The game theory dictates that Bitcoin will become a global reserve asset

Some time around 2010 I took a course at the Ben Graham Center for Value Investing at UWO (University of Western Ontario, in London, Canada), taught by the eminent Dr. George Athanassakos. He was the guy who unleashed a shitstorm across corporate Canada and within the corridors the CRA ( Canada’s version of the IRS), when in 2005 he wrote an op-ed in the Globe and Mail on why Bell Canada should convert itself into an income trust. When a company does this, they no longer pay corporate income taxes, and pass income through directly to their unit holders. Doing so would save the mega-conglomerate close to $1B CAD in taxes annually. They decided it was such a good idea they went ahead and announced they would do it. Their rival Telus concurred, actually announcing their conversion even before Bell did. In fact this became somewhat of a trend across boardrooms nationwide.

The political class went ballistic, and it culminated in a tax crackdown on income trusts by the Harper government.

In that course, which was attended by investors as far away as Germany and Japan, I learned two things about conventional finance which completely astounded me at the time. Given the most recent events of this year, the ramifications have finally come home to roost.

The first was an almost off-the-cuff remark by Athanassakos that “all short term debt eventually becomes long term debt”. Being a child of working-class European immigrants, this seemed batshit to me. A prescription for doom. I can’t remember if I mentioned it at the time but I did write it up on an old blog, that debt used to be something you actually paid off.

I referenced a passage from an finance textbook I had from the 40’s, which emphasized the importance of implementing a plan for liquidating debt at the moment it was incurred:

Any corporation, private or governmental, that wishes to provide for a sound and equitable continuity of its business must take steps towards the systematic retirement of debt immediately after it has been incurred. Postponement of all payment for property or priviledges by those who presently enjoy their benefits is calculated to bring uncomfortable consequences to them or those who succeed them.

What happened? August 15th, 1971 happened. The closing of gold convertibility (temporarily) and the birth of the post-Bretton Woods era. From that moment on, debt became perpetual and it had to grow in size. That also meant that interest rates would trend down to the zero bound, and once they got there, they’d effectively be stuck there forever.

The other epiphany from the course was when Dr. Athanassakos was teaching us some intricacies about calculating WACC (cost-of-capital) he referenced the risk-free-rate of interest (textbooks of the day were still using 6%, if you can believe that) and this time I asked, also off-the-cuff (although I believed it on the inside) “What happens when the risk-free-rate is set by an instrument that is no longer risk free?”

He asked me what I meant and I stammered something about unsustainable debt levels, monetary expansion and what if someday the US dollar isn’t regarded as safe enough to be the world reserve currency anymore. Dr. Athanassakos was polite about being dismissive, but I remember getting weird looks from my classmates. From then on I was the class clown.

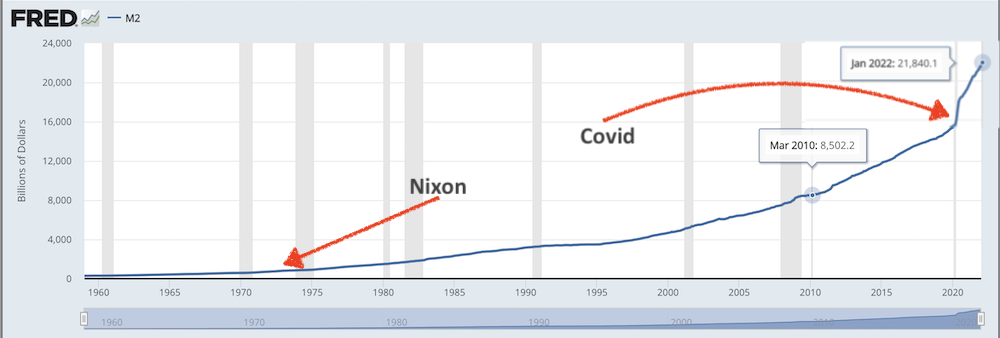

In hindsight, this institutionalized credulity was understandable. At the time US M2 was only $8T and it had taken an entire decade to double to $16T right before COVID hit.

