The following excerpts are from Tragedy and Hope. They detail the monetary environment from 1914 to the 1930s. When looked at independently the context helps explain the confusion we find across today’s monetary landscape.

These passages help us better understand money and the lack of order that takes hold when international players desire a change to the system. The greatest challenge then and now was the battle between real wealth and claims on wealth.

With the creation of the FED, the intent was to have a system of central control of the money supply, to provide a backstop in times of crisis, and to have a gold-based monetary system.

However, the outcome led to a handful of powerful global bankers rather than a few powerful centralized institutions.

While the mandate of the FED is said to be price stability and maximum employment, its actions arguably have been the opposite. Making it hard to resist the temptation to assume the goal was actually to empower and enrich the pockets of a few global investment bankers.

Shedding light on the inner workings of the FED and BIS exposes a few harsh truths. It reveals a century’s worth of bankers who have chosen personal gain and growth of personal net worth over mandates of stability. These means have filtered down to the everyday politician who trades by day and passes bills to benefit those trades by night.

Unfettered access to the cookie jar gives one the ability to control flows of credit across the globe.

This power is hard to ignore and easily takes precedence over the intent of price stability and employment. Especially, when “no one’s looking”.

In a post-2007 world, we find ourselves sitting with a very similar backdrop to the early 1900s.

- Global strife due to inflation and a currency system imbalance.

- Unsustainable global debt in the primary global reserve currency.

- Increasingly levered institutions and individuals.

- An upstart money/currency promising to reinstill a gold standard and promises to balance budgets while restoring exchange rates.

This is Bitcoin in 2024. It Was the U.S. Dollar in 1914.

What Bitcoin does that the dollar or any other fiat can’t do at this point is increase real wealth in the community.

An economist or central banker will tell you this is bad because it leads to deflation.

Yes, in an inflationary system like the one we currently have, that is true. However, in reality rather than in economics, deflation is not a bad thing. It is not bad that your cost of living should decline rather than increase over time. Unfortunately, it takes from the banker and gives to the individual. Therein lies the problem.

Deflation in this sense is good, as it allows prices to fall for those who make sound financial decisions, save, and hold money; sound money. While taking from those who choose to lever up or hold a debt-laden money. Money that pre-spends its future by pulling it forward into today.

This is the flaw of fiat currencies like the dollar.

They are debt based. They pre-spend our future without any intention of thinking about how the piper must be paid.

Gold, and now Bitcoin, play this deflationary role. Gold has for centuries and Bitcoin will in the digital century.

What Bitcoin does that the dollar or any other fiat can’t do at this point is increase real wealth in the community.

An economist or central banker will tell you this is bad because it leads to deflation.

This is the flaw of fiat currencies like the dollar.

They are debt based. They pre-spend our future without any intention of thinking about how the piper must be paid.

Gold, and now Bitcoin, play this deflationary role. Gold has for centuries and Bitcoin will in the digital century.

