As an Amazon Associate OOTC earns referral fees from the book links we cite in our posts.

This is the second instalment of The Jackpot Chronicles: Four Possible Post-Coronavirus Scenarios.

Force Majeure means:

a chance occurrence or superior force that renders a contract unenforceable and frees all parties from their obligations under it.

We are frequently told that there exists some manner of “Social Contract” to which we are implicitly bound by virtue of being alive. This implied Social Contract confers legitimacy upon the institutions that order our world, the national governments, the central banks, the miltary and police. And by extension certain communication outlets and media are endowed with a status of official curators over the narratives around institutional power.

Under the Force Majeure Scenario, the first of four possible Coronavirus aftermaths posited in “Welcome to the Jackpot”, the overwhelming or superior force is not the pandemic itself, but rather the collapse of the debt supercycle, the monetary system that derives from it, and the structure of nation states that are burgeoned by it.

The last time we were here, when a systemic crisis has shaken the foundation of the social order, the policy response was favourable to one party of the social contract at the expense of the others.

The GFC, which I now call GFC 1.0 or GFC ‘08, saw the financialized class, those closest to the monetary spigots of the Central Banks enjoy accelerating prosperity as their asset values rose, whilst the rest of the population endured stagnation and a steadily increasing cost-of-living (which mainstream commentators refused to acknowledge as inflation).

The policy response from the last crisis has led us directly, in a straight line to this one. The only surprise being the exact nature of the catalyst which would pop the Everything Bubble, and perhaps the ferocity with which the air began to let out once it did.

The signs were certainly there that we were nearing some kind of archetypical “shoeshine boy”moment or phenomenon. Complacency in passive investing, extreme overabundance in the unicorn population, the fact that there exists (existed) an entire industry around arbitraging long term leases with short term rentals via AirBnB, there was a sense of Roaring 20’s around it all and all those vile contrarians were wondering “just how long can this go on?”

Under Force Majeure the public begins to understand that the people who populate institutions are just that, people. Despite specialized training perhaps, they are not endowed with any superhuman intellect or wisdom. Success within the matrix of the institutional elite comes from proxemics and adroitly navigating the system itself, not much more.

“An era can be considered over when its basic illusions have been exhausted”

— Arthur Miller

An era like this comes to an end when the public realizes that their betters aren’t intellectually superior but rather institutionally privileged. Now facing an existential crisis of their own making, they are completely out of touch with the public mind and out of their depth to deal with it.

Then The System Finally Comes Unglued. Now what?

The central banks and national governments have fired their bazookas in unison yet despite a typical relief rally in the form of a standard issue dead cat bounce, reality continues to insist on asserting itself. On a recent Jelly Donuts podcast, Grant Williams talks about forthcoming GDP numbers coming off 30% “truly apocalyptic”.

Yet, the incumbent institutional custodians will continue to deny reality and to discredit themselves, what will it look like then the populace comes to realize that the old social order, and the institutions that curate it are being deprecated?

Breaking: A new bull market has begun. The Dow has rallied more than 20% since hitting a low three days ago, ending the shortest bear market ever. https://t.co/06YS0XqWGP

— The Wall Street Journal (@WSJ) March 26, 2020

Ontario Premier Doug Ford recently advised citizens who couldn’t pay their looming rent bills at the first of the month to simply “not pay”. He later tried walking that back, but when this sentiment gets writ large, with governments printing money and sending out cheques, what happens when people and businesses simply decide not to pay their taxes either?

Can political leaders say, with a straight face, that citizens should stiff their landlords or mortgage lenders but not the State?

And if the State can simply print up money and send out cheques, why do we need taxes anyway? Have we arrived at full MMT?

All of the central bank and fiscal stimulus portends a secular shift from deflation to inflation and I don’t think very many people understand what that means.

It means a whole lot of broken clocks are gonna be right for once, but at a time it counts the most.

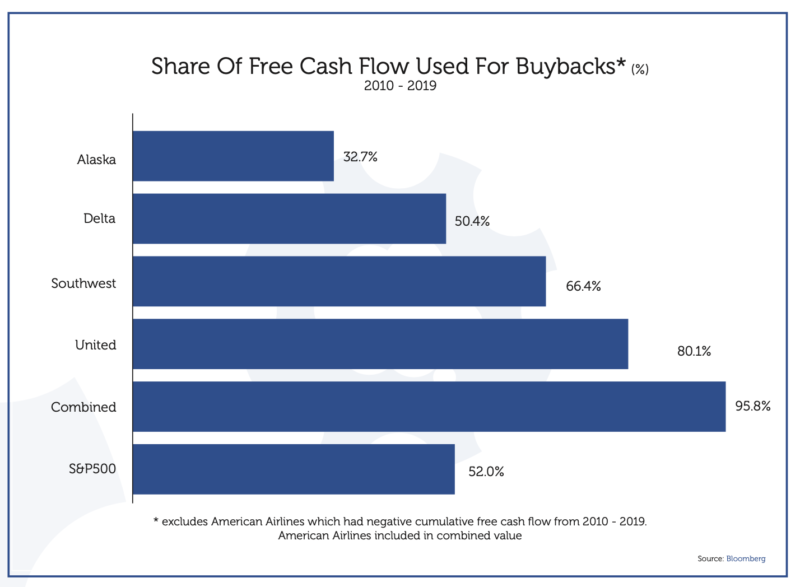

Now, every company that levered up on debt to buy back their own shares over the last 10 years wants a bailout. Grant Williams points out in Things That Make You Go Hmmm that the airline industry spent 47B on buybacks since 2010, they want a 50B bailout.

