Ironically, the push toward carbon-rationing and CBDCs is based on the same insight by sound money advocates: Fiat is worthless.

Let me tell you a parable about value. It’s about how the “thing” that everybody assumes has value can change over time, and by the time it changes, people have completely lost touch with the original measure of value.

In the early 00’s, easyDNS was getting ready to move our servers out of our physical office and into an actual data colocation center in downtown Toronto.

When we got our first cabinet, we were billed in terms of how much rackspace we were using, and what our bandwidth consumption was. In those days, the servers were trying to pack themselves into smaller enclosures and compress the data payloads to reduce bandwidth. There were 2U boxes, the bleeding edge stuff coming out was 1U, and if you were a dinosaur from late-90’s, you might have some legacy 4U servers, which were costing you a fortune to rack.

What was missing from that equation?

Power. There were no power costs, or if there were, they were negligible to the point where I can’t even remember having them. The power costs were just built into the price of the rackspace and bandwidth.

Fast forward 20 years, and it’s inverted completely. The number one cost when you provision new cabinet space these days is typically your power commit. Then bandwidth and transport. Now the rackspace is practically a throw-in. In many cases, what people think of as “servers” today are just virtualized images that don’t even take up any physical space.

What changed? The world did.

Who cares? Mostly nobody.

What I mean by this, is nobody thought that switching to charging for power consumption instead of rackspace was a big deal. The overall economics of the space changed, and as a result so did the pricing model. In other words, the underlying value commodity switched from Thing A (physical space) to Thing B (power). Other than adapting to it, nobody really cared.

The same thing happened with “money” -and it’s about to happen again

Money used to be backed by gold (Thing A) and then by a national currency exchangeable for gold (Thing B). In practical day-to-day terms, most people didn’t care and continued to use whatever they had in their wallets for currency. Thing B even became the global reserve currency.

Then in 1971, it switched again and that reserve currency could no longer be exchanged for gold (Thing A) while Thing B would henceforth be …nothing. It was supposed to be temporary.

People continued to use the reserve currency to denominate exchange and found that using nothing to back the value of the currency actually made life better, for awhile. At least for those who were in close proximity to the people who were able to mint more of this new “nothing money” out of thin air (they’ve come to be known as Cantillionaires).

Since all the other currencies were backed by the reigning reserve currency, this meant that they were now all backed by Thing B as well. And Thing B was nothing.

There were people who sounded the alarm that the the new Thing B (nothingness) was unsuitable for backing a currency, let alone a global reserve asset. Over time, they warned, it would create ever-increasing wealth inequality, blow up serial asset bubbles followed by ever worsening financial crises and probably end in a hyper-inflationary blow off.

They were dismissed as cranks and conspiracy theorists. In more recent times, right-wing extremists or Kremlin stooges.

Even so, as ignorant and retrograde as these people were and still are, today even mainstream commentators and anointed experts realize we’ve more-or-less run out of runway for having a global reserve currency backed by nothingness.

The fiat currency era is essentially over.

Goldbugs knew it wouldn’t last and invested in gold for centuries. They still do today. Now there is also Bitcoin, which captures the same mechanism: in this case using energy to back currency.

But globalists and central bankers are in a conundrum.

There is the realization that the fiat era, backing money with nothing is about to hit the wall.

But even central bankers know they can’t print energy out of thin air. It would render Cantillionism obsolete overnight, and we can’t have that.

What is needed is some basis to backstop that currency that has some kind of value, a perceived scarcity or cap attached to it, in order to reestablish faith and legitimacy in the “money”. Further, it needs to be something that can be controlled and distributed from within the central bank / state mechanism – it must be entirely outside the influence of market forces.

Finally, it has to have an ideological pillar that can be used to shape public opinion around its acceptance.

The New Thing B is Carbon

The last legs of the failing monetary system will see another of these transitions where the value medium shifts from Thing A to Thing B.

