Even if it was the NSA, the CCP

or the WEF

Rumours have abounded that Bitcoin was created by the NSA (or the CIA, or the CCP or WEFsters) going back at least as far as 2010, or so.

They resurfaced over the past week when Dr Mercola interviewed Catherine Austin Fitts. Since then I’ve had numerous readers forward me some choice quotes of their talk (the transcript is here), and highlighting Fitts’ suspicion that Bitcoin was created non-altruistically by the NSA.

In it, there is a reference to Nic Carter’s theory about the NSA having created Bitcoin:

“The common understanding is that Nakamoto is the ultimate altruist and abandoned his 1 million Bitcoin for the benefit of humanity. Nic Carter is a well-known figure in the cryptocurrency community, and he doesn’t buy that story and is convinced that the United States National Security Agency (NSA) is responsible for creating Bitcoin. He believes Bitcoin was written by NSA cryptographers as a monetary bioweapon.“

Mercola references this Cointelegraph article where Nic Carter clearly lays out that his NSA-origin theory for Bitcoin is “the lab leak” scenario:

“I call it the ‘Bitcoin lab leak hypothesis.’ I think it was a shuttered internal R&D project, which one researcher thought was too good to lay fallow on the shelf and chose to secretly release.”

Very much in line with the Promethean mythos behind the Satoshi Nakamoto legend that resonates so deeply throughout the community – and if true, might explain just why, the he/she/they/them that is Satoshi – left those 1 million BTC exactly where they sit today. Nobody would want to suffer the fate of Prometheus, doomed to spend eternity chained to a rock, having his liver eaten daily by an eagle.

Yet the discussion between Fitts and Mercola, as well as many others who suspect something nefarious behind Bitcoin’s mysterious creation, seem to be deriving the wrong conclusion from Carter’s theory – or dismissing it in favour of an intentional, deliberate creation, and presumably, what that would mean (as per Fitts),

“It depends on how their rollout of complete control works … As long as they have the ability to assert complete control and shut [crypto] down or marginalize it, it’s easy for [Mr. Global] to assert control. Until then, they can continue to pull money out of precious metals and real and hard assets by encouraging retail to go into crypto.”

The assumption being: whoever created Bitcoin, controls Bitcoin.

The reality is:

Bitcoin is beyond anyone’s control

And the reason, quite simply, is because Bitcoin is open source software.

What does “open source” mean and why does it matter to Bitcoin?

Contrast with something closed source and proprietary, like Microsoft Windows – or the entire Microsoft operating system stack, open source means that the instructions that comprise the computer program itself are published to the world openly in their uncompiled source code form.

Further, anybody running the software does so by downloading the open source copy of the code, compiling it locally and then running it.

What this means is that even if the NSA, or the CCP or the WEF secretly created and released Bitcoin intending it as a Trojan horse for digital slavery (like CBDCs will be), then we would all be able to literally see it in the source code, which is right here – and nobody would run it.

- There wouldn’t any Bitcoin devs maintaining the codebase (or if there was, they’d simply remove the malware)

- Nobody would be trading energy, or cash, for Bitcoin generated from compromised code, and

- Bitcoin miners would certainly not be spending hundreds of millions, or even billions of dollars in order to build out massive server farms to run NSA malware.

In other words, there would be zero market momentum behind the phenomenon known as “Bitcoin” that is sweeping the world.

Some others might concede that Bitcoin is an open source movement, with no hidden trojans or malware – but that it’s really One Big Psy-Op to acclimatize us plebs to a cashless society using digital money.

The people who believe this might even tweet about it from their smart phone while sitting in a cafe sipping a latte that they just bought via ApplePay or tapping their chipped credit card (like that Mastercard that already cuts off your spending when your carbon footprint quota is exceeded).

You don’t need Bitcoin to brainwash people to accept a cashless society or even the coming CBDCs – huge swaths of the population are going to line up for that – and in my mind it will result in a kind of Monetary Apartheid.

Bitcoin is emergence, CBDCs are totalitarian.

The people who think Bitcoin is some kind of meat tenderizer to soften the public’s mind up for CBDCs have simply not been paying enough attention to:

- The difference between Bitcoin and CBDCs, and

- The difference between Bitcoin and other cryptos

It all comes down to the decentralized nature of the blockchain, the miners (Proof-of-Work) and self-custody of one’s own private keys vs centralized banking, centralized cryptos, faux-decentralized shitcoins and the like.

We even see this manifesting in legal policy in the US, as Bitcoin is the only digital asset being treated as a commodity while everything else is looking at being designated a security (even Ethereum, especially since that unforced error of switching to Proof-of-Stake).

Where people mistakenly think that Bitcoin is paving the way to usher in CBDCs, Bitcoin is actually the anti-CBDC. It is the CBDC’s Kryptonite. An emerging monetary system as a response to the over-centralization of what I liked to call Late Stage Globalism, but lately I have become enamoured with George Gilder’s term: Emergency Socialism.

