This is part 4 of the Jackpot Chronicles: Four Post-Coronavirus Scenarios. Read the series here, or sign up for Out Of The Cave here.

“In the future there will only be one occupation: managing one’s wealth. And the majority of the population will be unemployed.”

– Me.

The original working title for this installment of The Jackpot Chronicles was “Mandatory Pollyanna”. That’s the one where central planners and bureaucrats manage to “save” the global financial system yet again, but at a cost of undertaking an LBO of the entire economy and running it as a centrally planned utility.

I’ve decided to rename this scenario “The Great Bifurcation”, because should it come to pass, I think the the inevitable result would be the emergence of an even more pronounced and starkly divided Two Tier Society.

It is arguable that the groundwork for TGB was laid as far back as the adoption of central banking and fiat currency, which gave asymmetric advantages to the class of elites closest to the monetary spigots: This was known as far back as the late 1700’s when Richard Cantillon wrote his treatise on Economic Theory…

“An 18th century French banker and philosopher named Richard Cantillon noticed an early version of this phenomenon in a book he wrote called ‘An Essay on Economic Theory.’ His basic theory was that who benefits when the state prints a bunch of money is based on the institutional setup of that state. In the 18th century, this meant that the closer you were to the king and the wealthy, the more you benefitted, and the further away you were, the more you were harmed. Money, in other words, is not neutral. This general observation, that money printing has distributional consequences that operate through the price system, is known as the “Cantillon Effect.”

Why Wall St. Gets a Bailout and You Don’t, by Matt Stoller

Today it’s not the King’s courtiers who benefit, it’s who is in closest proximity to The Fed: primary dealers, investment banks, hedge funds, private equity, venture capitalists and corporate monopolists. Even in Cantillon’s day, when he enumerated the various ways new money could come into the kingdom, it was all the result of actual money entering via conquest, trade, mercantilism, or taxation. The choke point then under any scenario was the sovereign, and those in court tended to do well whenever the money supply increased.

Now, imagine having the ability to print “value” out of thin air, and then exchange it for equity stakes in the means of production, the way central banks can today. Imagine being able to do that for the world’s reserve currency. Then try to imagine that power and wealth diffusing through society equally and proportionately. You can’t, because it doesn’t. It won’t. It never has.

So today we’re hit with this pandemic, which I’ve said before isn’t the cause of the economic dark age we’re now entering but a catalyst of it. This unidirectional wealth transfer has to be spun in a way that the marks (the subjects) don’t understand they are being robbed blind. They have to want to be leached into poverty. They have to demand it.

This is the underlying logic of ideas like Universal Basic Income, and descriptive rationalizations like Modern Monetary Theory. To the rabble, it looks like the government finally set aside any silly notions of fiscal prudence in order to further build out the welfare state for the good of society. There is an entire segment of the population who is now taking home more money from government stimulus and bailouts than they were when they were “working” for a living.

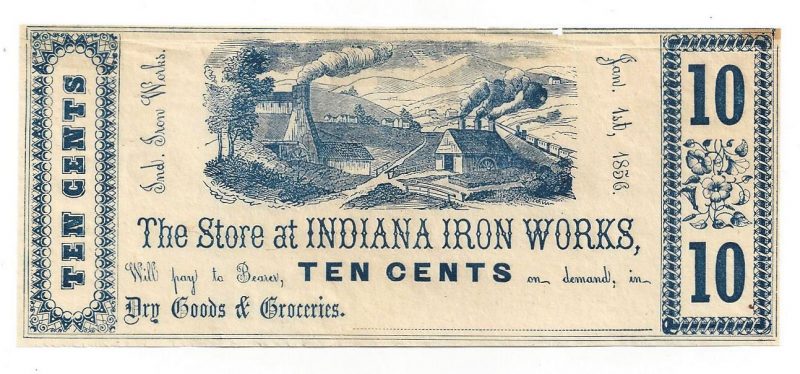

What is really happening however, is that the fiat currencies which are being printed into existence and distributed to the underclass in the form of various stimulus and aid packages are essentially being transformed into a kind of “company scrip”.

Company script of yore was only redeemable for living essentials at the Company Store. In our era, it’s more of a company platform: a fast emerging, digital, ubiquitous, cashless banking system, where all purchases and transfers are tracked and logged. With the digitization of this next generation company scrip, (“smart scrip”?) which has the veneer of a currency, policy makers will have much needed ability to fine tune economic activity under extenuating circumstances. Consumer behaviour can be tightly monitored, modified, coupled with “immunity passports”and other parameters deemed necessary, including having purchases curated or rationed.