There will at least be an attempt to implement one. Whether they get it out the door before the monetary end-game plays out remains to be seen. The destruction of the current system has been so accelerated by the ubiquitous mishandling of the Covid pandemic by policy-makers that the current system may come off the rails entirely before a new one can be implemented (subscribers of my premium newsletter have been getting our coverage on CBDCs and how far behind the curve nation states and central banks are in actually developing them. This why I think, ultimately, they try to go with something that already exists, like WEFereum Ethereum).

But the plan from on high is that we will go from pricing goods and services based on their input costs of production and distribution (Thing A), to pricing privileges and consumption based on their perceived carbon emissions (Thing B).

We’ve all seen the latest think piece out of the World Economic Forum, characteristically shrouded in their benevolent-sounding euphemisms, pushing for individual carbon rations and justifying it that because the world’s population sat still for, and complied with, global lockdowns. They suggest that the plebes are ready to accept having their individual carbon footprints metered by unelected bureaucrats and opaque AI-driven algos.

Inclusivity of citizens is becoming the most important element of success or failure in the journey towards sustainability. Community-led initiatives can make a significant contribution towards sustainability, increase resilience and social cohesion. There have been numerous examples of personal carbon allowance programs in discussions for the last two decades, however they had limited success due to a lack of social acceptance, political resistance, and a lack of awareness and fair mechanism for tracking “My Carbon” emissions.

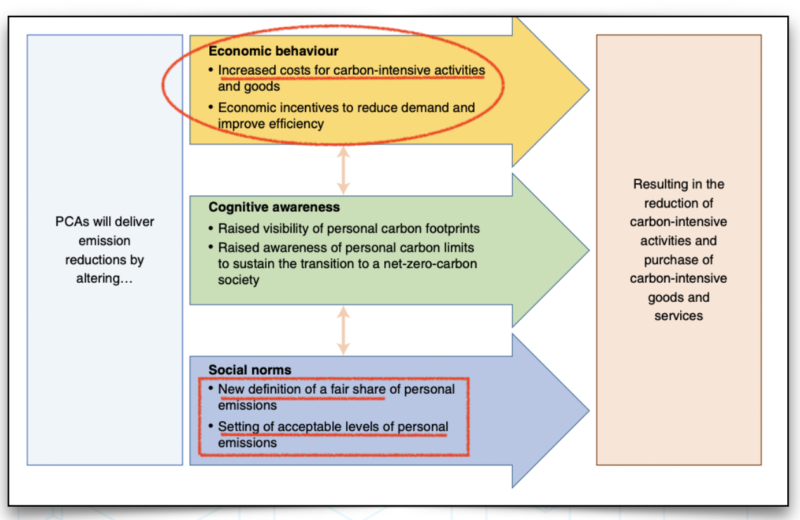

The WEF piece linked to a 2021 paper by Nature that mapped out Personal Carbon Allowances, and the impetus to define one’s “fair share” of carbon emissions and the “setting of acceptable levels of carbon emissions”.

When you set aside (for a moment) the totalitarian implications of this, it does make a certain amount of sense. In its own way, it proves the point that hard money advocates have been making for decades, if not centuries: fiat money is valueless.

Beneath all this climate alarmism driving the move to carbon rationing, there lies an implicit admission, conscious or not, that for money to be viable it has to denominate an economic trade-off.

You cannot print value ex-nihilo. In so doing these last 50 years (since the commencement of the fiat era in earnest), we’ve gotten to a world where the price of capital – and thus, time, if you read Edward Chancellor’s latest book (and you should) – is nominally zero, which collides with the reality of the finite (or with the laws of physics – as somebody like Doomberg would say).

The central bankers of the world made one big divide-by-zero error, and the result is what we actually see playing out across many dimensions, right now. Bitcoin and the coming CBDCs are both reacting to the same thing, but what’s different about them is who would be served by the adoption of one mechanism over the other.

