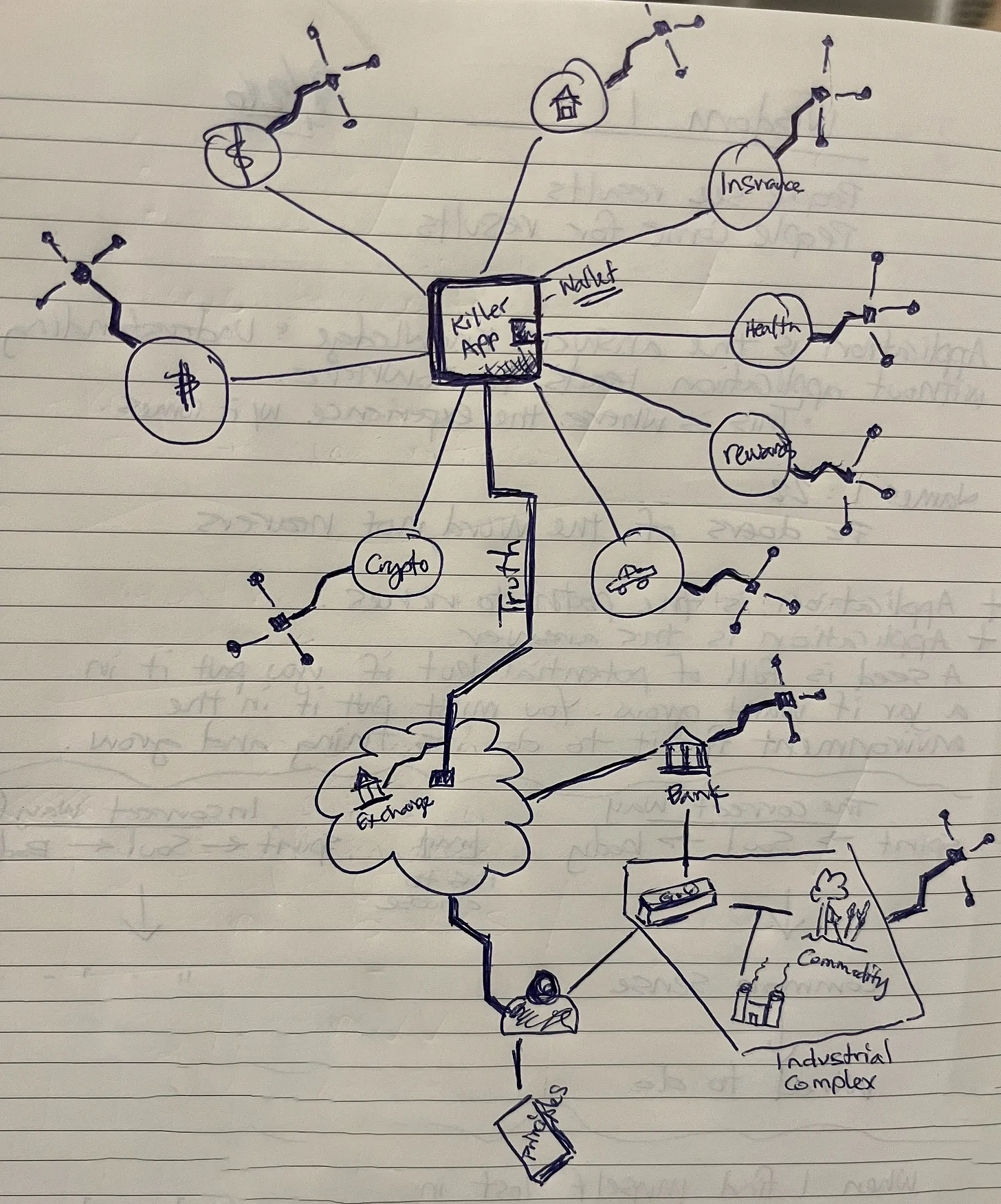

Technology waves are driven more by the “killer app” than by the tech itself. Just because this wave involves money, why should we expect anything different?

In many cases, the underlying tech has been there for a while, and it will sit there until someone creative enough sees a killer use case. It will stay dormant until someone prioritizes making the tech easy enough for all ages to become addicted to. The most crucial point of technological innovation is that we must get the societal timing right in order for monumental shifts to happen in the way we transact.

