Lumpenvestors are trapped within a system they believe is real

Probably everybody reading this is familiar with Plato’s “Allegory of the Cave”. Those who aren’t may recognize it in many of its contemporary variations: seminal blockbusters like “The Matrix” or lesser known cult classics such as “Dark City”, even the memetic thought construct of the “Simulation Hypothesis” – they are all expressing the same concept:

That what we think is The Real World actually isn’t, it’s just a flattened projection of reality. The common folk are like prisoners, chained in a cave, wherein observed events are largely acts of puppetry, choreographed from behind their field of vision.

In Plato’s allegory, the manufactured existence is quite literally the projection of shadows: what is taken for reality is really just images on a wall – a screen – if you will. Behind the captives, if one could make their way out of the cave, they could perceive reality for what it is – in the splendour of the full light of day.

The philosopher goes on to describe the difficulties an escapee would have, if they were to re-enter the cave and try to explain to those who are still captives what “reality” is really like.

The Allegory is timeless and open to never-ending interpretation, but one thing it takes aim at is a key observation which society increasingly loses sight of: that depictions of truth, renderings of it – even “reasonable facsimiles thereof”, are not reality. The “map is not the territory”. The thing that depicts, and the thing depicted, is not the thing itself.

In fact, the latter may be missing an entire dimension of truth that renders it a muted, faded simulacrum of what is real (I’ve always drawn attention to how the images on the cave wall were two-dimensional, and that the difficulty the returning escapee would face in explaining reality, is that it is 3D. What is “real” contains an entire additional dimension that is near impossible to describe).

The Cave is the Fiat Banking System

Inside the monetary cave, what passes for “reality” are just projections. They’re spreadsheet models and financialized derivatives of rehypothecated paper assets. Through these constructs, financial institutions can create renderings of assets which they claim are “economically identical” to the real thing. That phrase (“economically identical”) was proffered as an objection to my article of several years ago about Bitcoin Futures ETFs and why you shouldn’t buy them.

In the fiat cave, a synthetic derivative that is more or less correlated with the price action of an underlying asset is the same thing as the underlying asset. This mindset is so baked-in, it’s part of our zeitgeist: other fields, like Artificial Intelligence, have glommed onto it – if an AI can demonstrate behaviour just like human intelligence, then the AI is intelligent.

Neither proposition is true, a piece of code that can pass a Turing Test is not sentient, it’s just code; and having a derivative is not the same as owning the underlying – and if the recent David Rogers Webb book “The Great Taking” is right about anything (which I reviewed here), it’s that.

Bitcoin ETFs are not Bitcoin

The anticipation around the coming Bitcoin ETFs in the US, is euphoric (we’ve had them in Canada for years, and they’re actually better than the ones coming in the US, as we’ll note below). They’ve made believers out of skeptics. They’ve proved Bitcoin is an unstoppable force.

In my article about Bitcoin Futures ETFs, I listed four reasons not to own them

- Counterparty Risk

- Dilution

- Decay

- Divergence (from the spot price)

While spot ETFs will in theory obviate reasons 2 thru 4, the number one reason, counter-party risk, still looms large.

Owning shares of a Bitcoin ETF is just that – shares, units, claims. All of the US applicants had to modify their applications to the SEC to allow for cash settlement – both on fundings and redemptions (that’s the key difference from the Canadian spot ETFs, where there is at least a theoretical option to redeem units for in-kind Bitcoin, typically on one day a year – “Redemption Day”).

Whether we’re talking futures, US or other spot ETFs, when it comes to Bitcoin, none of these vehicles are self-custody of Bitcoin, with possession of your own keys, and in the case of the futures – may not even accurately track the price action of the underlying (they disclose this right in the prospectus).

The spot ETFs have their own challenges – if there’s a hard fork (say this ordinals and inscriptions business and the BRC-20 craze leads to one), the ETFs will apparently be forced to choose which fork to follow, and they may choose wrong (I don’t take seriously the conspiracy theories that the spot ETFs are a play to “take over Bitcoin” and force a hard-fork into something like ₿lackcoin.)

Make no mistake, Bitcoin ETFs, whether they’re spot or futures, while sure to open the floodgates to institutional enthusiasm for Bitcoin – is best left for institutions, funds and endowments – all of which would still be better off holding BTC directly.

There is one advantage that the spot ETFs have over the futures, and it’s a big one. They’ll provide a pathway to holding long term positions that won’t get chewed by decay, at least not beyond the management fees. Allocators just have to bear in mind that they aren’t holding Bitcoin long term – they’re placing long term bets on the price trajectory of Bitcoin using a vehicle that is collaterized by it.

Buying into these ETFs won’t make the lumpenvestor into a HODL-er. Not by a long-shot. (I have visions of people adding laser eyes to their Twitter avatars and listing the ticker symbols for all these ETFs in their bios…)

The extra dimension of Bitcoin is math

Those who have been in Bitcoin before now, got there because they had “left the cave” so to speak.