All the while the elites, the financiers, the political class and the kleptocrats continue to inexorably accumulate the lion’s share of the equity and productive assets of the global economy.

On the other end of the scale are the corporate behemoths, who have shifted their business models from normal course operations to financialization:

Companies today are borrowing money at artificially low rates to buy back their own shares, which are trading at or near all-time highs. The value investor in me finds that kind of stupid.

When I wrote this, the major indices were putting up a string of all-time-highs (but the underlying technicals like the advance/decline and insider selling look awful). But what a lot of people don’t realize, because the media doesn’t give it very much coverage, is that most of the earnings gains in the S&P (said earnings gains supposedly driving the p/e multiple expansion which is propelling it to new highs) are coming from stock buybacks.

In Q2 2016, share buybacks accounted for 72.9% (!!!!!) of the trailing 12 months net income of the S&P. Read that again. That’s not 72.9% of the earnings gains; it was 72.9% of the earnings. 72.9%! That means nearly ¾ of the earnings are all financially engineered, and most of the funds used to buy back all those shares are borrowed because of these ultra-low, artificially suppressed interest rates and credit expansion.

Out of the 500 companies in the S&P500 in 2016, 146 of them spent more on buybacks than they actually made in “earnings”.

That’s financial engineering. It cannot go on forever, but it will “work just fine” until eventually, it doesn’t. When that moment comes, it will be disorderly and there will not be enough chairs to go around when the music ends.

I wrote that back in 2016, in the inaugural post for Out Of The Cave. Now that eventually has finally arrived, we’ll see how corporate welfare plays out in the Jackpot. For those companies that blew their wads on buybacks over the last decade, the Great Bifurcation scenario would see their bail-outs come with conditions that they restructure their operations in alignment with the imperatives of The New Normal: such as enhanced pre-flight screening for the airlines, and sundry social justice initiatives that bring a centrally planned economy, controlled by the State closer to reality.

What will the Great Bifurcation look like?

Aside from permabulls pining for a V-shaped recovery in stonks, the subtle drumbeat being relentlessly pounded by policymakers and corporate media is that things have changed forever and there will be no return to normalcy as we would have understood it just a few short months ago. Nor should there be, if you take the advice of super rich celebrities softly singing “Non á un Retour á la Normale”

Under this scenario’s new rules, which will include enhanced tracking and surveillance, monitoring, government interference into every aspect of our lives and necessary restrictions on free speech to curb “misinformation”, we will notice one thing over and over again:

The New Rules for The New Normal will only apply to the rule followers, not the rule makers or the rule tellers.

Spot the difference:

- When Shelly Luther, a Texas salon owner defied a court order to close down her hair salon, citing that she had to keep working in order to feed her family, she was sentenced to 7 days in jail.

- When Almeda County, CA issued workplace shutdown orders, Elon Musk simply ignored it and the county “entered into negotiations”. with Musk in order to garner compliance.

The difference here, other than one is one is a self-employed solopreneur trying to keep her head above water and the other is a self-absorbed solipsist douchebag with a private jet, is that the former gets paid in company scrip (fiat coupons called “dollars”) while the latter is a lynchpin in the financialization juggernaut that makes its return on funding rounds, IPOs, secondary offerings and any other transaction that generates fees for underwriters.

For everybody else, how many of us will be able to simply refuse to comply with government ordinances when they are decreed from on high? Whether it comes to receiving mandatory vaccines, rolling travel bans, permanent restrictions on social distancing and assembly, or to close down our businesses again, will we then be able to enter into “negotiations” with our respective authorities regarding the finer points of whether we actually have to comply? Somehow I doubt it.

Spot the difference:

- Various jurisdictions around the world are imposing jail terms and fines for violating lockdowns, including numerous US states , Canada, India, Saudi Arabia (mildly surprised they’re not beheading them) and others too numerous to mention,

vs

- Canada’s Prime Minister traveled to his vacation home for Easter after lecturing Canadians to stay home over Easter

- Ontario Premier Doug Ford traveled to his cottage while advising everybody else not to

- NYC Mayor Bill Di Blasio, who set up a snitch line encouraging citizens to report each other for not social distancing, had no compunction about hitting the gym in Brooklyn

- Neil Ferguson, the man behind the botched computer model that factored into the global lockdown, breaks quarantine for a dalliance with a married climate activist, gets off with an “awww shucks” and a slap on the wrist.

https://twitter.com/DowdEdward/status/1257545327080427520

The difference here is between mere rule followers and the rule makers. Imagine these same disconnects across every aspect, every social strata, every economic sphere of society.

