Turns out Keynes was a Commie

Awareness of the centuries old concept of The Cantillion Effect has been experiencing a revival of late, particularly since the extraordinary acceleration of monetary injections that occurred under COVID. Named for the French-Irish economist who died in 1734 (he was murdered), the Cantillon Effect is when you create a bunch of new money and inject it into an economy. What happens is the people at the front of the line who receive the new money first become wealthier, while the people at the end of the line who receive it last are further impoverished.

This is not peculiar to the post-Covid era. For more than a decade I’ve been describing how rampant money creation and credit expansion skews formerly free markets into a kind of economic vampirism, without actually knowing there was a term like this to describe it.

From my vantage-point as a tech CEO running a company that has never taken on VC funding, it unfolded as having to compete with multiple deep-pocketed 800lb gorillas and billion dollar unicorns who were losing money on every transaction and driving a race to the bottom across the entire industry. Companies like ours have to be profitable or perish. Serially funded unicorns just have to keep their burn rate below their fund-raising tempo.

Marc Andreesen, the noteworthy VC icon touched on it with his famous “Software is eating the world” euphemism, but it failed to capture the financialization aspect of it. It’s more like “serial up-rounds are eating the world”.

The dynamic intensified dramatically under COVID. Not only were the monetary injections accelerating, but governments globally shut down small and independent businesses for nearly two years, and then central banks went out and bought the bonds of the quasi-monopolies who were left.

