Just wait ’til you see your government’s bail-in rules

One of the subplots that made for a bad week in crypto included a largely manufactured crisis around “The Coinbase bankruptcy disclosure”. After posting an earnings miss, the next shoe to drop was the discovery in the latest version of the Coinbase Terms of Service, the addition of text that included the following:

“Custodially held crypto assets may be considered to be the property of a bankruptcy estate, in the event of a bankruptcy, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as our general unsecured creditors”

This verbiage became a big deal with every corporate media outlet dumping all over it. It trended on Twitter and quickly went viral, almost as if this was some sort of revelation.

It’s not. It’s basically the oldest adage in crypto, “not your keys, not your coins” spelled out in writing.

Do you really think if you’re holding your crypto on some exchange that suddenly becomes insolvent it’s going to make a difference if a paragraph to that effect appears in the ToS or not? Good thing Mt Gox or QuadrigaCX didn’t have that in their ToS otherwise everybody with assets in either exchange would have been really screwed, right?

You’re screwed no matter what. At least Coinbase is calling your attention to it.

Don’t hold your crypto on the exchange, any exchange, full stop. Even the largest crypto exchange CEOs will tell you that.

But if you’re one of those people for whom this is something to be up in arms about, I’ve got news for you:

Your governments have already laid claims to your savings

If you’re reading this it means you’re probably living in a country where the same exact thing is written into your governing legislation with respect to all the money you have on deposit within the banking system (as covered in The Crypto Capitalist Manifesto)

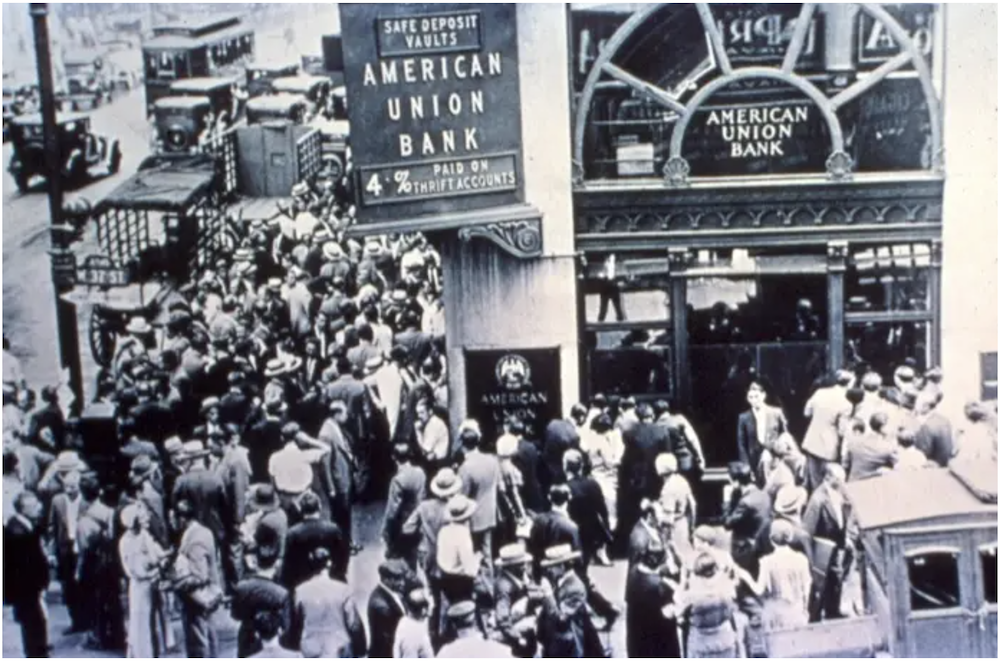

Remember back to 2013 with the Cyprus bail-in, which I always maintained was what put Bitcoin above $100 USD for the first time:

The Cypriots had a portion of their savings accounts confiscated to re-capitalize their failing banking system. In March 2013 Eurogroup president Jeroen Dijsselbloem told interviewers that Cyprus would serve as a template for future bank restructurings in the euro zone.

By April, the framework showed up in Canada, under then-Prime Minister Stephen Harper’s budget:

“The Government proposes to implement a bail-in regime for systemically important banks. This regime will be designed to ensure that, in the unlikely event that a systemically important bank depletes its capital, the bank can be recapitalized and returned to viability through the very rapid conversion of certain bank liabilities into regulatory capital”

If you haven’t figured it out by now, “certain bank liabilities” are your savings.

The language was preserved in subsequent budgets, even after 2015 when Justin Trudeau came to power. His government made it permanent in 2018 with The Bank Recapitalization (Bail-in) Conversion Regulations.

This wasn’t unique to Canada.

