“Blue Horseshoe Loves Gold and Bitcoin”

Suddenly the likes of Goldman and JP Morgan are talking about this and the mainstream press are framing it as “the so-called Debasement Trade”

Bitcoiners, of course, have been talking about this for, well since the beginning.

Except, it’s not a “trade.”

The trade du jour lasts for a couple weeks or a few months – then it starts getting referred to as “a crowded trade” and then some new theme emerges and all the hot-money rotates into that.

Less than two weeks ago a finance guru I’m aware of (I won’t name him) sold 90% of his Bitcon and crypto positions (via IBIT and ETH) “due to bearish MACD crosses and support breaks”.

Bitcoin has since run to successive new ATHs.

As I’ve long said, Bitcoin isn’t a trade and trying to time it with chart patterns generally does not work. (Technical analysis in general never carried any real predictive edge for me, and when it comes to BTC specifically, I’ve seen too many failed “death crosses” to change my opinion).

It’s a monetary regime change – if market participants are trading anything it’s getting rid of a currency (“it’s the denominator, stupid”) for a store of value – and we’re seeing it in spades with Bitcoin and gold:

what do you call this pic.twitter.com/qiWgG0bcGk

— Mark E. Jeftovic (@MarkJeftovic) October 6, 2025

To be fair to that finance influencer, I don’t follow him enough to know if he maintains separate core Bitcoin stack in self-custody, and these moves are just referring to his trading activities, as distinct from long term holds. He apparently rotated into TSLA and silver. He’s also since followed up, acknowledging that Bitcoin ran to fresh highs, but he still expects a 40% to 50% decline in cryptos over the next year because of that MACD crossover. That said, he sold his TSLA and went back into Bitcoin (which has since dropped about $4K 😱)

I don’t know if he’ll be proven right or wrong about a 50% drop – what I do know, and something I found out the hard way right when I was about to launch The Bitcoin Capitalist Letter, was that trying to pick the intermediate tops and bottoms when it came to Bitcoin was a fool’s errand.

You end up getting whipsawed. It sure looks like I’m watching it happen to this guy right now.

The advice I’ve been giving to my subscribers over the years, both for Bitcoin and the stocks we hold in our portfolio has always been:

- Don’t try to time or trade the intermediate tops

- Whenever Bitcoin (or one of our holdings drops) we ask ourselves:

- Is the underlying thesis intact?

- If yes: the only decision is whether to buy more or hold through

- If no: then you exit the position, at the moment your thesis is invalidated, regardless of the price.

- Beyond that – exit when your own personal financial goals are met.

