(Read on Medium)

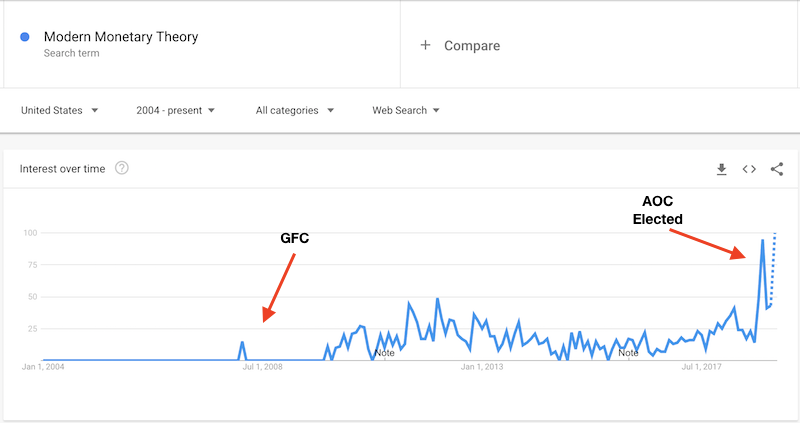

Lately, we’ve suddenly been hearing a lot about Modern Monetary Theory (“MMT”) in the mainstream media. It could be that with the election of Alexandra Ocasio-Cortez to congress, MMT’s star will rise with hers as she is reportedly an adherent and possibly views MMT as a means to fund her Green New Deal.

As we see below, MMT has been around for some time, having come out of the Chartalism school in the first half of the 1900’s and was made into MMT in the early 90’s by Warren Mosler, apparently after a “long steam” with Donny Rumsfeld, who then referred him to Art Laffer (creator of the Laffer Curve). MMT mostly flew under the radar until around the time of the Global Financial Crisis and is now clearly spiking into public awareness.

To the casual onlooker, MMT may sound a lot like standard-issue Keynesianism, the idea that the Government can and should run deficits to smooth out the business cycle.

The big difference is this: Keynesians believe that the deficits should be run to stimulate our way out of a recession or financial crisis, after which there will be some kind of return to normalcy, when deficits will matter again .

To MMT-ers there is no return to normalcy, this is the The New Normal. Deficits don’t matter and the Government can’t go broke because they can issue money in any amount required. We’ll look at how they rationalize this below, but suffice it to say now that Keynesians and MMT-ers are not synonymous and even Paul Krugman has had his criticisms of it:

it would be quite likely that the money-financed deficit would lead to hyperinflation.

The point is that there are limits to the amount of real resources that you can extract through seigniorage. When people expect inflation, they become reluctant to hold cash, which drive prices up and means that the government has to print more money to extract a given amount of real resources, which means higher inflation, etc.. Do the math, and it becomes clear that any attempt to extract too much from seigniorage — more than a few percent of GDP, probably — leads to an infinite upward spiral in inflation. In effect, the currency is destroyed. This would not happen, even with the same deficit, if the government can still sell bonds.

We’ll revisit his point that if the government attempts to extract too much from seigniorage that it will ignite an inflationary spiral. For now let’s make sure we know what we are dealing with when it comes to Modern Monetary Theory…

How to Understand Modern Monetary Theory

When I was in high school I had a physics teacher once tell me how when he was a kid he thought he should be able to hook up the outputs of a generator and a motor to each other and have himself a perpetual motion machine. For some reason it didn’t work and trying to understand why was what got him into physics.

The more I learned about MMT the more it seemed to be the same thing, in an economic sense and I have frequently made this quip expecrting MMT-ers to call it a strawman or point out some fundamental element that I’m missing but instead they usually confirm that I have it correct in broad strokes.

MMT-ers believe that currency is nothing more than an economic scoreboard or tally, and any government that denominates it’s own currency can never go broke because they can always create more currency. Of course, as Weimar Germany, Hungary, Yugoslavia and more recently Zimbabwe and Venezuela have all found out, you have to watch out for hyperinflation.

