My last couple of posts, the first on why a China-style Bitcoin ban can’t happen in Westernized liberal democracies and the second on how cryptos are a beneficial counterforce to the coming CBDCs seem to have a hit a nerve.

More people than usual made the trip all the way over here to my blog to be sure to tell me how clueless I am and there was a lot of defeatism in the comments on Zerohedge that all converged around a theme that governments will simply not permit the use of cryptocurrencies once their existence ceases to suit them.

I’ve been involved in cryptos since 2013, and for a long time I too was strategizing out the game theory around why would governments permit cryptos to gain traction.

It wasn’t until relatively recently, that I started to fully grasp something I read a long time ago, before all this crypto business ever started. It was in a rather obscure book by one W R Clement called Quantum Jump: A survival guide for the new Renaissance and it helped me understand the key point of today’s post.

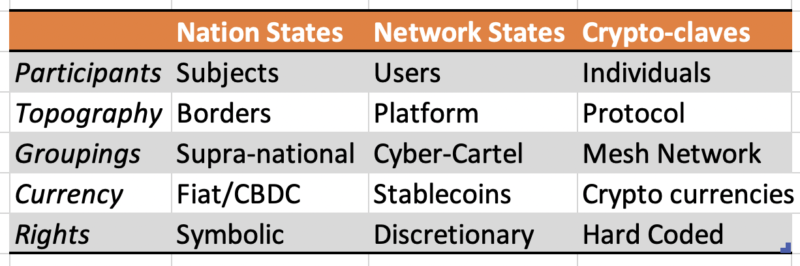

I started alluding to it in A Network State Primer that described how what we understand as “the nation state” is in the process of losing relevance to ascendent network states and crypto-claves. You can chart out the structural differences between those three different governance models based on what the architecture of the monetary layer is:

When it comes to technological leaps like the internet and then public key cryptography and decentralized, non-state, sound money; those who eschew the new paradigms generally do so because they have difficulty fitting the new model into their worldview.

People like Alvin Toffler called this “Future Shock” and he ascribed it mostly to an accelerating rate of change. He wasn’t wrong about that, but what Clement layered atop of that was the ascending level of abstraction.

In the 1400’s the seemingly innocuous discovery of perspective opened the floodgates to the Gutenberg Press and double-entry accounting which opened the path for the Renaissance, the Enlightenment and the Industrial Revolution. Each revolution occurred despite the objections of the incumbent power structures of their day, and that made for volatile, even violent transitions.

In the mid-90’s people were trying to wrap their heads around “cyberspace”. Somebody once wrote in Mondo2000 (I can’t remember who it was, sorry) that “cyberspace is where you are when you’re on the phone”. Meanwhile US lawmakers were calling the internet “a series of tubes”.

That contrast results from differing levels of abstraction.

Which brings us to the entire point of today’s post.

Levelling up to the next plateau of abstraction alters the architecture of the intellectual constructs upon which systems are based. What worked at the lower level of abstraction not only doesn’t work at the higher abstraction levels, it malfunctions. Clinging to it creates absurdities. Atrocities.

Further, once the level of abstraction jumps, it is the proverbial Promethean dynamic. In this chapter of history, Satoshi has stolen the secret of fire from the Gods and given it to the people. (He did so anonymously, I presume, in an effort to avoid the part where his gizzard is eaten by vultures for all eternity).

But it’s done now, humanity possesses the secret of decentralization and cryptography and nothing short of a complete and total system collapse can undo the newfound cognitive horizons that will accompany it. If society stays on the rails, then the new model will keep spreading at that higher level of abstraction and it will keep accelerating.

In other words, now that cryptos have created non-state, decentralized, open source money, the dynamics of finance and economics have irrevocably changed. There’s nothing the priests of the temple at The Fed or the IMF can do to unchange it.

Any attempt by nation states and central banks to preserve the old system, to extend the lifespan of their fiat currencies by porting them into digital forms like CBDCs are simply trying to linearly extrapolate something into a landscape that has a completely different structure. Faster horses in a new era of cars.

This is what no-coiners do not understand, granted, because many of them are engaged in livelihoods which depend on them not understanding it:

It is not a question of whether governments will permit Bitcoin and cryptocurrencies to exist.

It is a question of whether governments can successfully adapt to the new reality created by the dawning of the decentralized era.

So while policy makers can and will regulate the on-ramps and off-ramps (the exchanges), this is to be expected and it’ll be around these chokepoints where some sort of equilibrium between these two monetary universes will take form.

