“[Bitcoin] won’t end well, it’s a fraud…worse than tulip bulbs…[but] if you were a drug dealer, a murderer, stuff like that, you are better off doing it in bitcoin than U.S. dollars,”

— Jamie Dimon: CEO, JP Morgan

Headline: JPMorgan Guilty of Money Laundering, Tried To Hide Swiss Regulator Judgement

— via Cointelegraph

Given the current, latest successive series of spikes to all time highs for Bitcoin, the detractors are working overtime to make the case that the crypto-currency is a Ponzi, a scam, a phantasm or at the very least, a bubble. Oddly, many of these same detractors spend a lot of time cheerleading the other bubble, that everything-bubble, stocks, bonds, real estate, even ETFs of ETFs, you name it.

It’s easy to make superficial apples-to-screwdrivers comparisons about why Bitcoin is doomed to fail. Until you really take some time to look into it. When first was exposed to the idea back in 2013 and researched it, I realized that “this really is different”, and the reason why was because of something John Kenneth Galbraith had once written which (until then) had invariably held up as true. In A Short History of Financial Euphoria Galbraith said:

“The world of finance hails the invention of the wheel over and over again, often in a slightly more unstable version. All financial innovation involves in one form or another, the creation of debt secured in greater or lesser adequacy by real assets.”

(emphasis added)

When one looks at the history this accurately maps every financial bubble from Tulipmania (which we will debunk as a suitable metaphor for Bitcoin shortly) right up to 2008 and beyond.

However one place where it isn’t applicable, is to the phenomenon of Bitcoin. Crypto-currencies, at least at present, have no leverage and are near impossible to purchase on credit. In other words, if asset bubbles get that way largely through leverage, and there is comparatively no leverage in Bitcoin, then something else has to be driving it.

That said…

The Price of Bitcoin is a Side Show.

Granted, at the moment it’s a very exciting sideshow for those who are on the train. A long time customer emailed me as I was writing this asking “at what point has easyDNS’ profits from accepting and holding bitcoin exceeded the actual operating profits of the company?” I had never considered that but some quick math revealed that even after cashing a chunk out to buy gold (not my greatest trade), that happened last year.

But the price action around this isn’t what is exciting about Bitcoin and the crypto-currency revolution. What is exciting is that the centralized, bankster controlled monopoly over the issuance of money itself is finished. It’s over. Even if they successfully manage to co-opt some major crypto-currencies or issue their own, Gresham’s Law will assert itself as capital managers will select a truly decentralized crypto-currency wherein they control, or have the option to control, their own private keys to safely store their wealth while they’ll use the government version to pay taxes, etc.

Whatever state issued digital cash comes out in the near future, I’m suspecting it will be centralized with mandatory key private key custody or escrow. When that happens it shouldn’t even be called crypto-currency, call it something else like “pseudo-crypto” or “fauxcoin” to differentiate.

Given the mostly bad analogies and unfounded criticisms being levelled at Bitcoin, let’s first take a serious look at what Bitcoin isn’t. Then in Part II we’ll look at what it is and why its different.

What Bitcoin Isn’t

Backed by nothing

This is the goto criticism for people who simply don’t understand that crypto-currencies are based upon mathematics, zero-trust, open-source and consensus. They think that bitcoins can simply be created at will and are backed by nothing.

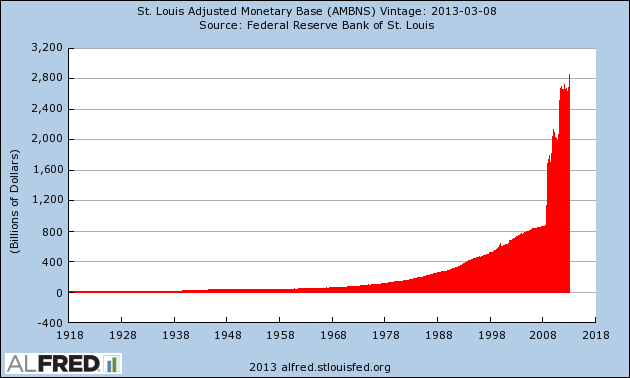

They also say that as if the world’s reserve currency, the US dollar, isn’t, literally, backed by nothing and hasn’t been since 1972; and as if can’t be created at will, which it most certainly has, with a vengeance.