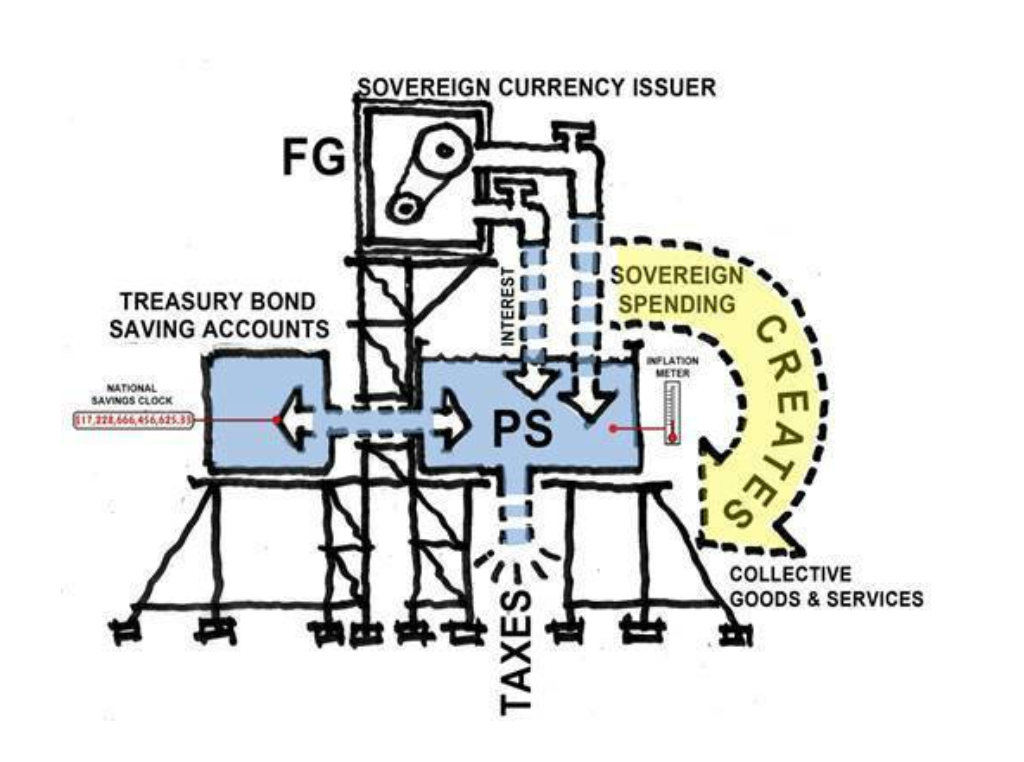

The MMT magic bullet for this is… taxation. Through taxation the government can drain excess liquidity from the system while printing as much currency as it needs to fund its projects and as long as the total value of currency printed doesn’t exceed the productive capacity of the economy as a whole. Thus:

This diagram is from “Diagrams and Dollars: Modern Money Illustrated” by J.D. Alt. After methodically taking the reader through how the old monetary system works, where the government has this HUGE untenable debt burden and is constrained by budgetary limitations, we arrive here.

The national debt is still present, but it has, through philosophical transmutation, been transformed by Alt into a “Net Spending Achievement” as measured by the “National Savings Clock” (formerly known as the “national debt clock”, or “Doomsday Clock”):

“the difference between what the FG plans to spend in a given budget-year, and what it plans to drain away in taxes, is “Net Spending Achievement”….imagine, for a moment, how our political discourse might change if everyone understood the discussion was no longer about the size of our national “budget deficit” but, instead, was about the concrete goals of our annual “Net Spending Achievement”….

We do NOT want a “balanced” budget—or, even worse, a budget “surplus”! What we want (as long as price inflation is under control) is the largest and most effective “Net Spending Achievement” we can envision.

“Entitlement” and “Discretionary” budgets do NOT have to compete with each other for a fixed pot of Dollars. As long as price inflation is under control, whatever Dollars are necessary can be allocated to the “Net Spending Achievement.”