Digital Wallets are the killer app for Bitcoin and the emergence of the cryptocurrency ecosystem for three reasons:

- Wallets will integrate bitcoin and digital assets into our traditional economy.

- Wallets will allow choice of what “money” to use. We have many monies and they all have varying velocities and tradoffs or associated cost to use.

- More importantly, wallets will allow us to carry *all* assets, money, and information in one place, at all times.

Money is more than just a single unit. It’s anything that can store value for various periods of time while also being a unit others have a commmon belief in. We use many different units as “money”. Each form depends on the timing of our needs and how quickly they can be exchanged for goods and services to match our tangible desires.

To date, we’ve built siloed financial systems that have created numerous forms of money, varying delays of liquidity, and numerous hurdles of settlement across a wide spectrum of ability to store or destroy value over time.

A digital wallet that can hold *all* assets, monies, and data (data is the new oil), solves the settlement issue and allows us to access our entire amount of value with much less friction because of the multiple points integration possibilities.

Once Your Grandmother Can Do It

When people from all ages can “get it”, it’s game over. Think about the cloud. You could have one in 2000 and before. Long before it was common or the term even existed. But, you had to setup and manage an FTP server in order for your data to be available anytime from anywhere. Not very many people wanted to do that… until Google and Amazon built server farms and made it as simple as entering your email address and password. Then everyone wanted it.

The cloud wasn’t exactly a tech limitation. It didn’t *exist* because it wasn’t easy enough for the below-average user to use. Tech advancements are about solving problems for the lowest common denominator in areas of society that will make our lives easier; more efficient

The iPhone. It wasn’t that original after all. It turns out, it wasn’t even thought up by Steve Jobs either. Hat tip to Jeff Booth for sharing recently.

Ever heard of General Magic? Me either. It was the iPhone. Long before the iPhone, but it failed because it came along at the wrong time. All the right stuff but too big, needed wifi, and gave access to a tool people didn’t see a need for → email.

Palm Pilot? Also an iPhone, before the iPhone. It failed as well. Due to timing and its complex alphabet, you needed to learn. The lesson here? Until your grandmother can use it, mass adoption doesn’t happen.

The iPhone was most likely the third attempted at pushing a handheld internet enabled device to users so they could do things on the go, from a screen. Several versions were first, but due to complexity and being too early, they didn’t make it.

Timing, having the right person at the right time, is what has driven the last several waves of innovation and I think that’s where we are with the next wave.

The Killer App, Digital Wallets, Are Here

Digital Wallets are here but the timing has so far been wrong. That’s why, we’re not quite there yet with Bitcoin. It has nothing to do with supply-demand, halvings, integrations or all that other stuff. Sure, they all play a part and have major roles in the growth of the cryptocurrency ecosystem, but the real issue is that it’s too complex for the below-average user at the moment. Additionally, it’s still not ready to scale for 8 billion people. But, neither was the internet in 1960, 1980, or 1990.

However, I think we’re close. Getting really close, because the killer app already exists. We just haven’t quite made them easy enough yet.

Digital wallets are getting better. They’re getting more commonly integrated. In my opinion, they will eventually become the single source for all of our financial needs.

When that happens we’ll see these new financial rails dwarf the old traditional financial rails. Why? Because having a single place for all our data and digital information will allow us to connect value, information, money to the infrastructure that drives our economy and daily lives in a way like never before. That’s the future of money. The rebirth of infrastructure is happening to support the use of wallets.

Assuming this is correct we’ll likely see our physical wallets be replaced by our phones.

Why? Because who needs to carry all the paper around when the rails of our economy are digital? When our wallets can hold a token for every single datapoint, reward, contract, or asset we have. Is there still a need to have a bifold? Sure, there will still be paper trails, but they will be less important when digital contracts create more efficiencies. When your house token can create liquidity (similar to a HELOC) and proof of ownership at the same time. When all items can be held in the same place, so your driver’s license token, passport token, proof of insurance token, etc. all are excessable, exchangable, verifiable, and transportable. This opens up avenues that we don’t have access because of the way things are today.

This is the only physical book you need when medical help is not on the way.

