Bitcoin is De-dollarization. Ethereum is DeFi-nancialization.

Lately I have been thinking a lot about the difference between Bitcoin and Ethereum. At the same time the world is witnessing the inexorable move to crypto in realtime. Some may question that assertion, given that the latest FUD cycle against cryptos has been one of the most intense that I’ve witnessed since getting involved in the space in 2013.

Behind the FUD we see actions. We see Russia dumping dollar assets (is that suprising?).

We hear Charlie Munger making almost childishly uninformed remarks on crypto, yet BRK is investing in one of the world’s most crypto friendly banks.

We see El Salvador as the first country in the world to make Bitcoin legal tender.

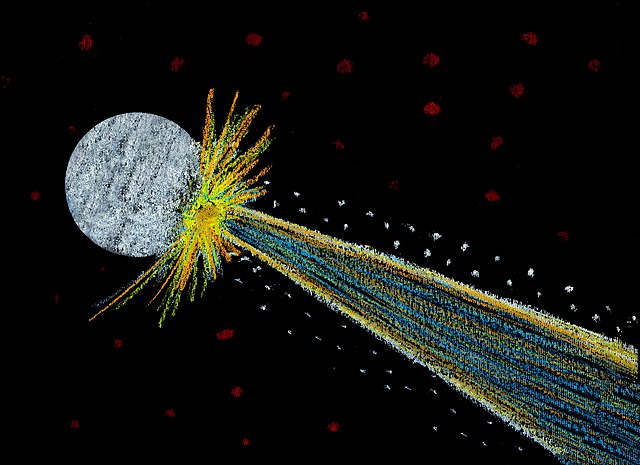

In my mind this has not only sounded the starting gun on de-dollarization in earnest, it goes beyond that. Back in the late 90‘s people like me were about the age of many of the crypto kids today, and we were talking about the Internet Asteroid headed straight at the telecoms and traditional media.

Today, pretty well everybody is aware of Bitcoin. They may have positive or negative opinions on it, but most people are figuring out that it’s here to stay and there is a spectrum of sentiment around that ranging from enthusiasm to denial. But I get the sense that traditional institutional finance sector doesn’t even see another asteroid coming, and it’s coming straight at them.

The new 60/40 portfolio will mean Bitcoin/Ethereum

Or maybe Ethereum/Bitcoin. Whatever your risk tolerance and investment objectives entail. I’ve been listening to the Bankless podcast lately and in more than one episode they’ve said something about Bitcoin as compared to Ethereum that I think is quite astute. It’s really helped me think about the two in terms of construction of a crypto portfolio.

They’ve said, in essence, that Bitcoin is for when you’re bearish on society and Ethereum is for when you’re bullish.

It’s not that I agree with that literally (I don’t), but it helped me refine the distinction I’ve always had around Bitcoin being the value and Ethereum being the execution in a coming tectonic shift into crypto.

In the olden days, bonds and equities had an inverse correlation. Bonds kept your portfolio afloat when the economy hit a soft patch and stocks went down (yes, in the olden days, stocks could experience bear markets, sometimes for months or even years). Conventional wisdom was to have a portfolio mix between equities and bonds, along some rule of thumb like 60/40 adjusted for your age, risk tolerance, etc.

We’re headed into a world where Bitcoin and Ethereum will fulfil the roles that bonds and equities did traditionally.

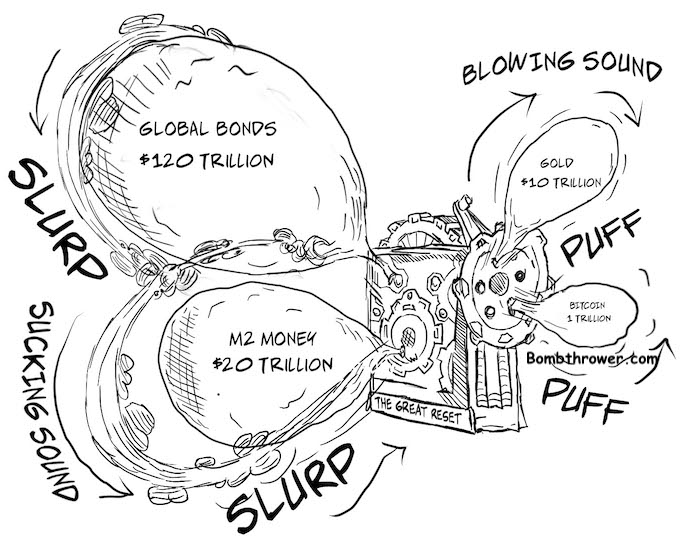

The basic thesis of my Crypto Capitalist Letter is that Bitcoin will be on the receiving end of an impending mother-of-all wealth-transfers. Many Bitcoiners think that if Bitcoin is “digital gold” then that means the incoming funds flow will be from the 10 Trillion dollar gold market. I think this is wrong.

Bitcoin’s looming funds inflow isn’t going to come from gold. Maybe some will, maybe some shorter term gold holders will jump ship to Bitcoin in much the same way that this latest down cycle since April has been driven largely by younger coins (weaker hands) selling out. (Overall I think gold and silver will also be a beneficiary of this great transfer).

