(From “Notgeld” to Hyper-Bitcoinization in Under Two Decades)

“Just because something is inevitable doesn’t make it imminent”

— Douglas Casey

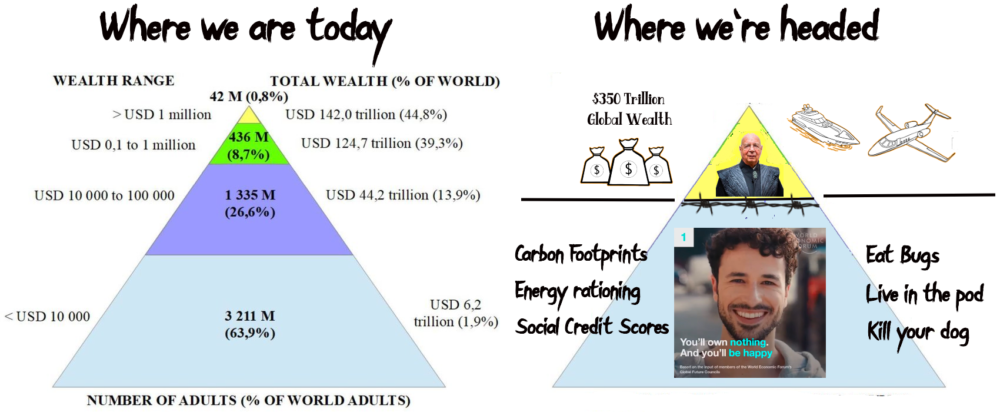

For a long time, anybody paying attention knew that central banks printing fiat money out of thin air, then lending it to nation states at interest and blowing it out into the economy would inexorably, eventually lead to such wealth disparity that the society would break down.

It would get to the point where popular revolts would threaten to overwhelm the position of the elite class; those Cantillionaires who lord over this phantasmagorical system that created value ex nihilo and caused, through inflation, the vast majority of wealth to accrue to society’s “capstone class”…

One of my personal favourite quips is:

Eventually always shows up sooner than everyone expects.

It’s been over three years since I released The Crypto Capitalist Manifesto, and in it I laid out my base investment thesis that “The Great Reset” wasn’t actually anything to do with climate change or any of the United Nations Sustainable Development Goals – what it really was all about, is the debt:

“YOU WILL OWN NOTHING, AND YOU WILL BE HAPPY.

The messaging coming out of global elites such as the World Economic Forum, The Party at Davos, the International Monetary Fund and even places as disparate as The Vatican and Hollywood are all riffing on the same theme: You, the middle class, the lower class, the masses – are going to have to get used to a lower standard of living.

The real reason why isn’t because of climate change, or even COVID. It’s because of the debt. The world has finally run out of runway from kicking the can down the road all those times the global economy threatened to backslide into recession or when previous monetary bubbles imploded. All those decades of collectively living beyond our means have finally hit the wall. This is it. We’re here.

Governments have spent beyond their means for decades, and now the bills have come due. The only way to pay them will include inflation and austerity. It will resemble a controlled demolition of the entire middle class. The easiest way to do that will be to turn them into a completely dependent welfare class via endless rolling lockdowns, Universe Basic Income programs and mandatory health passports.

However “The Great Reset” is basically at its core, a monetary reboot. A way to restructure the global debt overhang and turn “money” into technocratic lube for enacting grandiose social engineering projects: most of them geared toward ratcheting down the standard of living for the masses of the developed world and suppressing the standard of living for the so-called Third World.”

(If you want a free copy of the entire manifesto, just sign up for the Bombthrower mailing list and we’ll send you the PDF).

“The Great Reset” and “Build Back Better” attempted to lay the groundwork for the eventual (and still somewhat inevitable) pivot of fiat money into Central Bank Digital Currencies (CBDCs). They will almost certainly be fused with social credit systems denominated in carbon footprint quotas – and thus a mechanism to implement forced austerity across the debt-drowning economies of the world resulting in a kind of “monetary Apartheid”.

What I Got Wrong in My Manifesto

Aside from the fact that events I assumed would play out over decades happened within 18 months, there was another fundamental flaw in my analysis:

I first discovered Bitcoin during the Cyprus banking crisis of 2013 – when people began to understand that “as safe as money in the bank” didn’t quite mean what it used to anymore.

The Cypriots got hit with a 10% “bail-in”, but more ominously – bail-in provisions started showing up all over the place (from the Manifesto, again):

As the bail-in was being planned and executed in March 2013, Eurogroup president Jeroen Dijsselbloem told interviewers that Cyprus would serve as a template for future bank restructurings in the euro zone.

In April 2013, the idea of enshrining the framework for bail-ins surfaced in my home country of Canada, with the Conservative Harper government’s budget

The Canadian bail-in language was been preserved in the budget even after the Liberals under Justin Trudeau assumed office in 2015. In 2018 it officially became The Bank Recapitalization (Bail-in) Conversion Regulations.

In Australia the Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Bill of 2017 gave the Aussie government the power to facilitate bail-ins.

And in case you’re wondering, the USA was a front-runner for codifying bail-ins into legislation: the Dodd-Frank Bill that was passed in 2010, ostensibly to reform the banking sector after the Global Financial Crisis contains provisions for “Statutory Bail-Ins” to recapitalize any “systemically important” banks that gets themselves into trouble.

