On Cantillionaires, Sycophants and Losers

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning”

— Henry Ford

“The ultimate crisis will occur when the situation is so thoroughly perverted that the defenders of the status quo can no longer resurrect confidence in the system”

— Vincent LoCascio, Special Privilege: How the Monetary Elite Benefit at Your Expense

Over several previous blog incarnations I’ve been writing about a couple of core themes. When I started writing about artificially low interest rates and the bad outcomes they would produce, I didn’t even know the economic terms for some of the things I was writing about.

But I knew keeping interest rates artificially low, or even negative would act like a type of event horizon that would be impossible to normalize from. I knew keeping interest rates too low for too long would force fiduciaries and capital allocators out the risk curve in search of yield, and that the most vulnerable among us, such as senior citizens, were the least able to absorb the inevitable drawdowns that would entail.

I also realized early on that hot money and credit expansion would spur an explosion of money losing unicorns, who would suck up all the oxygen in all the markets cannibalizing entire markets at a loss in order to get that Series E or F up-round. That one became apparent to me when I started seeing billboards for one of my largest competitors every 1/4 mile across the entire city of Toronto on my daily commute, and every other place else I ever travelled to in North America. I knew that they were losing about $300,000,000 a year at the time. They also had some pretty kick-ass Super Bowl commercials.

I only learned about Richard Cantillon and his early economic treatise a couple years ago and since then I’ve never been able to shut up about The Cantillon Effect, which is what all this describes and what I think is the single most divisive, corrupting and toxic dynamic shaping our world today.

Max Keiser recently coined the phrase “Cantillionaires”, and that’s an accurate demarcation line between the elites and everybody else. It isn’t “the 1%”, it isn’t white privilege, it isn’t capitalism or managers vs labour.

This helps the trend of ‘taking America private’ in a multi-trillion LBO by a few PE firms.

Before neo-feudalism can begin, the S&P must be delisted and controlled by a few cantillionaires.

Cloaking these PE firms in darkness will speed up the process of neo-feudalism https://t.co/xaIDsUQF4Y

— Max Keiser (@maxkeiser) July 17, 2020

It’s this:

When the Fed, or the ECB or the JCB or any other central bank prints money out of thin air, and then deploys that “liquidity” into the market, are you, or the firm you work for, among the first, second or third order recipients of that fresh injection of money? If so, then you’re a Cantillionaire.

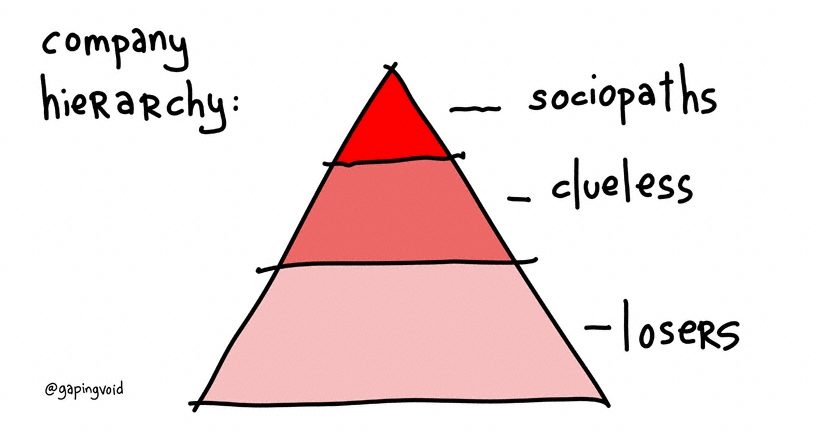

And the rest of us? We’re losers. Remember this old Hugh McLeod ditty? It was priceless….

