Nor will it change anything over the long haul…

We’ve always said that the rise of Bitcoin and non-state fintech was a monetary regime change, and that it would be naive to expect the entrenched “powers that be” and incumbent establishment to go down without a fight.

After all, the Cantillionaire class has had monopoly control over a magic lever that surreptitiously transferred everybody else’s wealth to themselves for over a century.

Now, suddenly Prometheus shows up – in the form of Satoshi – and gifts humanity with a new magic lever, called asymmetric public-key cryptography. It’s really just math. But it enables every individual on earth to just as magically shield themselves from this embezzlement

If you want to keep your #Bitcoin safe from the government, just make a seed phrase using Jeffrey Epstein’s clients’ names.

That way the FBI will never look for it.

— Walker⚡️ (@WalkerAmerica) April 26, 2024

Even worse for those elites, is that their mechanism for leeching wealth from society accrues to them in fiat currency units that lose their value over time, while all the unwashed plebes making use of this fancy new system are finding their purchasing power increasing over time.

The Cantillionaires are fighting the inexorable cannibalization of their own purchasing power, owing to the pernicious effects of using debt for money – while the rising system is being impelled by network effects, power laws, and good ole-fashioned incentives.

For the establishment, the central bankers, career politicians and fiat financiers, it probably all seems a little… unfair.

Which makes it completely unsurprising that whoever among them sees the writing on the wall and refuses to allow themselves to be “orange pilled”, as it were, will dig in and muster all the power, influence and institutionalized corruption at their disposal to try and forestall the prospect of hyper-Bitcoinization.

Chokepoint 1.0 was an Obama-era initiative, launched in 2013, that set the table for freezing unsanctioned financial players out of the legacy banking system: payday loans, money transfer networks – and possibly most notably because it ended an industry overnight: online gambling.

Chokepoint 2.0 happened in the wake of the 2021-2022 crypto winter, the fallout from the FTX bankruptcy (along with Celsius, Terra/Luna, and all that).

We saw SEC Chairman Gary Gensler fighting off Bitcoin ETFs, the formation of Liz Warren’s “anti-crypto army”, and a coordinated hitjob on crypto-friendly banks – among them our own Silvergate Bank, which was going swimmingly well until then, but ultimately succumbed. Silvergate was our first, and remains our only total wash-out over the course of The Bitcoin Capitalist.

One of the chief architects of Chokepoint 2.0, Bharat Ramamurti, was now heading up the CFTC (and we outlined the numerous connections in the June ‘23 portfolio update – which we actually titled “Are We Into Chokepoint 3.0” at the time).

Chokepoint 3.0 began to be recognizable in mid-2023; the first time I heard it referenced by name this year was from Riot Blockchain back in February, in response to the US government’s planned “survey” of Bitcoin miners’ electricity usage.

Since the SEC suffered its humiliating loss against Bitcoin in approving spot ETFs, it seems like the tempo of regulatory FUD in the US has increased and is now coming from all sides:

-

- We reported last edition that the SEC served a Wells notice on Uniswap.

- They’ve since accused Metamask – the near ubiquitous Web3 browser wallet – of being an unlicensed securities broker (Consensys, Metamask’s parent company, is now suing the SEC alleging “unlawful seizure of authority”.)

- The founders, CEO and CTO of the Samourai Wallet – a self-custody wallet with a built-in coin mixer/anonymizer – were arrested and charged “with money laundering and unlicenced money transferring offences”, according to the release issued by the US Department of Justice.

- The FBI just issued a warning to consumers to avoid using KYC-free exchanges:

“The FBI warns Americans against using cryptocurrency money transmitting services that are not registered as Money Services Businesses (MSB)… avoid cryptocurrency money transmitting services that do not collect know your customer (KYC) information from customers when required.”

Adding that:

“Using a service that does not comply with its legal obligations may put you at risk of losing access to funds after law enforcement operations target those businesses.”

Which is FBI-speak for saying, “Not your keys = not your coins”.

-

- On April 26th, The Depository Trust and Clearing Corporation (DTCC) announced they were cutting the collateral value of ETFs with Bitcoin or crypto exposure to zero, effective April 30th. They also decreased the value of B1-B3 junk bonds (pushing the “haircut value” from 50% to 70%)

The list goes on, but we’ll expand on a couple more beyond a bullet-point:

US Treasury Department’s Deputy Secretary Wally Adeyemo warned that ”terrorist groups will increase their use of virtual currencies and other digital assets”, even though:

“While we continue to assess that terrorists prefer to use traditional financial products and services, we fear that without congressional action to provide us with the necessary tools, the use of virtual assets by these actors will only grow…”

Said differently, and echoing what other US law enforcement agencies and government ministries have been repeatedly saying in their own studies: criminals and terrorists still prefer using fiat money – namely US dollars – to carry out their activities.

And yet – new constitutional powers are somehow necessary to solve a problem that admittedly doesn’t exist.