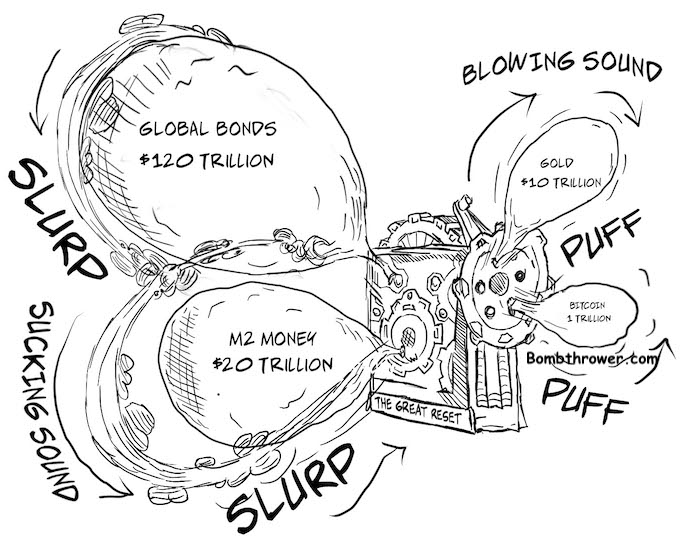

This diagram depicts the core thesis of The Crypto Capitalist Letter. It’s that the institutionalized financial repressions of NIRP, ZIRP, targeted inflation and coming regimes of UBI, MMT and CBDC-driven social credit are such that capital will exodus from the global bond and fiat bubbles over into the anti-fiat world. Anti-fiat includes gold and silver, it includes real estate, income producing businesses, commodities, intellectual property and cryptos.

It is true that regulations can ramp up and clamp down and become more repressive, for awhile. But as we’re seeing in the world today, the pandemic emergency response is wearing thin and people’s patience for things like lockdowns and mandatory vaccinations is beginning to wane. Here in the West, people were willing to have their freedoms curtailed to meet the exigencies of a global crisis, but they will not countenance government overreach as a way of life. In an ironic sense, the kind of Big Government that may have previously taken decades to creep into intolerable levels may have just accelerated its own rejection and obsolescence with the near ubiquitous, rampant mishandling of COVID.

No matter what happens, the nation state monopoly over the issuance of money is over. That’s why it really doesn’t matter if governments “ban” cryptos. Increasingly higher levels of wealth and capital that are moving into the crypto economy are on a one-way mission: it has no intention of ever returning to the fiat side of the system.

I cover this dynamic extensively in The Crypto Capitalist Letter, a long with a tactical focus on publicly traded crypto stocks. Get the overall investment / macro thesis free when you subscribe to the Bombthrower mailing list, or try the premium service for a month with our fully refundable trial offer.

I would add to stablecoins the corporate coins like Stellar and Ripple (XLM, XMR). I was entirely unsurprised about Zoom buying Keybase because Keybase already did a deal with Stellar. They are proto-network-states, and of course the brands will look different but the owners are gonna be the network state oligarchy.

"the dynamics of finance and economics have irrevocably changed. There’s nothing the priests of the temple at The Fed or the IMF can do about it."

Here's what states can do:

1. Declare cryptocurrencies to be securities

2. Require cryptocurrencies to pass regulatory hurdles to be listed on domestic exchanges.

2. Introduce KYC/AML requirements to quarantine shady offshore exchanges like Binance from regulated, domestic exchanges like Gemini and Coinbase.

People's ability to use crypto to evade capital controls, tax authorities, etc, at scale evaporates, because their ability to exchange crypto for dollars is now limited to the black market.

"capital will exodus from the global bond and fiat bubbles over into the anti-fiat world"

Capital is still paying taxes, issuing securities, and settling accounts in fiat, because they're required to by law. You greatly, greatly underestimate the state's ability to seize your property and put you in jail if you're annoying it too much. Remember ICOs? That was supposed to be the hot new thing, and after the US government put a bunch of people in jail for securities fraud, well, you haven't heard much since, have you?

1-3 wont matter of those will matter for decentralized exchanges/protocols/stablecoins (esp those with no blockable assets like USDT/USDC or overcollateralized to minimize that risk), cash for token on/off ramps that have always existed, and crypto for goods/services (which is very popular in some EM countries) without leaving the blockchains.

There have been about 5700 ICO's and sec has only gone after 27 between 2016 and 2020. Initial DEX Offerings (IDO) have largely replaces those for tokens on chains (obviously nft hype has largely outshadowed alot of the newer defi stuff going on now).

If a DAO's funds are controlled by decentralized governance, and one does not give up control over their individual private keys, it will be impossible to seize funds outside of extraordinary means that are available to any actor in the world (i.e hacking the protocol which gets increasingly harder due to the constant attacks and audits for largest protocols, or buying out existing governance token holders).

DAO's in name only that are incorporated and centralized exchanges have the most to lose, and decentralized exchanges and protocols will get their users if those are shut down.

"1-3 wont matter of those will matter for decentralized exchanges/protocols/stablecoins (esp those with no blockable assets like USDT/USDC or overcollateralized to minimize that risk), cash for token on/off ramps that have always existed, and crypto for goods/services (which is very popular in some EM countries) without leaving the blockchains."