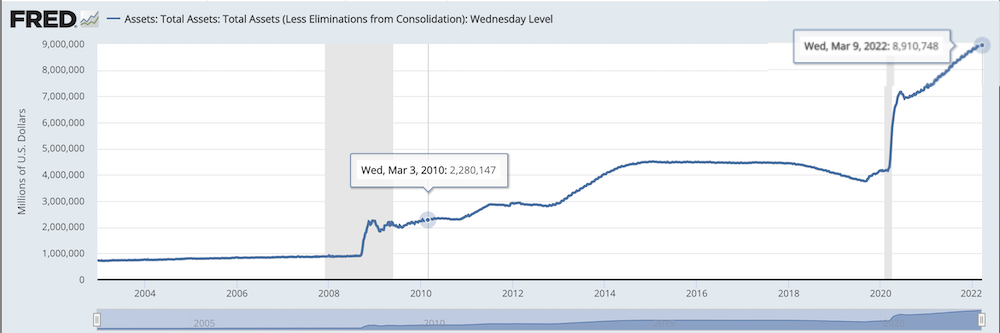

The situation looks a bit more pronounced when you look at the Fed balance sheet:

So maybe I was a little early on the call that this was all headed for uncharted territory.

Bitcoin had been invented by then, but I was still three years away from clueing into it.

Q1 2022 and the End of Trust

When Nixon closed the gold window in 1971, it was an instant in time that forever changed the global monetary order. It commenced the Post-Bretton Woods Era. One where there were no hard-backed national currencies, they would henceforth all float and jockey for position against each other (in many cases, actually incentivized to devalue themselves).

By Q1 2022 I had of course, fully drank the Bitcoin Kool-Aid and continue to do so. In fact, things have changed so radically in the last six weeks that I am now leaning further toward Bitcoin maximalism, where I wasn’t before. Further, where before I was highly skeptical that Bitcoin would ever become a reserve currency, the way I see it now, it’s a lock.

What happened over the past few weeks was nothing less than the end of the Post Bretton Woods era. That’s not me calling it, others have already done that. I’m agreeing with it. Until fairly recently, the end of the USD’s global reserve currency status simply wasn’t something spoken about in polite company. Policy makers have, through their actions, mainstreamed the idea. The risk now is of being unaware that the monetary regime that has been in place for the past fifty years just ended.

Trudeau deputy PM: “Financial service provider will be able to immediately freeze or suspend an account without a court order [if the person supports the truckers]. In doing so, they will be protected against civil liability for actions taken in good faith.” pic.twitter.com/DFzWxkL0dL

— Tom Elliott (@tomselliott) February 14, 2022

(This was the foreshock of the end of the global monetary order)

In the past I viewed Bitcoin as an evolving global “Notgeld”, a German term for “emergency money” that emerged during the Weimer Hyperinflation. As I’d written previously, every hyperinflationary event has its notgeld, whether it’s prepaid phone and gas cards in Zimbabwe, cities printing their own scrip, Venezuelans wrapping gold flakes in worthless Trillion Bolivar banknotes, there’s no end to the ingenuity (and desperation) employed.

My theory was that in an oncoming era where all global currencies were going to hyperinflate simultaneously, Bitcoin would emerge as the global notgeld. And then, I thought, afterwards some kind of global monetary reset would occur. That would probably be some kind of SDR against a basket of hard assets, including gold, but I never imagined that Bitcoin would be a component of that basket.

(To be clear: I still thought Bitcoin would remain important and desirable, especially as a counter-balance against CBDCs that would be inflicted upon the wealthless underclass of the world. But I didn’t think that governments globally would admit a currency that nobody could control to the inner circle.)

Now, all of that has changed

Thanks to Trudeau and Freeland setting precedent that a so-called Western G7 democracy can seize its citizens’ bank accounts with no due process and no appeal for the crime of demanding the reinstatement of their civil rights.

