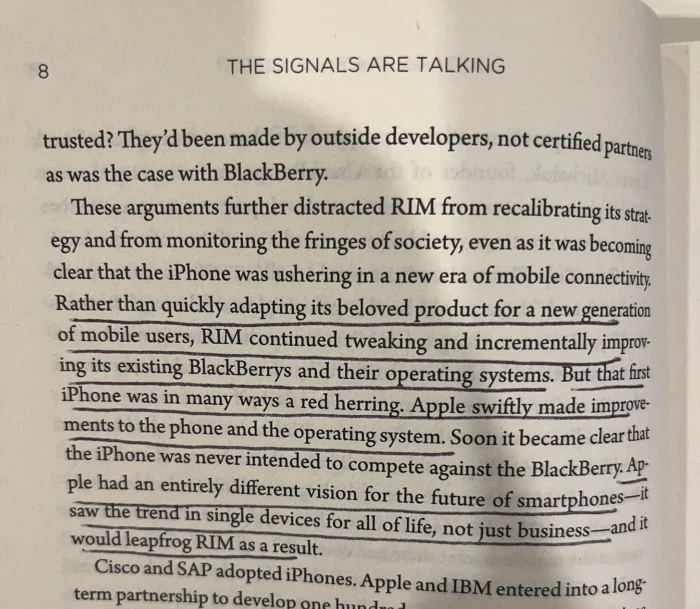

The above passage makes it clear. Now it’s time

It’s time for banking as we know it to change or be changed. We have two choices, see the negative, or embrace the opportunity.

The opportunity to allow individuals to pay and move their money in ways that match how they choose what to watch on TV, where they get their mail, how their news and food are delivered, or how they hail their taxis… over the internet and with a reduction of middlemen.

In the passage above, it’s clear that banking as we know it is done. It’s clear that banking as we know it is RIM and digital assets are the iPhone… Bitcoin and some things crypto (yes, I know a dirty word in certain circles) are how money and value will be transferred as we move forward.

Bitcoin solves the problem of broken money, providing a gold-like sound money asset in a digital system, while *some* crypto and DeFi act as integrators which is nothing more than technology for moving money. Think credit cards, Swift Network, FED Wire, ACH, EFTs (electronic funds transfer), etc. Most of these are protocols and they all need to be updated.

The tellers. The big institutions. They are all full of disjointed savings, checking, and brokerage accounts. So sparsely connected. When viewed in the context of Amy’s analogy. It’s clear the components of traditional banking are akin to BlackBerry’s famous keyboard on the phone. Great for the old-timers, so they feel part of the movement but limiting to the future benefits of full screens and swiping.

Just as the future of mobile computing was largely defined by the change that Apple brought, so will the be the future of banking. Economic society will change because of what digital assets and new digital protocols bring to the table. Remember, before RIM and iPhone there was the failed Palm Pilot… Being too early leads to the same death as being too late. But now it’s time.

It’s time for banks and bankers to join the party. No worries to be had. Larry Fink and Blackrock are there to pave the way. Just in time to pad their pockets once again.

It’s time for banks and bankers to begin transitioning to the internet era, delivering value over protocol rails. There’s a need to make use of and transform their business models towards digital assets and API money.

Why? Because, do rates really matter in a world where technology and digital tools have reduced the cost of doing business?

Do rates matter in a world where the need for loans to cover bloated inventories and property plant and equipment have been reduced? How about in a world where $1 Trillion dollars of credit card debt just means another guaranteed financial crisis at some point? You can only kick the can so far without adding additional liquidity facilities that match the needs of the people.

In a world driven by rates, the only benefits of handcuffing loans are to funnel money to politicians, organized crime, and corporate corruption. That can only continue for so long. Eventually, a tsunami wave wipes you out.

The Digital Wave is Upon Banking

Financial services stares down the same barrel that the music and movie industries faced around the year 2000. Retail and software saw the same in the early and mid 2000s with SaaS and PaaS and every other form of aaS. Now it’s time for BaaS – Banking as a Service. We’re ready to release the creativity of those who didn’t grow up within the shallow walls of Ivy League institutions where your degree or blood lineage carried more weight than your ability.

