Guest post by Marty Bent from Tftc.io

Don’t look now, but it seems that the regional banking crisis is beginning to reemerge after almost a year of hibernation. Last February brought with it the failure of Silicon Valley Bank, First Regional and Signature Bank. At the time, the crisis was quickly spreading and the Fed was forced to step in with an emergency facility known as the Bank Term Funding Program (BTFP), which allowed banks to turn in underwater treasuries in return for cash equivalent to the par value of the treasuries at a very low interest rate. The BTFP is structured as a 1-year loan and Jerome Powell and company announced that they will not be extending the BTFP due to the fact that banks were taking the cash and dumping it into higher yielding facilities at the Fed to take advantage of an arbitrage opportunity that the BTFP opened up, which hindered the Fed’s balance sheet.

This is your life on central planning. Even when the lender of last resort steps in to help out, the banks will seize on the opportunity to take advantage of any opportunity that arises to achieve their yield targets. Even if that means biting the hand that fed you. A real life manifestation of the ouroboros destroying itself.

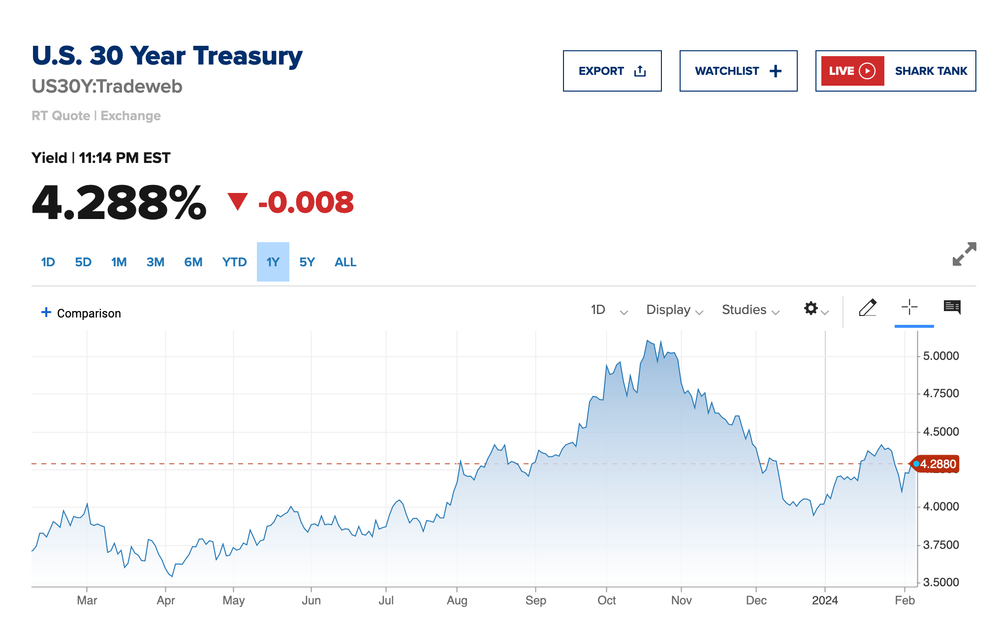

With the BTFP set to come to a halt next month it seems that markets are taking a gander at the markets, noticing that the 10-Year US Treasury yield is hovering a bit higher than it was when the banks started failing last year, the 30-Year is holding steady well above where it was this time last year, noticing that companies are laying off their employees en masse, and beginning to come to the realization that the problem that led to the failure of the banks last year has not been solved at all. If anything, it has been exacerbated and the ultimate consequences of more than a decade of ZIRP followed by a rapid increase in interest rates are quickly approaching our doorstep.

The sector of the economy that seems to be on the top of everyone’s mind is commercial real estate. The combination of economic lockdowns driving people out of their expensive office buildings and into their home offices and a precipitous increase in the cost of capital has created a perfect storm. Companies aren’t getting funded at the rate they were just three years ago, which mean there are less potential tenants for the owners of commercial real estate properties. The companies who were able to secure funding are rapidly cutting costs by laying people off to stay afloat. And people who see the writing on the wall and are beginning to jump ship are selling their commercial real estate positions for pennies on the dollar.

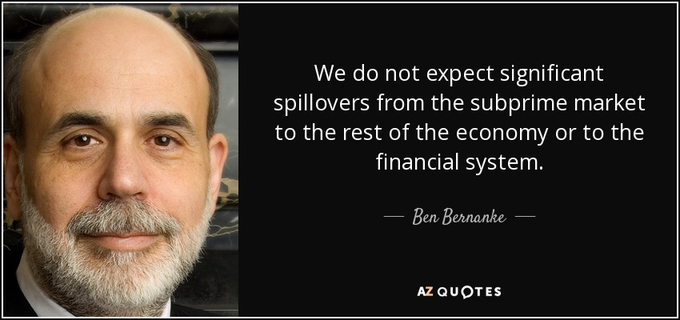

The banks who have material commercial real estate exposure are in for a rough time and it seems like the dominoes are beginning to fall with New York Community Bank leading the way. I would expect this crisis to begin to unravel rather quickly as we get closer to Spring. Nothing made me more certain of this than Janet Yellen’s comments on Capitol Hill that sounded eerily similar to the reassurance Ben Bernanke gave markets in 2007 when he was asked about the systemic nature of the subprime mortgage market.

Head for the hills, freaks! The counter-signal has been initiated.

In all seriousness, if a banking crisis is about to materialize it is better to begin preparing now as opposed when it is abundantly clear that you are in the midst of a banking crisis. If you are an individual with a good amount of savings that is wholly exposed to the banking system, it is probably a good idea to buy some bitcoin and get it in a wallet that you have control over. Our friends at Unchained can help you secure your bitcoin while eliminating single points of failure in your custody set up. If you are a business in the same boat, I would say that it is an imperative that you lock up three to six months worth of runway in bitcoin so that you can make payroll if shit hits the fan. Unchained can help you out too.

Who knows what’s going to happen at the end of the day, but it’s better to be prepared and wrong about a crisis than it is to be wrong about this being a nothingburger and unprepared. I’m sure if the crisis does reemerge in earnest the Fed and the Treasury will step in with extreme measures. However, if we have learned anything over the last two decades it’s that these extreme measures have extreme unintended consequences and the further they kick the can down the road the more extreme everything gets. The question is how much more road is left before the can crashes into the wall?

Follow Marty Bent via TfTc here on Twitter here, or on Nostr

Mark Jeftovic’s forthcoming ebook The CBDC Survival Guide will give you the tools and the knowledge to navigate coming era of Monetary Apartheid. Bombthrower subscribers will get free when it drops, sign up today.

Follow Mark on Nostr, or Twitter.