Indeed as Galbraith continued in our earlier passage:

“This was true in one of the earliest seeming marvels: when banks discovered that they could print bank notes and issue them to borrowers in excess of the hard-money deposits in the banks’ strong rooms”.

All fiat currencies today really are backed by nothing and can be created at will (that’s what the word “fiat” actually means), and perhaps unbeknownst to many we are right now in a protracted, global currency war. Every nation is racing to the bottom, trying to devalue their currency against their trading partners so they can:

- give their exporters a competitive advantage

- pull stronger currencies in to make money on the exchange, and

- service their ever expanding debts back with devalued, cheaper currency

This is why everybody’s purchasing power is going down despite tenured academics and central bankers incessantly complaining about low inflation and political spokesmodels always talking up a strong currency.

Bitcoin isn’t: Backed by nothing

What is? The USD and every other fiat currency in the world.

Bitcoin is a ponzi

The idea that Bitcoin or most crypto-currencies are a Ponzi is easily debunked by understanding what a Ponzi actually is.

As observed in CryptoAssets (Burniske & Tartar, 2017), it’s very simple: new investors pay old investors.

It is important to realize that in a Ponzi, the earlier investors are literally paid with funds being injected by the new investors in a flow through fashion (as distinct from later investors having to pay higher prices to earlier ones to induce them to part with an asset).

As long as the number of new investors and thus the influx of funds is growing at a rate faster than the payouts to the earlier investors, the Ponzi scheme thrives. When the expected payouts exceed the rate of input, it dies.

One doesn’t have to look very far to find mechanisms that fit the definition exactly: Social security programs are all classic ponzis. The demographic reality today is that with the entry of the Baby Boom generation into retirement, given that the subsequent generations are so much smaller in size, additionally penalized by falling real wages, rising or multiple taxation, decaying purchasing power on their money and returns on any savings they can eek out suppressed into negative nominal yields; this Ponzi is in its terminal phase.

(Given that these exacerbating headwinds which face later generations can be summed up with the phrase “financial repression”, it is only logical that capital would flee to some asset or currency which appears resistant to them.)

Granted, the current ICO craze probably includes some ponzis. The Cryptoassets book describes the OneCoin Ponzi as well as how to spot a ponzi in crypto-currencies. I would have been hesitant to even call OneCoin a crypto-currency at all. It wasn’t open source and had no public blockchain.

In Bitcoin or other true crypto-currencies, early holders are not receiving bitcoin from later entrants. In fact, quite the opposite is happening. Later entrants must entice earlier ones to part with their bitcoin. Since Bitcoin cannot be created at will, it must be mined at a rate that drops over time (this year approximately 640K new bitcoin will be mined, about 3.8% of the total supply).

Demand for bitcoin is simply outstripping supply of new coins being mined (for reasons we will discuss in Part II). If said price action rises dramatically (like for example, Bitcoin suddenly became the highest performing asset class in the world) then a feedback loop would occur. Ever higher prices would be required to induce earlier holders to sell.

Bitcoin Isn’t: A ponzi

What is: Social Security

Tulipmania

What is described above is the same dynamic that occurs in any bull market, as buying begets more buying, and fear of missing out (FOMO) kicks in. It is said one of the most accurate gauges of happiness correlates closely to how much wealth one has when compared to one’s brother-in-law. Alex J Pollock describes it in Boom and Bust: Financial Cycles and Human Prosperity, as “The disturbing experience of watching one’s friends get rich”.

