Everything that’s wrong with “The Politics of Bitcoin” book but were afraid to ask.

“It is not only those who see themselves as libertarians who, through the adoption of Bitcoin and the political communities around it, routinely distribute political and economic views that are grounded in conspiratorial, far-right accounts of the Federal Reserve and the nature of representative government…”

David Golumbia, “The Politics of Bitcoin: Software as Right-Wing Extremism”

(Note: It has come to my attention that David Golumbia passed away on September 14th, 2023. I posted my reflections on the matter here and extend condolences to those he left behind.)

The Cryptocurrency / Blockchain revolution is the second technological seismic shift to occur within the past 40 years. The first was of course, the Internet, and once that achieved critical mass the detractors and those who feared the erosion of centralized power that the net signalled began subtly promulgating the memes of The Four Horsemen of the Internet Apocalypse to warn off the population and justify centralized control (those were: terrorists, drug dealers, pedophiles, and organized crime. I recently dubbed “Fake news” the fifth horseman of the Internet Apocalypse).

It is no surprise then, with Central Banks and governments unable to control the uptake of cryptocurrency and further decentralization a new set of existential threats is being advanced. Let’s call this the “focus group” stage where all kinds of hyperbole will be floated to see what will stick.

The harbingers of the Bitcoin Apocalypse frontrunners are currently:

- All four horsemen of the Apocalypse plus

- Global Warming

- Energy Crisis

and if we are to take Virginia Commonwealth University associate professor of English David Golumbia seriously:

- Right Wing Extremism

Right-wing extremism, also known as “far right” politics is described in Wikipedia as…

often associated with Nazism, neo-Nazism, fascism, neo-fascism and other ideologies or organizations that feature extreme nationalist, chauvinist, xenophobic, racist or reactionary views. These can lead to oppression and violence against groups of people based on their supposed inferiority, or their perceived threat to the nation, state or ultraconservative traditional social institutions

In his book “The Politics of Bitcoin: Software as Right-Wing Extremism“, Golumbia attempts to make a case that “[these] political values are very literally coded into the software itself.”

The book was published in 2016 and appears to be an expansion of an earlier paper published in 2015. A colleague of mine made me aware of it before the holidays. It was admittedly a tough slog and I had to read it concurrently with Dave Collum‘s year-end review in order to stay sane.

Left unchallenged, we run the risk that this book could eventually attain a simulcrum of academic credibility, from which it could be used as a basis for future fallacious criticisms of the crypto-space. Think “Bitcoin is racist, everybody knows that. (Golumbia, 2016). The end.”

Golumbia himself is somewhat active, publishing articles for Vice and others in which his bio always features a reference to this book among his credentials. He also has another paper entitled “Code is not Speech”:

“Advocates understand the idea that “code is speech” to create an impenetrable legal shield around anything built of programming code. When they do this they misunderstand, or misrepresent, free speech law…The idea that government cannot regulate things because they are made of code cannot be right.”

His core thesis in “Politics of Bitcoin” is that:

in the name of this new technology, extremist ideas were gaining far more traction than they previously had outside of the extremist literature to which they had largely been confined. Dogma propagated almost exclusively by far-right groups like the Liberty League, the John Birch Society[* see update about JBS at end of article – markjr], the militia movement, and the Tea Party, conspiracy theorists like Alex Jones and David Icke, and to a lesser extent rightist outlets like the Fox media group and some right-wing politicians, was now being repeated by many who seemed not to know the origin of the ideas, or the functions of those ideas in contemporary politics. These ideas are not simply heterodox or contrarian: they are pieces of a holistic worldview that has been deliberately developed and promulgated by right-wing ideologues.

This passage sets the tone for the rest of the book, the premise follows this basic line of reasoning:

- Bitcoin was created out of a reaction to current monetary policy (The Fed / Central Banking / fiat money)

- Previous critics of The Fed were racist, far-right extremists such as John Birch Society and Eustace Mullens

Therefore… and this may sound like I’m exaggerating to make my point, but I’m not:

- any criticism of Central banking, the current monetary structure or “conventional mainstream economics” is right-wing extremism. And…

- This extreme right-wing ideology is “very literally coded into the software itself”.

There isn’t a lot to unpack in this, but for a short book there certainly an abundance of problematic material to address.

By the time you finish this review you’ll understand that this book can’t be considered a work of scholarship by the most generous reader as much as it is a piece of academic negligence. It’s a rant, chock full of fallacies and flat out factual errors. I’m astounded that the book passed through editorial review and (presumably) fact checking and made it to press in its current form. I had to check my quoted material several times to make sure I wasn’t reading it incorrectly.

Here we go:

Golumbia’s book has three big problems:

-

- It is predicated on logical fallacies: poisoning-the-well, invalid inferences, ad hominem characterizations skirting the edges of defamation, lack of supporting citations, this book has it all.

- Doesn’t show his work. Ever find yourself reading a book for what seems a long time and you catch yourself thinking “when is the guy going to put a point to some of this?”…and then you flip the page and you’re at the end? That exact thing happened to me here. Golumbia spends the entire book calling every heterodox opinion tantamount to right wing extremism, that it’s “literally coded into the software itself” and yet, never actually shows this to be the case. Even if I wanted to believe the core argument of this book, I would be nowhere closer to knowing just how “right-wing extremism is literally coded into the software” after reading it.

