The Five Big Takeaways from #Bitcoin2022 Miami

Last week was a blur: planes, trains and automobiles from Toronto through to Salt Lake City to tape a couple segments for Revealed Films. Then on to Miami for the largest cryptocurrency conference in the world, with an estimated 30,000-ish attendees showing up to take the decentralized revolution to the next level.

Here are the five big take-aways from this year’s conference:

#1) Bitcoin is well past the “here to stay” phase.

We’ve been hearing the “crypto is here to stay” mantra for a few years now. It’s not wrong, but frankly, we’re well beyond that point. I knew as far back as 2017 that crypto wasn’t going anywhere, even after the 2018 bear market set in.

We’re now into the “Bitcoin is taking over the world” phase, a.k.a the early innings of hyper-Bitcoinization. Same as what happened with the Internet after the dotcom bust. Any credentialed experts who said the Internet was a glorified fax machine (ahem, Krugman) were wrong then and anybody still pounding the table about cryptos being backed by nothing and headed for zero (Schiff) are being proven wrong now.

The only question is to what extent Bitcoin overtakes the fiat economy, whether it becomes an official global reserve asset or functions outside the system entirely as increasingly more individuals and locales opt-out of the fiat world order.

Two more political autonomous zones did just that, announcing Bitcoin as legal tender:

- Madeira, an autonomous region of Portugal

- Prosperos, a private chartered city in Honduras

While Mexican Senator Indira Kempis came to the conference to announce that she’s introducing legislation to make Bitcoin legal tender in Mexico (Edit: Or not. She introduced a Bill to create a CBDC instead).

#2 There will be no crypto ban in the developed world

This is still a major factor in many people’s calculus on whether they should get involved with cryptos or not. It’s been clear in the US since at least the tuck-in to the COVID infrastructure bill (as ill formed as it is) that the US approach toward crypto will be a regulatory one, not prohibitory.

In the Cathy Woods, Michael Saylor fireside at the conference, Woods noted the change in rhetoric coming out of Janet Yellen in just the last year:

Last year Yellen was harping on crypto’s use in illicit transactions. Now she’s talking about how they “are playing a significant role, not really so much in transactions, but in investment decisions of lots of Americans.”

“Somebody has been whispering into Yellen’s ear” opined Woods, her guess? SEC head Gary Gensler.

Saylor put the Biden executive order into context: “When was the last time the sitting President of the United States issued an executive order for all Federal agencies to get up to speed on an asset class?” – framing that as not presaging a crypto ban, but the de facto green light for the entire space.

There are numerous reasons for this, including:

- Being a leading innovator in crypto is increasingly seen as a net-positive economically for the countries that adopt it

- They provide a strategic advantage over countries that are attempting to ban it (China)

- There is already too much institutional money already involved or positioning to get involved

- With more than 30 million Americans and 300 million citizens globally HODL-ing, Bitcoiners are already a political constituency. There’s even a Bitcoin backed SuperPAC now whose stated aim is to rid the government of anti-Bitcoin politicians like Brad Sherman and Elizabeth Warren

#3 There can only be one

Over the past half year or so, as The Crypto Capitalist Letter was starting to gain steam, forcing me to pay even closer attention to all this, I noticed that I was becoming more of a Bitcoin Maximalist. Hopefully not a toxic one.

I still try to think like an investor and in that sense there will be successful projects and ecosystems outside of Bitcoin. I like Helium, for example. The idea of a mesh network being driven by incentives of hotspot operators is a compelling one. Given my dayjob running easyDNS, I pay particular attention to decentralized naming initiatives like ENS, HNS, Unstoppable and Stacks, although I still don’t see any clear winners here yet. On the privacy side, especially since the FreedomConvoy debacle here in Canada, I’ve become more interested in Monero.

But, like stocks (the tactical focus of TCC being crypto stocks), and as the case in most asset classes, the vast majority of contenders and aspirants are garbage, money grabs, often both.

Alas, where I had been previously thinking of Ethereum as the undisputed runner-up to Bitcoin, the silver to gold, the shine has been coming off for me.