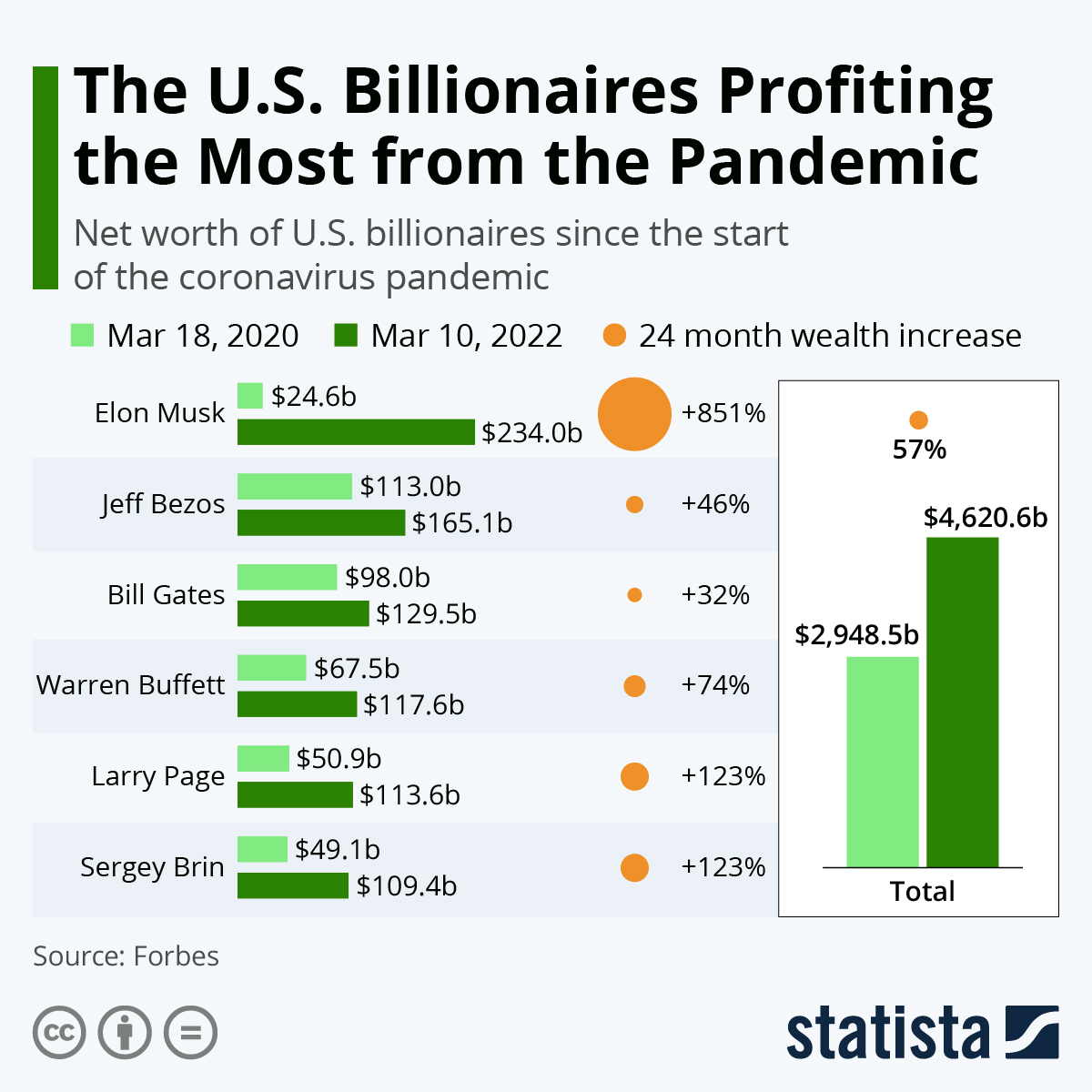

Via Statista – the Fed purchased bonds of companies controlled by every person on this list.

Via Statista – the Fed purchased bonds of companies controlled by every person on this list.

But even if the people at the front of the line have a privileged position, why does this necessarily translate into them either using that position to launch, fund and flip money-losing unicorns, or hollowing out via financial engineering what would have otherwise been long term viable businesses?

It’s the currency debasement, stupid

When the cost of capital is cheap, like near-zero cheap, companies never have to be profitable. In fact if the capital pool is growing faster than the operating earnings are, you’re actually incentivized to eschew profits in favour of taking on funding – provided you have a short-term time horizon.

Here’s the thing about printing money: because it devalues the currency, it compresses time horizons.

If you think of currency as “shares” in the economy they denominate, then it should be easy to grasp that by increasing the number of currency units, you aren’t magically growing the economy. You’re just increasing the numerator (the currency units) while keeping the denominator (the actual goods and services available) the same.

If the numerator grows, that means it takes more currency to buy the same goods and services, so it is experienced as variations of “number go up”:

- For people who are already wealthy: assets increase in “value” because they are being measured in more units

- For everybody else: food, shelter and essentials get more expensive, same reason.

In fact government metrics that define some arbitrary “poverty line” as being based on some level of income almost completely misses the point. The line between poverty and wealth should more accurately be measured in terms of net assets. The wealthy have assets – that compound. The poor have bills – that get more expensive.

Whenever the monetary authorities increase the currency supply or expand credit, it is always proffered as a necessity of saving the system. The fact that the reason the system needed saving in the the first place was a direct consequence of previous expansions is ignored or shouted down.

There are only three real moves in the central banker toolbox: print money, expand credit, suppress interest rates.

The intellectual basis of this approach is often rationalized as a prescription dictated by “Keynesianism” or “Keynesian economics”, after John Maynard Keynes, the intellectual father of mainstream “economics” as it is known today.

Keynes was a bit of a mixed bag. Though often cited for his “gold as a barbarous relic” quote, he ended up heavily allocated in South African gold miners years after he wrote that. Mid-way through his career he swore off macro investing, coming to the opinion that no amount of macro knowledge would give you an edge at the company level: he had become a sort of proto-value investor.

He was also a pederast, having kept detailed records of numerous young, mostly male partners, their names and ages, which are preserved still in the archives at King’s College, Cambridge …he was a Malthusian believing it was “the salvation of the British economy” and eugenicist – having served on the board of the British Eugenics Society.

…and, as it turns out, Keynes was a raving pinko. Full blown Commie.

The Socialist scaffolding of Keynesian Economics

Vladimir Lenin is often attributed as saying “the best way to destroy the capitalist system is to debauch the currency.” However the quote is possibly apocryphal, because the earliest reference to it is a citation by Keynes in his Economic Consequences of Peace.

Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. … As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless;…

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

Keynes is describing The Cantillon Effect, and yet, as we’ll see, Keynes may not have been viewing this as a bad thing. While Keynes clearly understood that government spending and money creation drove wealth inequality, it seems as though he viewed this as a beneficial dynamic, because it would inexorably lead toward the ultimate wealth inequality: Communism.

