Courtesy of Establishment Shills, Central Banksters …and Peter Schiff

It’s that time again, when Bitcoin is about to embark on a string of fresh all-time highs, triggering the mainstream pundit class into public displays of denial and angst.

Just in case you may think “It’s a bubble” and “Tulips, backed by nothing” is a next-level, unique argument that no Bitcoiners have ever heard before, we humbly present, the history of “Bitcoin is a Bubble” in graphic terms, going back over a decade.

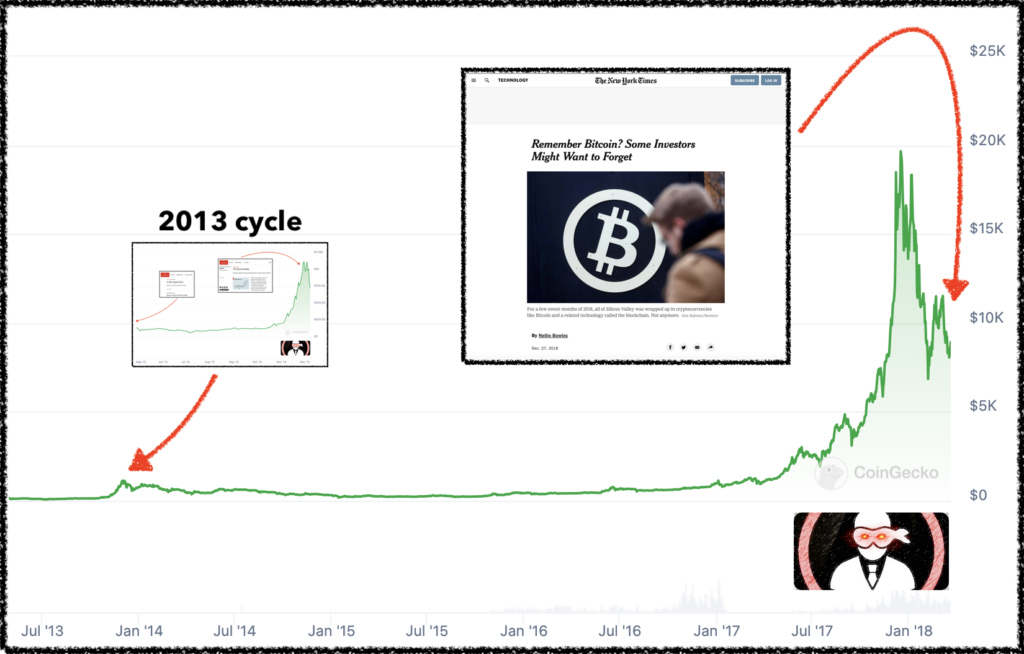

2013 Cycle

We start in 2013 when The Economist magazine declared Bitcoin to be a bubble in November as BTC cracked the $1,000 handle for the first time – they also declared “Bitcoin is expensive” and looking like a bubble earlier that year, in March 19, 2013 – when the Bitcoin spot price was… $59.

2017 Cycle

The next cycle peaked out in 2017 and by January, 2018 had plummeted all the way down to the $10,000 / BTC area, it prompted the New York Times to eulogize those foolish investors who tried to glom onto the phenom… “Remember Bitcoin? Some Investors Might Want to Forget” on December 28, 2018 – when the Bitcoin price was $3,653.13/BTC.

Even by this very next cycle, 2013 looked like a rounding error.

