New website and blog name

This is the June-ish issue of what I was calling Guerrilla Capitalism. The website is still up under that name, for now, and I will be doing an overhaul of it under the new name, Out Of The Cave. The new URL will be at OutOfTheCave.io.

Yes, another blog rebrand with a new format for the newsletter. This is probably the 4th or 5th rebrand over my years of yelling at clouds about things that nobody will listen to me about.

For a couple of years now I have been searching for a word. The word I’ve been looking for would be one that describes the added perspective attained from being able to view one’s world from a hitherto undetected dimension.

The best analogy I can use to explain it comes from Edwin Abbott’s venerable 1884 classic, Flatland. In it the protagonist Square living in the 2D world of Flatland, has a dream of a visit to a lower dimensional world, Lineland, populated by Points. Upon waking he encounters a being from a higher dimensional order, Sphere. Over the course of their adventures, Sphere shows Square the 3D world of Spaceland, and tells him that there is even a higher dimensional order, which is bounded by one additional dimension than Spaceland called Thoughtland. (Square is eventually sent to prison for preaching about the existence of Spaceland and that there is a third spacial dimension beyond the two the residents of Flatland can perceive).

What word would describe that continuum of dimensional ascension from 1D (pointland), up to 2D (lineland), then 3D (flatland) and finally into 4D (spaceland) and beyond? Whatever that word is, is what I wanted to use, in a verb form, to describe apprehending reality from the next level up the dimensional scale, to be the name of the next incarnation of this accursed blog.

But I can’t find such a word. A came across a few, like synairesis which apparently, according to Jean Gebser, “describes an intelligent realization of reality proceeding from the accomplished transparency of all modes of cognition”.[1] It’s in the ballpark, but I think it would be a crappy URL.

The only idea that really captures what I’m trying to convey is Plato’s Allegory of the Cave. We all know that one, or at least should know it, even if you’ve never taken a philosophy course I would hope that any classical liberal education would have introduced the concept at some point. Who knows, maybe there is no room for Plato in today’s curriculum of critical race theory or gender studies. Forget all that crap, read the allegory.

The key realization I had around the allegory is that it is also about adding an dimensional perspective to one’s grasp of reality. While the prisoners in the cave are chained to their rocks, viewing what they think is reality, they do not realize they are only seeing a projection of what is real and happening outside of their field of vision.

Furthermore, they are viewing this on a two-dimensional screen, and this is important. When the prisoners are freed and emerge from the cave that they thought was reality, they enter the sunlight, and they take in the world in full 3D. Not only are they seeing the source of the projections into their awareness at their source, they realize there is entirely additional dimension to that reality.

No more Jelly Donuts

I had planned to list a couple more Bill Fleckenstein appearances in this month’s edition, one on QuothTheRaven, and the other on Jelly Donut.

The Jelly Donut Podcast was one of the better new shows that came out recently, which strove to answer what is every bit an existential question

“How did get we here? And where does this all end?”

Every episode, Ryan (I can’t even find his last name) would start by putting the question to his guest “What were you doing in 2008?”

Ryan recognized the shift that was occurring, quipping to Bill Fleckenstein in the most recent episode, “I guess in the future that question will be ‘What were you doing in 2020?’”.

The single most important question, according to Ryan’s farewell address, the one you as an investor absolutely must get right is whether this “ends” in deflation or inflation.

When think about that question, it appears tied to whether one thinks “the system” as we understand it can hold together or whether it will crack up. Ironically, the “hold together” scenario is in my mind deflationary, even though policy makers are aiming at a targeted inflation, so as to be able to default on their debts at a nice gradual pace that won’t alarm anybody.

But I don’t think that will work, and either inflation will get out of control – leading to a crack up, or they will have to do something more drastic about the debt overhang, which Bill Fleckenstein mentioned in both of the podcasts I wanted to recommend to you, in his passing reference to “cold fusion”.

Cold Fusion appears to be an emerging financial term referring to debt cancellation or a jubilee. And now that there is a term for it, I think it’s something one needs to keep on the radar.

As I thought about this, the ever-present deflation or inflation question comes down to whether “this all ends” in a controlled demolition of the economy and debt via cancellation, which would be deflationary, or in runaway high inflation, the implosion of the bond markets, the destruction of fiat currencies, or both.

The Jelly Donuts podcast with Bill Fleckenstein is here:

https://www.podbean.com/media/share/dir-3bvby-913a898

And the QTR one is here:

The Inevitable Gold vs Bitcoin Debate

Also via QuothTheRaven podcast was a fantastic interview with Max Keiser. I used to listen to Keiser’s show when he was still living in England but at some point it dropped off my radar.