Contrary to the popular platitudes that socialism and communism are about achieving equality for all, going so far to prescribe absurdities like “equality of outcome”. The reality, documented by the likes of Dr. Kristian Niemietz in his “Socialism: The Failed Idea That Never Dies”, is that the only equality brought about by collectivism is where everybody beneath the thin scab of elites and their apparatchiks are equally mired in poverty and servitude.

In Edward W Fuller’s “Was Keynes a socialist” paper, published 2019 in The Cambridge Journal of Economics, Fuller looked at whether John Maynard Keynes, the chief architect behind the entire edifice of conventional economics (and arguably it’s intellectual descendants like Modern Monetary Theory) was a socialist.

He compared the defenses of Keynes as “a liberal who wanted to save Capitalism” against various writings, correspondence and accounts of Keynes himself and from those who knew him, including his own father.

John Neville Keynes, journaled on Sept 6, 1911 ‘Maynard avows himself a Socialist and is in favour of the confiscation of wealth’. Turns out this was not a passing fad, it was a lifelong devotion. Young Keynes first came out as a socialist in February 1911, declaring that:

“the progressive reorganization of Society along the lines of Collectivist Socialism is both inevitable and desirable”

Over the course of his career Keynes authored numerous odes to socialism, fraternized with notorious socialists like George Bernard Shaw (head of the Fabian Society) and Owen Mosley, who founded the socialist New Party in 1931, which later morphed into The British Union of Fascists.

Keynes supported the Bolshevik Revolution, even though it had seized power in a coup d’etat against what was then the only democratically elected government in Russia’s history (“the only course open to me is to be a buoyantly bolshevik”.) Keynes became a regular attendee at the 1917 Club, a Soho meeting place in vogue amongst socialists of the day, named to honour the year of the revolution.

It was at the 1917 Club where members of The Fabian Society met. The Fabians wanted to usher in global communism, but instead of doing that through, sudden, violent revolutions (a la Marx) they would take their time.

It was at the 1917 Club where members of The Fabian Society met. The Fabians wanted to usher in global communism, but instead of doing that through, sudden, violent revolutions (a la Marx) they would take their time.

They thought in generational increments and proposed the slow, steady infiltration of higher education, government bureaucracies, cultural chokepoints (theatre, pop-culture, the media and the press), and posited that over time they could pull society toward collectivism without anyone realizing it.

Their emblem was a wolf in sheep’s clothing.

As per Keynes: “Socialism can be introduced gradually….the economic transition of a society [into Socialism] is a thing to be accomplished slowly”.

Fuller’s paper concludes that Keynes was a non-Marxist socialist, meaning he eschewed the obsession with the idea of class struggle and focused his thinking around increased State control over the economy.

If Keynes was a commie, why does it matter?

In a previous incarnation of this blog, I wrote about Keynes’s predictions of a theoretical future where humanity would be freed from all care of day-to-day concerns through expert management of the economic cycle by credentialed technocrats.

He called this future state “Bliss” and described it in his essay The Economic Possibilities of Our Grandchildren (coincidentally cited via marxists.org)

The pace at which we can reach our destination of economic bliss will be governed by four things – our power to control population, our determination to avoid wars and civil dissensions, our willingness to entrust to science the direction of those matters which are properly the concern of science, and the rate of accumulation as fixed by the margin between our production and our consumption; of which the last will easily look after itself, given the first three.

Economic bliss sounds a lot like fully automated luxury communism. But you can’t get there if the rabble is still making economic decisions for itself. Free markets must be destroyed, and only credentialed elites can be permitted economic autonomy. (That’s why nobody’s life, liberty or property is safe whenever the World Economic Forum is in session).

Keynes laid out a path to get there. Through endless money printing, the Cantillon Effect would lead to the destruction of the middle class. By wrapping it within a cloak of crypto-socialism, he gave it a veneer of intellectual acceptability:

“The work of monetary cranks like John Maynard Keynes taught in the modern universities the notion that government spending only has benefits, never costs. The government, after all, can always print money and so faces no real constraints on its spending, which it can use to achieve whatever goal the electorate sets for it”

— Saifedean Ammous, The Bitcoin Standard.