But Bitcoin’s inflow will come largely from the more than ten times larger bond market. Not gold. Not 10 Trillion. 120 Trillion, of which 20 trillion of it already yields negative returns ( “return free risk”). A simple layer 1 Bitcoin lending program with an institutional level custodian like Gemini or Galaxy (whom we hold in our TCC portfolio) would yield 400 basis points right there, and that’s without even counting the price appreciation.

“The TAM is Everything”

But what I didn’t realize until the Bankless panel this week about the current state of DeFi is that there’s another 100 Trillion-plus market, and it’s going to be sending its value in a parallel mother-of-all wealth transfers. That wealth transfer is the flight of assets from the traditional banking system into Ethereum and into DeFi.

In my mind this is what DeFi actually means. Where financialization is the widespread hollowing out of all value and turning it into multiple layers of rehypothecated debt, DeFi is De-Financializing assets.

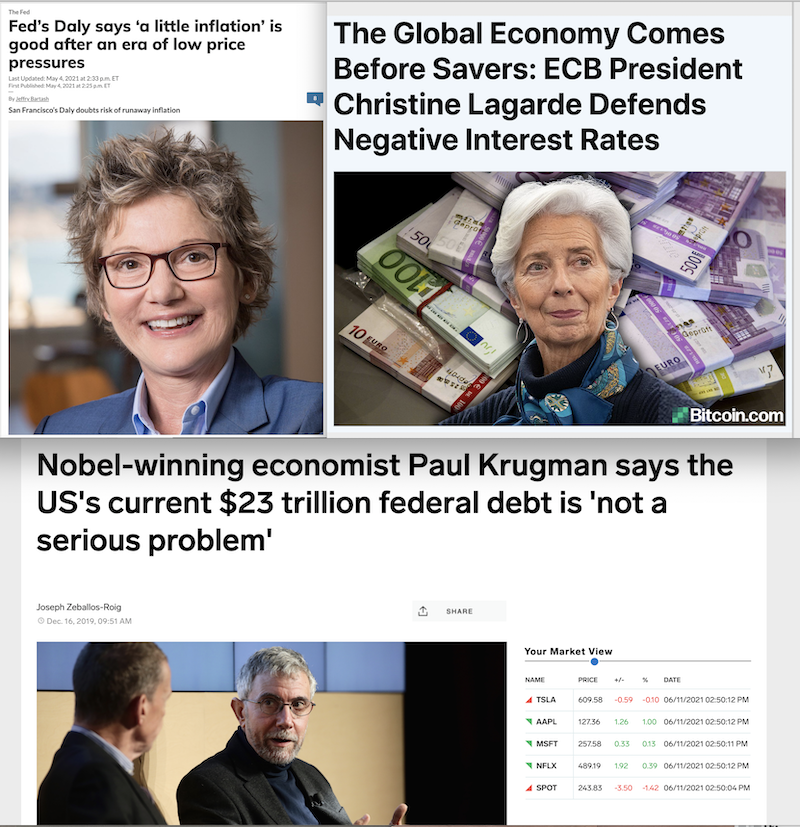

DeFi is where money gets intelligence and value can compound and where tokenized assets increase their purchasing power over time. It’s where savers are rewarded, instead of penalized and demonized. It’s where capital formation is possible.

Most institutions won’t be making this transformation. The majority of them will gravitate toward the Central Bank Digital Currencies (CBDCs), which as we say in The Crypto Capitalist Manifesto, CBDCs will be specifically constructed to preclude savings, make capital formation impossible and will be a honeypot of dependancy for the masses who allow their economic lives to be bounded by them.

But many of those institutional clients, the ones that see The Great Bifurcation coming, will make this shift, and they’ll bring their capital with them.

“I’m not excited about institutions in DeFi at all, I think they are just not the right users for this. This is about giving individuals financial tools that they’ve never had before such that they don’t have to go to an institution that rips them off”

— Spencer Noon

I see this playing out in real time in the world and in my personal experience, here’s three quick data points

- Trying to set up a simple USD/CAD hedge with my bank for the business, something I had already done 10 years ago when the CAD strengthened above the USD. This time it took months of meetings and they want me to put up 4.5X collateral on the hedge and sign off on a personal guarantee.

- Setting up that same business for EFT transfers for a large client and the bank solemnly informed us “you must possess a fax machine to use this system”. Uhm ok. I’ll see if I can dig one out from the back of my storage locker. Until recently their online FX system also ran only on Internet Explorer (which goes end-of-life next year)

- My credit card company, until recently, charged me a fee when I overpaid my balance they owed me money in terms of an “inactivity fee”.

It is this is the type of institutional lethargy that is all tailwind and gasoline for DeFi.

In the case of the forex hedges, I’m now looking at places like Synthetix and hiring a smart contract developer to simply create the hedges for me. The way I envision it, anybody would be able to earn a return on their assets by staking the liquidity pool for USD/CAD, and Canadian businesses with exposure to USD currency weakness would be able to easily hedge for that without pledging their house (if you know anybody who can help me out here, my DM’s are open).