MMT-ers believe that since our currency is actually comprised of debt obligations that government deficit is required to form net private savings:

Therefore:

- government spending creates private goods and services

- taxation drains excess liquidity and controls inflation

- the government can never go broke

For this to work, it would posit a pretty powerful central planning government that knows all (and if so, why can’t the government control inflation via price controls and eliminate taxes altogether?) and has the inhuman self-discipline not to overissue currency in a crisis (I guess, under MMT, there will be no further financial crises).

Oh, I almost forgot, under MMT there is also the jobs guarantee. So anybody who wants a job would be guaranteed to have one, at a living wage, by the government.

That’s MMT in a nutshell.

It’s ascent into its newfound economic fashionability is simply the latest episode of a long history of the pursuit of alchemy.

The Holy Grail of Government: Unlimited Spending With No Restraint

Government being overwhelmed by debt and constrained as a result is as old as history itself. In the 14th century King Philip of France was so indebted to the Knights Templar, and absent some clever rationalization that would transform his debts to them into money itself; he did the next best thing. He suppressed the order and had their leaders burned them at the stake. His debts were thus cleared but he had also disincentivized future borrowing. Another way would have to be found…

What governments really want is a way to either A) bribe the populace to keep voting for them or B) as this Epsilon Theory article laments, fund one or another of their incessant wars from an inexhaustible supply of credit or funding:

Modern Monetary Theory – which is neither modern nor a theory – is a post hoc rationalization of political expediency and power-expanding action.

It makes us feel better about all the bad stuff we’ve done with money and debt for the political efficacy of Team Elite.

And all the bad stuff we’re going to do.

At its core, Modern Monetary Theory is an argument that would be wonderfully familiar to every sovereign since the invention of debt. It is essentially the argument that significant sovereign debt is a good thing, not a bad thing, and that budget balancing efforts on a national scale do much more harm than good. Why? Because there’s so much to do and so little time for the right-minded sovereign. Because it is fundamentally unjust for the demands of private lenders to thwart the necessary ends of the sovereign, and it is politically difficult to finance those ends through tax levies on a fickle citizenry.

MMT is the sovereign-friendly justification for deficit spending without end.

Historically, this argument has been used by sovereigns to support wars without end.

(emphasis in original)

When you take a step back and comb through financial and economic history, amongst the wreckage of worthless fiat currencies from our past (note that 100% of all previous fiat currencies became worthless), we find hints and precursors of what is being rebooted as Modern Monetary Theory

Bear in mind that “Net Spending Achievement” neologism as we follow the rise and fall of the Austrian fiat regime in the 1700’s…

Unlimited National Debt?

A new phenomenon was occurring throughout Europe. Royal debt was being transformed into national debt. What had been the personal debt of the monarch was becoming the burden of the nation, payable by the people. And many central banks were created to administer this debt through paper money.

Austria provides one of the best examples of this new way of thinking. The First Bank of Austria was founded in 1703, with the express purpose of funding public debt by issuing paper money in exchange for deposits. With too few deposits, and too many notes, the bank and its currency failed.

In 1759, Count Sinzendorff, a prominent Austrian official and renowned financier, went a step further and suggested that government debt be brought to all the people, not just the depositors. He issued Austria’s first paper notes for general circulation, as a loan instrument with interest coupons attached. The new money was well received. Impressed by the expansion of commerce when more credit was made available, the government authorized a second issue of paper bills in 1769, and a third in 1771. Yet this prosperity did not last long. As excessive new issues were printed, they provoked a panic in 1797. The next decade was no better. Austria became embroiled in wars, spent heavily and ended up with a currency that lost over 90% of its value.

— (from Fiat Paper Money by Ralph T. Foster, emphasis added)

The idea that money is nothing more than an economic scoreboard or tally was advanced by John Law when he was trying to devise a method for Scotland to stave off bankruptcy, which he expounded upon in his book “Money and Trade” (“Money is the Measure by which Goods are Valued, the Value by which goods are Exchanged, and in which Contracts are made payable” – quoted in Fiat Paper Money).