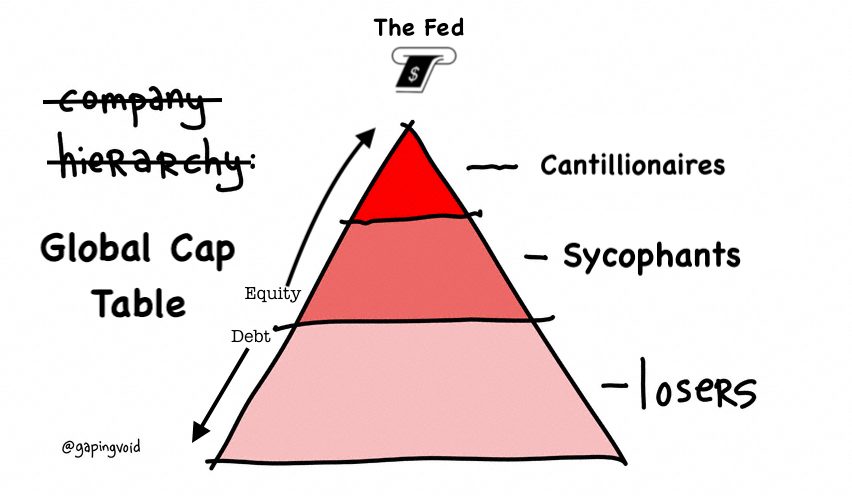

Let me correct it to depict the capital structure of the world.

An odd kind of reverse alchemy occurs as the newly created “money” flows downward toward the masses.

At the top we have the capstone class, the Cantillionaires, the superrich politicians and the Uber-rich financiers and conglomerators.

After this is the “The Sycophant Class”. In this layer are the spin doctors and support apparatus of the überclass of the Cantillionaires. In his book “The Coming Neo-Feudalism”, Joel Kotkin called them The Clerisy and described them as “the New Legitimizers”. Their job it is to hone the narratives that rationalize why this cap table makes sense for the losers below, as well run the actual infrastructure that perpetuates it.

As the newly created “money” flows down The Global Cap Table, it undergoes that inverse alchemy and the nature of the newly created money experiences a state transition.

The nature of the change is this: After it gets a few iterations out from the money spigot at the top, it stops boosting asset prices and starts raising the cost of living. At the top end of the funnel it makes everybody in proximity wealthier, and then down at ass end of the funnel, where the rabble resides, it makes it more expensive to stay alive.

That’s The Cantillon Effect and I’ve been searching for ways to explain it so more people would understand it for quite some time now. But lately, I came across a pretty stark manifestation of it that should, I hope, finally make this clear.

The epiphany occurred as I was reviewing the Federal Reserve disclosures listing the recipients of the SCCMF Program. The SCCMF is the Secondary Corporate Credit Facility to buy up corporate bonds in an effort to shore up the credit markets:

“The Federal Reserve established the Secondary Corporate Credit Facility (SMCCF) on March 23, 2020, to support credit to employers by providing liquidity to the market for outstanding corporate bonds.”

It later expanded the program to add junk bonds.

The SMCCF is supposed to be some mechanism to preserve jobs in the wake of the economic meltdown, but when you look at the companies whose bonds are being purchased, they don’t exactly look like they were in danger of going under throughout the course of 2020:

Berkshire Hathaway (three seperate entities), Cisco Systems, Exxon Mobile, Fox Corp, Halliburton, Intel, IBM.

All companies that are worth billions, Billions. With “B”s. You can see a full list is here.

Then what really got me was seeing Amazon, a company worth over One Trillion Dollars, a company whose business is up so much over 2020 that they had to hire 100,000 more people to keep up with demand, and the Fed is out there using a program justified as a job saver by buying Amazon bonds (some of which actually trade at a lower interest rate than US treasury debt was wrong, it’s narrower spreads – mjr) under the SMCCF?

AMAZON.COM INC Consumer Cyclical 023135BP0 0.400 06/03/2023 4,000,000 $3,994,878

The thing about Amazon that hit home for me, is that among other things, Amazon is also a domain registrar, and Amazon is a DNS provider, which means that Amazon is a direct competitor to my own business, easyDNS.

So not only am I competing, head-to-head, with literally the world’s biggest company, the Fed has to put their thumb on the scale by buying their fucking bonds?

But wait, there’s still more, as I perused the list I found other companies I have to compete with, directly, head to head:

MICROSOFT CORP Technology 594918BA1 2.375 02/12/2022 5,500,000 $5,678,039 MICROSOFT CORP Technology 594918BP8 1.550 08/08/2021 3,000,000 $3,040,837 MICROSOFT CORP Technology 594918BQ6 2.000 08/08/2023 5,000,000 $5,228,349 MICROSOFT CORP Technology 594918BW3 2.400 02/06/2022 3,000,000 $3,098,973 MICROSOFT CORP Technology 594918BX1 2.875 02/06/2024 2,000,000 $2,157,622

easyDNS competes with Microsoft’s Azure. The Fed is buying Microsoft’s bonds.