Thanks to the US government seizing the foreign reserves of another country (Afghanistan), not to freeze them until such time as democracy returns, but to actually redistribute them to their own citizens. Those funds were the savings of ordinary Afghan citizens who live under the Taliban, not as part of them.

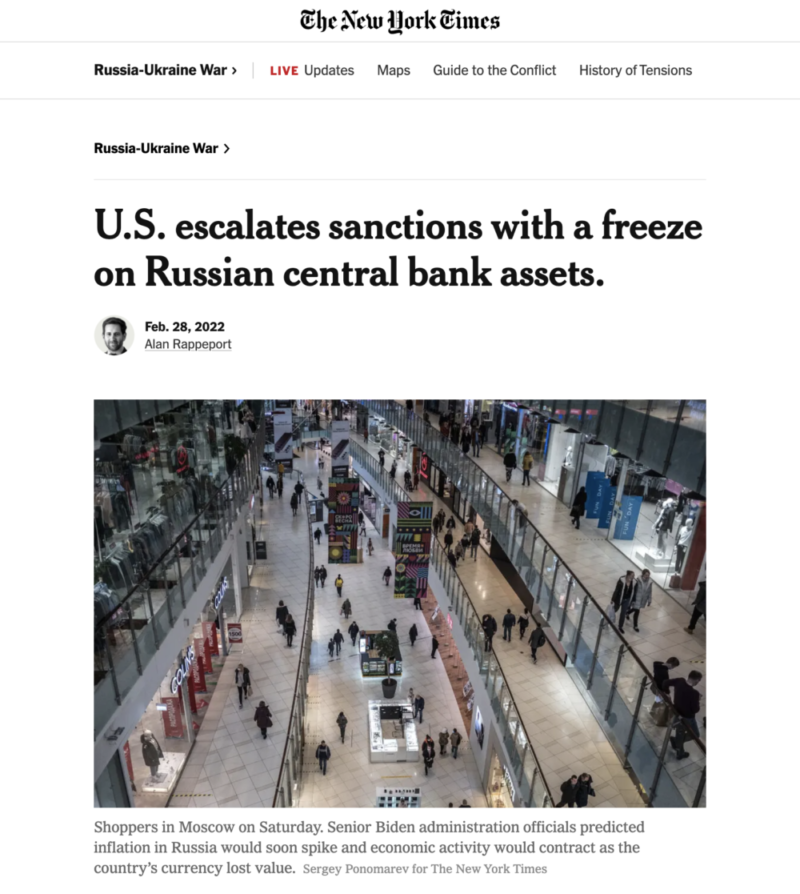

And finally, thanks to the widespread weaponization of the SWIFT payment system against Russia, the seizure of Russia’s foreign reserves (approximately 100X the amount of Afghanistan’s), not to mention Russia’s implementation of capital controls against its own citizens (again, the ordinary citizens coming up on the short end of the stick).

We have experienced a rapid sequence of events that have forever altered the monetary, financial landscape globally, to wit:

- Citizens can’t trust their own governments to protect their property rights, and

- Governments can no longer trust each other to respect each other’s currency reserves

What we have here is the realization that absolutely no one can be trusted as a third-party intermediary for capital. There is really only one alternative to this situation: that is the mass adoption of a trustless, frictionless digital bearer instrument that can be accessed by everybody, everywhere, no matter what.

And that is Bitcoin.

The original idea of hyperbitcoinization was defined as:

“the inflection point at which Bitcoin becomes the default value system of the world. As more individuals and groups around the world realize the advantages of a borderless, censorship-resistant and natively digital system for transacting value, a critical mass of users will eventually fuel currency demonetization and the replacement of our world’s ingrained financial institutions and world powers with a more equitable, publicly-driven system.”

When I think of it, Bitcoin doesn’t necessarily need to achieve the status of being the default value system of the world. Whatever comes next, I’m sure it will include gold for example. But as I’ve always said, gold and Bitcoin bring different advantages to the same problem.