- It’s missing the errata section. The book contains key factual errors. Statements that are proveably incorrect and then proceeds to use them as scaffolding to build his case.

The Logical Fallacies (i.e Eustace Mullens was not Satoshi Nakamoto)

The recurring theme throughout the book is to wildly and spuriously designate any idea or premise that is orthogonal to conventional mainstream economics, especially any criticism of the U.S Federal Reserve, as by definition “right wing extremism” and “conspiracy theory”.

To wit:

that central banking such as that practiced by the U.S. Federal Reserve is a deliberate plot to “steal value” from the people to whom it actually belongs; that the world monetary system is on the verge of imminent collapse due to central banking policies, especially fractional reserve banking; that “hard” currencies such as gold provide meaningful protection against that purported collapse; that inflation is a plot to steal money from the masses and hand it over to a shadowy cabal of “elites” who operate behind the scenes; and more generally that the governmental and corporate leaders and wealthy individuals we all know are “controlled” by those same “elites.”

If you de-sensationalize Golumbia’s above quote, you can find all kinds of credible sources who both historically and in contemporary times have repeatedly warned on many of the above points who are demonstrably not right-wing, not extremists who have been tirelessly trying to make the dangers of the current system more widely known – at great personal expense.

But according to Golumbia, these are the kinds of views that make one a right-wing extremist idealogue (The phrase “right-wing” occurs 78 times, “extremism” and “extremist” occur 32 and 21 times respectively. The book is 62 pages long).

He lays the case by cherry picking a few racists from yesteryear, quoting their arguments against The Federal Reserve or in favour of gold-backed money and drawing an inference from those cases around all criticisms of the current monetary system – a logical fallacy known as “poisoning the well”.

One of the numerous examples of this practice is illustrated below:

The idea that inflation is a “destruction of value” and that the U.S. dollar has lost most or all of its purchasing power over the course of a hundred years has long been a staple of conspiracy theories, in no small part used by demagogues like Alex Jones to drive the unsuspecting toward purchases of gold and other precious metals

Why even mention Alex Jones here? Why not Kyle Bass, Ray Dalio, hell even Steve Jobs or some other credible, noteworthy and successful luminary who are also vocal critics of Fed policy as well as espousing allocating a portion of one’s wealth in gold and precious metals to protect against inflation?

Because it is clear by the time a reader gets to this passage that Golumbia has an agenda to stigmatize any criticism of the current monetary system and to delegitimize any action the citizenry undertakes to protect themselves from it (we’ll return to this quote below when Golumbia makes a rare attempt to actually debunk the notion that “inflation is bad” in an actual economic terms and fails spectacularly).

The reality is that we can entirely dispense with the likes of Eustace Mullens, Alex Jones or the John Birch Society and still have an overabundance of credible criticisms of the current banking system, with some pretty frank descriptions of what it does and how it adversely impacts the populace and from people well positioned to have a profound understanding of it.

Non-right-wing Critics of the Federal Reserve and central banks.

The idea that the Federal Reserve has an adverse effect on the economy and the population at large has been harder to ignore over the past 10 years. Since the Global Financial Crisis the Fed and central banks worldwide have:

- artificially repressed interest rates, penalizing savers, pension funds and other fiduciaries

- imposed negative yields on sovereign debt. Peaking at 17 trillion, there is currently roughly 12 trillion USD of negative debt sloshing around the world. Negative debt is a signal from the central banks, it means “we’re totally trapped”. My personal theory is that once you cross the Zero bound on interest rates, it’s like an event horizon – you can’t normalize without crashing the economy.

- massively expanded their balance sheets. This is a non-conspiratorial way of saying “printing money” (that’s what “Quantitative Easing” means)

- buying equities. Central banks pick winners and losers, buying equities of select companies with money created out of thin air. Example, the Swiss National Bank is now one of the largest shareholders of Apple, owing to their “Swiss franc stabilization programs” – where they create Swiss francs, sell them against the Euro to keep the franc down, then buy equities with the Euros. Nice work if you can get it (except I think any of us tried this at home, we’d go to prison).

- somewhat beyond their mandate to “stabilize prices and maintain full employment” the Fed was recently revealed to be shorting volatility, yet again an unprecedented intervention into market functioning.

The cumulative effect of this widespread and systemic intervention, and permanent mangling of, the financial markets has been to utterly and completely destroy the signalling and discovery mechanisms. Any defensive action market participants have taken to guard their capital against the inevitable drawdown these policies will produce were systematically undermined by yet more interventions.

It’s no wonder then, that capital would necessitate the creation of some manner of escape hatch to put itself beyond the reach of this institutionalized economic solipsism.

Does that mean that these documented facts are “Conspiracy Theory” or anyone who has issues with all this is a right-wing extremist?

Would that include Ralph Nader, who wrote this open letter to Janet Yellen on behalf of the “Savers of America”?