He talked about so many things which were just “bang on” such as his concept of “Interest Rate Apartheid”. That’s a Cantillon Effect based phenomenon where people who live close to the money spigots of the central banks get to borrow money at near 0% interest, while regular Joe’s and Joan’s are still paying 22% on their credit cards. The stunning idea, which I think I will appropriate is the declaration, “never mind wealth redistribution, what we need is risk redistribution”. I don’t think I’ve heard the imbalances and wealth inequality that permeates our society described so succinctly.

But around an an hour and a half into this marathon 2h40m episode, Chris Irons and Max Keiser get into the “Bitcoin vs Gold” debate, with Irons taking issue with Keiser’s describing Bitcoin as a hard currency.

I understand why Keiser considers Bitcoin a hard currency, over the objections people would level against it, such as you need a functional power and IT grid in order to even use Bitcoin. To Keiser’s point however, even if the grid were to go down, the state of the blockchain would ostensibly be preserved once it either came back up, or you relocated to an area where it was working.

If the power grid were to go down globally, for an indefinite period, then I would see the advantage of owning gold, but only in theory.

In reality, you’ll probably be killed over a tin of dog food before you can harness the purchasing power of any gold you’ve managed to hoard.

Under less Mad Max-type scenarios I find the gold vs bitcoin debate somewhat pointless and strikes me as “how many angels can dance on a pin” type theological debates.

Example, Keiser likened Bitcoin today to being analogous in time to when Netscape revolutionized the Internet and made it accessible to the masses, via its harnessing of the hypertext transport protocol that put the World Wide Web at everybody’s fingertips.

Irons duly noted that Netscape is where today? Exactly. However Keiser’s response is that Netscape made the internet protocol (the OSI model, the seven layered protocol stack that underlies everything we do online) the permanent basis of everything that came after, and that Bitcoin is the protocol stack for decentalized, non-fiat, non-debt based economy.

They both have valid points. I’ve remarked myself, when the 2018 crypto-currency bear market ends (it may be over already), what might happen is leadership may change. Some new crypto-currency may lead the next wave up, and it could be something that doesn’t even exist yet.

(See: https://bombthrower.com/articles/welcome-to-bitcoins-trough-of-disillusionment/)

(Although it bears acknowledging from here in 2020, there are no other contenders in sight than Bitcoin. Bcash is a joke, easyDNS dropped support for it over a year ago and nobody cared. Ethereum, were it to continue well into the future will, I think, be something entirely different from Bitcoin and become more of an infrastructure utility and “dial tone” for smart contracts than money, the way Bitcoin is. If that were to happen I don’t even know for sure it would be Ethereum, or some other challenger like EOS or Hashgraph. That space is very much up in the air still, IMHO)

But where Max Keiser sees “Interest rate apartheid”, I see “crypto-apartheid”. There will be those who have access to the crypto-currency space and understand how to navigate it and there will be everybody else, who doesn’t. In a podcast I heard quite awhile ago, I can’t remember who it was who said (but I remember being surprised they said it because they were a mainstream finance person, not a crypto guy), in effect:

“There are less Bitcoins in existence than there are millionaires in the world. If and when Bitcoin achieves any kind of critical mass in the public’s mind there will not even be enough of it for every millionaire in the world to possess just one full BTC”.

Something about that statement, and who was making it, struck me as relevant. Regardless, even if something other than Bitcoin were to experience the winner-take-all jackpot of winning the crypto space, those people on the inside of the crypto-ecosystem will be prepared for it while the masses of people who don’t even know how to access it will be out in the cold.

It’s important to gain a working knowledge now of how to accumulate, move, transfer and convert crypto-currencies because I can envision an age where that may be your singular edge against wholesale financial repression.

Bitcoin and gold are both inelastic currencies with no counter-party risk. It’s never been Bitcoin vs gold for me. It’s always been Bitcoin and gold.

I like gold as a store of wealth (see below), even more so than cash. As for Bitcoin, I have always liked it, and despite that I have never actually put a dime “of my own money” into it. My preferred way to accumulate Bitcoin has always been to earn it through my businesses and then just sit on it until the next super-spike comes (you can do the same by deploying the open source BTCPayServer, or if that’s outside your wheelhouse, my company will be able to setup, host and manage one of these for you as a virtual appliance within a few months. More details here.)

However, both gold and Bitcoin suffer from custodial risk.

Bitcoin, obviously, because most of the exchange’s are quite frankly, disasters waiting to happen. If you have any of your crypto in an exchange, you should stop reading this right now and go move it out to your own wallet (“not your keys = not your coins”). Grab a Ledger Nano, or even if you need some place temporary while you figure it out, move any Bitcoin you have on the exchange to a wallet on your phone like Bread (BRD).