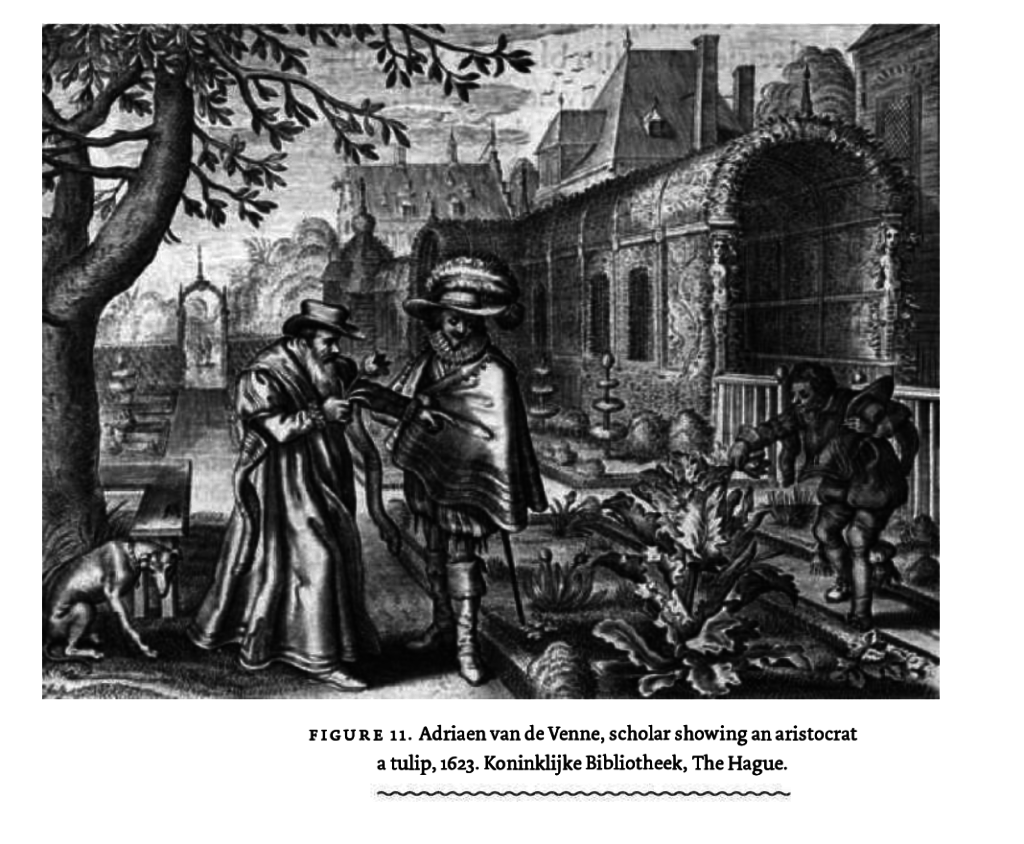

The trick would be to have some understanding of when a strong bull market has crossed into Bubble territory. One of the more popular analogies for Bitcoin is Tulipmania: the financial bubble that occurred in 1630’s Amsterdam with none other than tulip bulbs. Bitcoin is compared to Tulipmania so often I decided to take a closer look at Tulipmania to see if the comparison was valid.

What I found was that it most of what we know today about Tulipmania is superficial and self-referential, deriving primarily Charles Mackay’s chapter on Tulipmania in his seminal Extraordinary Delusions and the Madness of Crowds (1841). It is a scant 9 pages and is purely anecdotal, describing ridiculous prices paid by the otherwise pragmatic and level-headed Dutch and then it all just blew up like all bubbles do.

Finally I found Anne Goldgar’s Tulipmania: Money, Honor and Knowledge in the Dutch Golden Age, which is the most in-depth investigation to the rise and subsequent fall of Tulipmania extant today. In it we learn about the circular references that went on to inform our present time about Tulipmania:

“If we trace these stories back through the centuries, we find how weak their foundations actually are. In fact, they are based on one or two contemporary pieces of propaganda and a prodigious amount of plagiarism. From there we have our modern story of tulipmania.”

She traces the lineage of MacKay’s chapter:

“Mackay’s chief source was Johann Beckmann, author of Beytrage zur Geschichte der Erfindungen, which, as A History of Inventions, Discoveries and Origins, went through many editions tions in English from 1797 on. Beckmann was concerned about financial speculation in his day, but his own sources were suspect.

He relied chiefly on Abraham Munting, a botanical writer from the late seventeenth century. Munting’s father, himself a botanist, had lost money on tulips, but Munting, writing in the early 1670s, was himself no reliable eyewitness. His own words, often verbatim, come chiefly from two places: the historical account of the chronicler, Lieuwe van Aitzema in 1669, and one of the longest of the contemporary pieces of propaganda against the trade, Adriaen Roman’s Samen-spraech tusschen Waermondt ende Gaergoedt (Dialogue logue between True-mouth and Greedy-goods) of 1637. As Aitzema was himself basing his chronicle on the pamphlet literature, we are left with a picture of tulipmania based almost solely on propaganda, cited as if it were fact.”

(emphasis added)

Goldgar helps the reader in pursuit of truly understanding Tulipmania by rewinding to the late 1590’s, when there were no tulips in what is now Holland, or in fact Europe. Gardens were purely functional, for growing food, herbs or medicinals. Then tulips and other curiosities began coming into the country and Europe from merchant vessels trading in the Mediterranean and Far East.