Scotland never adopted Law’s ideas, and in their own currency machinations went bankrupt and ceased to be an independent country 1707 (ibid). Law moved onto France, continuing to promote his monetary theories, at one point declaring to an astonished room of aristocrats that he had discovered the secret of alchemy: “I can tell you my secret. It is to make gold out of paper” (ibid).

Even the MMT proposal to use taxation to control inflation is nothing new and was tried in New York in the late 1700’s, stability seemingly achieved by the New York Assembly having strict laws on their books limiting the amount of paper notes that could be issued. It’s not really clear what happened to this currency as it overlaps with the period when British laws were barring the colonies from issuing their own paper currencies and the subsequent segue into the revolutionary war, and the advent of the Continental (which eventually collapsed in a hyperinflation).

The Ascent of the MMT Narrative Today

I first became of aware of MMT when I used to read Business Insider back around 2010 or so and Joe Weisenthal, one of the most vigorous proponents of Cullen Roche’s “Pragmatic Capitalist” site, and he would unfailingly repackage anything Roche wrote on BI. Fast forward to today, and Roche seems to have backed off his MMT evangelism, or is at least a lot more nuanced and rigorous in his examination of it.

The next time I came across MMT was in David Golumbia’s book “The Politics of Bitcoin”, wherein he seemed to think that what we have today is MMT. I can see why people would make that mistake, and Roche notes that as well in the article I just linked. Golumbia’s book (which I deconstructed in detail here) also criticizes the economic truism that inflation erodes purchasing power as wrong, and an example of right-wing conspiracy theory.

I mention that here because that is an idea that Weisenthal also glommed onto back in his BI days, and while it isn’t yet, I fully expect this notion to be embraced by MMT adherents as this ideology is relentlessly pushed mainstream (the TL,DR of this idea is that a dollar doesn’t lose purchasing power when you issue more dollars if you put it into a bank account and earn interest on it. I debunked this thoroughly in my review of PoB. It’s one of those “not even wrong” notions in that it’s economically incoherent).

Now that Modern Monetary Theory and Democratic Socialism have found each other, we have to look at why it’s such a dangerous combination.

The Problems with Modern Monetary Theory

Most of the articles I’ve seen decrying MMT hone in on it being inflationary, full stop. Which is true. No government has the discipline to not bribe the populous with either other people’s money or “made up” pixie dust that they convince everybody to pretend is money.

Beyond that, there are numerous failings with MMT including the fact that calling debt something else, like “national spending achievement” doesn’t make it not debt, but does lose sight of what debt actually is.

When you think about it, all debt is the pulling of future value into the present. If it wasn’t, if you had present value on hand and the willingness to trade it for what was desired, there would be no debt incurred.

As I observed recently, when you rack up debt you are either borrowing or stealing from the future. The difference is whether you plan to pay off the debt (borrowing) or if you plan to perpetually roll it over (stealing). MMT is structurally and by design, the latter.

MMT says debt (err, sorry, National Spending Achievement) can expand perpetually and inflation will not occur provided it doesn’t expand faster than the value in the private economy (which assumes central planners can actually measure that accurately ) and any excess liquidity is drained off via taxation.

Like all fiat monetary schemes, you can make a theoretical case for it working. I once called MMT the elevation of circular reasoning to an art form, and Austrian economist Bob Murphy emphasizes that MMT relies upon “accounting tautologies”.

In practice, governments will always promise entitlements today at the expense of consequences tomorrow, so the monetary base will always expand and as each crisis is postponed, over time this dynamic will accelerate. If the monetary base happens to be credit (read: “debt as money”) then remember what we said debt is: future value, consumed today.

Under MMT however, when things go bad, they will get very bad. Here’s why:

Money started as hard currency, so it was near impossible to lose faith in it, and it would only happen as coinage was debased or replaced with fractionally backed paper notes.