Please, don’t lecture us about the Fed not being “political.” When you are the captives of the financial industry, led by the too-big-to-fail banks, you are generically “political.” So political in fact that you have brazenly interpreted your legal authority as to become the de facto regulator of our economy, the de facto printer of money on a huge scale (“quantitative easing” is the euphemism for artificially boosting the stock market) and the leader of the Washington bailout machine crony capitalism when big business, especially a shaky Wall Street firm, indulges in manipulative, avaricious, speculative binges with our money.

Former head economist at the World Bank and Nobel laureate Joseph Stiglitz?

“If we [i.e. the World Bank] had seen a governance structure that corresponds to our Federal Reserve system, we would have been yelling and screaming and saying that country does not deserve any assistance, this is a corrupt governing structure.“

John Kenneth Galbraith?

The process by which banks create money is so simple that the mind is repelled.

who also cautions us:

Almost every aspect of its (Federal Reserve) history should be approached with a discriminating disregard for what is commonly taught or believed.

(Except if you go ahead and question the Fed you’ll earn a “right-wing extremist / conspiracy theorist” label from Golumbia).

There is also the lesser known Stephen Zarlenga, who was a registered Democrat and the co-founder of the American Monetary Institute and author of the exhaustive opus “The Lost Science of Money“. In 2010 Rep. Dennis Kucinich introduced Bill HR2990 which aimed to remove the money creation function from the Federal Reserve and revert it to the US Government which was based on an AMI blueprint for monetary reform.

Zarlenga summed up his life’s work in one sentence: “Over time, whoever controls the money system, controls the nation.” And his book documents how that repeatedly happened over recorded history:

Our Thesis

is that a main arena of human struggle is over the monetary control of societies and that control has been and is now exercised through obscure theories about the nature of money. If it had to be summarized in one sentence, it is that by misdefining the nature of money, special interests have often been able to assume the control of society’s monetary system, and in turn, the society itself.

(emphasis added)

Zarlenga captures the crux of it here. I’ve written about him before and it bears repeating here. The Lost Science of Money is broken out into four main sections:

- The Main Obstacle is The Mystification of Money

- Monetary History Has Been Ignored

- Monetary History Has Been Censored

- Monetary Data is Often Misinterpreted

Golumbia’s book is guilty on at least 3 out of 4 of these points.

(Those interested understanding the historical basis of our current system would also do a service to themselves by reading Vincent LoCascio’s “The Monetary Elite vs Gold’s Honest Discipline” and “Special Privilege: How The Monetary Elite Benefit at Your Expense“. )

Errors of Fact

These numerous fallacies aside, the rare occasions throughout the book where Golumbia tries to build his thesis on something specific he actually gets it wrong to degree which can only be called “cringeworthy”.

Inflation is a “Conspiracy theory”

For example, in the chapter “Central Banking, Inflation and Right-wing Extremism” he again tries to assert that “inflation is actually good” and anybody who thinks it isn’t is a right-wing extremist / conspiracy nut:

These ideas are not simply heterodox or contrarian: they are pieces of a holistic worldview that has been deliberately developed and promulgated by right-wing ideologues. To anyone aware of the history of right-wing thought in the United States and Europe, they are shockingly familiar: that central banking such as that practiced by the U.S. Federal Reserve is a deliberate plot to “steal value” from the people to whom it actually belongs; that the world monetary system is on the verge of imminent collapse due to central banking policies, especially fractional reserve banking; that “hard” currencies such as gold provide meaningful protection against that purported collapse; that inflation is a plot to steal money from the masses and hand it over to a shadowy cabal of “elites” who operate behind the scenes; and more generally that the governmental and corporate leaders and wealthy individuals we all know are “controlled” by those same “elites.”

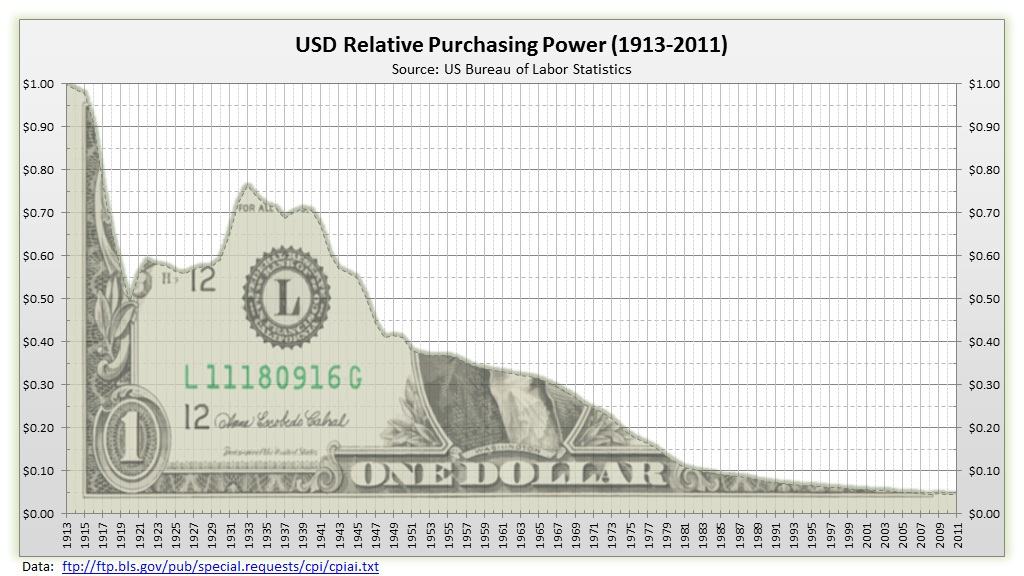

Whenever I try to explain to people what inflation really does, I – and many others – usually like a graph depicting the purchasing power of the US dollar since the inception of the Fed in 1913:

When you look at this graph you should also be aware of what happened with the dollar’s purchasing power in the 100+ years leading up to the creation of the US Federal Reserve. That was the era of the Classical Gold Standard it was mildly deflationary. The graphic below captures the 200 year span from 1800 to 2000. Also look at this table, which shows CPI (Inflation Rate) and the purchasing power of a dollar, year by year from 1800.

Golumbia unsuccessfully tries to debunk this reality:

The comparison of the value of US$1 between 1913 and 2009 is extremely deceptive, because it fails to take into account critical factors such as wage rates, the interest rate on savings, and the possibility of investing that US$1 in capital markets or in industry. A much less conspiratorial take on economic history would point out that US$1 invested in something as simple as a bank savings account using compound interest will typically be worth much more than the simple rate of inflation would provide by 2009; even slightly more aggressive investment would produce even more gains.

I don’t really know how to treat this assertion. “Wrong” doesn’t quite capture it. Economically speaking it’s incoherent, a non-sequitur.

He didn’t invent this, however. A few years ago some guy on twitter tweeted this exact idea and Business Insider, as they are wont to do, cobbled it and wrapped a “story” around it. I wrote about it at the time. I’ve seen similar arguments from proponents of Modern Monetary Theory (MMT) – more on that below, a rather fringe economic school of thought that elevates circular reasoning to an art form.

Today I can do a better job of articulating the problem with this premise: It confuses the purchasing power of a unit of currency with the nominal return of some asset or investment vehicle. By this same logic when one invests $1 into some stock and that stock goes to zero, does that mean the purchasing power of the $1 has declined? Certainly not. The same thing holds if the stock goes up.

Further, if you really do try to infer anything about the purchasing power of a currency unit in relation to investment gains from investing it, the relationship is inverted. If the asset goes up in value then the purchasing power of the currency relative to it is declining. This is what purchasing power actually measures: how much “stuff” a unit currency can, you know, purchase.

In other words, the returns earned on investments and assets (this includes savings accounts) tell us about the assets themselves and almost nothing about the purchasing power of the unit used to acquire them. I say “almost” here because those times when the return on assets do reflect on purchasing power of the currency unit it is because said purchasing power is in decline, perhaps rapidly – and capital is fleeing into assets, away from the currency. This is what happens in high inflation or hyper-inflationary events.

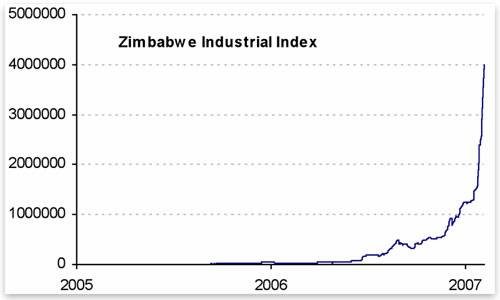

In 2007 the Zimbabwe had the highest performing stock market in the world in nominal terms while their currency collapsed. There is no difference between what happened there (or in any other hyper-inflationary event) and what Golumbia is trying to call the preservation of purchasing power of a currency unit, other than the speed and time horizon over which it is happening.

Golumbia expands on this premise that purchasing power hasn’t gone down if wages have gone up (an idea promulgated by MMT proponents such as Cullen Roche):

“Labor that earned US$1 in 1913 is likely to have earned around US$21.67 in 2009; and US$21.67 in 2009 buys about what US$1 did in 1913. This is no disaster, “hidden tax,” or “destruction of value”; but viewed in isolation and taken out of context, it can provide a completely distorted view of both labor and economic history.