You’ll never guess what happened next…

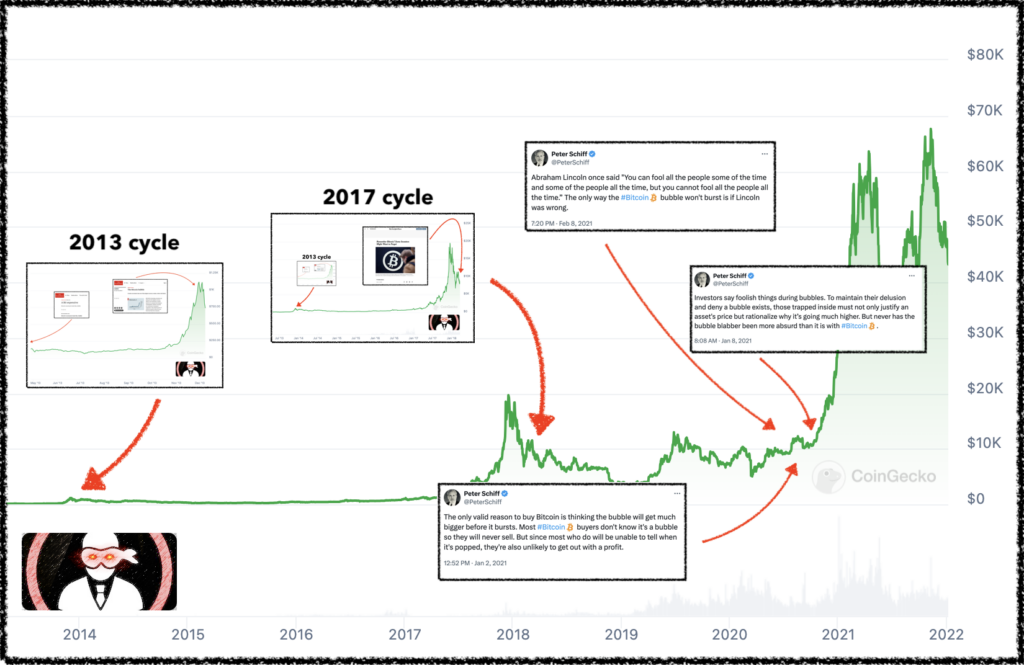

2021 cycle

One of the staunchest sound-money advocates in the world became one of the most vociferous critics of Bitcoin ever seen on social media.

None other than Peter Schiff went all-in on being a no-coiner, which, as a long-time gold investor myself, I found puzzling.

It may be understandable that one may prefer precious metals to Bitcoin, or even eschew the latter if it was outside of their wheelhouse. But for a professional investor and capital allocator to be so opposed to Bitcoin, while incessantly employing the most uninformed objections to it (“backed by nothing”, “a bubble”) belies a willful ignorance that would be extremely distressing to find in one’s financial advisor.

I’ve said it before: nobody who actually rolls up their sleeves and does any work on “why Bitcoin” ever comes out the other end saying “tulips, backed by nothing”. They may still say it’s not for them, but they won’t say that.

Honourable Mention

We could never run out of fodder for establishment shills of the Cantillionaire class who either loathe Bitcoin because of what it represents (a threat to their position and power); or lower order sycophants who don’t understand it, because in true Upton Sinclair fashion, their livelihoods depend on them not understanding it.

- Paul Krugman (an example of the latter) declaring “Bitcoin is Evil” (2013) and “has no use case” (2018))

- World Economic Forum – who declared that Bitcoin would consume all the world’s electricity by 2020 (update: it didn’t).

- Most recently, the ECB put out a piece echoing the same old, tired objections… backed by nothing… intrinsic value zero *yawn*, calling it “The Emperor’s New Clothes”.

And of course, Jim Cramer’s legendary call in late January… “Bitcoin’s new theme is number go down”.

Bang on.

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) March 4, 2024

Where are we today?

So with Bitcoin on the cusp of racking up another all-time high, the first of this cycle – call it The 2025 Cycle – are we at the top?