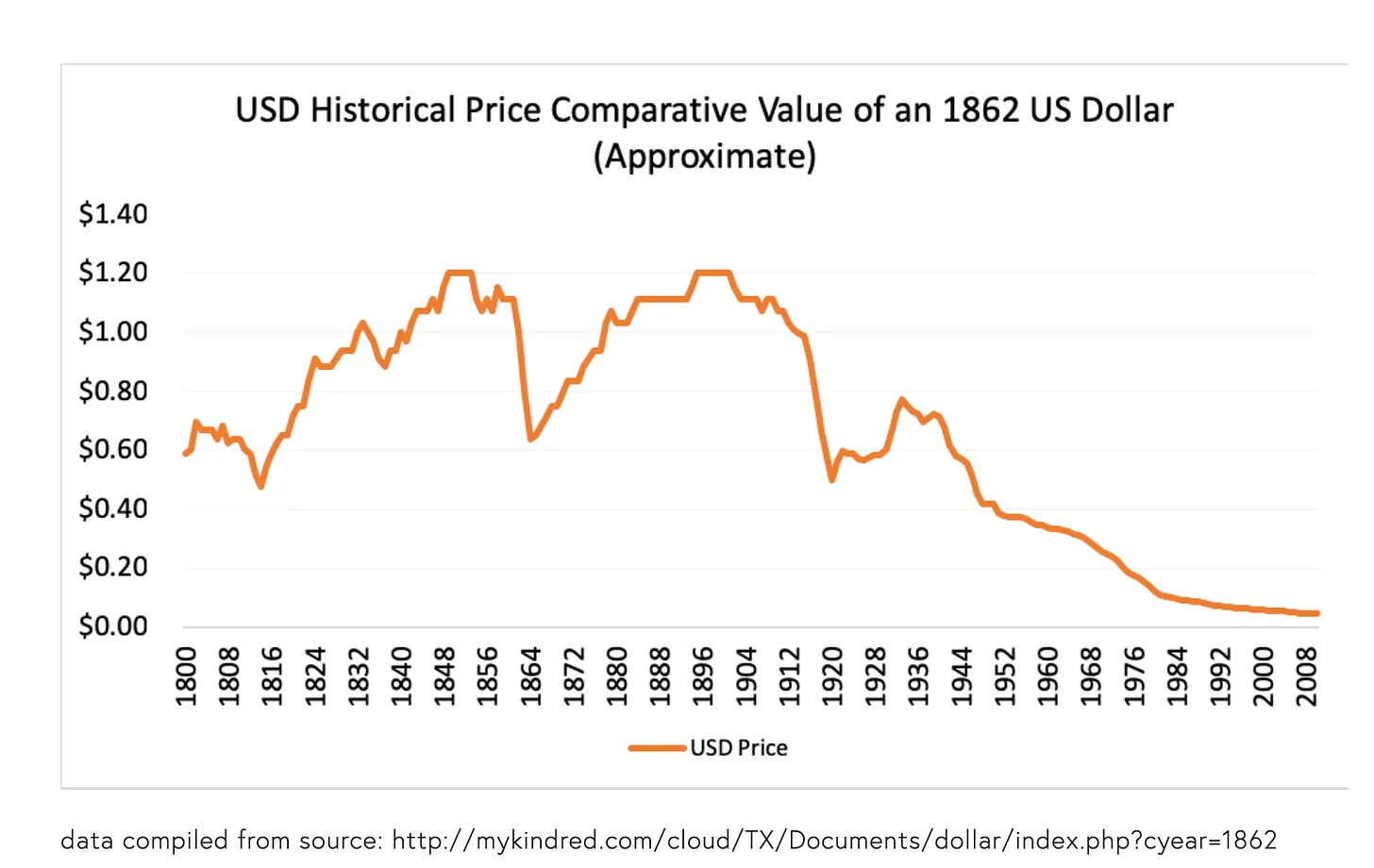

In the early years of the dollar, 1800s and early 1900s, it played a similar role. A rising asset that allowed for more purchasing power (real wealth); until it was commandeered by international bankers in 1913.

That was the moment when devaluation became the method chosen, as there were only three options to solve the economic issues at hand.

(a)to increase the production of real wealth; (b) to decrease the quantity of money; or (c) to devaluate, or make each unit of money equal to a smaller amount of wealth (specifically gold).

… The third method (devaluation) was essentially a recognition and acceptance of the existing situation, and would have left prices at the higher postwar level permanently. This would have involved a permanent reduction in the value of money, and also would have given different parities in foreign exchanges (unless there was international agreement that countries devaluate by the same ratio). But it would have made possible prosperity and a rising standard of living and would have accepted as permanent the redistribution of wealth from creditors to debtors brought about by the wartime.

Today, we battle the problems left by the choice of devaluation.

Sure, it led to a hundred years of the appearance of wealth and the appearance of rising standards of living. However, it shrank the pool of wealth and in a post-2007 world, the piper is here to be paid.

Prices have remained permanently high, forever. The value of money has been reduced forever; by 92-99%. The parity difference between foreign exchange markets was broken by negligence, incompetence, and caused immigration to be the tool of destruction.

These challenges could have been avoided but one must make a tough choice by choosing sound money. Money that builds real wealth and destroys claims on wealth. That is the choice today’s central banker seeks to avoid, again.

Why? Because it requires erasing the appearance of rising living standards. It brings forward truth, and bankers would rather crank up the music instead. They’d rather continue on, pulling chairs away while everyone dances. Because they know most won’t notice, and there isn’t a reliable system of accountability to hold them responsible.

Get on the Bombthrower mailing list here and receive a free copy of The Crypto Capitalist Manifesto, which outlined all this. However, by the time you read this it may already be too late to sign up for The Bitcoin Capitalist Letter: new subscriptions will be closed once Bitcoin hits a new all-time high.

Subscribe to Kane McGukin’s Substack here.

That light-gray font is very hard to read. Please make it black, color code 000000, and quit trying to "soften" it!

How about now?