It’s Bitcoin’s unassailable mobility that make it such a necessary ingredient to the coming era of hard-backed and zero counter-party reserves. People wanting to fund resistance in Ukraine right now are sending Bitcoin, not gold. The Ukraine had already spirited their gold reserves out of the country during the 2014 invasion. (Hopefully they don’t wind up with a government the US dislikes, or those reserves will be gone.)

So while Bitcoin is now at the point where it can fund arming the resistance in The Ukraine, it’s been pointed out that contrary to the histrionics of some policy-makers, it is still too small to help a country like Russia to evade sanctions. That means in order to take its place among the new set of neutral reserve assets that are usable to sovereigns wanting to defend their wealth, things like Bitcoin (and gold) will have to reprice dramatically in fiat terms.

I made my call in 2010 and looked like a clown making it: the USD would not remain risk-free forever.

I’ll make another one now since I’m used to looking crazy: when Bitcoin does reprice into its role as a global reserve asset, we aren’t going to be thinking of it in terms of BTC anymore. We’re going to be obsessing over if/when/buts of USD/satoshi parity.

Welcome to the Post-Post-Bretton Woods era, where third party custody of your wealth is a gun pointed at your head. Recall the old maxim about trust: once it’s gone, it can be near impossible to regain.

This is now true of the entire global financial system as well as the governments and institutions that prop it up.

The world is undergoing a monetary regime change. Get the Crypto Capitalist Manifesto free, when you join the Bombthrower mailing list or try our premium research service for crypto investors here.

Hey Mark,

Came across your mailing list and love the content. This post reminds me of when I too was sitting in an economics class at UWO (in 2013 when it was still UWO) asking similar questions of my prof and (similarly!) became the class clown. My prof couldn't answer a simple question: if unrestricted, inflationary monetary policy leads to hyperinflation in certain countries and is a disaster for the population, then why would the central bank/ government ever allow such an outcome? Not only have countries followed this policy, but different countries at different times have fallen into it and even the same countries repeatedly over time. Who exactly does superinflation and hyperinflation benefit, as it must benefit someone if it is allowed to happen? Of course the prof couldn't answer although I tried asking the question 3 times in different ways to his ire. The answer I had come up with privately was, as long as such a policy benefits the corrupt cantillionaire class (I didn't know the term 'cantillionaire' at the time but had a grasp of the idea behind it), then why not lop off 3 zeros every few years for a mini reset while your buddies in the military, government and private sector stand beside the money printer? Of course it's difficult to come up with this or any real answer as an equilibrium on a graph so maybe that answer simply wasn't plausible to him. How would any economist model the coming monetary sea change? Just like some can't understand how the USD might carry credit risk, good luck to all the econ. departments over the next 5 years getting anything right.

As for bitcoin, every G&M article (usually written by econ profs) I've ever read on the topic is so flawed and out of touch with the reality; they're complete FUD hit-pieces. Same goes for the understanding of BTC by the large banks, asset managers, etc. Over time their thinking will change, but it just goes to show you why you should never take life advice from someone in academia: they're too involved with esoteric minutiae to get a handle on the greater forces at play in the markets and the real world at large. And as for learning about the markets, 200 hours down the bitcoin rabbit hole will, in my opinion, give you more real life economics knowledge than a 4 year econ degree at any university ever will.

Finally someone who doesn’t beat around the bush and calls it like it is.

Mark, just an FYI, Ukrainians get really pissed off when people call their country “the Ukraine” rather than “Ukraine”. They view it as a dogwhistle hearkening back to Ukraine’s subordinate status during the days of the USSR, when it was merely a region of the Soviet Empire.

Pointing out that other places use it, like the United States, the Philippines, and the Gambia, doesn’t carry any water for them. It’s one of those “one hundred years of history” things, as Justice Kennedy commented during oral arguments for Virginia v. Black, 538 U.S. 343 (2003).

"Hopefully they don’t wind up with a government the US dislikes, or those reserves will be gone."

