Nobody loves Coinbase.

Nobody loved Amazon, either.

A bald and slightly malevolent CEO isn’t the only common factor between the behemoths of Crypto and Consumer Goods. When looking at how to value Coinbase and trying to figure out where they are going, it is instructive to compare them to a once tiny internet bookshop that went on to dominate a diverse range of tech markets from Web Services to Home Security.

From the Ashes of the Tech Bust

Amazon wasn’t always a Wall Street darling. Amazon crashed from highs above $100 in December 1999 to a low under $10 over the course of the next 16 months. The commentary at the time was filled with incredulity, “How could we be so stupid to value a bookstore at $100?”

The road back was long and painful with Amazon taking around a decade to recapture their $100 share price. The important thing to note about the path back to prominence is what Amazon did with this time. They built things that people used.

Not things people wanted to use. Things that people needed to use.

In 2006 Amazon launched AWS, their Web Services division. At the time, Business Week ran a cover on “Amazon’s Risky Bet”. The brightest financial analysts in the world couldn’t see the use for commoditised Web Services. That market segment is now known as Cloud Computing, it’s a $445 billion market and Amazon has captured a third of it.

Captured adequately describes the user experience with Amazon. You can leave at any time, but most users don’t. From AWS to selling on the Amazon Web Store, the costs to leave are often so onerous that most users don’t. They just stay and complain about the monopoly power that Amazon exerts over the US economy. No one stays because they love Amazon.

In this way, by offering essential services to internet companies, Amazon’s growth was tightly coupled with the growth of the internet itself.

No one loves Coinbase

When you talk to Crypto investors there’s broadly two camps: The regular investors that use Coinbase because it’s easy, available and they don’t mind paying a higher fee for greater peace of mind, and those that use other exchanges but practise high levels of risk management.

Almost no one uses Coinbase because they love it. They use it because they know it will still be there next year.

This is why the revelations about how Crypto could be seized from users by creditors during a hypothetical Coinbase bankruptcy shocked the market so much.

If you look under the hood about this statement from Coinbase you realize quickly that this is a legal issue with bankruptcy law that broadly applies to all crypto exchanges rather than a decision that Coinbase has made. That fact didn’t matter at all. When the foundation of the business is guaranteeing that customer funds will still be there next year then any questioning of that principle will send a wave of panic through the markets.