That’s it, basically the entire Bitcoin Capitalist playbook right here 👆

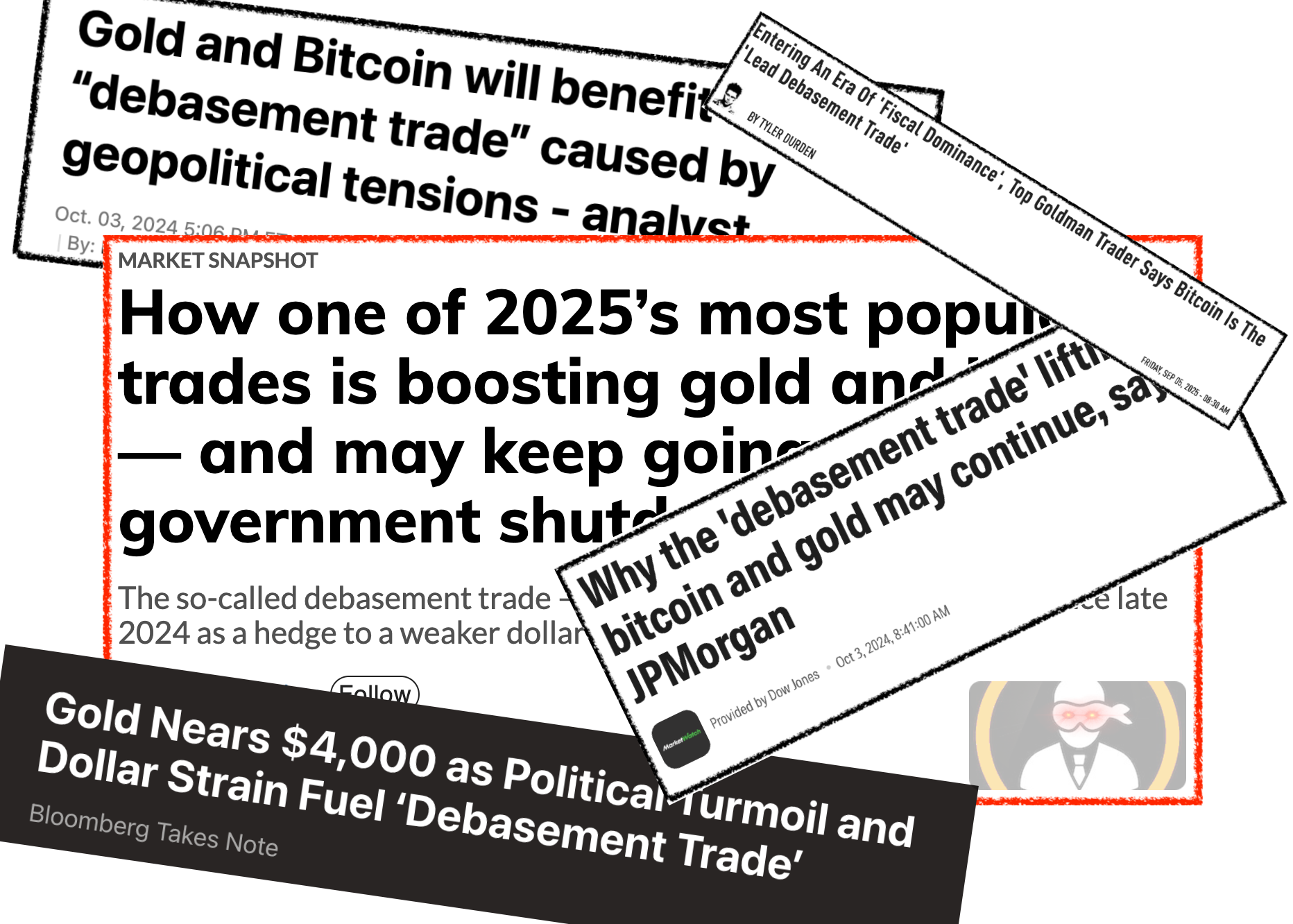

What got me thinking about all this today was all these headlines we’ve been seeing lately about “The Debasement Trade”.

This has been so obvious to Bitcoiners (and before that, goldbugs), for so long, that I didn’t really “clue in” to the fact that our entire long-term thesis is finally in the process of being mainstreamed right now.

Mainstream establishment analyst wakes up to what we have been talking about for 5 years. In fact, some of us even wrote books about it! @elerianm (had to do a screen shot because he blocked me). Proof that the elites are late and are not even here yet. pic.twitter.com/oxxOKClRpi

— Lawrence Lepard, “fix the money, fix the world” (@LawrenceLepard) October 2, 2025

Gold and BTC hitting all-time highs together is sending a signal.

Bond yields going up even though central banks are cutting rates, is sending a signal.

Stonks are hitting levels that make the .com bubble look like a bombed-out value play.

Why?

Because these aren’t trades anymore.

It’s capital flight.

The Bitcoin Capitalist Letter is our premium service for Bitcoin macro and the future of fintech. Try a special deal for Bombthrower readers here »

Sign up for the Bombthrower Mailing List here and get a free copy of The Bitcoin Treasuries Playbook.

Follow me Twitter/X or Nostr: npub1elwpzsul8d9k4tgxqdjuzxp0wa94ysr4zu9xeudrcxe2h3sazqkq5mehan

I am happily tolerant of Mainstream Finance's newly hatched embrace of Bitcoin as they bring their fiat to the table.

Love your work. I agree with the premise that the mainstream is waking up to the “debasement trade”. And the idea it is capital flight is probably true. However, one fact check:

“Bond yields going up even though central banks are cutting rates, is sending a signal.”. This is false. US 10 year rates are down to 4.1% from 4.5% at the beginning of year and 52 week high of nearly 5.0%.

I think this actually fits with gold, crypto, stocks going up. There is a lot of money all over the world looking for yield and safety.

You can't hold bitcoin because its an idea. You can hold gold. However, both are not edible.