In Saifedean’s follow up, The Fiat Standard, Keynes and Marxism are mentioned as having large areas of overlap, goals and practically identical results:

“The number and influence of third-world leaders who were educated in British and American universities from the 1930s onward is staggering…anyone familiar with the economic history of developing countries, or with the rhetoric of any development agency or ministry in a developing country, will see this influence in the distinct stench of Marxist and Keynesian notions of central planning.The entire framing of the notion of economic development is driven ultimately by a highly socialist view of how an economy works.”

“By the 1970s, the development failures piled high, and a lot of soul-searching within the misery industry would lead to more government control and more centralized economic planning. As the “dependency school” approach became more popular, government central planning became far more pervasive. The combination of global easy money, following the U.S. government’s decision to suspend gold redeemability, and governments and international bureaucracies staffed with Keynesians and Marxists proved disastrous.”

Fuller’s paper goes a long way in providing an explanation on why collectivism and Keynesianism seem to resemble each other: it’s the same thing. It is all statist, centralized technocracy under the guise of

a) high-minded collectivism for the useful idiots of the working class, and

b) high-powered intellectual macro-economic policy for the useful idiots in the universities and think tanks.

This could be why we’re demonizing capitalism, energy, self-reliance, family, spirituality and anything else that falls to the right of Stalin. This is why Big Tech unicorns are by their own admission “commie as f*ck”, and why many of the celebrity class these days are self-proclaimed “woke” socialists. Especially the super-rich ones.

The good news

There was a time, especially under lockdowns, when I looked at the direction things were going, and I thought the Fabians had achieved complete victory. World socialism was practically here, having arrived under banners with names like The Great Reset, The Fourth Industrial Revolution and Stakeholder Capitalism.

Even worse, large swaths of the public seemed to be clamouring for it.

COVID stimulus showed how the lubricant for a globalized socialism was the monetary printing press. In his day, Friedrich Hayek (the anti-Keynes) realized this as well and was similarly pessimistic.

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something they can’t stop.”

— Hayek, quoted in The Bitcoin Standard, p72

Enter, Satoshi.

The epiphany I had, and I’m not alone, is that we are not entering an age of centralized, technocratic authoritarianism, we are in the process of departing from it. We’re in the end game now. The crescendo of an age which has been unfolding for over a century – the era of the welfare state.

With the arrival of the Internet, and then Bitcoin, we’re undergoing a phase shift into the decentralized era of network states and micro-sovereigns.

The near universal mismanagement of COVID, from the possibility of a lab leak in the first place to being absolutely wrong about everything after that, pulled forward about 20 years of this tension and crammed it into 18 months. Too much, too soon. We were on track to gradually transition to a decentralized society via an interim phase of technocratic authoritarianism that could have lasted for decades, before giving away to the inevitable decentralized society. But now, we’re looking instead at a disorderly phase shift into deglobalization and decentralization. It’s already happening.

We’re at a point where reality is intervening with ideology and it was the pandemic that brought us here a few decades before I would have otherwise expected it. The conventional COVID narrative has all but broken down completely. Trust in institutions and experts is plummeting, the corporate media is a joke.

We may have already blundered our way into World War 3, while incumbent politicians around the world are being swept out of office on a wave of public backlash. Then there’s the economic and physical consequences of batshit policies that threaten to overwhelm our supply chains and energy availability everywhere.

Woke capitalism is being exposed as a sham. The public increasingly sees the Party at Davos as saturated with hypocrisy and arrogance.

⭕️ The numbers don’t lie. #WEF #Davos was always about advancing Neo feudalism.? pic.twitter.com/RkQkS1iySx

— 21st Century Wire ?? (@21stCenturyWire) May 22, 2022

Make no mistake, we’re talking about the end of an epoch and the demise of the legacy power structure. Not only in terms of who the incumbents are, but the very architecture and fabric of how geopolitical and economic power is configured.

The old guard will not go down without a fight, and for the moment, they have the institutions and the media, but that is already changing.

“We’re all Keynesians now” was the intellectual rallying cry of the fiat era. Laser eyes will be the defining meme of the next one.