Google trends seems to indicate we are nowhere close to a manic peak…

Doesn’t much look like a cycle-top, either… pic.twitter.com/FH84IGDmTW

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) March 4, 2024

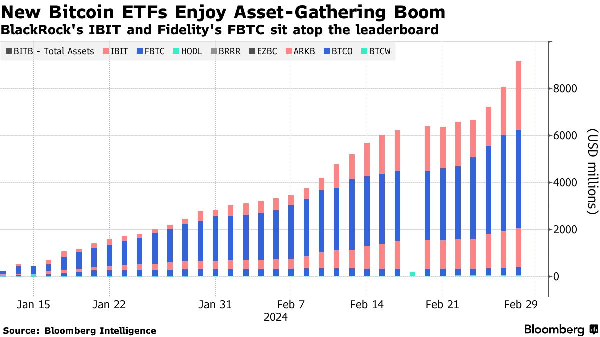

Which means all the inflows into ETFs right now are probably mostly institutional.

What is most surprising to me on this cycle (my fourth Bitcoin cycle since becoming orange-pilled in 2013) is how fast it is unfolding this time.

The milestones this year:

✔️ Bitcoin recapturing the $1 trillion market cap

✔️ Bitcoin hitting new all-time-highs in other currencies

✔️ Bitcoin cracking $60K USD for the setup to new all-time highs

A new all-time high before the Bitcoin halving event in April seems baked-in (hell, it may happen before I get this post published) – and the next major milestone after that will be the $100K USD per BTC mark. Seems hard to think that won’t happen this year either.

Is it too late?

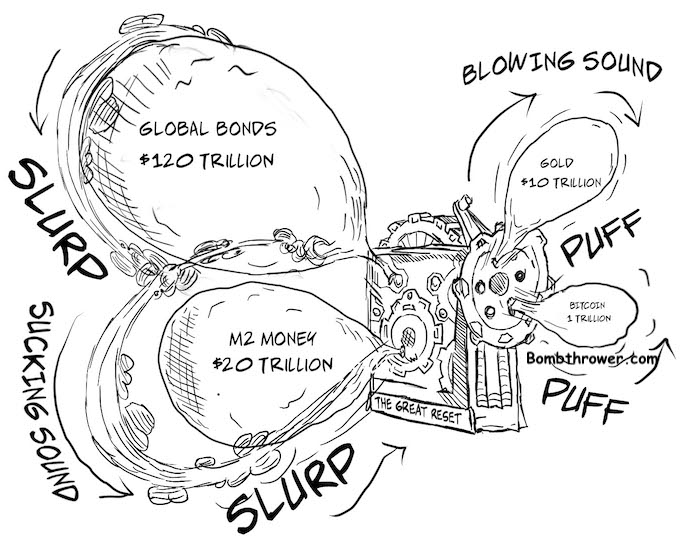

As a glimmering awareness that Bitcoin didn’t die on the last cycle begins to elbow its way into public consciousness – people may think they’ve missed the boat on this. But what I still look at is the relative size of the global bond market – about $150 trillion of “return free risk” vs Bitcoin, still only at just over a $1 trillion.

My base case is that the destruction of the current, fiat-based global monetary system will result in a bond exodus – and that “conventional wisdom” now includes a small allocation to Bitcoin – at least 1% – possibly 3% to 5%. When you consider that 70% of all Bitcoin hasn’t moved in over a year – even in the face of this latest run, we’re going to have anywhere between $1.5 and $7.5 trillion coming into Bitcoin over the next few years, and competing for about 30% to, call it 50% of the total supply.

What will that do to the spot price? Here’s Tuur Demester on Marty Bent’s TFTC making a cogent case for $1 million Bitcoin. We’ll just have to wait and see….

Get on the Bombthrower mailing list here and receive a free copy of The Crypto Capitalist Manifesto, which outlined all this. However, by the time you read this it may already be too late to sign up for The Bitcoin Capitalist Letter: new subscriptions will be closed once Bitcoin hits a new all-time high.

You are missing the first major bubble when price went from $0.70 all the way up to $32 then back down to $3

Yeah I missed that one – was relatively late to the game in 2013.

But for that one, there was no wider awareness of Bitcoin. There would have been next to no MSM commentary on it.