After Bretton Woods, money, or the worlds reserve currency was “backed by the full faith and credit of the US government” and for a few decades at least, that seemed “good enough”. Although there have been panics and the overall trend is toward less confidence in the current monetary regime and the USD as world reserve currency is openly acknowledged to be in its waning days. It’s a matter of “when” not “if” even in polite company.

Under MMT there is no more pretence that the currency has any intrinsic value – it’s an economic scorecard and nothing more. The system would work as long as confidence held for the system itself, not any faith in the currency. If any cracks appeared in the system, i.e. inflation accelerated or taxation crept too high, I submit that any speed-wobble in confidence would lead to a dramatic and sudden, disorderly reassessment. A panic. It would be a genuine “life imitates The Onion” moment.

Were an MMT system inevitably go awry, the outward manifestation would be of course manifest as inflation, so central planners would of course try to get ahead of it by draining more liquidity, faster, by increasing taxes. As this fed on itself and accelerated, the populace, as if being swept up in a hyperinflation isn’t bad enough, would be sandwiched between hyperinflation and hypertaxation!.

Think of an MMT crisis as an economic black hole sucking all value from further and further future generations into a gravitational vortex of the present moment, where all value collapses in on itself and disappears forever.

People seem on board with OAC’s 70% marginal tax rate on highest earners but in a failing MMT regime the hypertaxation effect would occur through the highest marginal tax rate threshold coming down.

People don’t mind Dwayne Johnson paying 70% on his income over 10M, but how will they feel when they’re paying 70% on any income over 300,000? 100,000? 40,000? How about an 80% tax rate on income over $20,000/year and a loaf of bread costs $250 today and $3,500 in a week? (When your marginal tax rate is then 92% on all income over $1,000/minute?)

That’s what a nightmare MMT scenario looks like. At least in Venezuela they’re only getting squeezed on one side of the vice, and their central planners are trying to go the other direction than MMT-ers, attempting to tie their currency to something tangible (failure of execution however, is hampering this).

Compared to what I see as the inevitable “dual death spirals of MMT”, letting all those banksters fry in 2008 looks a lot more palatable in retrospect. David Stockman’s Great Deformation shows how the economy would have fully recovered by 2010 or 2011 instead of being where we are now: trapped at the Zero bound and headed toward democratic socialism and MMT.

It would be nice if one could download this article as a PDF or EPUB. I wanted to save it for later study and reference. I simply saved the page as a complete HTML file and I’ll convert it offline to one or both of the above formats. Concerning the article itself, you brought up some good points. I recently became aware of MMT when I saw some videos on YouTube. I’ve long been interested in economics as an amateur and have read most of the main economists and many of the lesser-known. I’m 62 years old. Despite my years of study, it’s still not clear as to what, exactly, is money. Before seeing my first MMT video, my personal opinion was that it was an accounting method: money in circulation at any given time should be approximately equal to the value of goods and services exchanged during a given time-span. You seem to discount this description and hint that gold-backed currency is the only “real” money. That position is highly problematic. At any rate, I’m not tied to any particular school and am always trying to learn more on the subject, a subject that is difficult and mysterious, even to the great economists of the past 300 years! I enjoyed reading your article and it has added to my understanding. Thanks!

Try it now, there should be a “Print Friendly” button that let’s you generate a PDF.

Mike: As far as I know a US dollar has worth in the fact that it will be accepted by the Treasury to pay a dollar’s worth of taxes. The US Treasury only accepts dollars. This is a basic tenet of MMT.

Mark: Why did we not have rampant inflation when Bernanke started dumping about 4 trillion into the money base by quantitative easing? I mean every inflation hawk in DC was clutching his pearls and looking for the fainting couch when helicopter Ben went into action. Nothing happened. What gives?

The reason we did not have hyperinflation is that units of account, not being of a physically portable nature, can’t be spent or enter intoc ompetition for scarce goods. Imagine just creating enough UA’s to place in the Social Security Trust Fund to make it solvent to pay full benefits for, say, 75 years, despite aging of a large class of boomers. McConnell and other Austerians threaten to cut benefits to make SOC. SEC. “solvent.” It’s a threat that should be crushed with attitudes encouraged by MMT. We are the richest empire the world has ever known. Of course we can afford carer for our elderly, sick, hungry, etc.