ORACLE CORP Technology 68389XBB0 2.500 05/15/2022 2,000,000 $2,066,967 ORACLE CORP Technology 68389XBK0 1.900 09/15/2021 8,000,000 $8,133,006 ORACLE CORP Technology 68389XBT1 2.500 04/01/2025 4,000,000 $4,275,958

Oracle owns Dynect, who easyDNS competes with directly again. The Fed is buying Oracle’s bonds.

And from the June 29th disclosure I saw that the Fed was buying Google’s bonds, and Google is also in the DNS and domain registration business, yet another head-to-head competitor.

It’s tough enough running a small business when you have to compete with an 800 lb gorilla in your space. Especially when there’s a half dozen of them now and since everybody else who has to compete with these companies (not a single one with a market cap under 100 billion dollars) doesn’t get propped up by a central bank, printing up money out of thin air, it puts all other companies at a clear competitive disadvantage.

Isn’t this a little bit like picking winners and losers?

One might point out that small businesses were eligible for Federal funds as well. They sure were, they were eligible for loans and although loans and bond issues live on the same side of the balance sheet, the resemblance ends there.

In the US, any PPP loan over 25K is full recourse, and anything over 200K requires a personal guarantee. It’s similar up here in Canada. It means the business owner has to collateralize the loans, most often with his or her principal residence, and they have to be able to demonstrate that their business has been materially impacted by the pandemic.

I doubt Jeff Bezos has to personally guarantee those Amazon bonds, and if the Fed had a similar requirement to demonstrate business impairment to qualify I don’t know how Amazon would be able to make that claim with a straight face having just hired those 100,000 additional workers just to keep up with increased demand.

This is another example of that inverse alchemy we see as the new money trickles down the Global Cap Table:

At the top, it props up non-recourse bond issues and buoys the corporations who issue them. And when those bonds come due they can probably just do what every corporate behemoth does and roll them over.

At the bottom, the small business owner has to pledge his house and his personal assets as collateral and then those loan payments get added straight onto the monthly nut.

Referring back to the Global Cap Table, above The Loser Line megacorps can externalize their bad outcomes and in many cases, literally lose money for a living. Everybody up there makes their money on financial events

Below the loser line reside all the small businesses. The ones every politician says “are the backbone of the economy!” yet they enact policies that make it harder for them to remain open and as we’re exploring here, cultivate policies that make it near impossible to compete.

If all this wasn’t bad enough, everybody knows where this is headed next, once this economic depression asserts itself over the current blow-off top in stocks: eventually the Fed will probably step into the equities markets and prop those up too. So not only is the Fed buying my largest direct competitors bonds now, down the road they’ll be buying up their shares.

…with money they pulled out of their ass.

Does it make a mockery so-called free markets when the smallest businesses have to deal with the vagaries competition while the largest ones get propped up with the full faith and credit of the central banks?

This isn’t capitalism. I used to call it “crapitalism” or you sometimes hear it called “crony capitalism”, but extending Max Keisers’ label of “Cantillionaires”, I finally know what this is and what to call it. What we have here folks, is your good ole fashioned, centrally planned Cantillionism.

To follow my work sign up for the Out Of The Cave mailing list, or on Mastodon or Twitter

It seems that the 1%ers are now doing domestically what they done internationally for decades – Print up some money and get control of the target assets. They could just buy stocks sufficient to control whatever enterprise interests them with ‘money’ that cost them nothing to produce. If this perversion isn’t stopped, the ruling will actually legally own all the wealth-producing assets merely by paying for them with ‘money’.

Indeed. That was the Perimeter of Privilege I was describing in Let’s Talk Privilege…

It is interesting how “intellectuals” used to criticise Milton Friedman’s monetary theory of inflation and the free market with the canard “trickle down economics”. But Cantillon effect is the real “trickle down”, except it is worse than the canard, because by the time it trickles to the bottom it weighs down the losers.

Even without money printing, tax-and-spend and other money centralising systems have a Cantillon effect. Those closest to the spigot (i.e. the funds/tax gatherers end the immediate recipients of the centralised spending) flourish, while those down the line struggle. That is why, for example, university administrations bloat, while the researchers and teachers beg for resources.

Yes, “Trickle Down” as in: “Please tell me that stuff landing on my head is rain.”

Some people will think they are in the club but will then find they are on the fringes and then on the outside in the cold with the rest of us losers.

It’s a little galling to hear someone finally noticing because it now impacts them. This has been happening openly in size since 2009, so why now the complaint?