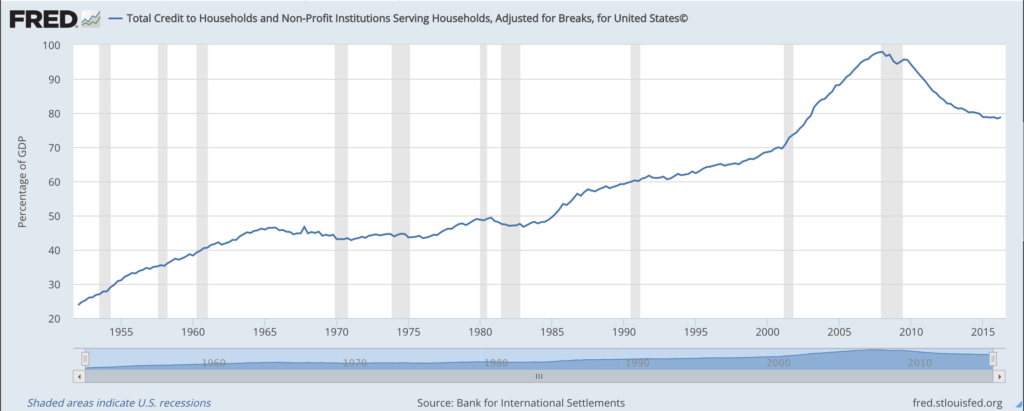

I’m not sure where people like Golumbia and Roche think wages actually come from. Maybe out of a money unicorn’s ass or something. Everybody’s wages are somebody else’s cost. If it used to take $1 to purchase a unit of labour and it now costs $21.67 then your currency units have lost purchasing power. The idea that wages rise at the same pace as inflation is a nice try by progressives and politicians to make it all seem “cost neutral”, but according to pretty well everybody keeping tracking of this, wage growth is chronically lagging both inflation and productivity gains. Just go out on the street and ask anybody if their wages are rising as fast as their cost of living. For the most part, no, which is why household debt is precipitously rising across most Western countries.

If there is still any doubt that inflation erodes purchasing power, let’s take a revered, orthodox central bank at its word, such as the Bank of England, which routinely refers to this erosion in their white papers:

“Real spot and forward rates The return on a nominal bond can be decomposed into two components: a real rate of return and a compensation for the erosion of purchasing power arising from inflation. “

Kansas City Fed chief Esther George said rather bluntly

I am not as enthusiastic or encouraged as some when I see inflation moving higher, especially when it has been driven by a sector like housing. Inflation is a tax and those least able to afford it generally suffer the most.

Or maybe that right-wing extremist Ben Bernanke, quoting that other demagogue, Irving Fisher

“As first pointed out by the economist Irving Fisher, interest rates will tend to move in tandem with changes in expected inflation, as lenders require compensation for the loss in purchasing power of their principal over the period of the loan”

(emphasis added)

Or even Alan Greenspan who as we all should know formerly ran the Fed…

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.

Make no mistake: Inflation debases a currency. Everybody knows it, from pension managers and fiduciaries over to FOMC committee members and leftist heroes like Ralph Nader. The only difference is the degree to which those in the know are willing to discuss this in polite company. It takes an act of willful cognitive dissonance to believe otherwise.

I am belabouring this point ad nauseum because Golumbia doubles down on his premise later in the book when he states that:

“Nakamoto seems not to have realized that his belief that Bitcoin would be immune to “debasement” was based on a flawed monetarist definition of inflation”

(emphasis added)

But as we’ve seen, it is not the definition of inflation that is flawed, it is Golumbia’s attempt to rationalize it. Profoundly so.

Wikileaks is illegal

Golumbia then tries to build a case depicting how Bitcoin is used to undermine the legitimate authority of the government by recounting it’s role in helping Wikileaks circumvent a blockade against its payment processors in 2010 (my company, easyDNS, was tangentially pulled into the blockade when Wikileaks’ DNS provider, Dynect, succumbed to pressure to yank the Wikileaks website offline and we ended up helping Wikileaks get a few of their sites back up.)

Widespread interest in Bitcoin first emerged from its utility as a means to bypass the “WikiLeaks blockade.” Bitcoin made it possible for individuals to donate to WikiLeaks despite it being a violation of U.S. law to do so.

(emphasis added)

The accusation here is that Bitcoin helped subvert the law. The only problem here is that it isn’t a violation of U.S law to donate to Wikileaks and it never has been.

When U.S politicians and institutions pressured private companies to sever relationships with their customers and then commended them for “breaking their contract” with Wikileaks (exact words of Senator Lieberman) , they were applauding behaviour which should normally get you sued in a court of law.

The fact is, there has never been a single legal finding or decision against Wikileaks in any jurisdiction. The closest thing one can find to one is when the Icelandic Supreme Court ruled in favour of Wikileaks and against Mastercard subsidiary Valitor. Finding that Valitor had illegally terminated their contract with Wikileaks when they blockaded their donations, the court fined them $6,000USD per day of the blockade.

In light of the actual facts, who acted illegitimately? The members and institutions of the US Government? Or those using Bitcoin to circumvent a extrajudicial financial blockade to make perfectly legal donations using their own money?

The monetary system in use today is called MMT

“…the majority of expert economic theory simply defines money as currency that is issued by a sovereign government. This theory is known as “Modern Monetary Theory” (MMT) or “neochartalism” and has its roots in economics going back at least to John Maynard Keynes, whose views have perpetually been a major target for every sort of attack from right-wing thinkers.”

Uh, no. One would be hard pressed to find a “majority of expert economic theory” that agrees on anything, but whatever the conventionally accepted norms are in this respect, they certainly don’t call the current monetary regime “Modern Monetary Theory” or MMT. I’m a bit surprised Golumbia didn’t go with its closely related cousin, Modern Monetary Realism (MMR) because that sounds less like a theory and more like “reality” (I said “sounds like”, not that it is).