We left the cave because of math:

The math that says (among other things), that:

- We’re in a debt bubble we can never pay off or even meaningfully reduce

- Our currency is backed by nothing and is actually steals from people with every new unit printed

- We can’t stop expanding either bubble (money supply & debt) because if either contracts it will crash the global financial system

And we use a specialized area of math (public key cryptography) to assert property rights in the real world:

- Bitcoin is a specialized expression of mathematics, secured by energy

- Private keys can be represented in a memorizable seed phrase

- The Bitcoin protocol is implemented through zero-trust mechanisms

- Any alteration to the protocol, such as the 21M hard cap, would create (fork) a challenger, rather than change Bitcoin

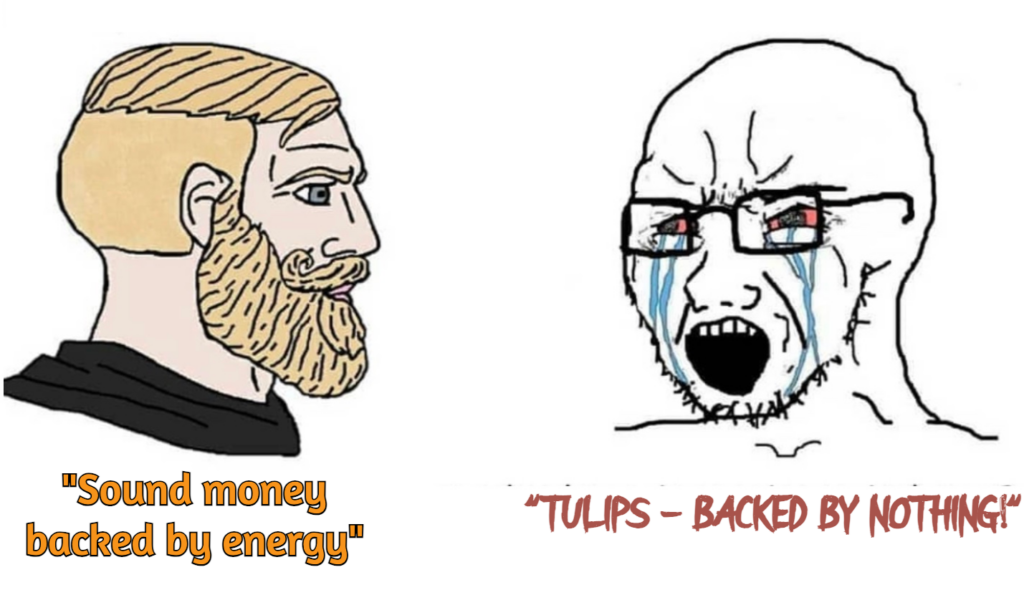

In cave world, this all sounds cray-cray to the inmates. “Hard money secured by energy”, they scoff, “You mean tulips backed by nothing! AmIRite? Checkmate”.

We can’t fault them for this. It’s a kind of institutionalized Stockholm Syndrome. They’ve never done the work to peer outside the cave.

Remember what I said earlier about how hard it would be for anybody coming back into the cave to explain the existence of an entirely new dimension over and above the 2D flatscreen shadows they assume is reality. (Ever read “Flatland”?)

So for the time being, more people will pile into Bitcoin ETFs because their approval will signal to the world that “Bitcoin is a legitimate asset class” – better late than never. And the funds will have to buy actual Bitcoin to meet inflows, in a macro environment where most actual Bitcoin HODLers are have moved their coins off the exchanges and are digging in the for the long haul.

As I type this, Bitcoin is still under a trillion dollars in total market cap, what I think will be interesting to watch going forward will be the ratio of total AUM of the Bitcoin spot ETFs measured against the overall market cap. My guess is this will provide hints in the future around cycle tops and bottoms.

My forthcoming ebook The CBDC Survival Guide will give you the tools and the knowledge to navigate coming era of Monetary Apartheid. Bombthrower subscribers will get free when it drops, sign up today.

Hello and thank you for the insight.

Could you elaborate on why ETFs cannot be used to manipulate BTC price? As I understand, derivatives are being used to do just that in gold, silver and pretty much any commodity and has been very successful action for many years now.

thank you.

The blockchain is audit-able at any time. Unlike Gold, which can be lied about the amount you hold. BTC held must equal ETF certs issued. It cannot be "overbooked"for very long without being exposed. SO, while holding the actual asset is the best scenario, at least a BTC ETF will be difficult to "over sell" certs for above the actual amount held, keeping the market price reflective of its relative scarcity even in an ETF issue.

Thank you Stephen for clarifying it. In my ignorance I was worried about that.