I’ll re-iterate a quote from my recent review of Ferdinand Lips classic, Gold Wars, about where monetary systems actually come from:

By 1900, approximately fifty countries were on a gold standard. including all industrialized nations. The interesting fact is that the modern gold standard was not planned at an international conference, nor was it invented by some genius. It came by itself, naturally and based on experience.

The United Kingdom went on a gold standard against the intention of its government. Only much later did laws turn an operative gold standard into an officially sanctioned gold standard.

The same thing is happening today, with Bitcoin (yes, really).

Hyper-Bitcoinization vs Notgeld

In the early days of my involvement with the space, I too, dismissed claims that the global monetary system was destined for “Hyper-Bitcoinization” – I just didn’t think it would ever happen because central bankers would simply never allow it.

Instead, I viewed Bitcoin as a kind of “Notgeld” – a German term that emerged during the Weimar Hyper-inflation that translated to “Emergency Money”. In those days towns would print their own scrip. In later hyper-inflations, other things would emerge as “notgeld” – in Zimbabwe it was prepaid phone cards and gas coupons. Every hyperinflation had one. I thought Bitcoin was an emergent, global notgeld, but I never thought it would become anything “official”.

Then, two things happened that flipped me into the Hyper-Bitcoinization camp:

The first was when the ruling Liberal/Socialist coalition government of Canada weaponized the banking system against the #FreedomConvoy protestors, probably the one single act that orange pilled the most citizens globally since the Cyprus bail-in of 2013.

The other was when the US government seized the foreign reserves of two other governments. It doesn’t matter that those governments were Russia and The Taliban, doing so probably orange-pilled more than a few nation states.

What I also realized since then, namely watching the globalists attempt – and fail – to impose a permanent technocracy under Covid, was that what ultimately happens isn’t up to the central banks, and it’s not even up to the governments. It’s up to market forces – despite all the central planning and authoritarianism marshalled against it.

That won’t prevent them from trying, however. Which is where CBDCs come in.

Money backed by debt, becomes social credit backed by carbon quotas

In the latest issue of the premium newsletter (while analyzing an Agustín Carstens speech to the BIS working group on CBDCs) I said:

Right now, what we call “the fiat world” uses debt for money. That’s no longer sustainable, so what we think will happen in the future is an attempt to switch what we loosely identify as “money”, from something backed by debt, to social credit scores, backed by carbon emissions.

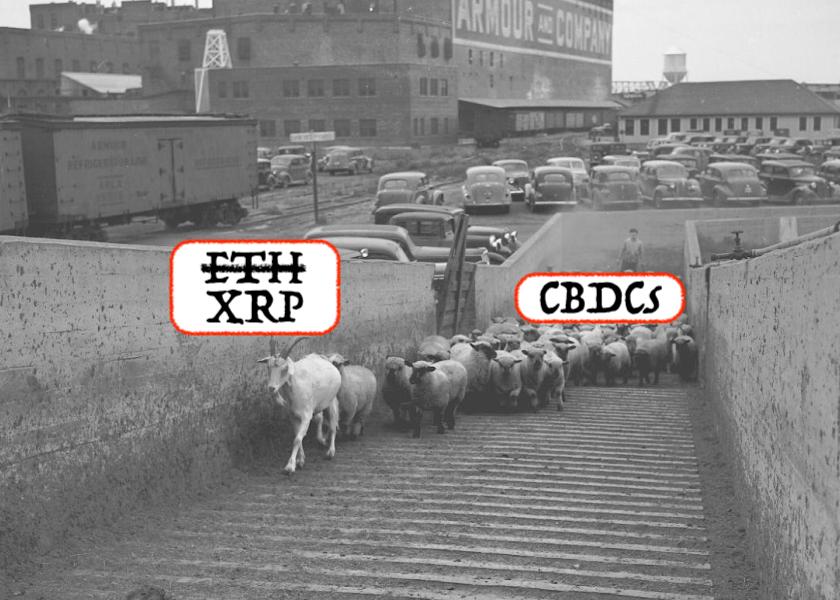

When that comes, Bitcoin will not be some sort of gateway drug to CBDCs because there are fundamental incompatibilities, and there are other cryptos out there far more suited to the task – like Ethereum and Ripple, and who actually want to the global base layer for Central Bank Digital Currencies (after all, it’s not called WEFereum for nothing…)

So where we are headed – is a global economy where the world is either going to have to adopt a non-state, decentralized digital bearer asset or international trade flows will inexorably grind to halt as trust deteriorates right along with every fiat currency going.

And a social credit system where the majority of the population (everybody who has any reliance on The State for their economic sustenance) has their lives gamified via their smart phones and their carbon footprints rationed in the name of climate justice.

Marbled throughout this world (for as long as such a system will last, because ultimately, it can’t) there will be “network states” and enclaves of those who hold their wealth and earn their income outside the social credit/CBDC system.

In my next post, I’ll tackle the inevitable arguments that “governments will never allow people to escape the coming CBDC system” and show why, at the end of the day, they have no choice. It’s already beyond their control.