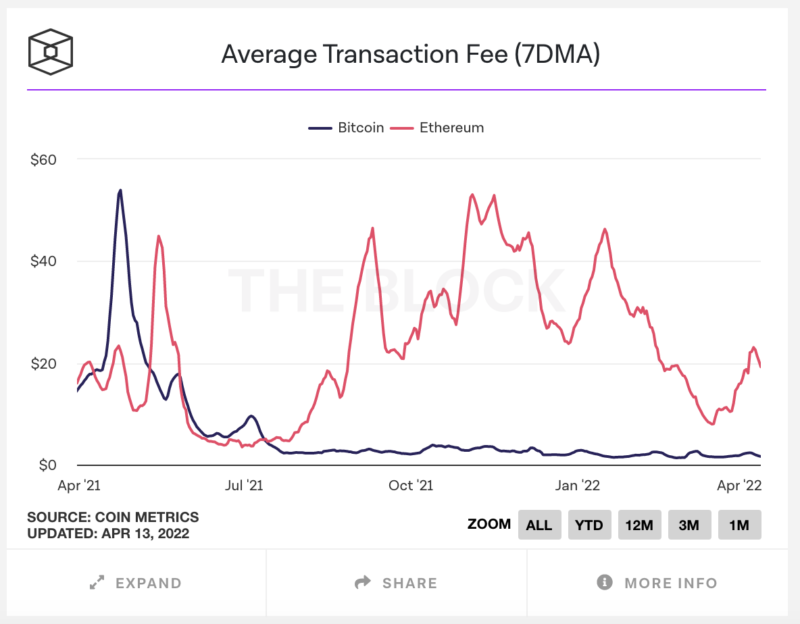

The biggest existential challenge facing Ethereum is and always has been the gas fees.

The entire time I was monitoring Ethereum’s all encompassing transformation from Proof-of-Work to Proof-of-Stake, I just assumed that the merge to ETH2 would fix this. Then in late ’21, in places like Bankless and elsewhere, I started to see this notion being walked back.

Unpopular opinion (?) – but I find the entire effort of morphing into ETH2, screwing all the miners, radically restructuring everything and STILL not solving the gas fee problem… totally pointless. https://t.co/RM3xG0Vl8d

— https://bombthrower.com/wp-content/uploads/2019/03/shutterstock_1030471843-e1551983495127-1.jpg E. Jeftovic, The Crypto Capitalist (@StuntPope) April 10, 2022

It almost seems like Ethereum’s central management (which isn’t really a thing in Bitcoin, btw) decided to prioritize the perceived ESG (Environment/Social/Governance) benefits – which is most important to people who don’t actually understand crypto. Otherwise they would be cognizant of mining’s true energy usage (220 TWh for Bitcoin vs 160,000 TWh total global use = 0.0013). Further they would understand how PoW incentivizes clean and waste energy capture more effectively than anything else.

If you’re going to totally re-architect your protocol and marginalize those who were securing your network (the miners), at least address the single, core issue instead of all this technocratic posturing.

Ethereum is still a centralized and highly concentrated around a single key-man. They’ve changed their core monetary policy, they have a history of giving bailouts via hard forks (this is why we have Ethereum/ETH and Ethereum Classic/ETC).

Which means: Ethereum’s monetary policy is not immutable, and that means in the future anything can happen. Where Bitcoin will only ever have 21M BTC and always be Proof-of-Work, Ethereum could become an amusement park.

That doesn’t prevent Ethereum, or various projects deployed on it, from vastly increasing in price as cryptos continue their overall ascent. But if you make a boatload of money on it, move the profits into Bitcoin. If you build your project on Ethereum, you’ll want to have support for competing Layer 1’s. Especially if you’re successful.

This brings to light a paradox for Ethereum: any projects that launch and succeed on Ethereum will almost certainly branch out into other Layer 1 protocols (Polkadot, Near, Avalanche, Terra/LUNA, even Binance Smart Chain) and cannibalize Ethereum. At least as long as they don’t address this gas fee issue, and they’re in the process of squandering their last best chance to do so.

Said differently, I don’t see anything on the horizon that could dethrone Bitcoin as the preeminent monetary crypto-asset. But I see plenty of competitors all chipping away at Ethereum. This includes Bitcoin’s own extensions that are building momentum. Lightning not only has the potential to provide Visa-level transaction processing throughput, but messaging and who knows what else. With Taproot here, we have the foundation for adding asset issuance functionality with proposals like Taro.

What finally did it for me was to see the early innings of cancel culture within the Ethereum community. It made me realize we’re dealing increasingly with virtue signalling and less so with the decentralized revolution. Make no mistake: Cancel culture is cancer. Once it gains a foothold and becomes normalized, the host is doomed. I fear that failure will be the norm for most DAOs as those who are able to shriek the loudest will distort and hijack most of them from their core missions, whatever those may be.