In any case, he makes it sound like MMT is the name for the modern day monetary system and forms the basis of conventionally accepted economics, another factually incorrect premise. MMT is rather fringe, with among others, none other than mainstream economic apologist Paul Krugman being skeptical about it.

In a rather curious admission, Krugman cedes that MMT is in harmony with his own theories around monetary policy, but that when he thinks through how MMT as posited works “it would be quite likely that the money-financed deficit would lead to hyperinflation.“ (We’ll just leave that right there).

MMT is economically analogous to hooking up the outputs of a generator and a motor to each other and hoping for a perpetual motion machine. The TL,DR version is that a government that denominates its debt in its own currency can print as much money as it wants because it can make the taxes payable in only that currency. The taxation sucks up any excess inflationary pressures from the money printing, ad infinitum. That’s MMT in a nutshell.

In any case, MMT isn’t a majority consensus . Even most mainstream economists at least pretend that the central banks can’t print forever and that someday they’ll have to unwind their balance sheets …somehow.

Golumbia also invokes the name of Keynes to somehow confer more legitimacy on the premise and reiterate that disagreeing with Keynes of all people amounts to still more far-right heresy.

Keynes played an enormous role in modern economic thought but in my mind his work is largely misunderstood. His tenets have been grotesquely mangled and I suspect that were he to see what economic policies have occurred in his name he would be appalled.

Over the course of his life Keynes substantially modified his investment approach and economic beliefs. Gradually eschewing the idea that superior macro economic knowledge could give him an advantage in the hunt for investment returns, he ended his career as a prototypical value investor.

Economists love to cite Keynes for calling gold “a barbarous relic” (in 1924) yet later, in 1934, after his transformation he had fully two thirds of his net worth invested in South African gold miners. Interesting fact: Keynes was on the Board of the British Eugenics Society from 1937 to 1944 which gives me a certain schadenfreude from pointing out to any progressives who revere Keynes that this in fact made him a rrrrrrrracist!

Misuse of “literally” makes me figuratively insane

Stylistically, Golumbia tends to hold all these “right-wing extremists” to a different level of accountability than he does himself. On Andreas Antonopoulos’ “Mastering Bitcoin” he laments that the book:

“includes several substantial economic discussions in which extremist views are proffered, without attribution, as if they are simply commonsense analyses of relatively uncontroversial subjects. Antonopoulos offers matter-of-fact accounts of Bitcoin technology that incorporate conspiratorial theories about the Federal Reserve: [examples cited:] ‘bitcoin mining decentralizes the currency-issuance and clearing functions of a central bank and replaces the need for any central bank with this global competition [to mine for bitcoins]’ (2); ‘mining creates new bitcoins in each block, almost like a central bank printing new money'”

I don’t really see what’s “extremist” about those statements. He’s simply describing how bitcoin issuance of unit of currency contrasts to how the Fed does the same thing.

But Golumbia himself saturates his book with “substantial economic discussions in which progressive / leftist views are proffered, without attribution, as if they are simply commonsense analyses of relatively uncontroversial subjects”.

That includes a rather terse and matter-of-fact connection of goldbugs to conspiracy theory (again) and racism:

“[Ron] Paul claims to want the abolition of the Fed and a return to the gold standard, as if this would result in the kind of absolute economic freedom libertarians demand, which is itself a line of argument with deep connections to racist conspiracy theories in which Paul has long been implicated (see, e.g., “Ron Paul Sites” 2011).”

The citation of (See, e.g. “Ron Paul Sites” 2011) is where I would expect to see some kind of footnote or documentation of Ron Paul’s longstanding racism. There is no endnote which matches this citation. Of the book’s 10 endnotes, none of them speak to this. Are you supposed to google “Ron Paul Sites 2011 “? No idea.

Let me help you. The idea that Ron Paul is racist is frequently trotted out during his many presidential runs yet traces back to a single event, that some of his newsletters in the late 80’s or early 90’s allegedly contained inflammatory material. The letters in question weren’t even written by Ron Paul. They were ghostwritten – some theorize by Murray Rothbard or Lew Rockwell. The point is, from a guy decrying the lack of citations and attribution it’s an example of borderline defamation delivered as fact.

In multiple sections of the book when Golumbia attempts to delegitimize some aspect of criticism against the monetary orthodoxy he doesn’t actually address the dissenting ideas head-on, but cherry picks web comments left in response to some posting, or a discussion forum, leaving the source material alone and simply dismissing it as a cornerstone of right-wing extremist conspiracy theory.

The equivalent here would be if instead of isolating some of the innumerable fallacies and factual errors in this book and offering specific refutations of them I rather offered criticisms of the more sycophantic and adoring Amazon reviews. But then I would not have proven anything. And neither has Golumbia.

In a closing crescendo Golumbia cites somebody I’ve never heard of who floated an idea for an assassination marketplace that never launched, completed his flourish adding:

This is not to say that Bitcoin and the blockchain can never be used for non-rightist purposes, and even less that everyone in the blockchain communities is on the right. Yet it is hard to see how this minority can resist the political values that are very literally coded into the software itself.