The Great Bifurcation will be baked in so that:

The underclass will be under the never-ending spectre of lockdown and quarantine, social distancing rules, restrictions on travel, events and diet, while the elites jaunt about in private jets, holding emergency sessions aboard super yachts and convening at Davos to reimagine the (your) future.

Wealth inequality will be even more starkly exacerbated as global currencies wither into money-like coupons and food stamps, redeemable within approved digital ecosystems on curated transactions.

Contact tracing, immunity passports and other “health initiatives” will morph into social credit frameworks worthy of China, from which the political class will almost certainly be exempt.

The people who decree and implement these measures will enjoy a life of comparative plenty and freedom.

And yet, it all has a certain logic to it…

Why should you have any liberties left?

If the Savior State is going to incentivize you to not work and eventually ends up paying you a basic income every month for staying home, then the logic does follow that they should be able to protect their property investment by setting the allowable parameters within which you should be permitted to operate. After all, you’re living your life on their dime scrip.

Under The Great Bifurcation scenario, humanity drifts apart, H.G Wells style, into two separate races. The capstone class will be our patrician overseers who have The Science, the models and the economic toolkit to deftly guide society through The Jackpot. The other will be a much larger underclass of comparatively childlike simpletons who believe #fakenews, have negative equity and no assets, and generally can’t be trusted to be left in a room alone with sharp objects. They’ll need shepherding, and the newly ascendent social credit system will give them the right dopamine hits at the right time to do it.

Between these two races will exist an impenetrable membrane of norms, culture, narrative and even law that enforce a social divide reminiscent of a Dickensonian steampunk tale. Normally I would posit that were this scenario to prevail, it would take generations to dumb down the populace to the point required to pull it off. However given the exigencies of The Jackpot, and what I expect to be a never-ending state of compounding emergencies, the timeframe may be greatly accelerated.

Remember the recurring theme of The Jackpot: The next 20 years will not be a linear extrapolation of the previous 20.

In the next edition of The Jackpot Chronicles, our final post-crisis scenario looks at The Deglobalization Scenario. That’s the one where reality sets in and is not only acknowledged but embraced. Businesses and policy makers get religion and realize that financialization and globalization have ultimately failed and in order to achieve long term viability, the entire paradigm has to be “reimagined”. I also discussed this recently in the AxisOfEasy podcast with Charles Hugh Smith and Jesse Hirsh.

Sign up for the Out Of The Cave list here or follow me on Mastodon or Twitter if you want to be notified when that publishes.

“we’ll see how corporate welfare plays out in the Jackpot”

How long ago was this article written? Isn’t the answer already evident (even if it wasn’t entirely predictable)?

Jackpot Chronicles:

This ain’t nothing new.

Builders of Babel (let us build)

Ancient Egypt (slave labor, make more bricks)

Ancient Babylon (hanging gardens drunken disorder)

Ancient Rome (etc., etc.)

France (let them eat cake)

+++++

Indeed. The cyclical nature of human societal experiments are undeniable. Welcome to the 4th Industrial Revolution where a transhumanist existence awaits you. Line up for your initial intake chemistry. Resistance is futile…. for the willfully ignorant.

Trudeau travelled to Harrington Lake where the serving prime minister of CANADA has access to the lavish cottage & guest house provided by the taxpayers of CANADA. Trudeau does not own the property, I do.

Yes he went to be with his family for Easter. Canadians don’t condemn Trudeau for being an aristocrat with privileges no other Canadians could dream about.

We live vicariously through Trudeau.

MOU

To Amplify Alan Monroe’s comment, the story in Genesis of the famine in Egypt parallels strongly the theme of the Bifurcation essay.

To summarise, during seven good years, the state instituted a 20% grain tax and built store cities on the advice of Joseph. During the famine years, the state sold the people grain in return for their assets. First their cattle, then their land, then their labour. At which point, the people were slaves of the state. The only people whose assets were not taken, were the priests (who were, of course, and integral part of the state machine).

The story is thought to date from 3.5 to 4 millennia ago.