In fact, new supra-national bail-in laws took effect across the entire G-20 in 2014.

It was during the Cyprus bail-in that Bitcoin surged above $100 USD for the last time. It would never again trade at the double-digit level.

Even so, I never thought Bitcoin would become the world reserve currency or even a component of whatever comes next after this post-post-Bretton Woods era we now live in.

My mental model for Bitcoin, right up until 2022 was as a kind of globally emergent “Notgeld” – a German term that came into being during their 1920’s Weimar Hyperinflation, and translates into English as “emergency money”.

In Germany, individual towns began printing their own scrip, during the Zimbabwe hyperinflation, people began using prepaid phone and gas cards. Every hyperinflation has its Notgeld, and until early 2022, that’s what I assumed Bitcoin was, on a global level.

Two things happened that changed my mind:

- The US seized the foreign asset reserves of two nation states – it doesn’t matter who those states were or what they did to “deserve it”.

- During the #FreedomConvoy, the Canadian government declared martial law and seized the bank accounts of truckers and any citizens who supported them.

The first sequence of events forever changed the calculus that nations would employ for deciding how to allocate and hold their sovereign wealth.

The second did that for individual citizens. It alone orange-pilled Robert F Kennedy Jr, who a year later would make Bitcoin a US election issue when he opened his historic keynote at Bitcoin 2023 in Miami with the words:

“I became a Bitcoiner when I saw what the Canadian Government did to the truckers”

From that point on – Bitcoin shifted from being “Notgeld” – emergency money amid a slow-rolling, global hyper-inflationary event, and it became inevitable component of a future, successor monetary regime.

The Next President of the United States Has Been Orange-Pilled

No matter what you think of Donald Trump, whether he induces either type of “TDS” (Type 1 = “Trump Derangement Syndrome”, Type 2 = “Trump Divinity Syndrome”), or you’re more dispassionate and objective, the fact remains that a Trump-led GOP landslide is all but baked-in come November 5th.

Like RFK Jr., Trump has firmly jumped onto the Bitcoin bandwagon. He’s been orange-pilled (props to David Bailey Bitcoin Magazine for doing so).

Trump declared that he “wants all future Bitcoin to mined in the USA”. Granted, it doesn’t quite work that way, but he went on to reiterate that, and the right to self-custody at: the Republican National Convention:

Donald Trump makes EPIC promise to US crypto holders: pic.twitter.com/LqCRtEZTbD

— Altcoin Daily (@AltcoinDailyio) July 19, 2024

The Big Announcement Will Drop on July 27th

This year Trump will be delivering the keynote address at Bitcoin 2024 in Nashville, Tennessee. RFK Jr will also be on hand. Both candidates firmly on board with Bitcoin, albeit one destined for the Presidency more than the other (I expect RFK will land somewhere within a Tump administration come January 2025).

The inside baseball is that at that keynote address, Trump is expected to announce his intention to create a strategic reserve of Bitcoin for the US Treasury.

HUGE BREAKING: Trump to announce a USA #Bitcoin strategic reserve in Nashville 🇺🇸 – Sources

— Dennis Porter (@Dennis_Porter_) July 18, 2024

Doing so could be as simple as a stroke-of-the-pen on inauguration day, as the US is already sitting on about $5B worth of BTC:

The next President of the USA should sign an executive order to convert the $5.5 billion held by the US Government into a strategic reserve at the US Treasury then use that reserve to back the dollar with #Bitcoin. pic.twitter.com/NYjcbCWXmV

— Dennis Porter (@Dennis_Porter_) July 18, 2024

Once that happens, we’re in a whole new ballgame. The Game Theory of Bitcoin will irrevocably change globally, and nation states will be incentivized to follow suit.

Regardless of how it plays out, Bitcoin has already crossed the Rubicon. It’s here to stay, it isn’t some kind of “emergency money” to temporarily sidestep the ongoing unraveling of the global fiat standard – it’s now part of the plumbing.

Read my special report on what a Trump presidency means for Bitcoin, and which companies stand to win big right here.

Join the Bombthrower mailing list and get a free copy of the Crypto Capitalist Manifesto here (and The CBDC Survival Guide once it drops)

Follow me on Nostr or Twitter here.

>Regardless of how it plays out, Bitcoin has already crossed the Rubicon. It’s here to stay, it isn’t some kind of “emergency money” to temporarily sidestep the ongoing unraveling of the global fiat standard – it’s now part of the plumbing.

I agree, but I'm worried about one scenario :

If Bitcoin becomes part of the U.S. Strategic Reserve, this will give the U.S. government very powerful leverage over Bitcoin's future.

I see several risky scenarios with this.

For example, the government or the Senate could decide that Bitcoin must integrate KYC natively for it to be used legally by the US state, US financial institutions, businesses and individuals.

They could pay developers to create a fork, and force all these people to use it.

The rest of the community will then have to choose:

– Stay with the original version of Bitcoin, which will NOT be used by the U.S. government, ETFs, Microstrategy and others.

– Or use the version that all these American entities will use.

The problem is that it's the version used by US entities that should have the highest price per Bitcoin, creating an incentive for all other users to use the new fork.

What's your opinion on this scenario and the risk it represents?