You can't access USD for anything at billion-dollar scales without access to SWIFT, because at that scale, you're dealing with dollars that only exist electronically in the federally controlled banking system. If the USG pulls the plug on Kraken and Coinbase, you're back to making small-value exchanges for Amazon gift cards. On/off ramps with no SWIFT access can't handle something the size of the US economy and aren't in any way a threat to the USD.

You're using jargon to paper over a very real issue: when you operate at scale, you're not hard for federal regulators to find. At its peak, total crypto volume in Venezuela was about $300m for the year. This is less than 0.1% of Venezuela's economy. So, no, there's no evidence here that crypto can escape a government and scale up, not even one as incompetent as Venezuela's.

"There have been about 5700 ICO's and sec has only gone after 27 between 2016 and 2020."

In other words, all the feds have to do is prosecute about 1 out of every 200 people involved, and they can drive something out of public markets. That doesn't bode well for the future of crypto.

> You can’t access USD for anything at billion-dollar scales without access to SWIFT

You are wrong because, its not about dealing with USD directly, but denominating things in USD. You can swap into USD deposits from any currency as long as currencies around the world float agaisnt another.

> You’re using jargon to paper over a very real issue

Your ignorance of basic concepts in the cryptocurrency space and how decentralized protocols (can) work will not paper over the reality that there is no all powerful actor that can stop anything that happens on chain unless the protocol/chain was explicitly constructed for such.

> So, no, there’s no evidence here that crypto can escape a government and scale up

Its continued existence is evidence enough. Since 2008 with ever increasing intervention by governments around the world it has thus far avoided such and usage has grown (as well as adoption by major banks and a few minor governments around the world). Diktats mean nothing to decentralized protocols except for short term bottlenecks against those who are least informed how things actually work, who would rather imbue governments with magical powers at being able to do things.

Maybe it’s not evidence for you, but your perspective of what is evidence does not matter for those who use the tech everyday and have their assets on chain. If governments want a say in defi, they will need to construct protocols that people will want to actively use, just like everybody else.

> In other words, all the feds have to do is prosecute about 1 out of every 200 people involved, and they can drive something out of public markets. That doesn’t bode well for the future of crypto.

1 ICO/IDO does not map to 1 person, you can have a bunch of anon’s be behind ICO/IDO. People have been projecting the their doomsday scenarios on cryptocurrencies since its genesis (and even before that with cryptography export controls in the 90’s lol) and ignore that its centralized predecessors were easily stomped out. And even if the government decide metadata drone strike 1 person (with a bunch of collateral damage lol), it does nothing to the protocols already deployed on chain that are decentralized in governance.

MPAA had to learn the hard way (and still fights it tooth and nail), that just because you decided to waste resources going after individuals, in no way shape or form threaten the long term adoption usage of p2p and decentralized technology. I hope governments continue to waste more and more resources with their sisephean efforts to controlling such.

What does or rather how does this impact those of us who are still purchasing gold and silver?

The massive "money" printing can only end badly. How bad and when I don't know, but the Governments will continue until public confidence in the fiat stops, remember Margin Call?

What government fails to appreciate is that unlike fiat currencies, their introduction of CBDC will have competition. Bitcoin has a limited supply; only 21 million will ever be mined. CBDC's, like their fiat counterparts, will have unlimited supply. Where would rather invest your money?

Secondly, as the central banks of the world's major currencies continue to print tens of billions every month, how long before confidence is lost in those currencies? How long before the markets realise that the debt can never be repaid and interest rates will never return to historical norms? Investors will be looking elsewhere to protect their wealth, never mind seeking a return on investment.

The problem I have with crypto – is there there is no way to protect the ends of the transactions. You can be held at gun-point, until you give up your codes (John McAfee, anyone?). If you want to pay for anything with it, there's a record (for all time) which will link you to past payments on your behalf. This data is ripe for exploitation. Any security failure on your part, or any part of your suppliers (do you code your wallets? your own OSes? do you create your own IC chips – to prevent backdoors?) can expose you (privacy) or your valuta (tied up in bits) to exposure. You can't even 'own' your assets without a net connection to access the ledger. That's not even getting into the huge underlying fundamental problems of closed systems (Bitcoin at 21 million). Open crypto systems aren't much better.

So, there are some assumptions in your thinking – that the states are just going to let people have and use crypto. They are going to discover people using it, and they will use the records to convict them, and seize the crypto. Who was the biggest owner of bitcoin in the world? US Gov, after seizing everything associated with Silk Road. How did crypto protect the assets of people involved there? It did not.

Governments love crypto on the downlow. Even better than credit card virtual money. And this doesn't even count all the fraud, pumping, etc that's happening between fiat value in relation to crypto value – which is what every end user needs to do, to get goods and services out of the network.

TL,TR people can be coerced into stuff. None of it unique to crypto. What is unique to crypto is even if a transaction can be traced, there’s nothing anybody can do about it. That’s the value of crypto, the ability to circumvent capital controls and confiscatory wealth redistribution. schemes.