As I thought all this through last week I moved about 20% of my ETH into wBTC, which (sooner than later) I’ll move across a bridge into native BTC. I have about 40% staked on Beacon Chain, which I’m fine leaving there to earn some yield (approx. 4.5% APY).

#4 This is more than an asset, it’s a spiritual philosophy

The Thank God For Bitcoin conference ran a one day event concurrent with Bitcoin2022. There is a larger contingent of Christians within Bitcoin than I realized. Beyond that there is a general sense of the underlying spirituality behind a movement that truly restores economic sovereignty to anybody who wants it, with effectively zero barriers to entry.

That there is a spiritual component to sound money is not new. Gold carried (carries?) the same gravitas amongst the most highly respected and penetrating intellectual minds throughout history that has endured into today.

Jordan B Peterson came to #Bitcoin2022 and one of his most well known lectures is around the psychological meaning of the Tower of Babel parable. In a fireside with Tuur Demester he drew a through line from it to Austrian School Economics to Brexit. And it made perfect sense because Babel is a story of technocratic hubris, very similar to what we are subjected to on a mass scale today.

He built on that in the after-conference event with Robert Breedlove, citing the Austrian school notion that monetary integrity and moral integrity are inextricably linked.

“What is Money?” dialogue between @Breedlove22 and @jordanbpeterson #Bitcoin2022 pic.twitter.com/Wlt1pjsY4B

— https://bombthrower.com/wp-content/uploads/2019/03/shutterstock_1030471843-e1551983495127-1.jpg E. Jeftovic, The Crypto Capitalist (@StuntPope) April 9, 2022

This exact sentiment has always been considered the very nature of sound money. The legendary commentator Harry Shultz, as quoted by Ferdinand Lips in his seminal work Gold Wars:

“Money sets a standard that spreads into every area of human activity. No paper money backing, no morality….Layer by layer we are corrupted when money loses certainty… Big Brother was made possible through the absence of automatic controls and loss of individual freedom via non-convertible currency. So, pass the word. Fight for gold. Not for profits, though they are helpful and help us fight for individual freedom, but for a future that returns to sanity in various standards. If we have a gold standard we get golden human standard! The two are intertwined. They are the ultimate cause and effect. Gold blesses.”

There really is something below the surface, something much more than Bitcoin as digital gold, or cryptos as a new asset class or even a global monetary regime change. For me it comes down to what I think will be considered the geocentrism of our age. Geocentrism was the belief that the heavens revolved around the Earth, which was the center of the cosmos. This was “settled science” for thousands of years and in those days “deniers” were burned at the stake.

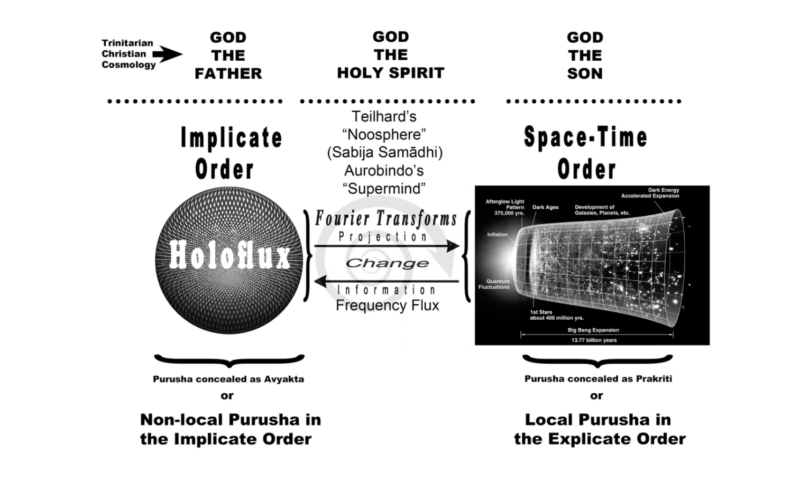

Today’s geocentric pseudo-science is the idea that material reality precedes consciousness. That our minds are a byproduct of our brains. This is actually backwards. All manifest reality really emanates from a non-material something (call it, “God”, Spirit, quantum foam, Bohm’s implicate order, etc) and global, historical currents and directionality comes from there. Somewhere.

In “Faith of a Futurist” George Gilder (pro gold, pro Bitcoin) posits a reversion from the radical material reductionism of the 20th century as we rediscover the spiritual core of existence and regain our ascent into global prosperity:

The twentieth century has been an era when an atheistic belief in the ultimacy of matter and the triviality of man led to the horrors of Nazism, Communism, and an epoch of total war. Now sweeping through the global economy, the overthrow of matter will unleash an undertow of [spiritual] belief that will make the new millennium a time of awakening to the oceanic grandeur and goodness of the universe. An economy of ideas and innovations ultimately means an economy ruled by spirit and faith.