If I had to offer advice to anybody who was looking for ways to pivot their existing affairs and navigate the coming changes I would bullet point them as follows:

- Do not be reliant on government entitlements: these will soon be delivered via CBDCs and be full-throated social credit systems

- Turn off your TV, cancel all mainstream media subscriptions: read more books, get your news through alternative / indie media channels (start with The Sovereign Individual, both Saifedean Ammous books, and George Gilder’s Life After Google)

- If you’re a business owner: start taking crypto payments and HODL them

- If you’re not a business owner: Start one. Even a kitchen table business that you can grow over time.

- And stack sats. Always be stacking sats.

Buying Bitcoin is calling bullshit on everything

— Interstellar (@InterstellarBit) May 27, 2022

We’re going through a Fourth Turning-style phase shift. It will be turbulent, violent and at times terrifying. But it will also bring boundless opportunity. Never before have we lived in an age where nearly anybody can go from a standing start to financial independence and self-sovereignty in the shortest amount of time with the lowest barriers to entry.

This dynamic will only intensify over the coming years and in the long run, this is what will propel a quantum leap in the human endeavour.

The world is undergoing a monetary regime change. Get the Crypto Capitalist Manifesto free, when you join the Bombthrower mailing list. Follow me as @bombthrower on Gettr or if you haven’t been kicked off Twitter (yet), @StuntPope

Boom!

As a long time aspiring protocol engineer, first encountering bitcoin in 2012 thanks to Silk Road, my current main thing is about how Proof of Work is a bulletproof method of distrtibuting governance. Proof of Stake is literally “He Who Has The Gold Makes The Rules”. If we are going to be serious about replacing Amazon and Google et al, we need to disentangle governance from the consensus protocol. Picking the leader and the rules of replication are two separate things.

I’m working on this https://github.com/cybriq/kismet – it essentially creates a CPU based proof of work that creates validator queues for a standard pBFT consensus. I have further ideas related to application session sharding consensus protocol but I haven’t picked out the governance scheme for that. There is a protocol that was developed by a project I was working for briefly called Kadcast, which uses a kademlia DHT to create a routing map, which can’t be gamed, and thus guarantees partition free distribution of new transactions. From such a basis, with an additional strategy for latency optimisation, we can replace the controllable, hackable Kafka style message distribution systems and cover the whole gamma from fast clearing financial transactions to realtime virtual environment systems, without needing any damn centralised management.

“I’m working on this https://github.com/cybriq/kismet – it essentially creates a CPU based proof of work that creates validator queues for a standard pBFT consensus.”

Interesting, but what is the advantage of it? Energy saving?

I remember kademlia from an old file sharing p2p service. But again what is the advantage of using it in connection with bitcoin? Verifying transactions without having to pay miners?

I had exactly the same take on “proof of stake” as a means for those in power to surreptitiously manipulate “cryptocurrency”.

Upon further reflection I realized “proof of work” created a stake of sorts and that all cryptocurrency designs involve “stake” of some kind, with “proof of work” being a sort of digital sweat equity, creating value in the form of assurance of legitimacy of transactions. What we’re calling “proof of stake” is buying in.

I believe we can expand ways Bitcoin brings value into the system in such a way as to reward the workers, while allowing those who have accumulated wealth to play a valuable role “staking” others. In fact some of the issues with fixation on mining, and excessive energy consumption might be addressed by recognizing value of not just hash validation work, but consensus/governance work, other computational work, network bandwidth, and storage. We should try to incentivize meeting needs, not just incentivize stacking up mining ASICs until the lights flicker.

The trick will be doing this without ceding control of the decentralized public ledger to any one group or adding computational load. Part of magic of Satoshi’s design for me is in how the system design tries to make computation which creates wealth be computation which is actually valuable to those using the system.

The value of the organic computation (brain power) being contributed to protecting the integrity of the public ledger by programmers such as yourself cannot be overstated. Hopefully you (and others) will be rewarded with wealth and recognition proportional to those contributions which add value to the system.

I believe successful designs will continue to model Satoshi’s presumption that there will always be someone trying to cheat or game the system.

This was awe inspiring thank you

Very inspiring! I’m going to start a “kitchen table” business, promoting to small businesses, that they accept Bitcoin/crypto as payment. My guess is that small business owners don’t understand Bitcoin, think its risky and don’t know why they would want to accept it.

I’d love help with a one or two sentence answer.