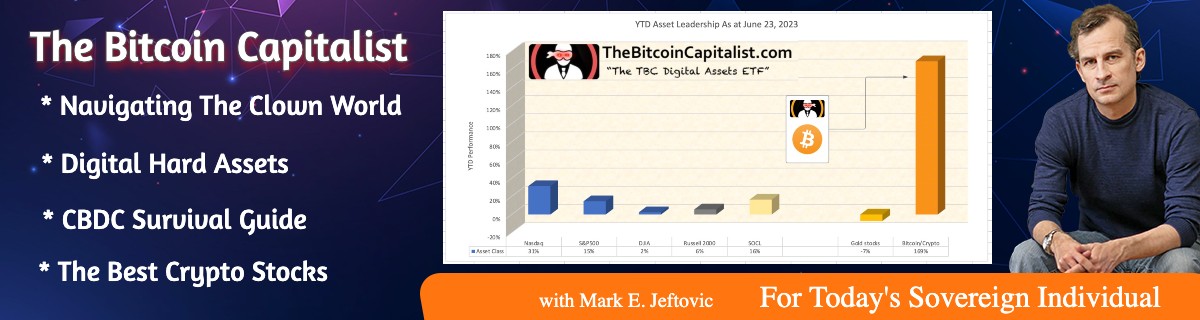

My forthcoming ebook The CBDC Survival Guide will give you the tools and the knowledge to navigate coming era of Monetary Apartheid. Bombthrower subscribers will get free when it drops, sign up today.

Knowledge does matter.

Bitcoin is nothing but a digital set of rules, that ultimately can be altered should the Core decide to. As it sits, Bitcoin is freedom to the people – and the Nemesis of the banking cartel – but current and past attributes do not guarantee future ones. It’s imperative to keep a close eye on any Core developments, with the main focus being on the privacy development. What is the point if the transactions per block reach mass adoption levels if there is no real privacy?

I will agree with you that in the bottomline it does not matter (much) how Bitcoin came to be and by whom. What does matter however – is whether its decentralised nature is controllable in any form, shape or aspect – that being its reliance on the internet services on a global scale (insert big tech cyberattack). I’m sure we can also agree that should the internet be disrupted on a massive scale (not world wide necessarily, could be just the US or Europe – definitely not China or Nigeria), Bitcoin would plunge by automated AI trading bots – then to probably exponentially recover – but only for the benefit of the few and at the expense of the majority of the people (thank you MSM). Then we can have our mass adoption.

Although I’m a huge fan of the concept of abolishing taxes for the plebs, I can’t help wonder if this is the vehicle that enables TPTB to “erase” and handle their ballooned trillion dollar debt deficits, and reset the world economy onboard the Bitcoin standard (hyper-Bitcoinization). In this (un?)realistic scenario, Bitcoin would have failed on almost all counts it stands by today, especially if there is no privacy involved.

Such moon!

From the white paper allegedly written by a Satoshi Nakamoto:

"as long as honest nodes control the most CPU power on the network, they can generate the longest chain and outpace any attackers"

The whole origin story never passed the smell test for me. The backdoor , even if not directly embedded with "invisible ink" in the digital protocols, seems wide open by this statement.

what is unrepeatable about Bitcoin?

why is it the only digital "coin" that can have a "limited in number"?

why can't a digital "coin" be created that is far superior to bitcoin and have a limited number?

Just sayin"…

Not sure what your point is.

A 51% on Bitcoin now would be prohibitively expensive.

Anybody can create a new digital currency that’s “better than Bitcoin” and limit the number of coins. The trick now is market adoption.

At this stage of the game, enough people have agreed that Bitcoin is sound money that it’s achieving escape velocity. Ethereum tried to make a “superior” system and has failed.

| what is unrepeatable about Bitcoin?

Well Saki, maybe that it’s the first trust-less and permission-less decentralised digital currency?

Most other “coins” involve trust to 2nd and 3rd parties, are centralised, and have huge apparent backdoors in their coding, thus making them incomparable to Bitcoin. Creating a “superior” to Bitcoin – coin – would require trust by the market and a lot of time to validate its integrity. Bitcoin has already been there, done that, and the only thing that remains for it to prove in the future – is the privacy and scalability features. The hard cap and the halving, ensure its deflationary nature in full contrast to its rival pair FIAT.

| A 51% on Bitcoin now would be prohibitively expensive.

The problem with that Mark, is that you’re talking about a direct 51% attack on Bitcoin. In reality, Bitcoin is under “constant 51% attacks” meaning that there is a plot twist involved – that being all the other junk “coins”, creating their coins out of thin air, pumped and dumped with the aid of dubious exchanges with zero to little liquidy, and then converting their proceeding profits to Bitcoin and consequently FIAT. I like to call it: “a side chain covert 51% attack on Bitcoin”, with Binance being the main attack facilitator, and the added bonus being the flock of sheep that support this.

Human greed at it’s finest!