Fix The Money, Fix The World

Via Marty’s Bent

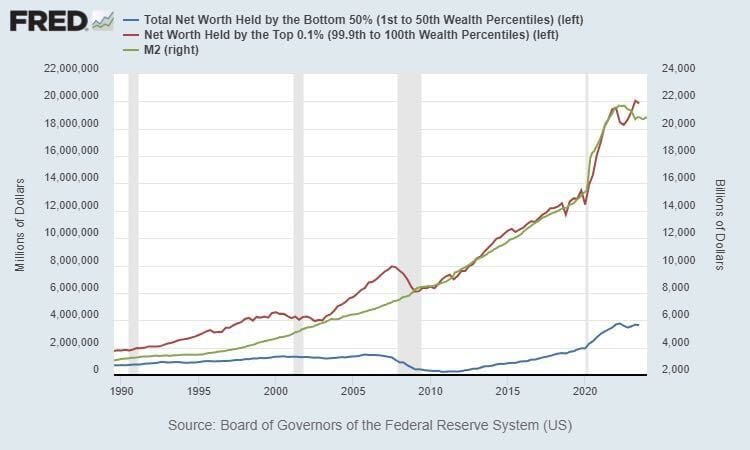

This chart has been making the rounds on Twitter this week and I think it’s a good image to send you freaks into the weekend with. It’s easy to get swept up in the chaos of the day-to-day volatility that exists in our world. Recently, our minds have been inundated with headlines about illegal immigration, squatters and the degradation of private property rights, war across the world, small battles within the larger “culture war”, increasing prices, and the decisions made by central banks around the world. In the midst of all of this chaos it is important to take a step back and remind yourself of what lies at the core of most of these issues; the fact that we’ve completely broken money.

When you break money, the most important tool humans use to facilitate economic activity, a ripple effect of negative consequences begins to emanate from the root of the world’s engine. Those ripples create the momentum that leads to chaos that we are witnessing today.

Broken money leads people to store their value in sub optimal vehicles like housing. This drives the cost of real estate up unnaturally and increases the gap between the “haves” and the “have nots”. Sowing seeds of animosity. Seeds that, when left to germinate and grow via the further degradation of the money people use, blossom into ugly flowers of Anarcho Tyranny.

This has manifested in the trend of people claiming other’s houses by squatting in them when they are left unattended for an extended period of time. The preferential treatment that has been given to squatters over homeowners in recent years can be seen as the regime which controls the money printers throwing the plebs a bone as they struggle to get by, an attempt to push the productive class to violence against a state unwilling to respect private property rights, or a combination of the two.

Broken money incentivizes governments to allow their borders to be bum rushed by cheap laborers who will take low paying jobs that enable the systemically fragile economy to keep chugging along while simultaneously increasing the chaos that already exists and diluting the values that the natives of this country believe in.

The excess and decadence enabled by a world run on broken easy money allows people to live in a detached reality that leads them to push objectively false narratives. This is why there are running debates about gender and a retreat from merit based compensation.

All of this stems from broken money.

The chart above should act as a reminder to you all that the biggest problem in the world right now is the money. The chart above should also prove to you that the most powerful people throughout the economy are going to fight tooth and nail to protect the broken money because they benefit massively from the fact that it is broken.

Keep this in mind as the chaos increases and narratives begin to form around using bitcoin as money.

Get on the Bombthrower mailing list here and receive a free copy of The Crypto Capitalist Manifesto, which outlined all this. However, by the time you read this it may already be too late to sign up for The Bitcoin Capitalist Letter: new subscriptions will be closed once Bitcoin hits a new all-time high.

Follow Marty’s Bent via TFTC.io

I think that graph might be more effective if you recalbrated those three vectors in terms of the buying power represented by those dollars. I believe that should result in fairly flat lines for the top 0.1% net worth and for M2, and a plummeting line for the bottom 50% net worth, which imo is both quicker to grasp, and a more vivid representation of reality.

I like the phrase 'broken money' The chart does nothing for me. Gray text sucks. Black text matters.

Agree. This quote from a recount by Stefan Zweig of the Weimar hyper-inflation:

The State cranked up the printing presses to create as much paper money as possible but it could not keep pace with inflation so every town and city and finally every village began printing its own ‘emergency currency’, which would not be accepted in the neighbouring village, and later on when it was recognised that it had no intrinsic value at all, was usually just thrown away.

Bitcoin is today’s ’emergency currency’.