What the chart, right, doesn’t show is the total dollar amount spent by the airlines on buying back their own shares between 2010 and 2019.

That number is $47.3 billion (of which American Airlines – whose negative cumulative free cash flow between those dates was $7.9 bln – contributed $13 bln).

Even the private jet industry wants a bailout.

And what will public citizens get? Those whose businesses have been ordered to close, whose jobs have already been lost? They’ll get a check for $1,200, or a tax deferral until August. Bfd.

Charles Hugh Smith’s books speak a lot about this type of secular wane in institutional relevancy, which we discussed on our podcast once and it bears repeating here:

MJ: when I look at Pathfinding [Our Destiny] like part seven where where we’re talking about what the way forward looks like, that it’s outside of the control of the of the establishment, that it’s outside of the system I get this sense that for society to flourish and adapt around this and evolve. I guess that’s the key word, we’re going do this around the institutionalized hierarchies.

They’re not going to get religion one day, we’re not going to elect the right candidate, we’re not going to have the right party gain power that’s suddenly going to say “I read this great book by Charles Hugh Smith and this is how we’re going to do it”.

It’s going to be something like institutionalized hierarchies will just lose more and more relevance as these new social and business and financial configurations start gaining more and more relevance.

CHS: That’s an excellent point and I think if anything I didn’t emphasize that enough. That really what we’re talking about is kind of like hacking the system in in the old time sense that a hack was a workaround. It wasn’t like you were breaking into the system to steal something, you’d created a workaround for a kludgy system that just didn’t work anymore.

And so I think you’re absolutely right, it’s going to be working around us and and Bitcoin is one example of how workarounds are manifesting and of course the status quo is going try to suppress those and/or co-opt them but what we’re really talking about is when systems fail at a systemic level you can’t reform them. You’re not going to make a policy tweak that’s going to fix higher education or the health care system. It just isn’t going work.

People are going to start working around that and they’re going be starting to pay cash for for medical care from pop up providers or remote physicians. Or there’s lots of different solutions to that in education. What I see the model that’s going to emerge whether people like it or not and is that students are going to start taking control of their own education and they’re going start organizing their own education.

They don’t need this bloated structure that charges them $70,000 a year and so that’s where technology, the internet and networking has really enabled a whole suite of solutions that basically bypass all the institutions that now hold the wealth and power, that have all this as you say institutionalized lethargy as as their their model.

It’s actually quite an exciting time but for those who are dependent on the system within these institutions it’s a very disturbing time

Under Force Majeure as the institutions become understood to be out of touch with both the causes and remedies to the immediate crisis, they begin to signal their own hypocrisy and irrelevance more intensely.

It will not be long before citizens will face the dilemma of continuing to observe the edicts of their governments, whose policies inexorably stripped them of their ability to weather any kind of economic speed bump. They will come to realize that despite what the government decrees, especially if that means keeping their businesses closed or their jobs on hold for much longer, they may be better off working around that.

That’s when myriad alternative economies and ecosystems will explode, black markets, grey markets, Local Exchange Currencies, private blockchains, invisible agoras.

As governments at all levels teeter on insolvency and their inability to control their own populace everywhere or to be in a position to guarantee security and order, I could envision neighbourhood watch groups morphing into localized militias. I would anticipate an explosion in private security and ex-military contractors.

Don’t be surprised to see Facebook resurrect their Libra, either under that monicker or some rebranded version as the large corporations, the ones that have revenues larger than most national GDPs begin to reassert some of their plans which may have been impeded earlier.

However it plays out, the key points to bear in mind are that:

- It would be a mistake to think of the next 20 years as a linear, albeit accelerated version of the previous 20 years (a la Chris Martenson)

- We are about to undergo a change in secularity from deflation to inflation (a la Grant Williams, Peter Schiff and many others)

- The incumbent institutions of the fiat currency era are about to be swept away, akin to the way the royal houses of Europe were after World War 1 (the last major “Force Majeure” transition period that comes to mind for me).

It will all be very reminiscent of Neal Stephenson’s “Snow Crash”

If you want to receive the rest of the Jackpot Chronicles series, or get on the list for my Business Survival Blueprint (available to subscribers only), sign up for my mailing list.

As an Amazon Associate OOTC earns referral fees from the book links we cite in our posts.

Hello Mark,

There are few conventional options to resolving the deflating asset balloon, and only those which inflict pain on the masses. My unconventional solution is found in the two articles below.

A depression is spreading throughout the world under the guise of a mischievous flu. The latter shall resolve itself quickly. The former won’t.

https://www.realclearmarkets.com/articles/2020/01/31/if_government_wants_to_spend_it_neednt_tax_to_do_so_104061.html

https://www.realclearmarkets.com/articles/2020/02/19/ignore_the_alarmists_the_public_debt_is_no_burden_at_all_104083.html

Regards,

Gary Marshall

You are very mistaken when you assume we have 20 years left…the truth is we have fewer than 10.

Please see the trumpet.com

That’s not exactly what I said. I said the next 20 years will be very different from the last 20 years.