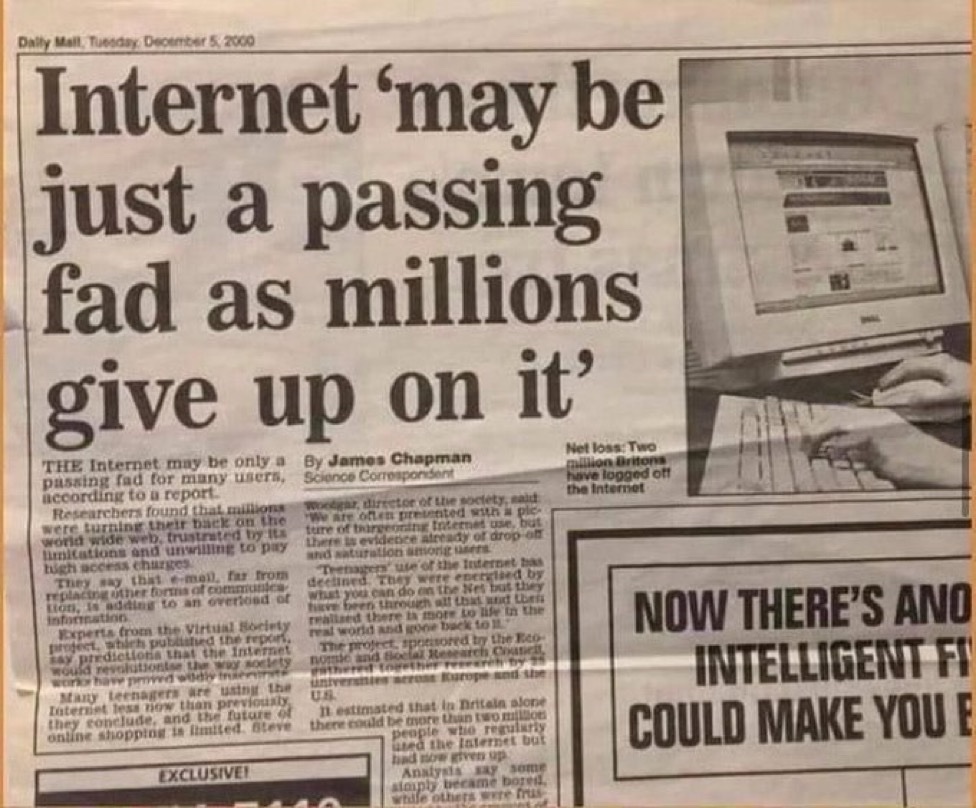

Coinbase is currently down 80% from its highs just like Amazon was down 90% from its highs in 2000. The only reasonable way to read this is that the market is making a bet that Crypto is going away and taking Coinbase with it.

The market made the same bet on the internet in 2000.

Coinbase is Crypto

The usual user interaction with Coinbase is through using their exchange to buy and sell, but just like how Amazon was not just a bookshop by 2010, Coinbase is not just an exchange.

Just this year Coinbase launched an NFT marketplace to compete with Opensea, a wallet to compete with Metamask and a liquid staking protocol to compete with Lido.

And that’s just the products that face the retail consumer. On the backend Coinbase provides a huge range of API, computing and data infrastructure through their cloud division. Some of these products won’t work. Arguably the NFT marketplace is already a failure. That doesn’t matter, Amazon had plenty of failed products. Do you remember Amazon Haven health services? No, me neither. Coinbase only needs to have control of the most important parts of the Crypto ecosystem just like Amazon has control over the most important parts of the internet ecosystem. They’re building every conceivable service to make sure this is the outcome.

Coinbase is building Amazon with AWS but the market is still pricing it as if it were Amazon the internet bookstore.

Regulatory Capture – Coinbase doesn’t want to share

In 2020 Coinbase made huge waves in crypto industry circles by very publicly leaving the premiere industry lobbying group, The Blockchain Association, to form their own in-house lobbying division. Since then Coinbase has submitted their own regulatory frameworks and engaged with Congressmen on their own terms.

The other significant factor in the regulatory landscape is compliance. When a financial institution like a bank or a hedge fund wants to trade or hold Crypto they don’t devise their own custody solution and they don’t shop around for the cheapest option. They do the same thing the retail trader who is concerned about security and safety does and sign up with Coinbase as the largest regulated and trusted company in the space.

Coinbase currently has 9000 institutional customers with a total of $92 billion in Crypto assets custodied. If you need your crypto-skeptic compliance team to sign off on a custody solution then you propose Coinbase.

This has become such a known quantity within the industry that Coinbase has become a proxy for Institutional flows. There is a “Coinbase premium” which represents the additional price that institutions are willing to pay to buy Bitcoin and other Cryptos through Coinbase. Any analysis of institutional buying or selling will look to flows in and out of Coinbase in order to gauge the sentiment within institutions.

We’re even seeing market actors who want Crypto exposure without holding Crypto using Coinbase as a way to get that exposure while staying within the stock market that they know and understand. All institutional Crypto revolves around Coinbase.

Coinbase as Amazon

You’ll notice that very little of the reasoning behind this has to do with Coinbase being a superior product. It’s generally not. It has the highest fees in the industry and fairly poor customer service. There’s some important signal in that. Coinbase charges more for their services than competitors and users willingly pay for it.

Coinbase gets used because it’s the safe option. Just like no one ever got fired for using IBM in the mainframe computing era, no one will get fired for using Coinbase in the Crypto era.