Hi Tom:

The inflation showed up in the everything asset bubble. Credit induced. Cantillion Effect writ large. Also – main street inflation is much higher than reported inflation, see Shadowstats.

Another way to look at debt (as used to fund consumable goods and services) is that the debtor is consuming while others are producing but retraining their consumption (net creditors). In other words, the “borrowing from the future” is a local approximation with little or no meaning for the economy as a whole.

One might argue that consuming something like oil is a global “borrowing” from the future. However, oil consumed today, will not be replaced for millions of years, so, in human terms, is simply not available to the future.

Locally, if the debtor of today restrains his consumption tomorrow, he has repaid his debt.

Bottom line: “spending achievement” by the government, today, means that some other players in the economy have produced more than they consume, today. On the scale of the whole economy, the future is now.

Mark Jeftovic: 1. Your “taxing it back to cure inflation” part was excellent. What a nightmare. But what is the actual likelihood that your elected representatives are going to vote to raise taxes on the populace during an inflationary crisis as you describe?

2. As Mises pointed out in 1912, the entire “state theory of money” is “acatallactic” and thus does not deal at all with exchange or pricing. Therefore, there would be no honest prices and the regime would be fatally afflicted with the socialist calculation problem and regime would not know what to spend the new money on.

3. The entire MMT plan is nothing but a massive Cantillon Effect. The wealth purchased by the government with new money is actually extracted surreptitiously from the wealth of average people who do not get the new money first. The illusory free lunch does not exist.

4. The MMTers talk more of the government just spending new money into existence in excess of tax receipts. There’s no need for the muss and fuss of borrowing or government debt, much less taxes. The excess of spending new funny money over tax receipts is the “deficit”.

5. We know that the market does not fail and does not lead to mass unemployment. The problem that the MMTers think they are trying to solve does not exist but for the existence of their beloved fiat funny money system. They are clueless about economic calculation and mis-calculation.

6. The MMTers howl about “democracy”. If there is a consensus to do something, just do it. There’s no need for government force. If there is a democratic consensus, perhaps that means that at least a majority of voters want to pay taxes to do something. MMT is implicitly based upon there being no consensus of the first two types.

7. Therefore, the public will not understand at all what is happening when things inevitably go wrong and there will be amble opportunity for politicians to scapegoat the easiest targets. All the while, the system will allow those in charge to essentially control the nation’s entire economy because they will be in charge of spending big projects into existence with new fiat funny money emisisons as the impoverished public desperately seeks food and shelter in an oppressive Venezuelan-like hyper-inflationary environment.

From the description, once a black swan catastrophe appears in a sovereignty practicing MMT, the end results are indistinguishable from late-stage socialism, as near as I can see. This may be incorrect, but if so, the moral upshot is this: that MMT is just a socialism shell game, where the means of monetary evaluation is shared rather than the means of production.

In practice, this just means the thugs have a bigger ratchet to wield from their ivory tower, even while they can afford to let the plebes pretend to have a democracy. We have seen that setup before, in Carthage and modern day China, amongst others.

For a critic I think you gave a very fair and accurate explanation about the key qualities of MMT.

I would add though that for 300 years there has been a debate about the nature of money. Warren Buffett calls it a claim check on real goods and real resources. If we are shipwrecked on an island, food and tools are of great value, but if we had a suitcase full of gold or money with those real goods and resources – we would have nothing.

This brief item explains the missing link which the finest of economists have advocated for a century… Three centuries if you include Benjamin Franklin

https://www.youtube.com/watch?reload=9&time_continue=149&v=287Cu5me0Og

“Were an MMT system inevitably go awry, the outward manifestation would be of course manifest as inflation, so central planners would of course try to get ahead of it by draining more liquidity, faster, by increasing taxes.”