Oh my God I didn't think about that. I don't think the Ukrainian government is going to come to terms, which means they will lose and get a Russian backed government. And that means the U.S. will freeze their gold.

And then…whose gold is it? The new Ukrainian government will demand the gold, of course. And of course the U.S. will tell them they can have it when Hell freezes over. But the Ukrainian people are still the very same people who put that gold there in the first place. And Russia will never let go of Ukraine.

It's not bitcoin though. Proof of Work cryptocurrencies are backed by and tied inversely to the cost of energy. The emerging nexus of the Cosmos internet of Blockchains, Solana, Ethereum and its bridges, and now Polkadot is imminently going to bridge across to Cosmos, this is where it's going.

Not only can money now flee into cryptocurrency, it can flee cryptocurrency networks themselves as well, and this is a trend that will continue to escalate until all networks can carry all other tokens and the security of the … effectively a second level of abstraction above infrastructure – the security of the protocol itself, and its resistance to partitioning, most especially, will be critical to its being the chosen basis, and thus, to whom the fees for transactions will go.

It's my opinion that the seeming kerfuffle going on in europe is going to be a transient thing. USA and NATO is now way in the minority not just in terms of population but also access to hard commodities. While the pipes for gas to the west of Russia are being closed, the pipes to the east are opening up wider. India and China are going to have to start getting along with each other better on their borders.

Because there is a convergence going on amongst the continental nations, as the west is increasingly alienating themselves from the majority of the world (both people and resources), this has to be factored in as well. Energy rich nations now have a huge incentive to welcome proof of work mining.

Proof of work mining is not going to go away, no matter what the staking maximalists say. Proof of Work is a proven and unbreakable limit on currency issuance, and will grow and shrink in accordance with the economics of energy and the security is vouchsafed by this – if it's not possible for one group to get cheaper energy than any other, the amount of hashpower required for a given level of security is going to directly correspond to the amount of energy available in general, and PoW will always be at the margins, where the power is the cheapest, picking up the slack in off peak periods, and being used by refiners to offset their waste flaring, and many other marginal energy sources.

Because the energy comes from the continent, mainly, Eurasia is going to be the new stronghold for this hyperbitcoinization as you are calling it. Because it's essentially tied to the energy supply, and the miners will go where the energy is produced. China and Russia will have to change their attitudes towards cryptocurrency mining, because it benefits both of them to protect the network, and no matter what they try to do with their idiot central banks, when the monetary policy of these organisations fails, as it inevitably will, they will always have that backstop and that's eventually going to become the back*bone* of their economies.

> Proof of Work cryptocurrencies are backed by and tied inversely to the cost of energy.

I don't see how this is an issue, especially if you look at the paragraph below. Seems to me that it's an advantage to secure something digital using physical real world goods (energy/hardware). Unlike the scam coins you mention, which are orders of magnitude less secure. It doesn't surprise me you think the ability to hop chains has a benefit. To me, it just means you believe those chains are not secure enough and most if not all the value will eventually end up on the most secure blockchain, which, is bitcoin.

Yes, PoW will over time always relocate to where energy is cheapest, meaning locations on earth where there is a surplus of energy and since ASICs don't care about geographical location(not taking into account heat), only about power, that's where they will go.

There is a geographical component to the price of energy. 1GWh is worth more near a city or an industrial area than at a remote location, say Greenland. Bitcoin makes it so that even locations where excess energy previously had no value now has value and a use case.