This ethos won’t just be about exchanges and custody moving forward, it will extend to all areas of crypto. Given a choice of NFT marketplaces, Defi wallets, Node infrastructure, Liquid staking pools and anything else that will exist in Crypto, institutions with a risk wary compliance department will choose Coinbase over a competitor purely because the branding already conveys safety and longevity.

If you wanted secure cloud computing in 2010 you were signing up with AWS. If you want consumer goods shipped to you overnight you’re ordering from Amazon. If you want secure Crypto services you’re signing up with Coinbase. Like it or not.

Coinbase isn’t just building a Crypto exchange. They’re building a Crypto monopoly.

Arguably they already have monopoly power over the most important parts of the industry and they are rapidly building out the full suite of products and services. The Crypto monopoly hopefully won’t be here to stay but for the moment it is Coinbase’s to lose.

I don’t know what this means for Coinbase’s stock price in the short-term. All I know is that over the longer term American monopolies have tended to do quite well historically speaking.

We don’t have to like it. We just have to recognize it for what it is.

Related

P.S Today’s post is from contributing analyst Scott Hill, who will be providing additional insight of this space for our premium newsletters.

Try The Crypto Capitalist for 30 days for $7, fully refundable.

An old wine in new bottles ?

Positive returns to scale and network externalities both in play.

Separately, what does it mean to be a “macroeconomics researcher in the cryptocurrency media space ” ?

Macroeconomics from a textbook perspective is overwhelmingly academic Keynesianism. Which is now widely understood to have collapsed.

Not clear to me why this is a valid framework to research cryptocurrency. I would have stared rather with F. Hayek.

I’ve never used coinbase, I’m a big believer in Binance, the original global service provider, not the US version. I know it’s not fully regulated by the west yet, but to me that is a major part of its charm. The liquidity is unbelievable, the stable coin was in the top 5, and they offer a myriad of staking, nft and api services too. I also use multiple ledgers to keep things safe when times call for it. So overall they are great and they have such a good thing going that I believe they would never jeopardize that for anything.

I also like Binance, and have often wondered: if Binance Smart Chain is simply a fork of Ethereum, why can they run it with negligible gas fees while Ethereum gas is still in the stratosphere.

Alas, I live in the nanny state of Ontario, so at the moment I can’t deposit anything there.

Coinbase so far has made their site the easiest to use for me (a crypto newbie who self-identifies as a computer wiz).

Their business model seems not to care I have no money to convert from fiat to crypto at the moment. They seem to be doing tidy business getting crypto startups to have them offer someone like me “earn and learn” — making a few US$ equiv in the sponsoring currency for watching a few slides and taking a quiz.

I converted most of the the initial $20 earned to fiat and spent it, but realized I could use it for “staking” (allowing me to accept XLM$ in Coinbase Wallet which they just bought, formerly “Bread Wallet”).

Now I’m converting everything I get to Bitcoin and plan to use it to practice sending to/from a private wallet. They’re creating good will and positively reinforcing using the service with the occasional scratch off ticket level rewards. They’re hoping I’ll feel warm and fuzzy enough to upgrade to their premium “Coinbase One” membership. It may work. 🙂

I bought $5k of SOL in $1k increments, but then all of a sudden I was limited to a max of $250 purchase on Coinbase. An inquiry to their support said only that limitations of purchases were set by an algorithm and that no other explanation would be forthcoming. Kind of insulting. Can’t think of a successful business model that would limit a legitimate buyer from purchasing a product.

I would rate Coinbase as probably the worst exchange for someone who has been in cryptocurrencies for more than a hot minute. If you’re a total noob with no friends in crypto then fine. Do it. Pay that fat fee for them to hold your hand. But Coinbase is bad not only for the disadvantages noted in the article but also for the absolute duplicity of their position v-a-v moving humanity toward a sound money system. No matter what words come out of their CEO, he is establishing his exchange as just another intermediary between people and their wealth… aspiring to be another big bank. Las Vegas is not as big and shiny as it is because the house loses. Same goes for Coinbase. #btc