We already have an “MMT system”. When inflation manifests, those scary “central planners” invariably raise interest rates and reserve reqs. They can also sell bonds to shrink the money supply, as I’m sure you’re aware (“stealing from the future” in the process!). I don’t see how those monetary tools will vanish if an AOC becomes Prez.

And given that the examples of hyperinflation are all exceptional extreme cases of either zero productivity or rapidly declining economies (John Law, Zim, Venez, Weimar), we also need to assume that a massive supply side shock has bowled over the national economy and the “MMT system” is trying to fix it by pumping new money into it (which is patently false, MMT academics recommend shrinking the money supply under those conditions, prior to inflation, using monetary policy as now).

“when you rack up debt you are either borrowing or stealing from the future”

Money initially has no value. It is only a token. When a govt or a private bank creates new money it is intrinsically worthless. It only gains value when it is exchanged for real goods and services, creating (or rather, measuring) productivity. Therefore it is impossible for a currency issuer to ‘steal value from the future’, except in the limited sense that interest payments on outstanding bonds deplete a fraction of its current fiscal capacity and transfer it to the owners of the debt, adding to their own private purchasing power. Interest payable, and to whom, should be the focus, not the total debt.

While we’re on interest payable and its social impact: China owns a large share of US bonds. This is a result of US consumption of Chinese goods, itself the result of cheap Chinese labor, which has decimated US manufacturing (amongst other countries). Is it then not fair to say that the US appetite for cheap imports sacrificed its own manufacturing industry and led to a rise in foreign held treasuries, burdening the current Federal budget with interest payments? In this wider view, the restructuring of the US economy toward free trade is what ‘stole (a small part of) the future’, not the issuing of bits of paper. And if you believe in free trade ideology, total utility is increased regardless.

What about the third of treasuries held by the government? Is it stealing its own future from itself?

The trouble with the reception of MMT is that so many people think it is far more radical than it is, and that is simply because it seeks to empower govt to spend money on the plebs (can’t have that, free lunch blah blah, who ever thought it was a good idea to pay someone to work? what about the American Dream?).

btw I was searching for Benjamin Franklin on money, somehow found your blog entry

“… It is essentially the argument that significant sovereign debt is a good thing, not a bad thing, and that budget balancing efforts on a national scale do much more harm than good. …” NO! NO! pure fiat need *never be issued* with debt attached. MMT would replace all government debt. There would be no need to collect taxes, UBI could be accommodated, student loans could be paid, infrastructure could be built, education and medical care could be paid. The best thing about any monetary system is the circulation of that money. We have a very low velocity of money under the current system, while there is a large need for money for consumers of many different types of goods and services, there are many needs going unmet. Money is hoarded by the wealthy who bid up asset prices, and there is no such thing as trickle down. Government money spent into existence can be retired as individual members of the society die off. I cede any argument you would like to make about using it for external purposes such as trade. I posit that people might be more receptive to immigration if they did not feel they would have to support those people, who should be supported on their own labor. Soooo many articles out here in cyberpsace that just really really don’t want to deal with this issue. Either people really don’t understand it, or there is really that much propaganda against it.

all that first year student hot air and strangely you got the taxation all wrong. Ya big dope!

There is no date at the top of this article. I had to follow the link to Medium to find out when it was published. Yes, there is a date at the bottom but that’s a bad place for it.

No – you are NOT borrowing from the future. Debt is an obligation to pay SOMEONE. That is not what a government deficit under MMT is. It

The value of the currency is ultimately underpinned by the production of goods and services in the economy – the relationship between the respective quantities of production and money is what decides inflation. So if supply of capacity increases in future then you dont need to worry about taxing future generations or whatever it is you had in mind when you wrote this.

If you don’t have the funds to pay for something now (or you do have them but you decide to borrow against it instead) you are committing to settle at some future point instead of now. But you are consuming the service or acquiring the good in the present. That most certainly is borrowing from the future. It’s literally what the word “obligation” means, which is the word you should have all-capped. MMT tries to use rhetoric and accounting gimmicks to gloss over this.