That’s where the impetus toward civilization originates, its where universal human rights emerge from, it why consciousness evolves over time up an ascending scale of increasing mental abstraction and it’s from where this impulse toward decentralization and non-State money germinates. That’s why it is unstoppable.

At the conference I found this underlying spiritual driver behind Bitcoin to be palpable.

#5 The War on ‘Woke’ Capitalism has begun

Finally, we come to the punchline to Bitcoin2022….

That was Peter Thiel’s keynote which I described as a declaration of war against “Woke Capitalism”.

You can view it in it’s entirety below,

…and you probably should, because if the Wall Street Journal “reporting” on it is any indication, mainstream media coverage was your typical journalistic malpractice.

A more accurate TL,DR (from somebody who was in the room) is that Peter Thiel called out “The Gerontocracy” – filled with oligarchs and plutocrats like Warren Buffet, Jamie Dimon and Larry Fink and he said they were driving this ESG narrative to further ensconce their own interests and power. Further, the logical outcome of ESG is China-style social credit.

Of course Thiel is right. We can focus on the energy usage question alone: if we concede that any outside “authority” has the moral claim to moderate energy usage for Proof-of-Work mining then you just ceded discretion over all of your energy usage to that authority.

Just suppose that Bitcoin mining were to be somehow squashed today on environmental grounds (and you may agree, provided you’re completely ignorant of Bitcoin’s actual energy usage and incentives).

That means tomorrow you’ll earn demerits for turning on your dishwasher during peak hours. Heated bathroom floors will be banned as Bourgeoisie decadence. This will all be decided by committees that you aren’t on or algos you have zero control over or visibility into.

The True Cost of Wokeness

Germany is scrambling, looking at rationing power and in the early stages of reversing their own policy of shutting down their nuclear reactors. They are even considering recommissioning coal fired plants. It turns out you can’t heat the nation on hot air and platitudes.

Meanwhile the US government is begging Communist a dictatorship like Venezuela and a fundamentalist theocracy like Iran for oil, while Canada’s tar sands, among the highest proven reserves on earth, literally next door, can’t fulfill demand because the Liberal Socialists incumbent in both countries won’t let the pipeline projects be completed (But rail lines are packed to capacity moving that same oil, more dangerously and at lower throughputs… that may be bad for the country but business is booming for railway owners, including Uncle Buffet).

As these externalities and second-order effects come home to roost, Thiel’s speech came at an inflection point. He finally said what many have known or suspected for a long time, but may have ben hesitant to vocalize because the completely captive media and Big Tech cartel would unleash legions of cancel culture beserkers upon anybody foolhardy enough to speak the truth.

The true cost of wokeness is beginning to hit home, we’re seeing it first at the gas pumps here in North America. We’re seeing it in energy shortages and rationing abroad.

Next up: out of control food inflation. They don’t call them “meal”-worms for nothing…

Here’s the summary I did for Steve Bannon’s Warroom after the conference

The veneer on Woke Capitalism is coming off, and everybody knows it.

The world is undergoing a monetary regime change. Get the Crypto Capitalist Manifesto free, when you join the Bombthrower mailing list. Follow me as @bombthrower on Gettr or if you haven’t been kicked off Twitter (yet), @StuntPope

I have resisted entering the crypto realm just because it seems so alien and esoteric to me, and I covet my time for keeping up with other matters. But you may have pushed me over the edge. Excellent article, especially the insight of materialism as the geocentrism of the modern age. Very glad to discover you through the Warroom, as well as your connection to easyDNS, which I didn't realize. Looking forward to digging into your Manifesto.

Great post, thank you so much.

It's refreshing to find out so many smart people ready to embrace the paradigm shift unfolding before our eyes.

I am just curious, I tried to use NAMECOIN in 2014 but it was not flying well. I see you've been watching ENS, HNS. Decentralized DNS is key for censorship resistance and we are still not ready for that. I could say the same for the Internet as such, shortwave would be like returning to the telex. Technology provides us with the tools to bypass censorship. That is now and in the near future.

My question then is: should the fight for our basic freedom persist for years, how fast or how soon can we expect decentralized DNS and Internet to become available?

Thank you.

Excellent article, Mark.