(emphasis added)

I almost audibly exclaimed “finally!”, thinking we had at what seemed like long last, gotten to the part in the book where Golumbia was going to now show the reader exactly where the right-wing extremism was “very literally coded into the Bitcoin software itself” …and I eagerly turned the page…whereupon I reached the end of the book.

Closing Thoughts

Let’s face it, Bitcoin is a movement born from protest. If the people behind it thought that the monetary system was fairly structured, that those who control it exercise legitimate power to the benefit of wider society and that an egalitarian democratic ideal was at work, functioning largely as intended; then nobody would have bothered to invent it.

The opposition to Bitcoin and the wider crypto-space is following a predictable arc, very similar to the early Internet days: it facilitates criminality, it will destabilize everything, and in a plot twist peculiar to this specific point in history, it is, like anything else progressives and self-appointed social justice warriors disagree with: extremism and racist:

“Many of these debates over new technologies are framed in context of risks to moral values, human health and environmental safety. But behind these concerns often lie deeper, but unacknowledged, socioeconomic considerations”.

Calestous Juma, “Innovation and its Enemies, Why People Resist New Technologies“

The reality however, the driver behind the hostility is the existential threat a technological innovation such as a decentralized extraterritorial monetary system poses to entrenched vested interests:

“The face-off between the established technological order and new aspirants leads to controversies…perceptions about immediate risks and long-term distribution of benefits influence the intensity of concerns over new technologies”.

(Ibid)

Given the stakes, it’s not uncommon for a book like this to appear, but it is important that it be widely known that the book itself offers no substantive rebuttal of the emerging paradigm and is, consciously or not, a smear campaign proffered under the veneer of scholarship:

“One of the most favored propaganda tactics of [the establishment] is to relabel or redefine an opponent before they can solidly define themselves. In other words, [they] will seek to “brand” you (just as corporations use branding) in the minds of the masses so that they can take away your ability to define yourself as anything else….

Through the art of negative branding, your enemy has stolen your most precious asset — the ability to present yourself to the public as you really are.

Negative branding is a form of psychological inoculation. It is designed to close people’s minds to particular ideas before they actually hear those ideas presented by a true proponent of the ideas. ”

Brandon Smith, alt-market.com

He is absolutely correct in diagnosing this phenomenon. In particular, Golumbia’s “Politics of Bitcoin” has said absolutely nothing about Bitcoin itself, merely throwing fallacious strands of “racism”, “conspiracy theory” and “extremism” at the proverbial wall and hoping that something will stick.

A recurring theme throughout Golumbia’s book is around the accumulation of excessive power in private hands, something he sees the State as the counter-balance and his concern is that crypto-currency, given its general refutation of the orthodox monetary regime, is aligned to upset that dynamic; pushing more power unchecked into private corporations.

We might say that right-wing politics sides emotionally and practically with power—it identifies with power, and via this identification works to ensure that nobody interferes with the concentration and exercise of power. On this view, left-wing politics is specifically focused on the limitation of power, on mechanisms for distributing power equitably, and on the excesses that almost inevitably emerge when power is allowed to grow unchecked.

This is an old debate, which concentration of power is unchecked and out of control? Private companies, no matter how large they get will still always be subject to the vagaries of competition. The bureaucratic monolith of the State, not so much.

I too worry about the influence of Google, Facebook, Amazon (that was the impetus behind Guerrilla-Capitalism in the first place), but I don’t see the government acting to limit the reach of these behemoths as much as allowing them to operate quasi-monopolies in exchange for their capability to assist the state in their quest for wholesale surveillance of the citizenry and the obliteration of privacy.

There are legitimate criticisms of the Bitcoin / crypto spaces. Even Brandon Smith, whom I just quoted above, is somewhat skeptical.

As I’ve written before about easyDNS’ involvement in Ethereum Name Service development, “there will be governance”. The grand experiment of the crypto space will succeed or fail to the degree that it can create governance structures, perhaps competitive decentralized ones, that can function effectively before the world governments do it for us.

We’ve been here before. In the early 2000’s there were Digital Gold Currencies (DGCs) like E-gold, pecunix and goldmoney. I went on record that e-gold’s lack of governance would be its downfall and I was right. E-gold was soon gone, while Goldmoney – under the stewardship of James Turk and his brother, operated with an even handed, rigorous governance structure. Surprise: Goldmoney still exists to this day and has merged with Bitgold, actually fusing DGCs with Bitcoin, while e-gold is dust in the wind.

The crypto-currencies that successfully create a governance structure around their ecosystems will succeed, those that don’t won’t. There is a very specific Achilles Heel to the current crypto space and I’ll be writing about it next time in my final Bitcoin piece before I return to the core mission of Out Of The Cave (which is how the small to medium sized business can successfully compete with 800lb gorillas within a wave of centralization and consolidation).

Golumbia however, seems to be playing his role within this debate along well known and easily anticipated lines. A self-described “nocoiner” and “Lawful Good Elitist Priest class” brings the obvious historical parallels to mind:

“Vested Interests

One vivid historical account of the tensions over innovation is illustrated by the case of the Luddites in England. In fact, concerns about mechanization predates the Luddites. The popular narrative portrays Luddites as machine breakers who were simply opposed to change. But the situation was more complex than just opposition to new technology –it represented a clash of competing worldviews and moral values. In many cases responses to new technologies depend on the extent to to which they transform or reinforce established wordviews, values or doctrines.”