The flower garden arose for the first time, and it was spectacular – giving rise to an entire movement of collectors and aficionados, whom in the early days were as a rule well-to-do and affluent. In later years, more people sought out, and then speculated in the tulip trade to not only profit, but to lay their own claims on what they perceived to be a higher economic class or status.

At the risk of over simplifying her work, the Tulip trade became intertwined and inseparable from, art.

“The collecting of art seemed to go with the collecting of tulips. This meant that the tulip craze was part of a much bigger mentality a mentality of curiosity, of excitement, and of piecing together connections between the seemingly disparate worlds of art and nature. It also placed the tulip firmly in a social world, in which collectors strove for social status and sought to represent themselves as connoisseurs to each other and to themselves.”

The more I delved into understanding Tulipmania, the more I couldn’t escape thinking that the analogy was much more applicable to a different asset class which did enjoy a momentous bubble in recent times, but it wasn’t bitcoin or crypto-currencies. To belabour my point, Bitcoin was impelled not by art, beauty or any semblance of collectibility but emerged primarily as a resistance to financial repression.

Something that was driven by uniqueness and fostered an aristocratic in-club all it’s own and until recently enjoyed stratospheric price action, was the aftermarket in domain names. This isn’t the place to conduct a post-mortem on that bubble, but suffice it say that the distinct characteristics of domain names more closely resembled that of tulip bulbs than Bitcoin does. (For the reader interested, I have written at length about the domain aftermarket here and here).

Bitcoin isn’t: Tulipmania

What was like Tulipmania? Domain names.

If Bitcoin isn’t a digital fiat backed by nothing, nor a ponzi nor Tulipmania, then what is it? Why has this come out of literally nowhere to become the strongest performing and fastest growing asset / currency in the world?

When I started writing this post I wasn’t sure myself. I had to go back through my library and look at history and try to find some historical antecedent for what was happening. After looking back through the origins of money itself and working forward I still wasn’t any closer to a mental model that “worked”.

Then around 2am the other night I woke up with the idea that I was looking in the wrong place, and it hit me with such force that I had a hard time getting back to sleep – even though I had made an off the cuff tweet that captured the basic idea of it a few weeks earlier (which I can’t find now).

I’ll take you through it in Part II. (Hope to have it up soon). But in the meantime, I’ll leave you with another megabank CEO who’s take on all this is very different from Jamie Dimon’s. Goldman Sachs’ CEO Lloyd Blankfein here muses on why it’s entirely plausible that money may evolve from being based on fiat to being based on consensus. Some truly extraordinary remarks coming from a man in his position.

Good post. I’m eager to read part 2.

Where I’d push back a little is the tulipomania piece.

I agree generally with your argument, but I do think that the price and existence of Bitcoin is influenced as art.

While on a political level Bitcoin has its purpose, it also exists on an artistic or cultural level.

I believe that there are people, call them fans of nerd-chic, who are attracted to Bitcoin as part of the worship of technology, or the worship of digital, or even the worship of peer to peer phenomena.

Bitcoin does not exist purely as a technical concept, but as you quite clearly argue as a political concept, and as I would argue as an aesthetic or artistic concept. I believe that all technology is art, and that the more powerful that art is received, interpreted, and engaged by its audience, the more powerful that technology will be. 🙂

I also agree with your earlier point about leverage, and how for the most part, people are not buying BTC via leverage because the institutional infrastructure doesn’t exist to enable it. However I do think, to a far lesser extent than the established system, there are people who are taking on some kind of debt so they can speculate on BTC and other currencies.

I think the point here is not what is backing fiat currency or what is not backing fiat currency. Whether we consider current fiat to be spineless (which it has been since it was not backed by gold since the 70’s) does not matter. What matters is the perception that the value of world currencies is mostly due to the value of their stock market which is (theoretically) meant to represent the productivity of a given country. Ideally, a strong stock market index, results in a strong currency value – that is the perception (whether that is real or not is a different conversation and I myself believe it is actually all fairy dust).