“Because Bitcoin is a hedge and safe harbor against the destruction of the dollar. You want to HODL Bitcoin as part of a diverse portfolio.”

I don’t currently buy things with crypto when given the opportunity. That’s going to change.

Thanks for an eye-opening piece, Mark!

Very well written article Mark. Everybody can understand it without much effort. You have a gift for clarity and neatness, Mark. A lot of people understood that Keynes is just sold to governments and wrote a lot of paper about it, but your ability to condense it and still be clear is rare.

😭😭😭

Thank you

Thank you for a very concise treatise on Keynesian for someone introduced to it in 1980’s MacroEconomics 101. His connection to the Fabian Society was previously unknown to me. The current threats to our well being from the WEF’s “Great Reset” will be a challenge to overcome, but I agree that in the end it will lead to a more distributed, de globalized, and egalitarian society for us all. I just wish I shared your optimism for the time frame. This battle may take many years for those of us still left around to complete. I sincerely hope I am around long enough to see it happen. Cheers!

I’m somewhat agnostic on the last quarter of your essay, but the first three quarters was as clear and perceptive an analysis and explication of the common, coercive thread binding all popular mainstream collectivist economic gibberish together as I’ve read in a long, long time.

And thanks for the new info on Cantillon who I had never heard of prior.

Bookmarked.

Brian, I am in complete agreement with your comments.

Mark E. Jeftovic, this is a most excellent missive about JMK. I have always had reservations

about his economic theories, which were adopted by the western world economists without any

questions nor debate.

The only critical review of JMK economic dogma I could find, was a sterling book by Henry Hazlitt,

a well known business writer, ‘The Failure of the New Economics.’

What is disturbing about the accession of JMK’s economic theory, was how it was so readily adopted

without any constructive reviews or criticism. It was a sure sign of the penetration that Socsheviks

were making in the western democracies and the failure of academics.

AWESOME 👌

Great stuff. You are extending the reach of these ideas beyond current bitcoiners.

My own registrar seems to be going woke so I am looking for a new home. They still have bang up search capabilities though.

Hope to see more from you!

Thank you Mark for yet another awesome and timely piece.

For anyone interested in the full story of Cantillon (and all the other fiat fiascos of history) I can recommend a book by hard money enthusiast John Butler, the golden revolution revisited, available from all the usual suspects but well worth the read nonetheless

Solid Piece Mark

John Koyle Famine

Cardston Morman Temple Prophecy

Adam and Eve Story by Chad Thomas (aka Charles Hapgood?)

Dr. Robert S. Harrington.

********** WARNING **********

INCOMING

********** WARNING **********

Why reinvent the wheel? Precious metals are your proof-of-everything. No energy waste, middlemen, fees and discretion.

Why would one wish to have a digital trace of anything ever done? How economically feasible to power an energy-hungry mining network, especially with exploding energy prices?

silly boy, how do you

a) transact with gold over the internet eg shop at amazon

b) how do you prove its 99.9% gold and not gold plated tungsten?

the joy of bitcoin is that you transact with the money itself. no need for tokens which say they 'represent' the money eg value. Thus PaxG – a token for gold held in a vault – may or may not represent gold in the vault. Thus its like a paper currency, susceptible to fraud. Whereas bitcoin is not a token. It is the money – the value – in itself.

To posess bitcoin is = to the ownership of physical gold, yet one can use it to transact online. That is the miracle of bitcoin.

"The near universal mismanagement of COVID… pulled forward about 20 years of this tension and crammed it into 18 months. … now, we’re looking instead at a disorderly phase shift into deglobalization and decentralization. It’s already happening."

That was a most perceptive comment. Now at the end of 2023 its becoming clear that the elite's management is incompetent. They are invariably old men who are using cutting edge concepts …..from when they were young. To us, in 2023, they just look silly. Trying to scare us into using lithium batteries with stories of rising sea levels is just not working. Probably because that policy dates back to the Club of Rome in the 1980s.

Unfortunately "The old guard will not go down without a fight, and for the moment, they have the institutions and the media, but that is already changing."

Indeed the MSM are a spent force, no one who thinks cares what they say. It seems the crunch issue will be the new laws intended to enforce censorship of all speech on the internet. I expect them to accelerate a move to de-centralised social media. They won't be resisted so much as left eating dust.