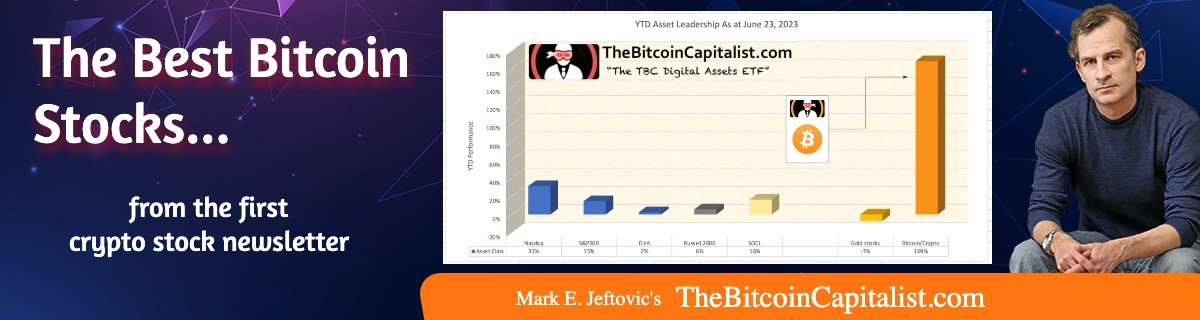

Early Amazon Web Services (AWS) was misunderstood. But it was a world-changing infrastructure upgrade for business and information. It brought the cloud era. You see similar banking infrastructure upgrades with companies like Coinbase and their Base. And of course on Bitcoin where you have protocol layers being built out on Lightning and other projects like Fedimint. Somewhere within these means lie the answers that Wall Street will miss once again.

These new protocol rails along with base layer Bitcoin will provide the core infrastructure for new-age economies. The time is now to build out the next wave of integration. Where humans and machine services move from not just a general upgrade of e-commerce but to an upgrade of the e-conomy.

Big institutions don’t move until there are guidelines in place. Until there’s a guarantee. They’ve been slow and subtle, but they are definitely there.

This week’s FASB (Financial Accounting Standards Board) announcement is just the latest. It is a tale in my opinion, that the playing field for traditional companies and institutions is now being set.

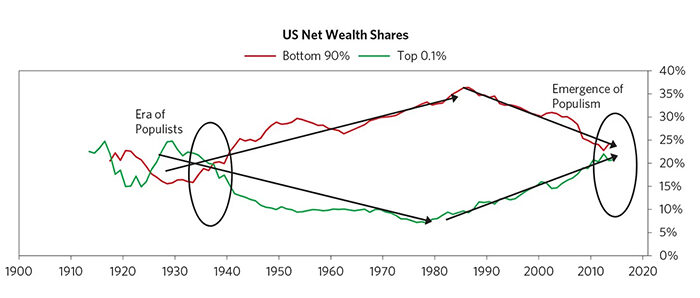

To borrow from Ray Dalio, the divide among the people is as wide as it’s ever been and the net worth of the masses is being surpassed by the net worth of the few. That is precisely the time you get change in money and politics.

See the 1920s and 40s and compare that to now. That’s why it’s important to understand that change in the way we interact and send value, is coming. Those that stick to the RIM keyboard will be left out or at minimum struggle.

A few more signs:

🪧 signposts…

While world markets, including #BTC, are getting pummeled; fundamental signs of systemic shifts are present.

While there may be disagreement around how algo finance should happen, this hints it’s not a matter of “if” but “when”…

Take note, system transitioning. pic.twitter.com/NM5RZ36VvS

— BitKane (@kanemcgukin) May 10, 2022

Fundamental 🪧’s banking is transitioning… Paper products continue to be built just like in #TradFi.

ht: @CoinDesk pic.twitter.com/X7KI38wys7

— BitKane (@kanemcgukin) August 16, 2023

Not a small deal by any stretch (fundamental data point).

It won’t be at all surprising to see massive headcount reduction at banks in favor of #DeFi and #APIs when the next bull wave takes hold.

ht @TheBlock__ https://t.co/k3f4X1pc2f

— BitKane (@kanemcgukin) July 16, 2022

The wave started with Bitcoin in 2009 and was recognized in 2018 with a report by Treasury laying out the framework for going digital and proving the US was far behind the major nations of the world.

Subscribe to the Bombthrower mailing list to get these posts as they come out, and follow Kane McGukin via his Substack and Twitter.