In 2017 Australia did it with the Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Bill:

“The TLAC standard builds on a significant body of international regulatory reform already undertaken by the Financial Stability Board to improve resolution frameworks for globally significant financial institutions. In particular, it builds on the Key Attributes which specifies that Financial Stability Board jurisdictions should have in place legally enforceable mechanisms to implement a ‘bail-in’. (emphasis in original)”

In the US, provisions for depositor bail-ins existed even before Cyprus, with the “Statutory Bail-Ins” provisions in the 2010 Dodd-Frank bill.

The fact is, if you’re living in any of the largest economies globally, then your country is party to a supra-national agreement on “flexible bank bail-in bonds” put in place at the G-20 Brisbane Summit in 2014.

So while you have the ability to choose not to do business with Coinbase (or better, properly custody your digital assets), your country has already granted itself the same ability to bail-in your fiat savings a long time ago, and it isn’t voluntary.

It’s the one issue that is completely bipartisan and duly ossified into the law of the land. From loose canon populists to far-left Marxist ideologues, nobody within the corridors or power is talking about getting rid of the government’s authority to confiscate your savings in order to recapitalize a failing banking system. When this thing blows up subject to the inexorable outcome of their own failed policies and under its own warped incentives, there won’t be any quibbling over it, it’s the law.

Given the behaviour of governments just this year alone, where

- in Canada having the wrong political views could get your bank accounts seized,

- The US seized the foreign reserves of two sovereign nations

- European banks are frantically seizing assets of persons with surnames ending in ‘-ved’ , ‘-nin’, ‘-tin’, ‘-lin’ or ‘-ov’

- Russia, for their part, is seizing assets of Western companies within their borders

Two things become apparent:

First, we’re in an age where your assets and savings are considered fair game for everybody else, either as guilt-by-association with somebody else’s political ideology, or as retaliation for government actions you had no involvement with.

Second, seen from this perspective, it’s either ironic or (more likely) disingenuous that the corporate media is feigning shock over Coinbase.

Holding a portion of your wealth in Bitcoin and properly custodying it solves both problems.

Disclosure: Long COIN (screaming buy at these levels).

Today’s post was an excerpt from the The Crypto-Capitalist Mid-Month Portfolio Review, were we cover the global transition to decentralization, the inevitability of hyper-Bitcoinization with a tactical focus on publicly traded crypto stocks: currently one of the fattest pitches in value investing going.

Get the overall investment thesis free here, follow me on Getter or on Twitter.

Ordinary deposit accounts (in Canada) are not one of the eligible sources for re-capitalization.

Given recent behaviour I don’t think it would matter much to this government.

Confusing to everyday American just trying to provide for themselves and their families.

Will you write some stuff on ABCs of how and where to move/safeguard an existing portfolio made up of 401ks, Iras, real estate, and cash…..to…gold? Bitcoin? More real estate?

Where to safeguard gold for easy access?

How can marxists commies socialists take real estate assets like primary residence and income property? What is world economic forum plan regarding real estate?

New and green to bitcoin..need help

Do NOT mess with that crypto mess period. I own none and I am just fine. And do NOT leave large amounts of cash in the bank, any bank. I would imagine pretty soon and people’s money will be SEIZED just as the article is talking about.

The Kleptocrats in full swing.

In comment above,ditto to “new and green to bitcoin..need help. Especially where to buy and how to take custody. Already a subscriber.

We’re working on some resources for that, stay stuned.

Cold storage crypto wallet ( Ledger cold storage wallet) ( cold storage = and electronic device you control from your home OFFLINE you connect to the internet at your convenience, to sell your crypto, to send it etc.

In the UK, the Bank of England stares in their bail-in rules, “Deposits that are protected by the Financial Services Compensation Scheme (‘FSCS’) are legally excluded from bail-in. This generally includes deposits up to the amount of £85,000 per eligible person.” (Source: https://www.bankofengland.co.uk/freedom-of-information/2021/questions-about-bail-in-and-customer-deposits) It does beg the question: what happens if they deem you not to be an “eligible person”? I think the wording is very much in the favour of the technocrats…

–> Vic Monte: “How can marxists commies socialists take real estate assets like primary residence and income property? What is world economic forum plan regarding real estate?” This is older then WEF and the US gov’t [will] seize all your (and every other Americans) assets under ‘Executive Orders’. Similar rules apply to all western civilization as well as 2nd and 3rd world countries if they’re still around!!!

Why not have an alt coin you can hold in your hand like cash? And the government can’t trace its usage like cash? And can’t be hacked by quantum computers like blockchain coins? Cloudcoin.com

Is that really the leader up there with socks like that? Man, you guyz are UCKFED!