This is the only physical book you need when medical help is not on the way.

The Home Doctor: Practical Medicine for Every Household

featuring

32 Home Treatments That Can Save Your Life one Day

Financial systems thrive on liquidity and liquidity is the ability for all components to be fungible. We aren’t there yet, but can be much closer with digital wallets.

When all (or most) items can be held in the same digital wallet as my Bitcoin, stock tokens, bond tokens, commodity tokens, and all the other financial assets one *might* actually own (yes, people might own crypto too :/), then my ability to have access to and to create liquidity from *all* of my holdings becomes much, much easier than it is today. I become much more integrated into the financial system, into the world, than I am today.

That’s the entire problem of the unbanked. They aren’t integrated into the financial system, leaving them out of the world.

What if I had no cash or credit card, but was at a store and needed to pay? If all my assets were in a digital wallet, I could sell a stock, a bond, a digital currency, or use fiat tokens to pay (note: I’m not an advocate of CBDCs).

The thing that keeps this from happening is siloes within our financial system. Lack of real-time information. Too much rehypothecation, slow settlements, and antiquated infratstructure. All of these points are opportunities that will be updated as we move further into a digital ecosystem.

The timing around the ability for one to create, use, and acquire liquidity is the major flaw in our existing system. Not from a FED and Keynesian perspective of “we need infinite elasticity”, but from a standpoint of there being too many siloes in our financial lives.

Too much friction and too little verifiable insight into our systems. This creates hurdles and rolling boom and bust cycles. This creates a never ending environment of credit crisis that are not an “if” but a “when” because we have very little ability to see how the underlying financial assets are *actually* being used. We are required to trust someone at there were.

This leaves us to having to inherently trust people and systems that together, if nothing else, have proven to be untrustworthy for thousands of years. Particularly untrustworthy when it comes to the topic of money and financial interests. When you take all that disparate financial information and all of those varying financial assets and stick them in one place we can easily change the path of the world.

This is what is happening. Albeit, ever so slowly. This is what the Digital Wallet will bring us once it becomes simple.

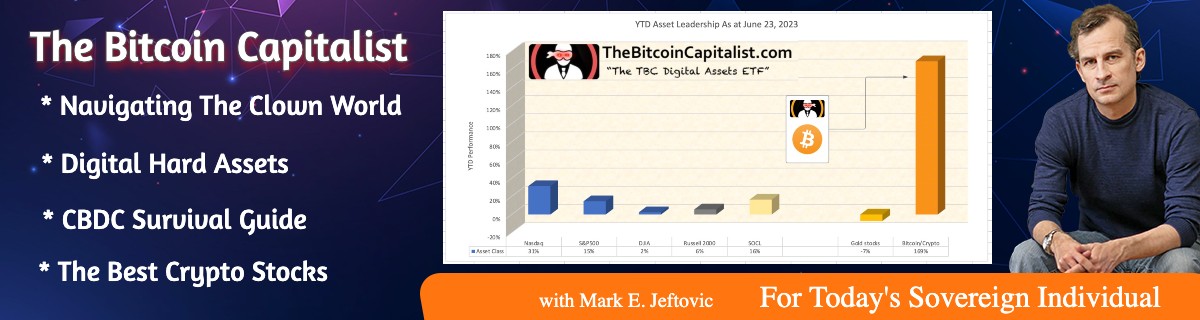

Subscribe to the Bombthrower mailing list to get these posts as they come out, and follow Kane McGukin via his Substack and Twitter.

I'm not hostile to this concept but I have questions.

I'm selling a piece of real estate in the UK at the moment. It's not fungible for various reasons, but put that to one side.

First thing – having a token for the property is OK, it proves I'm the owner, but the buyer will still have to ask a lot of questions before they part with whatever they are using as money (has it flooded since I bought it? have there been any issues with the neighbours? and so on). And they need to be sure that I am the rightful owner of the ownership token. How would a wallet store those questions and answers and identity?

What happens if my phone is stolen? Is the token for my property recoverable? If so, from where? In the UK that would be the Land Registry (which, by the way, is for practical purposes essentially non-digital, fecked up, slow and crappy… but let's assume it is better in the future). The Land Registry provides a state guarantee of title so it's indispensible. We haven't really got rid of the trusted third party, have we?