(Juma)

Speaking of legitimate criticisms of the crypto space, there are far more credible critics than Golumbia. Jim Rickards comes to mind – a trained economist who actually understands finance and history, Rickards hasn’t been shy about his misgivings around Bitcoin. But he keeps those criticisms on point and has the background, knowledge and experience to do so without the need to put on that broken record of the social justice repertoire: “extremism” and “racism”.

In closing, to those who would be dedicated to delegitimizing crypto-currency, Golumbia’s book follows the progressive playbook:

- demonize the phenomenon through spurious linkages ✓

- arbitrarily define all dissenting opinion as right-wing extremism ✓

- fallaciously link in racism ✓

- build the narrative on a foundation of factual errors ✓

- avoid specific refutation or examination of target material ✓

Bitcoin Magazine’s Giulio Prisco called this book “A masterpiece of sophistry” but I think he’s being charitable. It’s not even very good sophistry. I think Saul Alinsky would have graded it a C minus.

Update:

* In this article I cited John Birch Society as among examples of far-right extremist groups without being familiar with them. After listening to this Tom Woods interview with John F. (“Jack”) McManus about the JBS I realize that I simply unquestioningly accepted Golumbia’s designation of JBS (and others) as “far-right extremists” despite my own criticisms of his book that his definitions of such were arbitrarily sweeping and misused to nullify legitimate criticisms of central banking and the Fed. I should have known better.

If you want to follow my work on Guerrilla-Capitalism, sign up here.

I can’t help calling to mind Wolfgang Pauli’s put down of a fellow physicist’s incoherent nonsense: “Not even wrong!”

You have done a great job in analysing a work of nonsense. I should have been tempted to summarise as: “If I could find anything substantive with even a glimmer of apparent validity, I should have attempted to frame an answer.”

On the issue of inflation: I have sometimes wondered whether it might be the fairest form of taxation. The only problem is that you can only inflate when people believe the currency has some value to start with. That means either precious coinage (which can be debased slowly, as was done in ancient times), or requiring some other general tax to be paid in the currency.

We have become used to a world where general prices rarely fall, so economic actors are slow to cut nominal prices when the market demands it. Inflation has become a tool to overcome the psychology of never allowing prices to fall. The central bankers fear that currency will be hoarded during a deflation, so prefer the continual breaking of the value promise that inflation represents.

“On the issue of inflation: I have sometimes wondered whether it might be the fairest form of taxation. ”

Frank Zappa (of all people) once suggested in his book that income tax should be eliminated and replaced with a universal goods and services tax. His reasons were pretty sound (including that even though criminals hide income, they all spend money) and it would scale evenly across the income curve.

Mark,

Nice informed post. I was particularly impressed with the following: “The crypto-currencies that successfully create a governance structure around their ecosystems will succeed, those that don’t won’t.”

In the interest of full disclosure, I help with the governance structure of Dash. I would appreciate it if you would spend a few minutes seeing exactly why Dash will succeed and Bitcoin will fail.

https://www.dash.org/governance/

Hello Mr. Jeftovic,

Thank you for your review. I enjoyed reading it. You are a powerful writer.

I just finished Golumbia’s book myself, and I wonder if I may offer a dissenting viewpoint from yours: The book doesn’t say that all criticism of the Fed is necessarily right-wing. Rather, the book says that the Bitcoin community’s criticism of the Fed, which is focused on its ability to print money, is ALSO used by the far-right as part of a wider right-wing philosophy. He talks about ideologies and how they can be spread on page 40.

Golumbia doesn’t bother claiming that the Fed is above reproach because the focus of his study is the Bitcoin community’s relationship to the Fed, especially as compared to the far-right’s relationship to it. He doesn’t investigate the Fed. He investigates the Bitcoin community.

Golumbia’s concern is that the supposedly apolitical Bitcoin and the far-right’s rhetoric are identical regarding the Fed’s authority to print money, and thus Bitcoin promotion, in addition to whatever good it may be doing, is ALSO spreading far-right ideology wrapped in a delicious, technologically revolutionary tortilla.

Don’t you think that’s a more accurate reading of the text?

My interactions with Golumbia indicate otherwise. He completely rejects the very basic mechanism of inflation as an erosion of purchasing power, in fact he misunderstands basic economics so profoundly that it is near comical. He thinks the BLS calculations on the purchasing power of the dollar over time demonstrate that the purchasing power as increased, not eroded. He then claims that any arguments that inflation erodes purchasing power (which is almost a truism) is right-wing extremism and conspiracy theory.

Further the idea that criticisms of the Fed should be rejected because they ultimately originate from right-wing sources is, as a noted in the article, a type of logical fallacy. It doesn’t matter what that political leanings are of anybody originates a criticism of Fed policy, only the policy and the criticism should be examined (or dismissed) on their own merits.