Gold has its own custodial risk profile….

Gold can be confiscated.

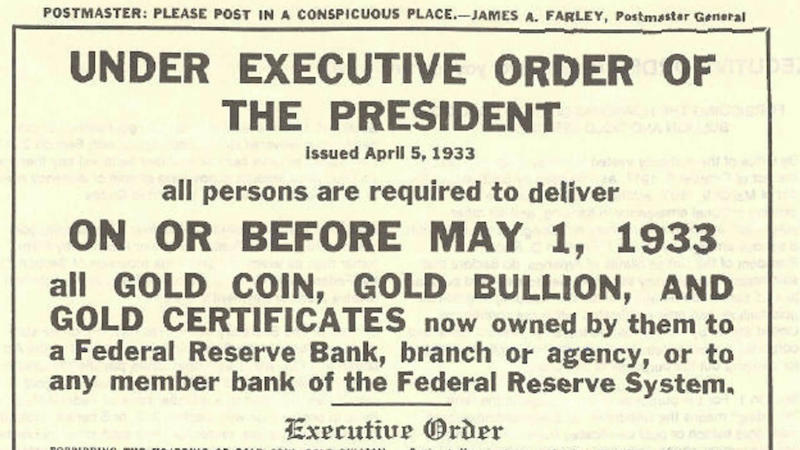

I think about this a lot, and it was refreshing that Keiser openly acknowledges this. We all know that private gold ownership in the US was banned in 1933 and citizens did not have government permission to own gold until right up into the 70’s.

There are pundits today, of whom I respect, who are convinced that once the USD loses reserve currency status, the world will have to return to some kind of gold standard monetary convention. Peter Schiff is amongst the foremost of these.

What I cannot understand is this: given that governments have hopelessly rigged the game and engaged in ever increasing amounts of financial repression for decades, how can anybody expect a return to a gold standard that is not accompanied by a ban on private gold ownership?

It makes no sense not to do it. Governments are skilled at avoiding accountability, does anybody think that were they forced to return to the discipline of a hard backed currency, they would permit the crazies and the contrarians on the fringes of the financial landscape become the among the most wealthy members of society, overnight, because they were right about fiat currencies and debt bubbles and the governments were wrong? Do you really think that’s how it would play out?

I don’t. I think if it came to that, gold would be confiscated, miners would be nationalized and gold bugs would be blamed for the financial meltdown and hung from lampposts.

This is a question that’s haunted me for a long time. I have been trying to get the question of gold confiscation in front of Peter Schiff for nearly year. Bill Fleckenstein once answered me via Twitter, saying he doesn’t think it’s a risk.

no i dont think that will happen.

— bill fleckenstein (@fleckcap) December 24, 2018

James Rubino over at DollarCollapse.com did answer me, thank-you…

“your question is a good one. Desperate governments do crazy things, including wealth confiscation and capital controls. So it’s important to diversify. Own physical metal in several locations, and shares in miners that are headquartered in different countries. That way at least some of your capital will survive. There doesn’t, alas, seem to be a way to save all of it. But if gold goes to $10,000, just some of it still will be nice to have.”

One of the articles I came across this month was US Gold Confiscation Would Be Folly, by Egon von Greyerz over at GoldSwitzerland. I hope he is right and I am wrong. However what I think his logic omits is if there is a coordinated global effort to reset the financial system. Perhaps all G20 countries acting together in concert, as part of a radical restructuring of the global monetary system would deliver us a “One World Money”. Then if the likes of Schiff were to be right, that it would include gold or SDRs based on gold, they would want all the gold so that they could revalue it at will.

The War on Cash and Evil Savers

Despite my reservations around gold confiscation, it’s actually further down the list than the problems I see with protecting one’s cash savings.

Because the stock markets, in the words of Jelly Donut’s Ryan, “have artificially sever[ed] price from value” and if the predictions of a Fleckenstein come true, eventually the bond market will break, what does one do with actual savings?

If you leave it in the bank, you actually face the same custodial issues, because Bail-ins are a thing now, and there be wealth taxes in our collectivist future. How do you deploy the money you’ve managed “to get off the table” without engaging in speculation, or even having to entertain an investment thesis?

You can’t! Those days are over. Alas. So we have to do the next best thing and try to stay diversified and agile.

To that end I have made a major mental shift with regards to gold and silver in that I no longer look at it as an investment position as much as I am now using precious metals to hold my capital savings.

Over the past few months I’ve been slowly reducing my cash balances and moving them into online bullion vaults, and I know for some people, doing that may raise the spectre of custodial risk all over again.