Good point – I believe there are many companies who’s corporate model is based on losing money and then having it magically replaced at intervals. They are easy to spot, they are the most absurdly extravagnt.

On a more common level, how about all the mom and pop cafes and sandwich shops getting clobbered by the ubiquitous Subways and Dunkin Doughnuts.

And is Musk or Gates really such a genious or do they have a Sugar Daddy?

Jared, I have been writing about this dynamic since about 2004 or so, so it’s not like I lived in a gilded cage and “finally noticing” this. It’s true that despite this systemically uneven playing field I have been able to do ok in terms of financial independence, but that has been in spite of a rigged system, not because of it.

Starting a tech company in 1998 and making the conscious decision not to take on VC was the point at which I took the road less traveled. Your analogy about the mom-and-pop cafes is exactly right and one I have used many times in private conversations over the decades I’ve been railing about this.

If there is any “finally noticing” going on, it is perhaps that my writings are getting a bit of a wider audience lately. For some reason.

It is an excellent article with many excellent points that need to be made known.

It’s amazing and frustrating to know that various old dead guys were already making note of these points using a freaking feather quill pen. How does Krugman claim to have any expertise in the subject? It’s almost as if it’s not an accident – almost as if it is not the first time. In which case they are doing this with malice.

Also there is an issue of timing – the elite are stuff their pockets with greenbacks that are “dollar-good”, but by the time they get to us the value is squeezed out of them.

So where is it taking us?

I suspect the owners know that the situation has reached the point that it is no longer sustainable. It is not a black swan, it is the four horsemen.

Keynsian economics only works in an expansion – it is not interested in equilibrium which might not protect the right people. So they have to collapse it and begin anew. The people are being prepared to live with less. And then the owners will learn to live with less – fewer people to feed.

The sovereign nation is a fatted calf from which the owners feed – without killing it. Until it is no longer useful. The military serves them.

Not sure how much this relates to your piece, and I’m a financial layman, but this from Yahoo News explains the Fed’s buying of all the stock you mention is not for them. They are buying them up for the US Treasury, who is the ultimate owner. They are doing it through some vehicle called a SPV/ But in essence, the US Fed is now working under the Treasury, acting mainly as a banker for the government.

https://finance.yahoo.com/news/feds-cure-risks-being-worse-110052807.html

It doesn’t matter who they are buying the paper for. It matters that there is a buyer at the table, using newly created money to buy these issues. It takes the interest rate pressure off the issuer because they have a buyer of last resort with unlimited funds on the other side of the trade.

I believe their explanation is that these are liquid bonds and small businesses are not so liquid. These large purchases help the masses who hold large stocks in their social security pension portfolios and/or that it will trickle down. I wonder if there are practical reasons why they can’t buy bonds of small companies (maybe they don’t exist) or it won’t move the needle.

One layman to another:

Commonly used quote from Henry Ford –

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

It is also well that it is the primary job of people in vestment finance to lie – essentially all of the time because the entire industry is based on something often referred to as a “Ponzi” scheme. So when they use banal terms such as “SPV”, the normal human can immediately detect that by there use of a vague and obscure term “Special Purpose Vehicle” they are lying – a lie of hiding from the public the true nature of what they are doing which in this case would be more accurately something like money laundering. The Treasury is effectively prohibited by law from buying such as stocks so they have the FED act as intermediary – buying it on behalf of the treasury. In a similar vein, even the (corrupt, private bank cartel) FED is prohibited from buying government debt directly from the Treasury, so they have have dealers buy it and then they buy it from the dealers. It is the definition of corrupt finance and it does not work in your interest. I find that people infinitely more knowledgeable than I avoid discussing how bad it is. Abandon all hope, ye who enter here…

New to your site. Love this piece. Articulates what frustrates so many of us in the lower/loser class. If only we could get someone who understands this to run for political office here in the states. I am increasingly concerned that change will come violently, ANTIFA and BLM style, rather than through a peaceful, deliberate effort because of the arrogance and indifference of the Cantillionaire class. Wow, I sound like a raving conspiracy theorist, but I am really just normal person concerned about what I see happening in my country.

Mark,

A few questions:

Can you please explain what is specifically meant when they say the fed is adding liquidity? How does it add liquidity? And what is liquidity crises?

When the fed buys bonds of private companies how do we know that theses bonds are not just forgiven amounting to a gift since the fed is not audited?