I’m cancelling that credit card and getting set up with one of the many new crypto backed credit cards that give you cash back on every purchase in crypto.

One of the reasons people are skeptical of crypto and fool themselves into thinking it’s some kind of passing fad (“ponzi” or the negligently uninformed “tulips”) is because this is happening so fast. In realtime. (They didn’t read Future Shock back in the 70’s, 80’s or 90’s or if they did, they either forgot about it or didn’t fully understand what it meant).

Bitcoin is going to eat the bond market and capture the flight from fiat currencies. It will become that digital gold or bond equivalent in a crypto portfolio.

Ethereum is going to demolish the financial institutions and probably be the front line against CBDCs, functionally.

CBDCs will be disposable money. Get it, spend it, use it on disposable stuff (if it’s algorithmically permitted) and that you don’t mind being surveilled buying.

To receive future posts in your mailbox join the free Bombthrower mailing list, follow me on Twitter, Mastodon or join the Bombthrower telegram

I am firmly convinced that cryptocurrencies are here to stay and that defi is the revolution in the world of finance that most have not yet realized. I subscribed to the newsletter precisely because I believe in this.

But what I still can't figure out is how the new crypto capitalists will be able to play the game against the old powers and governments, if they decide to exercise their power to ban commercial transactions using cryptos or ban fiat money-to-crypto exchanges.

Banning exchanges or even banning the possession of "unauthorized" cryptocurrencies would not be unlikely or surprising. At that point people could continue to buy and sell using crypto at businesses that accept crypto payments but governments tend to make any parallel economy illegal as soon as a certain level is reached.

But it must also be said that just making crypto transactions impractical would be enough to alienate almost all of the people who are not strongly motivated.

It all seems even more complex once the transition to CBDC is complete.

How do you see this power struggle will play out?

Can we really expect banks taking the asteroid without fighting back as hard as possible using their influence on governments? I think that's not the case, but I can't figure out how this will be played. What do you think?

Are you deranged or what? Decentralization is only true insofar the technology is run in a decentralized fashion. This is not the case for Ethereum. On the surface it looks decentralized but look where all its activity is moving. To centralized "Second layers" that promise (and maybe they are not lying) that they will be decentralized in the future.

Mark, great article, but swapping the last two "sections" would make it a better read.

End with "…on every purchase in crypto."

I read it on zh.

Dave

Great Article, when I was young and broke I could feel the computer and cell phone markets changing the world. However I had nothing to invest.

Now I see the same thing happening in real time with bitcoin etc and Im not going to miss it. I have my miners working day and night, I Have bought crytro web domains with the names of major banks, waiting for them to need them and make me a offer. Was trying to explain all this to my wife this morning and I was stunned at how she and others think Im dreaming, How many will be caught off guard.

Dave S

Dave,

Yes, you are dreaming…but they're good dreams.

PlanBTC.com

>DeFi is De-Financializing assets.

No… Decentralized Finance (not this “De-financialing” crap) can financilize assets just as well as the existing financial system…

And alot of protocols on chain are decentralized in name only because alot of teams have full centralized control over the contracts, and users themselves now pidgeon hole themselves on things like infura, and nearly all but one evm compatable chains scale horribly… and even that one has huge concentration of validators with the most at stake that run on 5eyes comprimised clouds…

Alot of work needs to still be done to pursue further decentralization and away from alot of nonsense you spew…

Good life Group TAURANGA New Zealand , Ethereum Health Club Team Derek C Howie , Aseem Malhotra , Mount Maunganui New Zealand the jewel of the South Pacific Crypto , B with us we pray for a better future & world , in need & Homeless pleased to partner with U all , Tree of truth PIOPPI Diet Team, philosophy Pay it forward ,

You may have been in crypto since 2013 but the very fact that you suggest 40% portfolio of ETH leaves much to desire. ETH is dying. Get over it. It did serve it’s purpose but it’s now falling out of the scene. Kadena, Cardano, Quant should be in everybody’s portfolio. Please rewrite the article.

Uh yeah, I’ll get right on that.

The Internet structurally separated telecommunications and Bitcoin is doing the same for the trust network.

"A simple layer 1 Bitcoin lending program with an institutional level custodian like Gemini or Galaxy (whom we hold in our TCC portfolio) would yield 400 basis points right there, and that’s without even counting the price appreciation."

Paying compound interest on and in a capped asset seems a self-limiting proposition.

Ethereum: a distributed computing platform which is so robust that it can be made public – Peter Borah.

Bitcoin: a distributed database which is so robust that it can be made public – Peter Borah.

ERCs (and once upon a time Ethereum) are elastic, and useful because of that.

Bitcoin is inelastic and useful because of that.

PS. "dependancy"

Good life Group TAURANGA New Zealand , Ethereum Health Club Team Derek C Howie , Aseem Malhotra , Mount Maunganui New Zealand the jewel of the South Pacific Crypto , B with us we pray for a better future & world , in need & Homeless