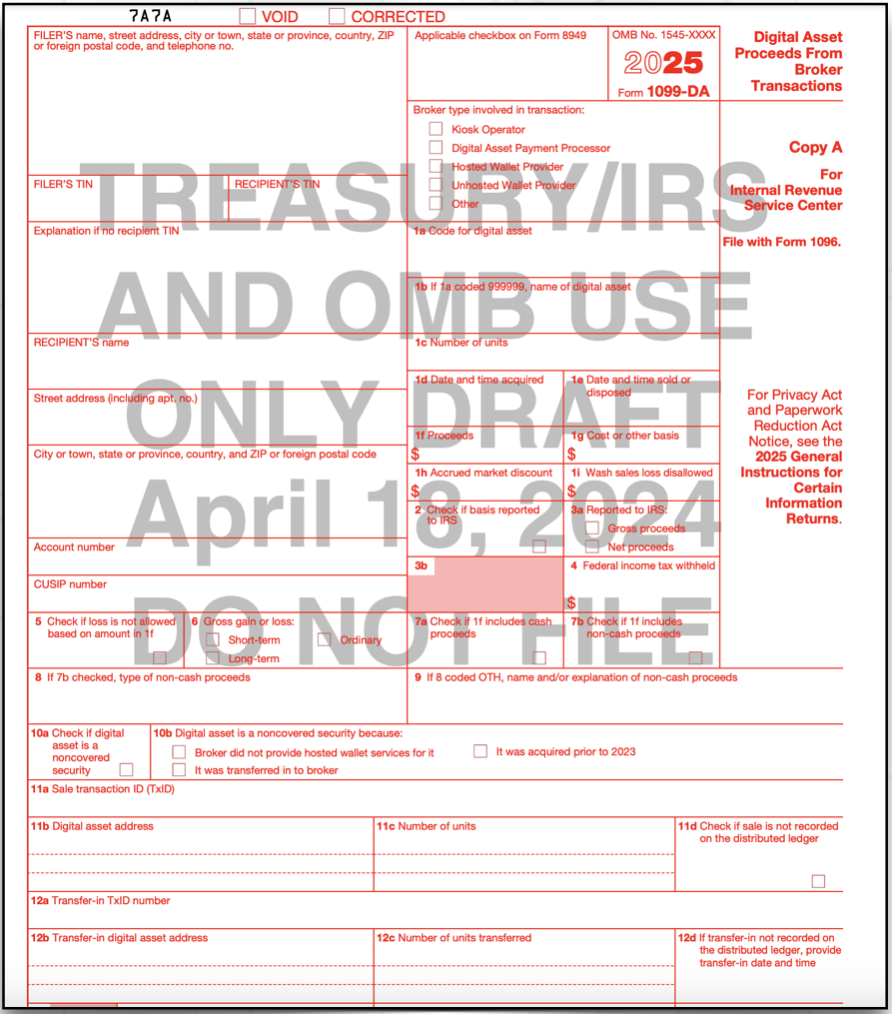

Toward those ends we’ve gotten a preview of possible forthcoming tax disclosures regarding digital assets via the US IRS:

The proposed new 1099-DA tax form to report “Digital Asset Proceeds From Broker Transactions” was released via the IRS website:

Conspicuous by its presence is the checkbox option for “unhosted wallet provider” and we can see it asking for transfer-in wallet addresses and even transaction IDs.

This is the format of the proposed form, with public comments invited via IRS.gov/FormsComments; include “NTF 1099-DA” in your response so they know it’s about this – I encourage our US readers to do so.

Again, none of this should be any surprise, and we’ve never advocated the use of Bitcoin and crypto to engage in tax evasion. We’ve expected increasing regulations and identity verification on all roads into or out of the crypto-economy.

When it’s time to take chips off the table (should you choose to do so), you factor in your tax hit and report that accordingly (here in Canada, the Liberal government just hiked the capital gains inclusion rate from 50% to 66.6% – taking the effective tax hit on cap gains from 25% to 33%: this becomes effective June 27th and absolutely covers Bitcoin and cryptos).

Also bear in mind that one of our core premises is that wealth is increasingly on a one-way trip into the crypto-economy, and has no intention of ever returning to the fiat system – which we think has limited timespan. This means the global financial system will inevitably bifurcate into two separate monetary systems:

A UBI/welfare system running on CBDCs where money is replaced by social credit scores; under which neo-Feudal serfs plod through lives of quiet desperation, their day-to-day regimens being gamified and optimized for collectivist, “degrowth” objectives. “Emergency socialism” to use George Gilder’s term for it.

And a network of Crypto-anarchy – marbled throughout this global, neo-Marxist utopia, will be numerous enclaves, micro-sovereignties, city states and even castes where real wealth is held by market participants who are comparatively free to exercise free-will. It’s “The Sovereign Invidividual” scenario, writ large.

Which side of The Great Bifurcation you’re going to be on is basically up for grabs right now. As we’ve been reporting in the newsletter (and outlined in my book, when I finally get out this year), retail facing CBDCs are still a ways off – measured in terms of years.

There is still time to get on the right side of the coming Monetary Apartheid.

Today’s post was a small excerpt from the May edition of The Bitcoin Capitalist Letter.

My forthcoming ebook The CBDC Survival Guide will give you the tools and the knowledge to navigate coming era of Monetary Apartheid. Bombthrower subscribers will get free when it drops (and The Crypto Capitalist Manifesto while you wait), sign up today.

Follow me on Nostr, or Twitter.

Mark, love your writing and agree with you on 99% of the issues we're facing. I only lament the shift from Crypto Capitalist to Bitcoin Capitalist. Reason being, Bitcoin has been hijacked, and is only marginally useful at this moment. ETFs now control the BTC market price for Blackrock's benefit, and the government likely only needs to make one phone call when they need the price dumped 75% overnight to cause a panic. BTC blocks were artificially limited to force people onto Lightning Network, which is confirmed DOA. BTC fees are astronomical and went to $240/tx last month.

The good news is we live in a multicoin world. ETH, BCH, XMR, or DASH all offer uncongested blockchains with low fees and innovative improvements in: block propagation, difficulty adjustment, governance, and staking. They all offer P2P payments not requiring any intermediary. It doesn't matter what coin anyone uses, because the name of the game is now ABF (Anything But Fiat). Look into decentralized exchanges and atomic swaps. Check out THOR and AVAX. The future is here, there is no point clinging to BTC as if it has some magic other than the first mover advantage.

Keep the Faith!