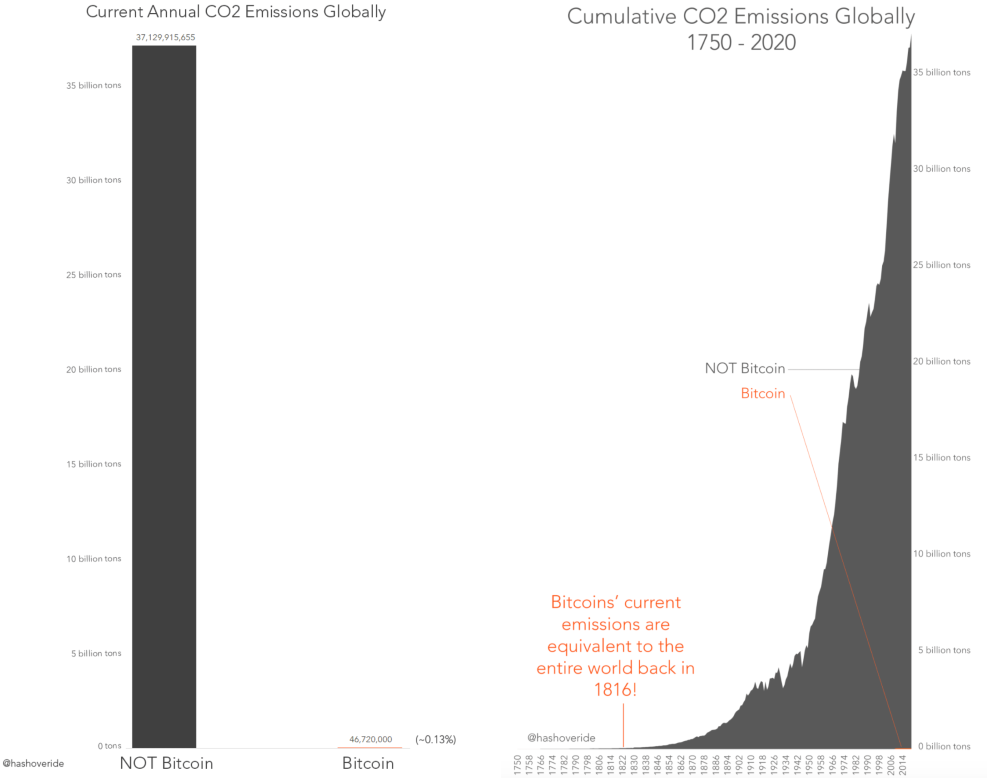

I don't like Bitcoin. It might be a good reserve currency. What I don't like is the amount of energy and resources being devoted to its development. Zillions of dollars and zillions of kilowatts are being used to competitively compute a checksum that could be done by an original IBM PC. I intend to spend some time (one of these days) figuring out just exactly people are getting paid for mining. And we won't talk about how many terabytes the block chain has now got to and how much digital storage is being consumed worldwide just to hold the umpteen zillions 'distributed' copies. I haven't invested the time because it is basically a thankless task, kind of like ancient archeology. It might alleviate your curiosity but is unlikely to provide any material benefit, other than to confirm my already deeply held suspicions.

So in other words, you’ve already decided you don’t like it and haven’t invested any time in examining your beliefs.

Well, I have invested the time an I can tell you the energy consumption is both necessary to the economic value of Bitcoin and the overall “uses too much energy” criticism is farcically misinformed.

But for now, start here:

The entire Bitcoin blockchain is around 450 GB right now, and growing at about 400-600 MB per month.. You can set up your own Bitcoin full node on a Raspberry Pi with a 1 TB drive for a few hundred bucks. Since there are 15,500 full nodes in operation at the moment, Bitcoin's total digital storage in use is about 7000 TB. Which is really pretty tiny for a worldwide distributed network.

You don't need to do heavy research to find this out. Likewise for how miners get paid. All of this is extremely well known.

Hello Murray,

Are there any advantages doing so?

Thanks

"I haven't invested the time because it is basically a thankless task"

Well I think this might be your issue. It is most certainly not a thankless task.

There are a couple really great books that might help you (The Bitcoin Standard and Inventing Bitcoin are good places to start).

But to be blunt, Bitcoin doesn't need you to invest your time in learning it. Plenty of other people already have and many, many more will.

It's still early, but if I were you I would get started today.

Spot on.

Excellent article and I really appreciate pointing out how governments use currency to steal from individuals and bully other countries.

Thank you for enlightening me.

Buford Taylor