What I do like about online precious metals vaults is I can choose to spread my holdings across numerous foreign jurisdictions: Switzerland, Singapore, Frankfurt, I’m avoiding Hong Kong at the moment.

I’m using two services so far, Goldmoney and Bullionvault. Goldmoney is based here in Toronto with vaults spread around the world. They are also publicly traded (disclosure, I am long this stock). Bullionvault is based in the UK.

How do I know these are reputable vaulting services? I’m glad you asked.

My cousins, Christian and Daniel Haese, who live in Berlin run TrustableGold.com, which researches and reviews gold storage services. So don’t take my word for it, go to their site and look at their rankings – and if you decide to create an account, please do use their links because they get a referral for the new business and it costs you nothing.

What are ultra-long corporate bonds yields telling us?

One of the recurring themes my co-conspirators (Charles Hugh Smith and Jesse Hirsh) over at the AxisOfEasy podcast is the crash in establishment legitimacy and the accompanying crack up of society’s institutions.

Part of this, we worry, is the “what comes next part”. If the nation state is (in our words) obsolete, then what will rise to deprecate it? We usually end up ruminating that it will be Big Tech platforms like Google, and Facebook and Amazon (the last of which I’ve taken to start calling “The Company Store”).

Are we delusional? Maybe. But one of the yardsticks you can use to measure your ideas is to look at how insanely huge money pools are valuing risk out the time curve and compare those valuations between Big Tech platforms and nation states

Amazon took this ultra-low interest rate environment to issue 10B in bonds, all the way out the maturity axis with ultra-long 2060 bonds.

How much would a private company have to pay for investors to bet on them for forty years, one might ask? Try 150 basis points. 1.5%, for forty year paper. The thirty-year tranche priced out at 130 (1.3%).

By comparison, that’s lower than the current yields on sovereign debt of Israel (30yr @ 1.76%), Australia, (30yr @ 1.74%), Portugal (30yr @ 1.459% – astounding in itself), Singapore (30yr @ 1.402) and… wait for it… The United States of America, the issuer of the world reserve currency (30yr @ 1.516%).

In other words, the Big Money is telling us that they’re ascribing less risk to the 30-year debt of Amazon than they are to the sovereign debt of the aforementioned nation states.

Various odd lots

I haven’t finished going through everything I had bookmarked for this edition of the newsletter and I realize this new format, well I’ve gone over 10 pages on it so far.

So I will summarize the next few bits quickly – and, to you, dear reader, please do let me know if this new format works for you (one monthly PDF report of, hopefully not quite this long in length)

How Do You Like Democratic Socialism So Far?

I wrote this earlier in the month and didn’t bother sending out an email to the list for it because I felt like I was preaching to the converted. It was mostly a rant to relieve tension.

https://bombthrower.com/articles/how-do-you-like-democratic-socialism-so-far/

The Dawning of a New American Era: Post-Capitalism 1.0

This article was posted in the comments section on Zerohedge in response to that aforementioned Democratic Socialism post, which ZH picked up, and it’s a great read.

https://thebullbear.com/profiles/blogs/the-dawning-of-a-new-era-post-capitalism-1-0

Vitamin D: the New COVID-19 Chloroquine?

This was supposed to go in last month but I forgot. In it a luminary from my own tech space (the DNS business), with a background in science and number crunching took a look at Vitamin D as it relates to Coronavirus. Is it a magic bullet?

The TL,TR is you don’t want to catch Coronavirus with a deficiency in Vitamin D.

https://berthub.eu/articles/posts/vitamin-d-the-new-covid-19-chloroquine/

That’s it for this month.

Feel free to forward this to any friends or colleagues who may be interested, and they can always sign up for the mailing list here.

[1] As related by Shelli Renée Joye in Sub-Quantum Consciousness

Hi There,

something seems off with your writing on amazon debt. I think your looking at spreads not the total interest. None of their 30y or 40y debt was issued with 1.30% interest rate. the 40y AMZN 2.70 6/3/60, was however issued with at a spread of +130 basis points to the current UST 30y. That gives it a coupon payment of 2.70%. Still ridiculously low, but quite a ways from being lower than the yield on US government 30y debt.

Enjoying the blog otherwise though!

-Lee

Thanks for letting me know.

Mark,

Being in the 4th level of the rabbit hole due to trying to find the "Four Post-Virus Scenarios" articles, I came across "Come Out of the Cave".

To provide a suggestion for your question regarding one word to describe your quest for one word to describe the added perspective of seeing things on a new dimension, I would say: Unbelievable.

Because doing so is impossible to do for someone else. So, you may believe it is Pointless.

However, I liked your description of your efforts: YellingAtClouds.

Or you could go with your analogy and call it: Flatland.

E-you later,

Jim