What’s important to understand is that, similar to the Cantillion Effect, when the underpinnings of a monetary system transition from Thing A to Thing B, the outcomes are non-neutral. One example of this is the Gini Coefficient, which is a measure of wealth inequality.

In the chart below via @WTF_1971 we see how after a period of secular decline under the Bretton Woods system, it suddenly reversed and blasts off right at the inflection point where the global monetary system abandoned its last link to hard money (Thing A) and the fiat era began (Thing B).

All indications are that the coming CBDCs will be carbon-based, social credit schemes, and they are being promoted and implemented by the same vested interests who profited and consolidated unimaginable wealth throughout the prior 50 years of the fiat era – the Cantillionaires.

This path is ultimately doomed, because as I frequently point out, it seeks to extend an industrial era worldview (top down, centrally planned and linear), onto a new architecture: one that is decentralized, self- organizing, adaptive and non-linear.

Because it’s one iteration behind in the level of mental abstraction, it’s like breeding faster horses in an era of cars. No matter how good you get at it, you’re still playing the game on an obsolete playing field and will ultimately be unable to compete on the new one (if you’re wondering why I frequently reference the level of mental abstraction as being such a game changer that ensures the eventual supremacy of networks over nations, I refer you to a relatively obscure book by W R Clement called “Quantum Jump: A Survival Guide For the New Renaissance“).

The only advice I can offer for navigating the coming transition is to be as financially independent and resilient as possible. Do not allow yourself to become reliant on government entitlements and if you are now, figure out a way to end that reliance immediately. That these systems will become tightly coupled with CBDCs and carbon footprint rationing is a foregone conclusion.

You’re going to have to be ready for at least a transitionary period where the lifestyle choices you take for granted today will be priced in terms of carbon credits in the future. If you are reliant on government entitlements, get used to eating plant-based protein patties. If you aren’t, get ready to have to pay more for those Wagyu burgers. A lot more.

Hold as much of your wealth outside of the state run banking system as possible. Bitcoin (off the exchanges, I also like Monero), hold gold, silver, and own cash-flow producing businesses, and multiple revenue streams. If you have a job, start a business on the side. If you own a business, start another one.

Start connecting with people and tribes who are opting out of the current system, because the one we’re in now is either going to come off the rails entirely or try to go full CCP in the near-term.

Ethereum is a shitcoin and will eventually unwind to the drain just like all fake fiat Ponzi scheme money.

I'm advocating a carbon currency based on carbon allowances, where the currency mechanism creates a dual pricing system for every thing and every service in the economy. This removes the concerns about the social control aspect from the personal carbon trading component, as well as creating a large number of other benefits. It makes carbon equivalent to money in all its behaviours, properties and vulnerabilities. Please spread the word if you agree, or get back to me for a debate if you don't.

If the elites were open about using carbon as money and allowed what you suggest, I believe people would accept carbon as the base for money. However, the psychopaths want to control everything, and limit everyone's ability to accumulate wealth. It won't work, it stifles creativity and grinds an economy to a halt. You'ld think they'd understand that.

Of course their ultimate goal has always been to have the entire world just like China, most people don't believe me when I tell them that. It's obvious to me though.

Wow, you make so much sense. I'm older and retired but have been following the UN'S whole SDG plan and charging for carbon. Those people are crazy, no, actually they're psychopaths. When one currency falls, wealth changes hands and it does it rapidly, many of those Cantillionaires will not be Cantillionaires for long if they stick to the old ways.

I haven't been able to see much of a way forward until reading this. Oh, I've invested in gold and silver, I think those will always be worth something but I didn't, and still don't understand digital money. My son tried to explain it to me but he didn't know what it was based on at the time. I'll have to dig deeper into it now.

I think if the elites would just explain their money to carbon exchange, people would understand and accept carbon as money. However, since there is an ulterior motive of control, they can't do so, they have to "trick" people into accepting it based on lies. I'm so glad I'm older, not too many years left to go.