"Monetary integrity=moral integrity" is such an insight…

Always enjoy your posts…

What about CBDC? Centralized Digital Currency, which — along with ESG — will absolutely bring in social credit systems; worse, CBDC will facilitate "smart contract" mechanisms that can cut off a 'user'/citizen from access to their funds if they don't meet certain criteria (a 1/0 on/off switch, essentially, based on code, without the need for any human bureaucratic functionary: missed a car/mortgage payment? funds will be frozen unless/until payment is made. Missed your quarterly inoculation/'vaccine' inoculation? Assets will be frozen until you comply. etc.).

My concern — as a current investor in cryptocurrency, is that much of this may be a honeypot of sorts to lure in the idealists and then pull the rug from under them once there's enough buy-in into digital currency/blockchain/related systems.

This tech will need to stay decentralized; we need to ensure autonomous zones with decentralized, autonomous options for currency and commerce will always be options for any individual. I hope the likes of Thiel is not a Trojan Horse. We already know others — like Gates — are brazenly against the betterment of the common human. Hopefully there are others with power/influence that at least have the interests of the enterprising individual in mind to allow pursuit of enterprise without overly restrictive centralized/bureaucratic restrictions.

Coincidentally stumbled over this on the topic of low bitcoin fees https://twitter.com/intangiblecoins/status/1511340416263766027, full version https://docsend.com/view/jsgnh3vnssip3uvt

And while I agree wokeism is a distraction away from satisfying the customer to appeasing some disengaged (apart from outrage) audience, it is just the latest in a string of them.

The threats to organisational performance in order of proximity, it the organisations own self-regard, then attempting to oil-the squeakiest wheels, then following a current fashion ("Content is king" for some carriers). All of this is fine if the organisation is competed or irrelevant, but sadly some dominant monopolists have embraced one or more of these threats and we've got to find our own way out.

Central Banks whose delusions extend beyond even unsnarling supply-chains with interest rate rises, but believe they have tools that will help the environment, racial harmony, social and fiscal equity, exchange rates, employment levels, etc. etc. are a prime example.

"For a successful technology, reality must take precedence over public relations, for (Human and Mother) Nature cannot be fooled." Richard Feynman

I feel like “Journey to the Center of the Earth” as I delve into crypto source, only the initials carved on the cave walls are Satoshi’s. Bitcoin, Litecoin, and even Dogecoin are obviously designed from the same source trees. I’m seeing unmodified Bitcoin source in Doge and elsewhere.

Ethereum “feels” like the banking industry trying to protect themselves from what they see as an existential threat. They have always been of a mind to “protect stakeholders”, so naturally they prefer a system where they can “stake a position”. Work is a four-letter word for them.

I believe your prediction of a unified system will come about in the same sense that the Internet is unified. The Satoshi’s model was a system that is intended to work even if some of those participating are morally weak and attempt to game the system. Rather than being under one roof, I believe it will be more a matter of consensus on key interfaces and an interoperability of nodes. Just as current Bitcoin and derivatives work with nodes running various versions or even own-code wallets, the “web3 world” will (through the process of market consensus) will see much greater interoperability as cryptocurrency is woven into the fabric of human society.

Going on a binge of adding public wallet’s to my personal site (no reason not to make it easy to send me crypto), it struck me that we need a common notation for crypto so that warning you see “make sure you only send XYZ coin to this address…”, and ideally embed that in a standardized crypto QR code format. I am currently using $ notation, not sure if I would recommend a leading $ to reduce CPU cycles parsing and as a way to distinguish from national fiat currencies. This will probably be decided by whomever first creates a node, exchange, or wallet software that popularizes it. If I send you address BCH$1FKHrdLnYjnv8u68RycUpJ4dPcRkrPGjA2 you know to send “Bitcoin Cash” not “Bitcoin”. Especially useful with the visually identical Ethereum spin-offs: ETC$0x8D31935cE0cbe08Da83A44f106d619d5E560afbA (“Ethereum Classic”) etc. Seeing this in print I’d say a trailing $ wouldn’t be bad to ensure we have a complete address, amounts if specified appended, if no hash then you have BTC$$0.0025 notation to specify amounts, good visual/parsing cues to reduce erroneous transactions, allow multiple chains to interoperate in a wildly decentralized world.

The generation that grows up with cryptocurrency will have an easier time with this. I see “proof of stake/proof of work” concept evolving into a broader “proof of stake”, with “proof of work” being a subset (essentially digital “sweat equity), and “providing bandwidth”, “providing cpu cycles”, “providing storage”, “providing traditional assets” being useful types of work to incentivize (the last one being the “stake” which I believe Ethereum advocates are trying to protect).

Look at Zilliqa.