I also have a few gold sovereigns, my preferred form of gold ownership because there is no Capital Gains Tax if I sell them for a profit which can be measured in fiat. These things aren't individually identifable in any way which would tie them to a token. That's actually one of their virtues – there's no serial number, no record of them changing hands. If I exchange them for something, be it fiat or goods or even Bitcoin, they have to change hands physically – in fact that's the whole point because although I maintain an account at Bullionvault.com I don't really like paper gold, I prefer the real thing even though it carries costs of storage and insurance. Nobody knows how many sovereigns I own (and just as an aside, I'm the guy who first suggested the boating accident meme on Zero Hedge). Bullionvault will tell you that all their gold is allocated, and I do actually own identifiable grams of gold (ie: grams forming part of a serialy numbered LBMA bar, which is audited) but unless I can afford to withdraw a whole bar I'm never going to to see or touch, and certainly not hand over to someone else, the gold I am said to be owning. How do tokens on a phone replace my sovereigns?

Another question (remember, I'm not hostile, just thinking this through). Suppose my government identities end up in a digital wallet – my national Insurance account, my tax account, my state pension, my passport, driving licence, pilot's licence… and so on. All in a digital wallet which I access and to some extent control through my phone. Is there now a temptation for the state to say, "We don't like you having all that stuff on your own device. Here's a device provided by us, which we control, and you must keep those tokens on this." Or even on a chip, implanted in my body. I'll fight to the death to prevent that hapening.

Final question – are people going to trust an electronic wallet completely? I still print out bank statements for accounts holding substantial sums because I don't trust my bank to run its IT system 100% perfectly for ever. Do some people still hold Bitcoin offline in print (QR codes or whtever)?

Now, ignoring the problems for a moment, let's assume we have a digital wallet which can store tokens for just about anything, and it's either on phones, or hard drives, or on remote servers ("in the cloud" – which I'm guessing is its natural home). There's no need for new hardware to be invented to make that happen. And there's no need for any fundamentally new software. And possibly existing cryptography can protect it. What we actually need is a protocol which allows automatic conversion of any token to a standard format on a standardised blockchain which every device in the system can understand, exchange, and store. Is that here yet?

Tokens/coins can send value and store text plus operate based on smart contracts. Which would take care of the storing of data within the coin or contract.

If a wallet or token was lost or stolen. The owner would have some way through an exchange to reissue a token by proof of traditional ownership documents. Obviously, Bitcoin would be the best but without the ability to create and burn tokens, this would not work. I'm not a proponent of that, but in this case, it would make sense and would allow the rightful owner to maintain possession in the event of an adverse situation. On a sale, the old coin would be burned and all holders paid off based on the value of the selling transaction. That would be paid in fiat, USDC or whatever the holder desired it be converted to (programmatically).

A token would not replace sovereigns, just make them liquid and more easily usable / transferrable if desired. The intent you bring up, it does not seem like it would make sense to bring them "online" as people would know about them and it sounds like your point is for people not to know.

The nation-state wallet question would most likely work like custodial and non-custodial with the various tradeoffs.

The border point is to merge the offline with the online to allow more seamless liquidity to the assets we have. Making those that are more sticky and less liquid become more usable, or at least giving choice to those that would like to move portions or all of it and have it connected to other things as tech continues to migrate us in that direction.

I think this article hits the nail on the head when mentioning the problem with rehypothecation in the system. Hell, even the "official" collateral multiplier for T-bills is acknowledged by the Fed/Treasury at 6-8 (actual may be as high as 25-30). Clearly, the system is based on fraud and rotten to the core. The only way to unravel this smoke and mirror house of cards and begin on some type of solid digital path as described in this article (more liquidity, transparency, settlement speed, etc.) is a massive reset/collapse that wipes out all of the bullshit. There have been massive and coordinated changes in financial laws over the last 20 years (especially regarding collateral and hierarchies of ownership) throughout the world and these are described in detail at the online publication presented at: https://thegreattaking.com. This article makes a convincing argument that a future financial shearing/reset has been in the works at the highest levels for a while. Until the inevitable reset/shearing/taking has run its course, I will be storing a significant portion of my wealth off the grid in the form of assets that are not easily "taken."