Bitcoin however is backed by no perception of productivity *at all*. It is backed by the only fact that each of them is more and more scarse as the mathematical problems to solve become more and more complex – thus requiring more and more KWh to find. It is not backed by anything that is measured by human productivity and to actually say that “oh, but it is measured by machine productivity” is …. a little dystopian and useless – since nothing is produced other then a solution to a math problem – if the collective of these solutions would then be utilized to cure cancer – then heck… yes, you now have value – but to simply state “it has value because there is not a lot of it” well…. little naive imho

The moment you have a crypto-currency which is backed by a legitimate way of measuring human productivity – is the moment you have a crypto-currency that in my opinion is not fairy-dust. And honestly, If someone tells me that crypto-currencies can be backed by the stock-market I’ll puke a little because that would be like building a castle on a pile of .

Have you ever heard of Charles Hugh Smith and if so, read his “A Radically Beneficial World” ? (I actually produced the audiobook version of it).

What you are talking about here:

Sounds pretty close to what CHS envisions and proposes as his “CLIME” system.

I’ve looked at bitcoin off and on over the past year or two, but I haven’t invested, because I’ve several times been in the situation where local elites teamed up with corrupt officials to take my property and/or business. — similar to civil forfeiture, but for more complicated assets. From what I hear, my experience is more common than one realizes. Traditional assets have some legal protections (the law could only take away the use of the property, to force a sale, for example); but bitcoin has no real legal status. Additionally, it seems that governments have been propagandizing it as “only for criminals and money launderers”. I am very interested to know if other people have been thinking about this issue, and what the thoughts are?

Bitcoin is anonymous to buy, but subpoenas still exist, money transfers are traced, and as we see in Saudi Arabia, shakedowns based on physical detention happen (it also happens in the US). Bitcoin strikes at the centre of modern government; at it’s ability to tax, and to control money flows, won’t it be a case of government co-opting it, or fighting bitcoin to the death, so to speak?

You don’t seem to looked into cryptro at all, otherwise you’d understand what level of control you have when you own crypto. If you leave it at an exchange (like Coinbase) then yes it is subject to regulatory whim.

The solution is to put your coins on an encrypted thumb drive (Trezor and KeepKey are 2 examples). On KeepKey you have a 12 word passphrase along with a 6 digit pin. I can light my Keepkey on fire, run it over with a steamroller and then drop it to the bottom of the ocean and my coins are still safe. I buy another KeepKey, enter the 12 word passphrase and all my coins are restored. Like many things in this world, If you can’t touch it, you don’t own it.

Money transfers you speak of can be traced, but all they show is that an amount was sent from 1 address (3HyvoPY5srKgMbtXv1RUixEiN7wG5k92ce) to another. As every transaction/transfer i do has a new unique address it’s nearly impossible to trace back to any individual. Of course, if you use the same computer WITHOUT a VPN, then your IP address is stamped on everything you do.

And worry not about the “criminality”. BTC is worth 350billion USD (give or take). The USD float is between 3 and 4 TRILLION. I assure you, more greenbacks are used for criminal enterprise than all the crypto in the world.

Brad Templeton argues that the real problem with Bitcoin is that there are hundreds of other cryptocurrency systems.

http://ideas.4brad.com/bitcoin-bubble-and-real-value

Yes, why wouldn’t money come to be backed by consensus that can’t be manipulated by a central bank? Fiat money is money by consensus, but an inferior one because the supply is at the discretion of the fallible and self-interested central bankers. The biggest consensus today is around the US$, but that is certainly not sacrosanct. Especially when you look at the monetary base and debt leverage.

Thank you for addressing these myths and common misconceptions about Bitcoin. There is nothing more frustrating than hearing someone spread around false information. So many people offer their two-cents without being properly informed.

Interesting reads but money is controlled by power – economic and military.

The power will control it or destroy it.

The IRS and US Treasury have already taken the first steps in this direction

Yes, you have convinced me that “technically” Bitcoin is not a ponzi scheme. I would rather define it as greed.

Thus I disagree about Bitcoin’s value. The reason is that Bitcoin has no intrinsic value and one reason it has no intrinsic value is because you can create an endless number of crypto currencies all with the same qualities.

If I created a corporation and created a finite number of shares using the technology of crypto currencies what would I have created? If there were a total of one million shares and they were first issued at 1 dollar the total value of the enterprise would be one million. What would be the value of each share the next day? The shares could be traded just like Bitcoin. Who would pay more than one dollar a share? Bitcoin is worse because what the early buyers paid for it is gone. Bitcoin is worthless.

Correction

One compelling reason Bitcoin has no intrinsic value is that an endless number of crypto currencies can be created all with the same qualities.