Today’s post is from this month’s Bitcoin Capitalist letter which went out earlier today, and is usually reserved for premium subscribers – I’m making this excerpt available because of the timeliness of the “Debt Ceiling” theatrics.

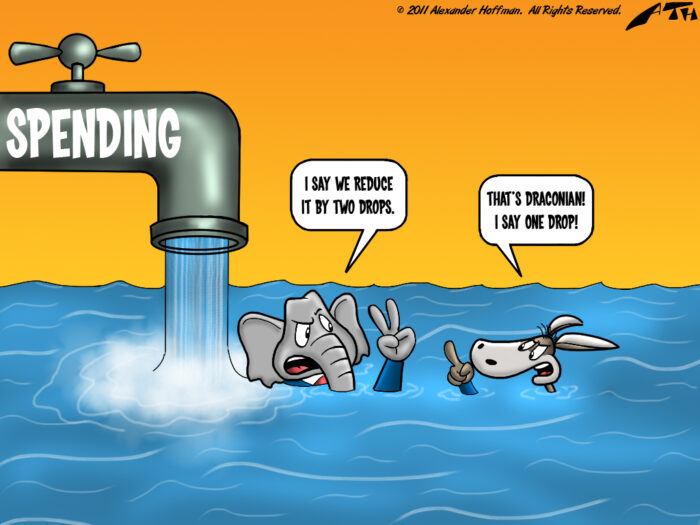

Since the beginning of the fiat era, what we know and fear as ‘the debt ceiling’ is really just a ritualistic and largely ceremonial posturing by adjacent slivers of a political mono-party that always occurs ahead of another round of pork, spending and debt.

Recently I was on a podcast and was asked my thoughts on “the X-date” – that’s when the US hits its so-called “debt ceiling” and will technically default on its obligations.

My response was a somewhat knee-jerk, “they’ll just raise it”.

As I type this on what would have been “X-day”, and policymakers have avoided a default, it’s being widely reported as hiking the debt ceiling by $4 trillion – with minimal spending cuts. It’s actually a suspension of the debt ceiling until Jan 2025.

“Non defense spending” will be “near flat” for two years (which for the literate means slightly more non-military spending); capped at 1% – and probably unlimited funding for Ukraine, since that all comes under “defence”.

Then in 2025, no budget limits. Who ever imagined that such austerity would come to America?

Since the onset of the fiat currency era in 1971, the debt ceiling has been raised 37 times, and suspended seven, last night was the eighth suspension.

Remember that over the years there have been various permutations of this idea: under Bush II the concept was floated of a debt ceiling that automatically reset higher as the limit was approached.

As we can see from the table below, it doesn’t matter whether the Oval Office is occupied by a Republican or a Democrat, or who controls either house – when the debt ceiling approaches, the goalposts will always get moved.

As I said on the podcast – the fiat system will inevitably fail (“It’s just math”, as Greg Foss likes to say), but it isn’t going to be triggered by some known event that everybody can see coming.

Especially one like “The Debt Ceiling”, which has devolved into a largely ceremonial and ritualistic jousting between adjacent slivers of a political uni-party.

When the debt super-cycle finally comes unglued, it will either be some exogenous event that nobody anticipated, or from unforeseen knock-on effects of some otherwise routine circumstance.

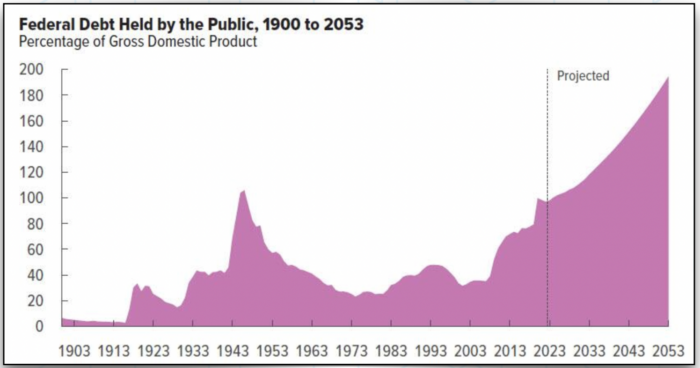

As of May 23, the US debt-to-the-penny was $31,462,154,854,903. Billionaire investor Stanley Druckenmiller, whose only high conviction trade is “shorting a weaponized USD”, said it was like watching a horror movie unfold.

There’s a graphical representation of it below. After taking 215 years to rack up the first $7 trillion in US government debt, they doubled it in 26 months and are looking to add another $4 trillion over the next 20 months.

Boggling.

It’s really that simple. pic.twitter.com/5bLc4sC1G0

— Murray Rothbard (@MurraySuggests) May 23, 2023

The Treasury has about $49.5 billion in cash – with access to another $80B via “extraordinary measures” (like halting contributions to the civil service pension fund, etc.), which they’ve been relying on since January.

If this deal goes through (Congress votes on it Wednesday), they get to kick the can once again, this time safely out past the next Presidential election in the US.

That way neither candidate needs to confront the reality that the nation is essentially bankrupt.

This post is an except from this month’s Bitcoin Capitalist, tracking Hyper-Bitcoinization and crypto stocks since 2020. Grab a trial subscription here, or get on the Bombthrower mailing list for my next e-book: The CBDC Survival Guide – free. (Or follow me on Nostr, Twitter or Gettr).